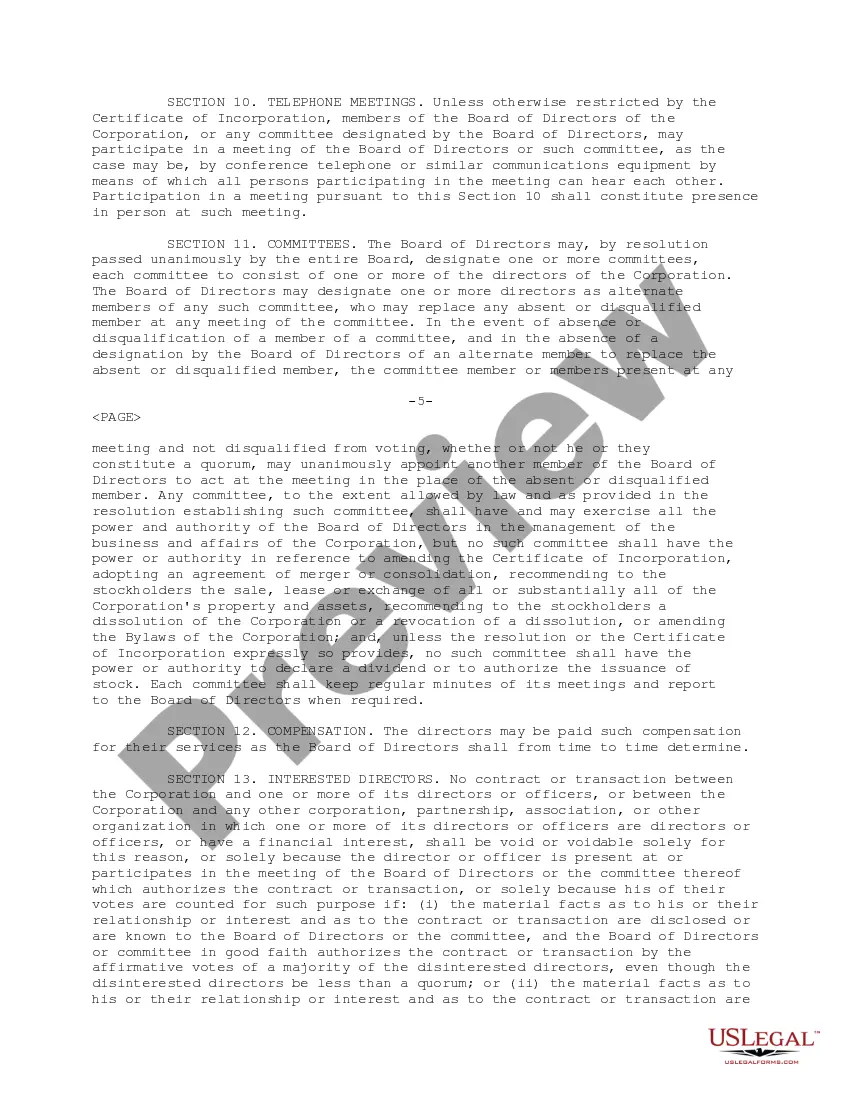

Puerto Rico Bylaws of Ichargeit. Inc.

Description

How to fill out Bylaws Of Ichargeit. Inc.?

US Legal Forms - one of the most significant libraries of authorized forms in the USA - gives a wide range of authorized record web templates you are able to obtain or printing. Making use of the site, you may get thousands of forms for organization and personal reasons, sorted by groups, says, or keywords and phrases.You can find the most up-to-date types of forms much like the Puerto Rico Bylaws of Ichargeit. Inc. in seconds.

If you have a registration, log in and obtain Puerto Rico Bylaws of Ichargeit. Inc. in the US Legal Forms collection. The Obtain option will appear on each form you see. You get access to all in the past saved forms from the My Forms tab of your own accounts.

If you want to use US Legal Forms initially, listed below are straightforward instructions to help you started out:

- Make sure you have chosen the correct form for your area/region. Select the Review option to review the form`s content material. Browse the form explanation to ensure that you have selected the right form.

- When the form does not suit your needs, use the Research field at the top of the screen to get the one who does.

- Should you be pleased with the shape, validate your choice by simply clicking the Buy now option. Then, select the prices strategy you want and supply your references to sign up to have an accounts.

- Method the financial transaction. Use your bank card or PayPal accounts to perform the financial transaction.

- Pick the structure and obtain the shape on your own device.

- Make adjustments. Fill up, modify and printing and sign the saved Puerto Rico Bylaws of Ichargeit. Inc..

Each and every format you included in your money lacks an expiry particular date which is the one you have for a long time. So, in order to obtain or printing another duplicate, just go to the My Forms portion and click on the form you need.

Gain access to the Puerto Rico Bylaws of Ichargeit. Inc. with US Legal Forms, by far the most considerable collection of authorized record web templates. Use thousands of professional and express-particular web templates that satisfy your company or personal requires and needs.

Form popularity

FAQ

The U.S. Department of Transportation's new Charging and Fueling Infrastructure (CFI) Discretionary Grant Program, established by the Bipartisan Infrastructure Law, will provide $2.5 billion over five years to a wide range of applicants, including cities, counties, local governments, and Tribes.

Foreign LLCs only need to file the Certificate of Authorization and pay state fees in order to do business in Puerto Rico.

NEVI is administered by the Federal Highway Administration and supported by the Joint Office of Energy and Transportation (Joint Office) and invests $5 billion to deploy fast chargers along more than 79,000 miles of designated alternative fuel corridors.

A foreign corporation may be engaged in trade or business in Puerto Rico as a division or branch of that foreign corporation, or as a separate corporation or subsidiary.

In terms of tax benefits, Puerto Rico is a sunny place for US residents to start a business, especially if they plan to export products out of Puerto Rico to the rest of the world. The Puerto Rico government offers tax incentives to attract US business owners to emigrate to Puerto Rico.

If you are a corporation, you will also need to register with the Department of State in Puerto Rico, or with the Department of Corporations and Trademarks in the U.S. Virgin Islands.

The National Electric Vehicle Infrastructure (NEVI) Formula Program will provide $5 billion over five years to help states create a network of electric vehicle (EV) charging stations along designated Alternative Fuel Corridors, particularly along the Interstate Highway System, including Puerto Rico.

NEVI funding can cover a portion of installation costs, including the ?make-ready? work needed to prepare a site for EV charging, such as utility upgrades, running wiring to charging station locations and associated construction work.

Aside from income tax, U.S. federal taxes include customs taxes, federal commodity taxes, and federal payroll taxes (Social Security, Medicare, and Unemployment taxes). Not all Puerto Rican employees and corporations pay federal income taxes.

Puerto Rico offers great tax incentives to LLCs and individuals who move to Puerto Rico, including a 4% income tax and exemptions from paying taxes on capital gains, interest, or dividends (for individuals and businesses that meet the requirements).