Puerto Rico Distribution Agreement regarding the continuous offering of the Fund's shares

Description

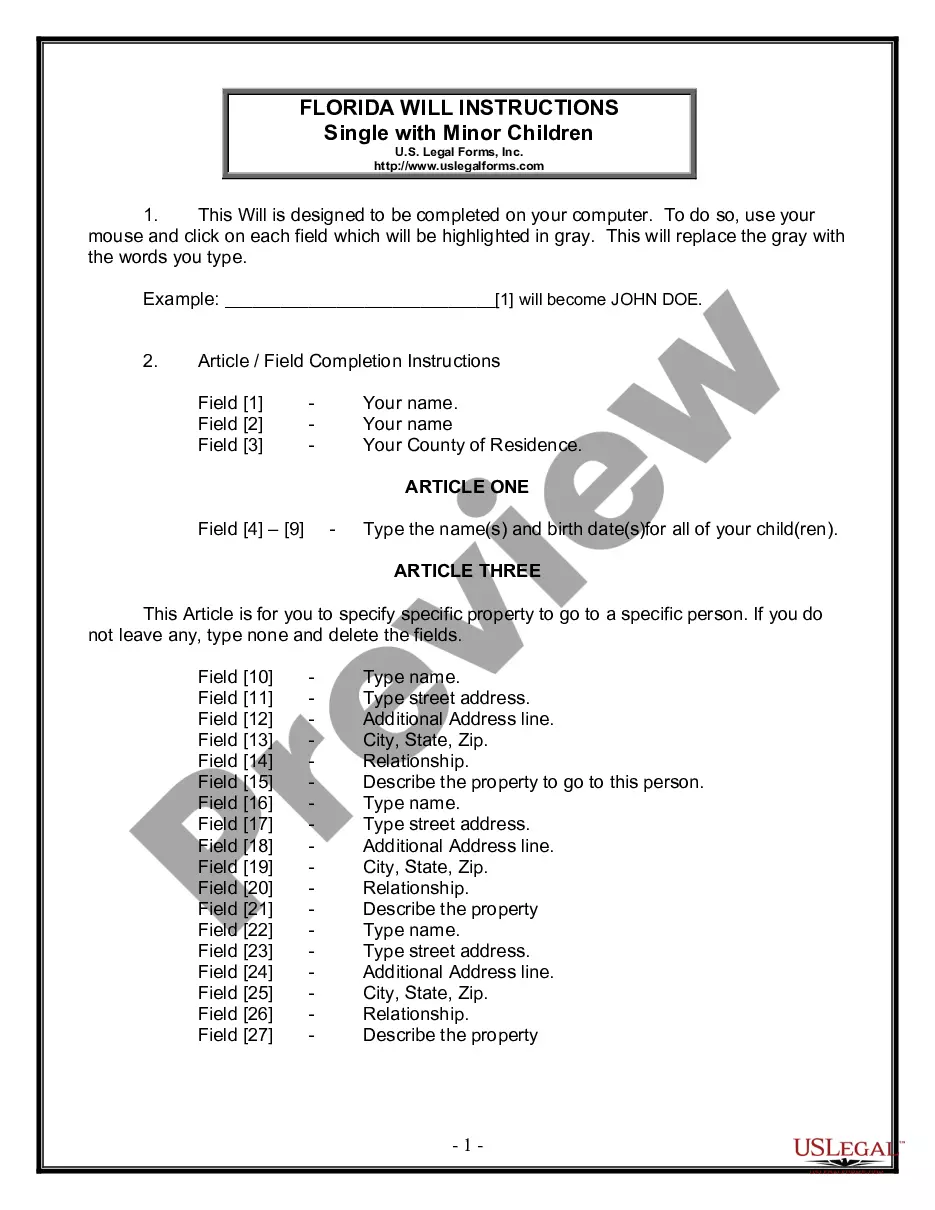

How to fill out Distribution Agreement Regarding The Continuous Offering Of The Fund's Shares?

You can commit time on the web attempting to find the legitimate file web template which fits the federal and state demands you need. US Legal Forms provides a large number of legitimate varieties that are reviewed by specialists. You can actually obtain or print out the Puerto Rico Distribution Agreement regarding the continuous offering of the Fund's shares from my service.

If you already have a US Legal Forms bank account, it is possible to log in and click the Down load key. Next, it is possible to full, change, print out, or signal the Puerto Rico Distribution Agreement regarding the continuous offering of the Fund's shares. Every single legitimate file web template you acquire is your own forever. To have another copy for any obtained form, visit the My Forms tab and click the corresponding key.

If you are using the US Legal Forms internet site the first time, follow the straightforward directions listed below:

- Initial, be sure that you have chosen the best file web template to the county/town of your liking. Read the form information to make sure you have selected the appropriate form. If readily available, use the Preview key to appear throughout the file web template at the same time.

- If you would like discover another variation in the form, use the Research discipline to discover the web template that suits you and demands.

- Upon having discovered the web template you want, just click Buy now to move forward.

- Find the costs strategy you want, key in your accreditations, and sign up for a merchant account on US Legal Forms.

- Comprehensive the deal. You may use your bank card or PayPal bank account to fund the legitimate form.

- Find the structure in the file and obtain it for your system.

- Make changes for your file if required. You can full, change and signal and print out Puerto Rico Distribution Agreement regarding the continuous offering of the Fund's shares.

Down load and print out a large number of file web templates while using US Legal Forms website, which provides the most important assortment of legitimate varieties. Use specialist and status-certain web templates to handle your company or individual needs.

Form popularity

FAQ

Exclusive distribution is defined as when a company grants another company or individual the sole right to sell, distribute, or resell its products or services in a defined territory. The terms of an exclusive distribution agreement vary depending on the industry and product being distributed.

Businesses that carry luxury brands often utilize exclusive distribution as a method of enhancing their brand images. Other types of products that utilize exclusive distribution are automobiles, women's apparel, major appliances and furniture.

Exclusive distribution For example, if you sell luxury cars, your customers may only be able to purchase them directly from one of your company's stores. This strategy works well for expensive, highly sought-after items.

Subject to the terms and conditions of this Agreement, including, without limitation, the General Terms and Conditions of Sale, Supplier hereby appoints the Distributor as its exclusive distributor of the Products within the Territory, and the Distributor hereby accepts such appointment.

A common example of exclusive distribution is automobiles. Automobiles are distributed through exclusive distributorship, meaning that each distributor is the only one authorized to sell a particular make of car within a specified territory.

Long form clause by which the customer agrees to purchase a particular product or service exclusively from the supplier and the supplier agrees not to supply a particular product or service to the customer's competitors.

Exclusive distribution : In an exclusive distribution agreement, the supplier agrees to sell its products to only one distributor for resale in a particular territory. At the same time, the distributor is usually limited in its active selling into other (exclusively allocated) territories.

A distribution agreement is one under which a supplier or manufacturer of goods agrees that an independent third party will market the goods. The distributor buys the goods on their own account and trades under their own name.

An exclusivity clause limits licenses, distribution rights, and other rights to specific parties. It grants to that party only the rights outlined in the contract and further limits how that party may use the rights they were given. These clauses often appear in contracts, including: Intellectual property agreements.

An exclusive distribution clause prevents the supplier from forming other distribution contracts in a given market or territory. This gives the distributor the exclusive right to sell the products in that region. Exclusivity might be provided contingent on the distributor's performance.