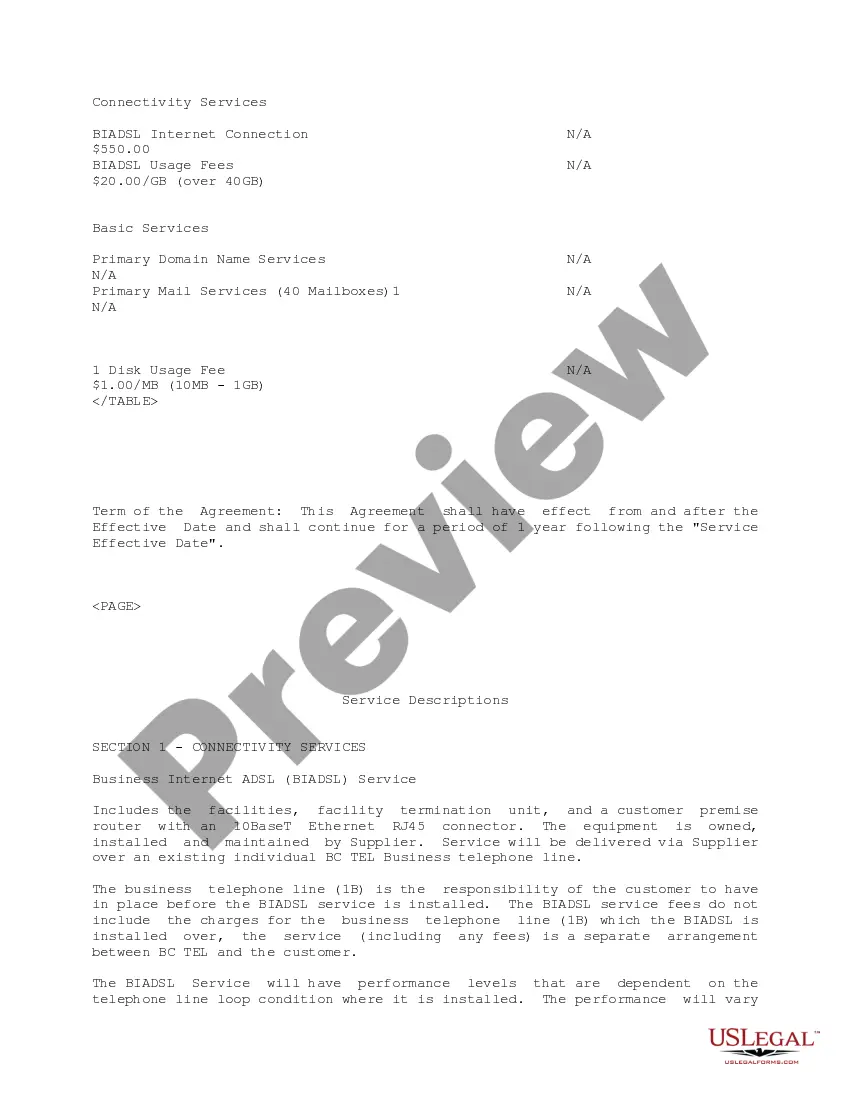

Puerto Rico Internet Business Services Agreement

Description

How to fill out Internet Business Services Agreement?

You may devote time on the web searching for the authorized papers web template which fits the state and federal needs you will need. US Legal Forms gives a huge number of authorized forms which are reviewed by specialists. It is possible to down load or produce the Puerto Rico Internet Business Services Agreement from our services.

If you already possess a US Legal Forms profile, you may log in and click the Down load switch. Following that, you may total, change, produce, or indicator the Puerto Rico Internet Business Services Agreement. Each authorized papers web template you get is your own property forever. To have yet another copy associated with a bought type, visit the My Forms tab and click the corresponding switch.

If you are using the US Legal Forms internet site for the first time, follow the straightforward instructions beneath:

- Initially, make certain you have selected the best papers web template for your area/town of your choice. Browse the type information to ensure you have picked the proper type. If readily available, take advantage of the Review switch to check through the papers web template at the same time.

- If you would like get yet another model of the type, take advantage of the Search discipline to obtain the web template that meets your requirements and needs.

- Upon having identified the web template you would like, just click Get now to continue.

- Choose the rates program you would like, type in your qualifications, and sign up for your account on US Legal Forms.

- Total the transaction. You can utilize your bank card or PayPal profile to pay for the authorized type.

- Choose the structure of the papers and down load it to the product.

- Make adjustments to the papers if necessary. You may total, change and indicator and produce Puerto Rico Internet Business Services Agreement.

Down load and produce a huge number of papers templates while using US Legal Forms website, which provides the greatest collection of authorized forms. Use specialist and condition-distinct templates to deal with your business or person needs.

Form popularity

FAQ

Employers and non-employers in Puerto Rico file this form to obtain an Employer Identification Number (EIN).

Sales and Use Taxes The SUT rate applicable to the sale of tangible personal property is 11.50% out of which 10.5% goes to the Commonwealth of Puerto Rico and 1% goes to municipalities.

Annual reports must be filed electronically by accessing the Department of State website at .estado.pr.gov. A $150 annual fee is payable when filing the report. The payment method is a major credit card or any other method provided at the Department of State website.

Entities in Puerto Rico are identified through a taxpayer ID known as the Employer Identification Number (EIN), which is issued by the US Internal Revenue Service (IRS). Unlike other jurisdictions, the local Treasury does not issue a separate identification number.

If you're a sole proprietor, your business's legal name is your first and last name. Either way, if you want to do business under a name other than your legal business name, you're required by Puerto Rico law to file a DBA.

And Puerto Rico keeps those taxes low for certain businesses and individuals. Under the Act 60 Export Services Tax Incentive, a qualified business enjoys a corporate tax rate of only 4%. That's lower than the 21% corporate tax rate (plus state taxes, in many cases) on the mainland.

Absolutely! Foreign businesses operating outside of the US can also apply for a Foreign EIN. It allows them to comply with specific legal requirements and facilitates their operations in the international business landscape.

A Puerto Rico LLC is a foreign eligible entity for U.S. federal income taxes.