Puerto Rico Private Placement Subscription Agreement

Description

How to fill out Private Placement Subscription Agreement?

Choosing the best legal papers web template might be a have a problem. Naturally, there are a lot of web templates available on the net, but how would you discover the legal develop you want? Take advantage of the US Legal Forms website. The support gives 1000s of web templates, like the Puerto Rico Private Placement Subscription Agreement, which you can use for company and personal requires. Every one of the varieties are checked out by pros and meet up with state and federal demands.

In case you are presently signed up, log in to the profile and then click the Obtain button to obtain the Puerto Rico Private Placement Subscription Agreement. Utilize your profile to check with the legal varieties you possess purchased formerly. Proceed to the My Forms tab of the profile and have one more copy in the papers you want.

In case you are a new customer of US Legal Forms, allow me to share easy recommendations that you can adhere to:

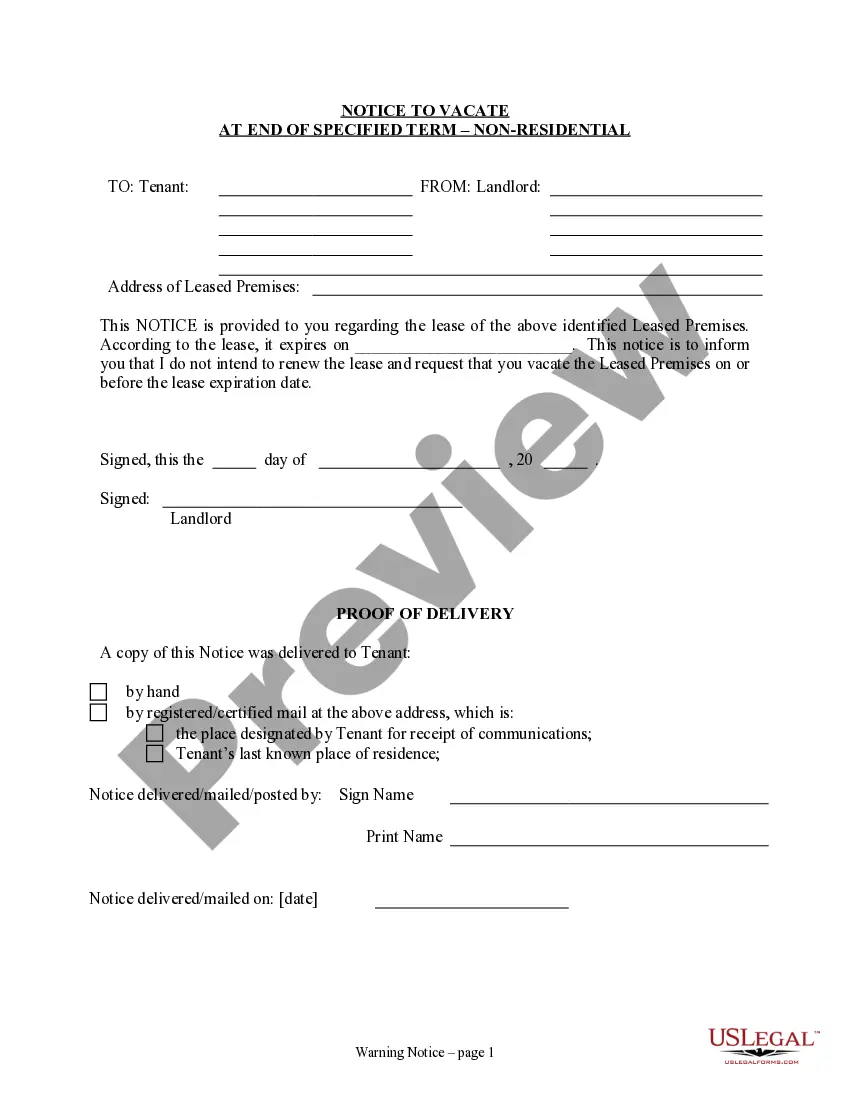

- First, be sure you have chosen the appropriate develop for your town/area. You may examine the form while using Preview button and look at the form description to ensure it will be the best for you.

- In case the develop fails to meet up with your expectations, make use of the Seach area to obtain the appropriate develop.

- When you are sure that the form is suitable, go through the Get now button to obtain the develop.

- Select the rates strategy you desire and type in the essential information. Design your profile and pay for the order with your PayPal profile or charge card.

- Opt for the file file format and download the legal papers web template to the product.

- Full, revise and produce and indication the received Puerto Rico Private Placement Subscription Agreement.

US Legal Forms is the biggest collection of legal varieties that you can see various papers web templates. Take advantage of the service to download skillfully-produced papers that adhere to express demands.

Form popularity

FAQ

How is a Subscription Agreement different from a Private Placement Memorandum (PPM)? The PPM goes into the specifics of the offering, whereas the Subscription Agreement acts as the purchase agreement to acquire interests in the offering.

The Private Placement Memorandum (PPM) itself doesn't represent the actual ?offering.? Instead, it serves as a disclosure document that comprehensively describes the offering, encompassing its structure, strategies, regulation, financing, use of funds, business plan, services, risks, and management.

A Private Placement Memorandum (PPM) is a securities disclosure document used by a company (issuer) that is engaged in a private offering of securities. A PPM serves as a single, comprehensive document outlining the material details about the offering.

Use this as a basic checklist for what must be in a PPM: Notice of Offering. Executive Summary. Description of the Investment. Investment objectives and Criteria. Terms of Offer. Investment Structure. Financial Information. Use of Funds.

Use this as a basic checklist for what must be in a PPM: Notice of Offering. Executive Summary. Description of the Investment. Investment objectives and Criteria. Terms of Offer. Investment Structure. Financial Information. Use of Funds.

The following are among the key sections of a PPM: Summary of Offering Terms. ... Risk Factors. ... Estimated Use of Proceeds/Expenses Disclosures. ... Description of the Securities. ... Business & Management Section. ... Other Offering Documents.

Outline of a PPM Introduction. ... Summary of Offering Terms. ... Risk Factors. ... Description of the Company and the Management. ... Use of Proceeds. ... Description of Securities. ... Subscription Procedures. ... Exhibits.

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.