Puerto Rico Checklist — Certificate of Status as an Accredited Investor: A Detailed Description Puerto Rico offers various incentives for individuals interested in becoming accredited investors and participating in its vibrant investment landscape. To navigate this process effectively, it is crucial to have a clear understanding of the Puerto Rico Checklist — Certificate of Status as an Accredited Investor. This checklist outlines the necessary steps and requirements needed to acquire the certificate, enabling individuals to benefit from the unique investment opportunities available in Puerto Rico. 1. Determining Eligibility: Before proceeding with the Puerto Rico Checklist — Certificate of Status as an Accredited Investor, it is essential to understand who qualifies as an accredited investor. Accredited investors typically include high-net-worth individuals, certain organizations, or individuals with significant investment experience or specific knowledge. Eligibility may vary depending on the specific type of accredited investor being targeted. 2. Gathering Required Documentation: To obtain the Certificate of Status as an Accredited Investor in Puerto Rico, applicants need to gather and submit specific documents. These may include financial statements, tax returns, bank statements, or any other relevant proof of financial status. Accurate and comprehensive documentation is crucial for a smooth application process. 3. Filling Out the Application Form: Applicants must complete an application form provided by the relevant authority in Puerto Rico. This form requires personal information, financial details, and general information regarding investment experience or expertise. It is crucial to provide accurate and up-to-date information to ensure a successful application. 4. Paying the Application Fee: To process the application for the Certificate of Status as an Accredited Investor, applicants are typically required to pay an application fee. The fee amount may vary and is determined by the issuing authority. It is recommended to contact the specific department or agency responsible for processing such applications to obtain the accurate fee information. 5. Obtaining Acknowledgment and Approval: Once the application is submitted, it undergoes a thorough review by the relevant authorities. This process aims to ensure that the applicant meets the necessary criteria to be recognized as an accredited investor in Puerto Rico. Upon successful evaluation, the applicant will receive an acknowledgment of their application's receipt and eventually the approved Certificate of Status as an Accredited Investor. Different Types of Puerto Rico Checklist — Certificate of Status as an Accredited Investor: 1. Individual Accredited Investor Certificate: This type of certificate is suitable for individuals who meet the specified criteria as accredited investors. It is designed to cater to the needs of high-net-worth individuals who want to participate in Puerto Rico's investment opportunities. 2. Organizational Accredited Investor Certificate: Apart from individuals, this type of certificate is directed towards organizations, such as private equity firms, venture capital firms, or partnerships, that want to establish a presence in Puerto Rico and engage in investment activities. These entities must meet the necessary financial thresholds and have the required expertise. 3. Experienced Investor Certificate: This specific certificate caters to individuals with significant investment experience or specific knowledge in a particular asset class or industry. It allows these experienced investors to take advantage of the investment opportunities offered in Puerto Rico based on their expertise. By successfully completing the Puerto Rico Checklist — Certificate of Status as an Accredited Investor, individuals or organizations gain invaluable access to a wide range of investment opportunities, including real estate, renewable energy, tourism, and various tax incentives available in Puerto Rico. It is worth noting that the specific requirements and processes may vary, and it is always advisable to consult with professionals familiar with Puerto Rico's accreditation regulations to ensure a smooth application experience.

Puerto Rico Checklist - Certificate of Status as an Accredited Investor

Description

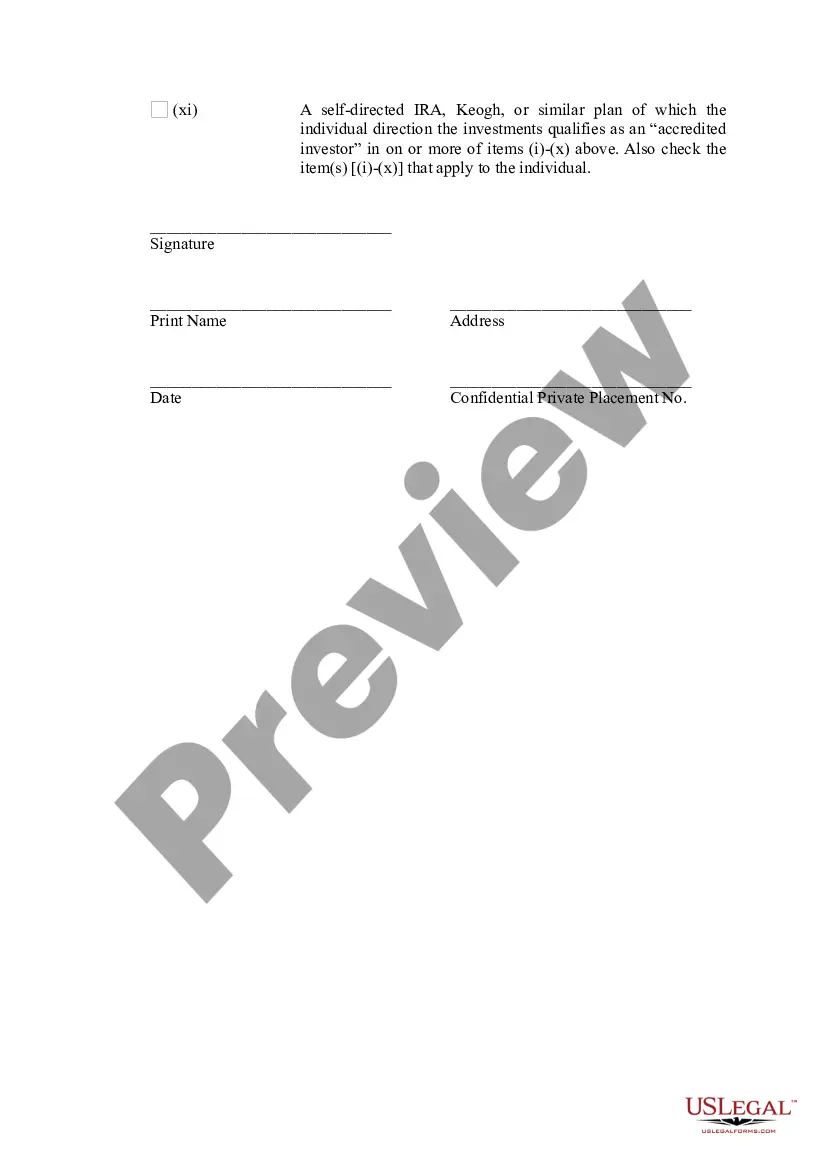

How to fill out Puerto Rico Checklist - Certificate Of Status As An Accredited Investor?

US Legal Forms - one of the greatest libraries of authorized forms in the United States - gives a variety of authorized document web templates it is possible to down load or produce. Making use of the web site, you may get a large number of forms for business and person functions, categorized by types, states, or keywords and phrases.You will discover the newest variations of forms such as the Puerto Rico Checklist - Certificate of Status as an Accredited Investor within minutes.

If you have a membership, log in and down load Puerto Rico Checklist - Certificate of Status as an Accredited Investor through the US Legal Forms collection. The Down load option will show up on each type you perspective. You gain access to all formerly downloaded forms in the My Forms tab of your respective accounts.

If you would like use US Legal Forms the first time, here are straightforward recommendations to obtain started off:

- Be sure to have chosen the correct type for your personal metropolis/county. Go through the Preview option to check the form`s articles. Look at the type outline to ensure that you have chosen the right type.

- When the type doesn`t fit your needs, make use of the Lookup field at the top of the display screen to obtain the one who does.

- In case you are satisfied with the form, verify your option by visiting the Purchase now option. Then, select the pricing program you like and offer your credentials to register on an accounts.

- Approach the purchase. Utilize your bank card or PayPal accounts to finish the purchase.

- Pick the formatting and down load the form on your gadget.

- Make modifications. Fill up, change and produce and signal the downloaded Puerto Rico Checklist - Certificate of Status as an Accredited Investor.

Every format you included in your money lacks an expiration particular date and is your own property forever. So, if you would like down load or produce yet another backup, just check out the My Forms portion and then click on the type you will need.

Get access to the Puerto Rico Checklist - Certificate of Status as an Accredited Investor with US Legal Forms, probably the most considerable collection of authorized document web templates. Use a large number of specialist and condition-particular web templates that meet up with your organization or person demands and needs.