Puerto Rico Board Member Agreement

Description

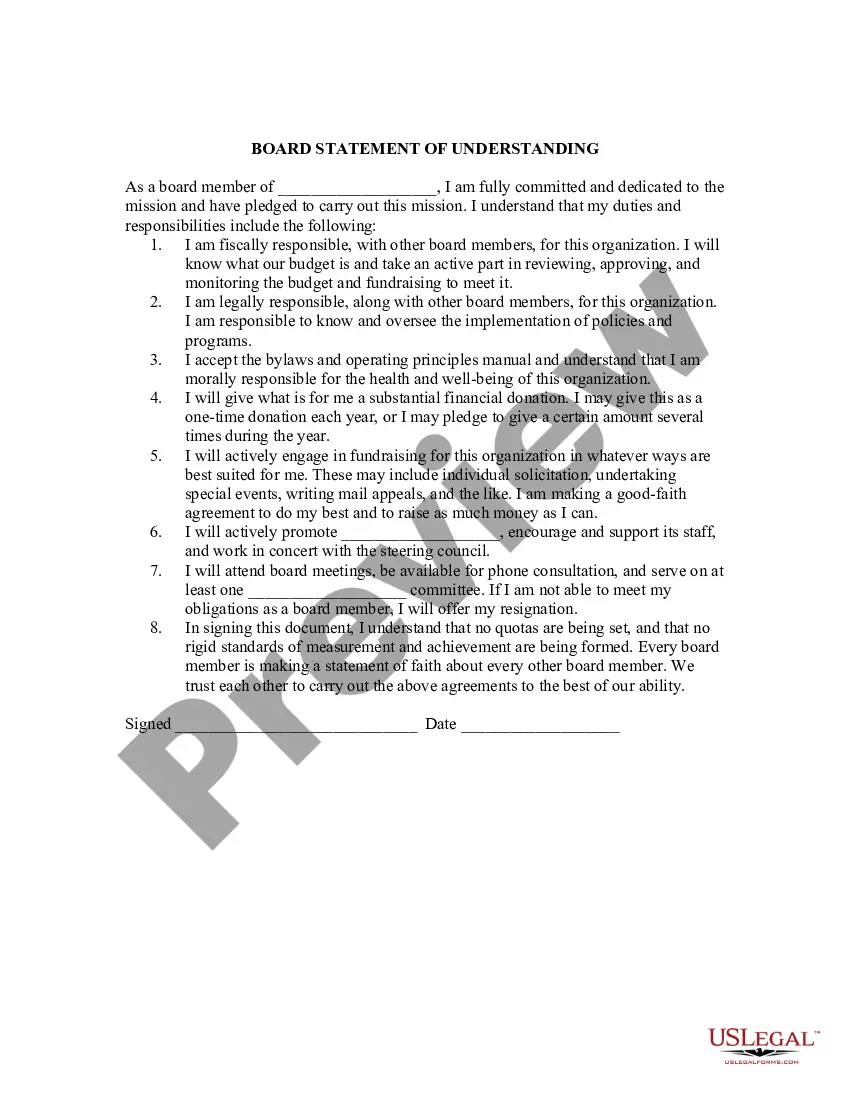

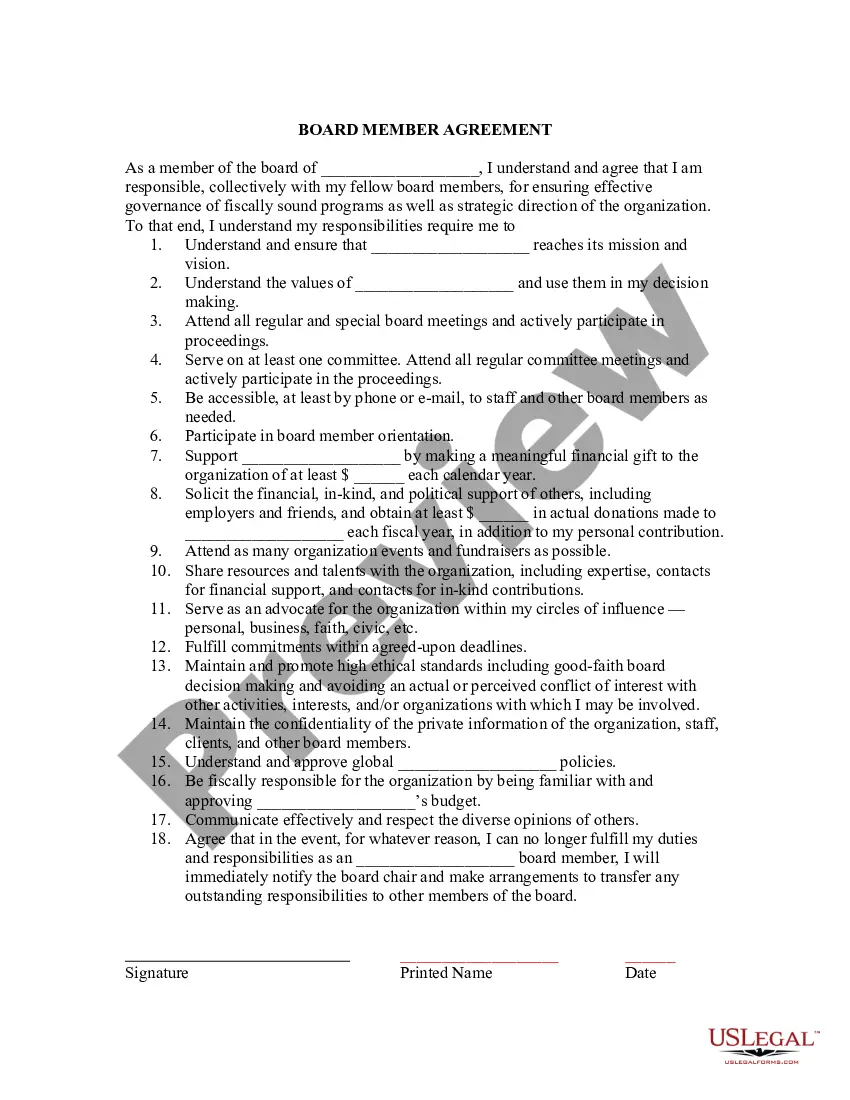

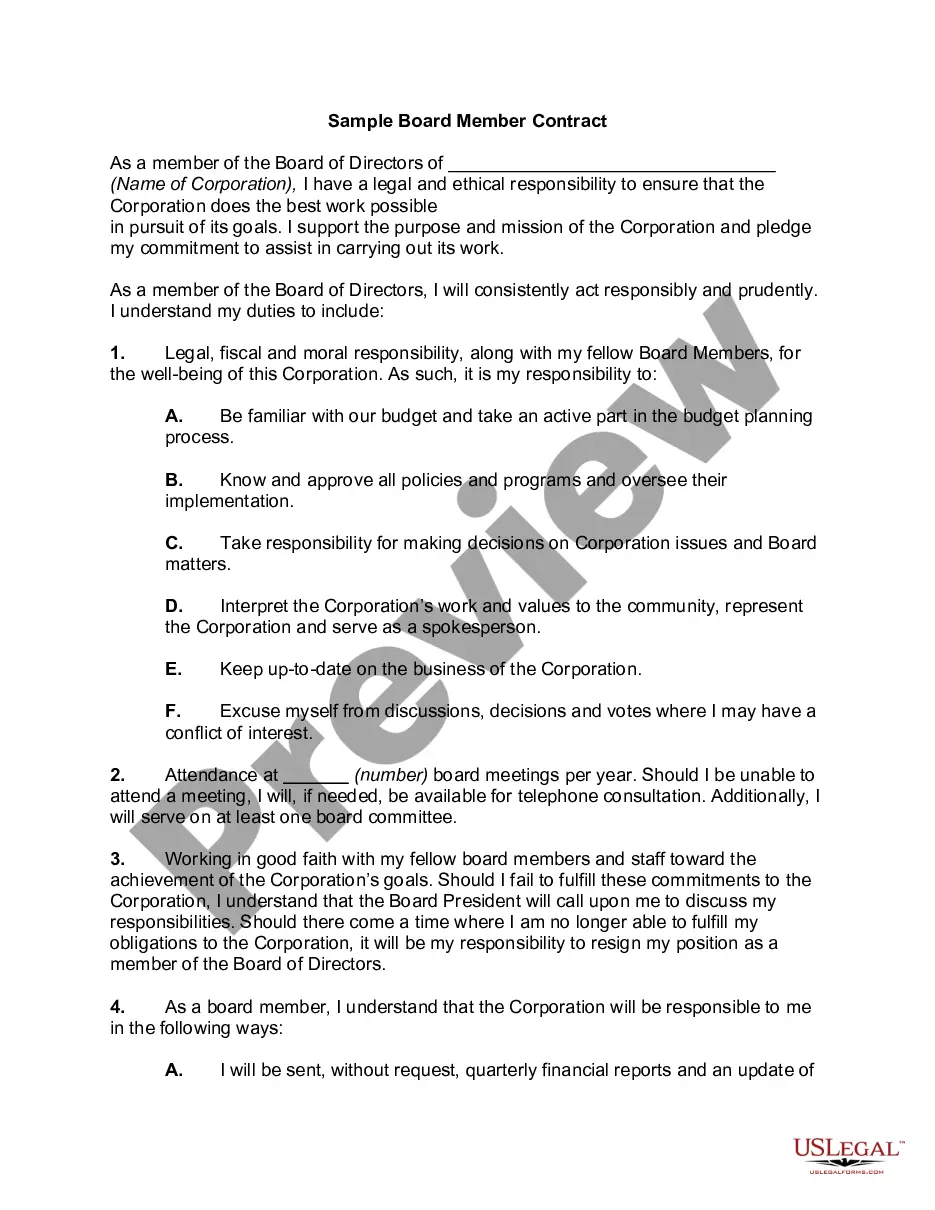

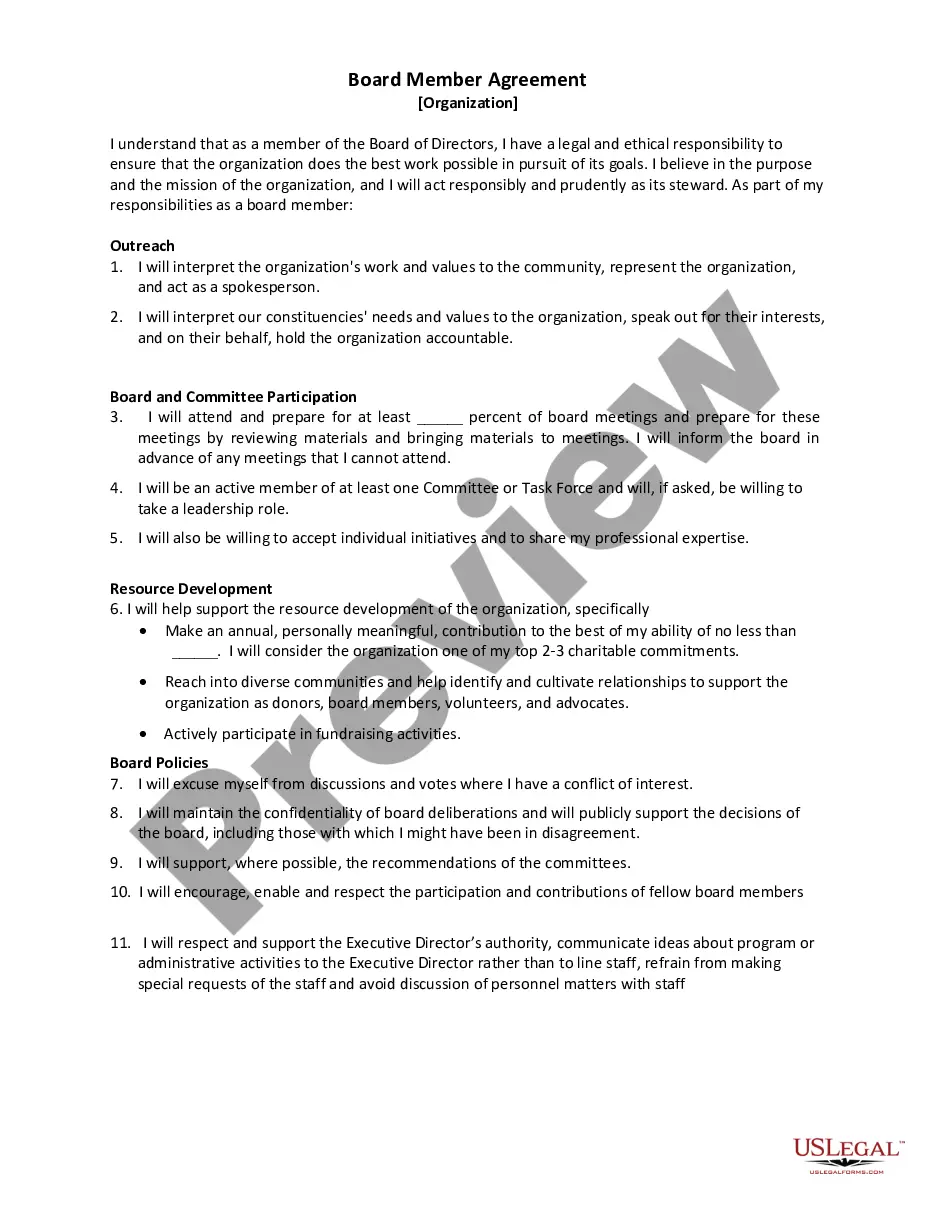

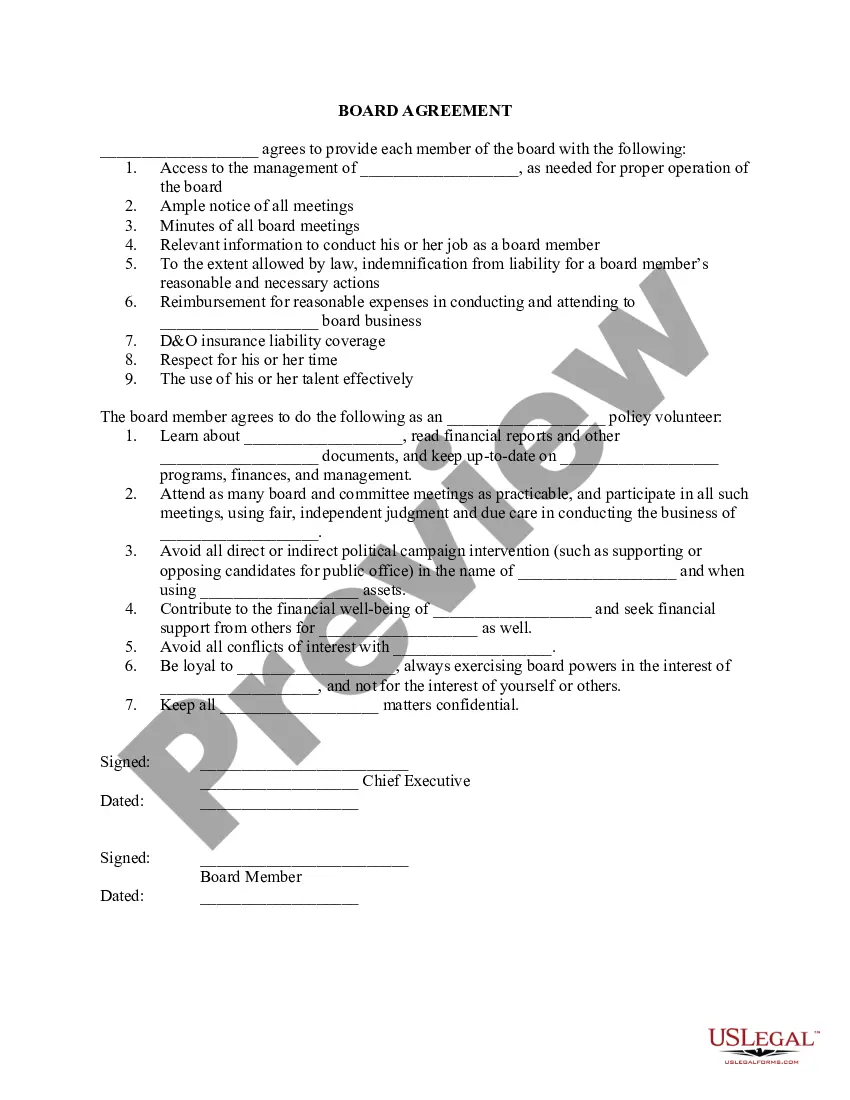

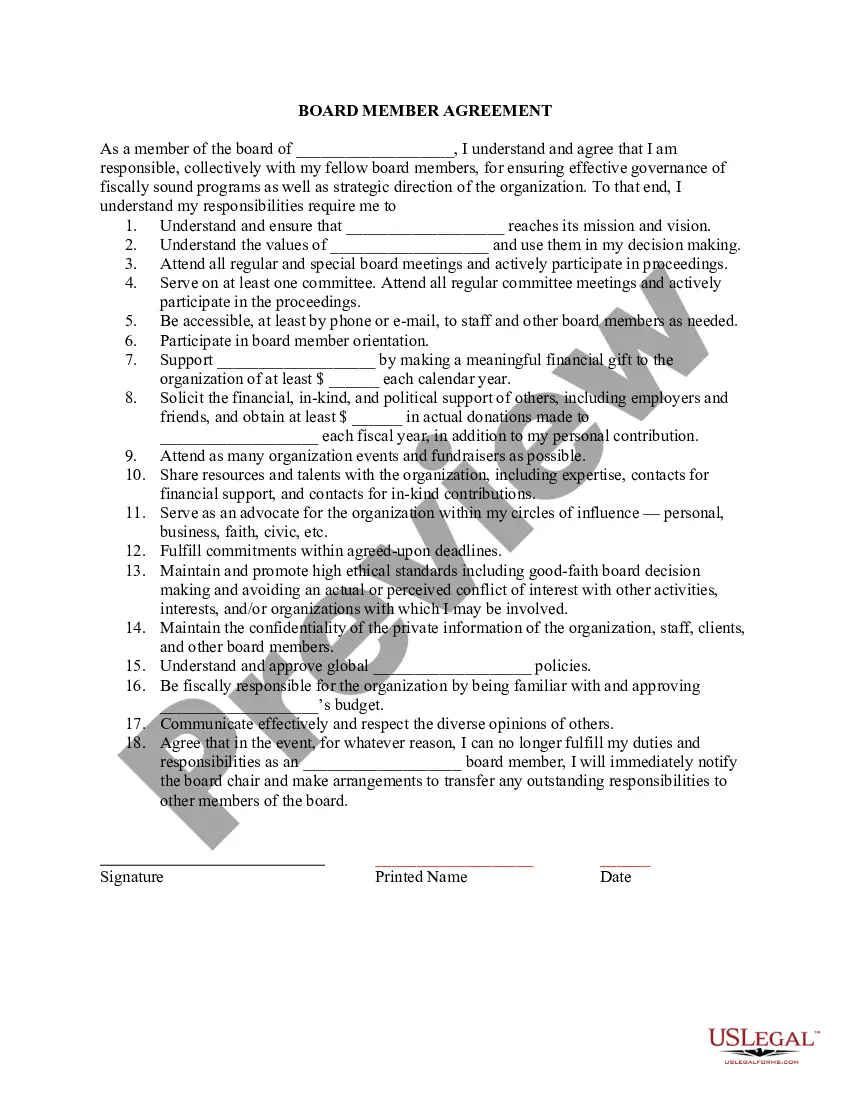

How to fill out Board Member Agreement?

You can commit hrs on the web attempting to find the authorized record design that fits the federal and state requirements you want. US Legal Forms supplies a huge number of authorized forms that happen to be reviewed by professionals. You can actually obtain or print out the Puerto Rico Board Member Agreement from my assistance.

If you already possess a US Legal Forms accounts, you are able to log in and click the Down load option. After that, you are able to total, change, print out, or indication the Puerto Rico Board Member Agreement. Each authorized record design you acquire is yours for a long time. To get one more duplicate of the acquired type, proceed to the My Forms tab and click the corresponding option.

If you work with the US Legal Forms site for the first time, adhere to the basic guidelines under:

- First, be sure that you have selected the proper record design for your county/city of your liking. Browse the type outline to make sure you have chosen the correct type. If available, use the Preview option to look through the record design at the same time.

- If you would like find one more model of the type, use the Lookup field to get the design that fits your needs and requirements.

- Upon having located the design you desire, just click Acquire now to carry on.

- Find the costs plan you desire, enter your references, and sign up for a free account on US Legal Forms.

- Total the deal. You can utilize your charge card or PayPal accounts to cover the authorized type.

- Find the file format of the record and obtain it in your system.

- Make alterations in your record if necessary. You can total, change and indication and print out Puerto Rico Board Member Agreement.

Down load and print out a huge number of record themes using the US Legal Forms web site, that provides the most important collection of authorized forms. Use professional and express-distinct themes to deal with your company or individual requires.

Form popularity

FAQ

Puerto Rico Business Taxes No income tax on dividends and interest. No capital gains tax. Fixed income tax rate of 4 percent on income gained from export services. No property tax for the first five years (Only 10% of the usual property tax rate afterwards) 60% reduction of the municipal tax rate.

To start a corporation in Puerto Rico, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Certificate of Incorporation with the Department of State. You can file online or by mail. The certificate costs $150 to file.

Under Puerto Rico law, an LLC uses a limited liability company agreement, or LLCA, to govern the internal affairs and administration of the LLC. This is valid regardless of what it is called, but the law says that they must be written. We recommend a written LLCA that is signed by all members.

Application for Registration CostDescriptionDownload$150.00Stock CorporationDownload$5.00Non-Stock CorporationDownload$150.00 o 5.00Foreign Corporation - Certificated of Authorization to do businessDownload$150.00Close CorporationDownload2 more rows

Puerto Rico LLC Cost. The initial cost to start an LLC in Puerto Rico is $250 to register your business with the Department of State. After that, you'll have a yearly recurring cost of $150 for your Annual Fee, which keeps your LLC current with the state.

Annual reports must be filed electronically by accessing the Department of State website at .estado.pr.gov. A $150 annual fee is payable when filing the report. The payment method is a major credit card or any other method provided at the Department of State website.

Business name and registration Register your business name with the local government where your business is located. If you are a corporation, you will also need to register with the Department of State in Puerto Rico, or with the Department of Corporations and Trademarks in the U.S. Virgin Islands.

Filing and forming an LLC in Puerto Rico requires a $250 filing fee. Under Puerto Rico law, an LLC uses a limited liability company agreement, or LLCA, to govern the internal affairs and administration of the LLC. This is valid regardless of what it is called, but the law says that they must be written.