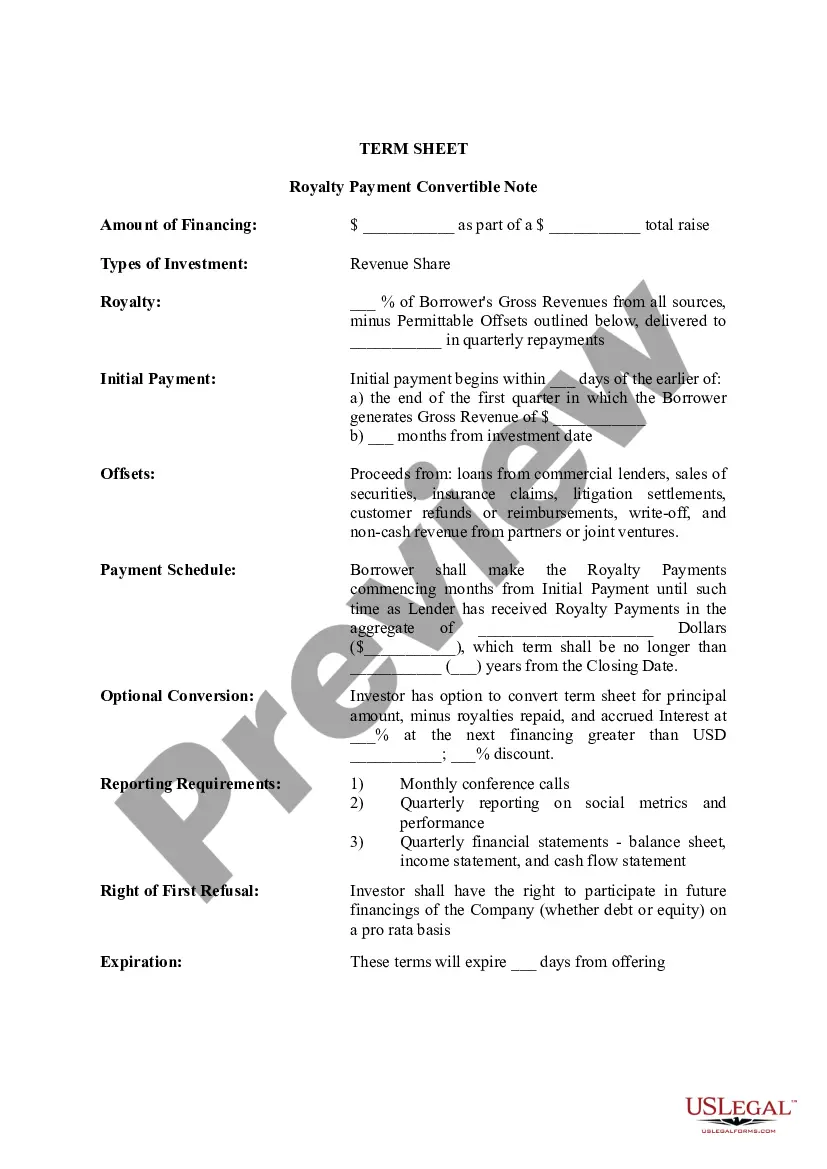

Puerto Rico Term Sheet - Royalty Payment Convertible Note

Description

How to fill out Term Sheet - Royalty Payment Convertible Note?

Are you within a placement in which you need files for either organization or individual reasons just about every day? There are tons of authorized record themes accessible on the Internet, but locating ones you can trust is not simple. US Legal Forms delivers thousands of kind themes, just like the Puerto Rico Term Sheet - Royalty Payment Convertible Note, which can be created to fulfill state and federal specifications.

In case you are presently knowledgeable about US Legal Forms internet site and get an account, basically log in. After that, you may down load the Puerto Rico Term Sheet - Royalty Payment Convertible Note design.

Unless you come with an profile and want to begin to use US Legal Forms, adopt these measures:

- Find the kind you want and ensure it is for your proper town/region.

- Utilize the Preview option to review the shape.

- Read the information to ensure that you have chosen the proper kind.

- If the kind is not what you are trying to find, use the Look for field to find the kind that meets your needs and specifications.

- If you find the proper kind, just click Acquire now.

- Pick the prices plan you need, complete the specified info to produce your bank account, and purchase your order using your PayPal or charge card.

- Decide on a handy document format and down load your duplicate.

Locate all of the record themes you might have bought in the My Forms menus. You may get a additional duplicate of Puerto Rico Term Sheet - Royalty Payment Convertible Note at any time, if possible. Just click the needed kind to down load or print the record design.

Use US Legal Forms, by far the most extensive variety of authorized varieties, to save time as well as stay away from faults. The assistance delivers appropriately produced authorized record themes that can be used for a selection of reasons. Create an account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

Are SAFE Notes Debt? No, SAFEs should not be accounted for as debt but instead as equity. Experienced venture capitalists expect to see SAFE notes in the equity section of a company's balance sheet - therefore, they should be classified as equity, not debt.

So the cash coming in from your convertible note will generally equate to the liability that you add to the balance sheet. And, if your accounting is doing a good job, the accrued interest is a non-cash expense that flows through your income statement and impacts your accumulated net income in the equity section.

As noted above, convertible notes can be classified as all debt, all equity, or a mixture of both. To determine the appropriate classification, we need to consider the relevant definitions in IAS 32 Financial Instruments: Presentation.

Calculating post-money valuation Post-money valuation = Pre-money valuation + Size of investment. ... Share price = New investment amount / # of new shares received. ... Post-money valuation / total # of shares post-investment = New investment amount / # of new shares received.

A convertible note is a short-term debt instrument that automatically turns into equity when a predetermined milestone or conversion event occurs. Essentially, a convertible note functions like a business loan that converts into equity instead of being repaid..

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Common provisions of a convertible debt financing include: The interest rate. Usually somewhere between 4% and 8%. The maturity date. Usually 12?24 months. A mandatory conversion paragraph. ... An optional conversion paragraph. ... A change of control provision. ... A conversion discount. ... A valuation cap. ... An amendment provision.