Puerto Rico Investors Rights Agreement (PRI) is a legal document that outlines the rights and responsibilities of investors in Puerto Rico. It is designed to protect the interests of investors in various sectors, such as real estate, tourism, manufacturing, and other industries. Here is a detailed description of the Puerto Rico Investors Rights Agreement, highlighting its key components and relevant keywords. 1. Purpose: The PRI aims to provide a transparent and secure investment environment in Puerto Rico, promoting economic growth and attracting foreign direct investment (FDI). It establishes a framework that governs the relationship between investors and the Puerto Rican government. 2. Investor Protection: The agreement ensures that investors are granted certain rights and protections. These include the safeguarding of property rights, protection against expropriation without fair compensation, and non-discrimination based on national origin or residency. 3. Tax Incentives: Puerto Rico offers attractive tax incentives to investors, and the PRI delineates the specific benefits available to those who qualify. These incentives may include tax exemptions, credits, or reductions in corporate, individual, or property taxes. 4. Dispute Resolution Mechanisms: The PRI establishes dispute resolution mechanisms, providing investors with an avenue to address any conflicts that may arise between themselves and the Puerto Rican government. These mechanisms typically include arbitration or mediation processes to ensure fair and impartial resolution. 5. Foreign Ownership: Puerto Rico embraces foreign investment, and the PRI sets guidelines on foreign ownership and control of local businesses. It may specify permitted ownership percentages or outline any restrictions on foreign participation in certain industries or sectors. Different types of Puerto Rico Investors Rights Agreements may exist based on factors such as sector specificity or investment size. Some common types include: 1. Real Estate Investors Rights Agreement: This variant focuses on the rights and responsibilities of investors engaged in the Puerto Rican real estate market. It may include provisions related to property acquisition, development, and sales, as well as zoning regulations and environmental compliance. 2. Manufacturing Investors Rights Agreement: This type of PRI caters to investors interested in establishing or expanding manufacturing operations in Puerto Rico. It outlines incentives, permits, and regulations specific to manufacturing, including tax breaks for industrial investments and regulations on labor and environmental standards. 3. Tourism Investors Rights Agreement: Aimed at investors interested in the tourism industry, this agreement includes provisions relevant to hotel development, the establishment of resorts or recreational facilities, and associated tax incentives. It may also outline responsible tourism practices and environmental considerations. In conclusion, the Puerto Rico Investors Rights Agreement is a comprehensive legal document governing the rights and obligations of investors in Puerto Rico. It aims to attract and protect investments, promoting economic growth and development in various sectors. Different types of Prius may exist, tailored to specific industries such as real estate, manufacturing, or tourism.

Puerto Rico Investors Rights Agreement

Description

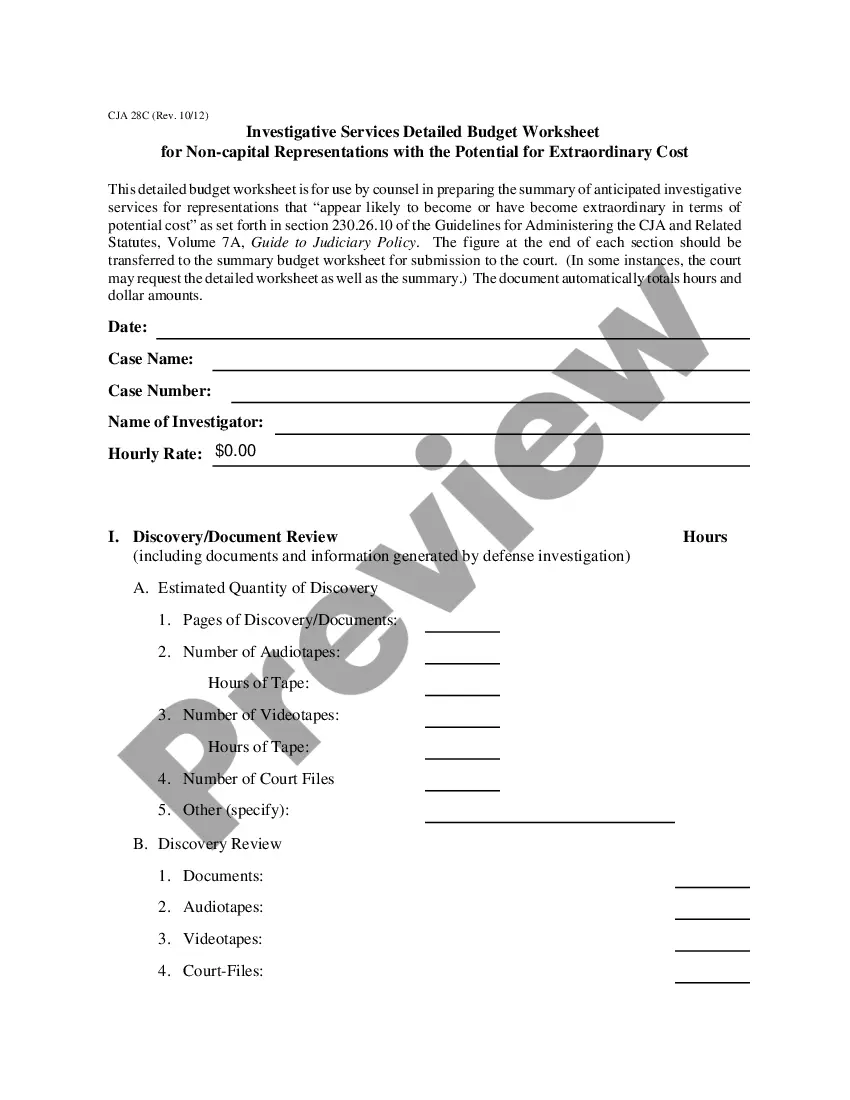

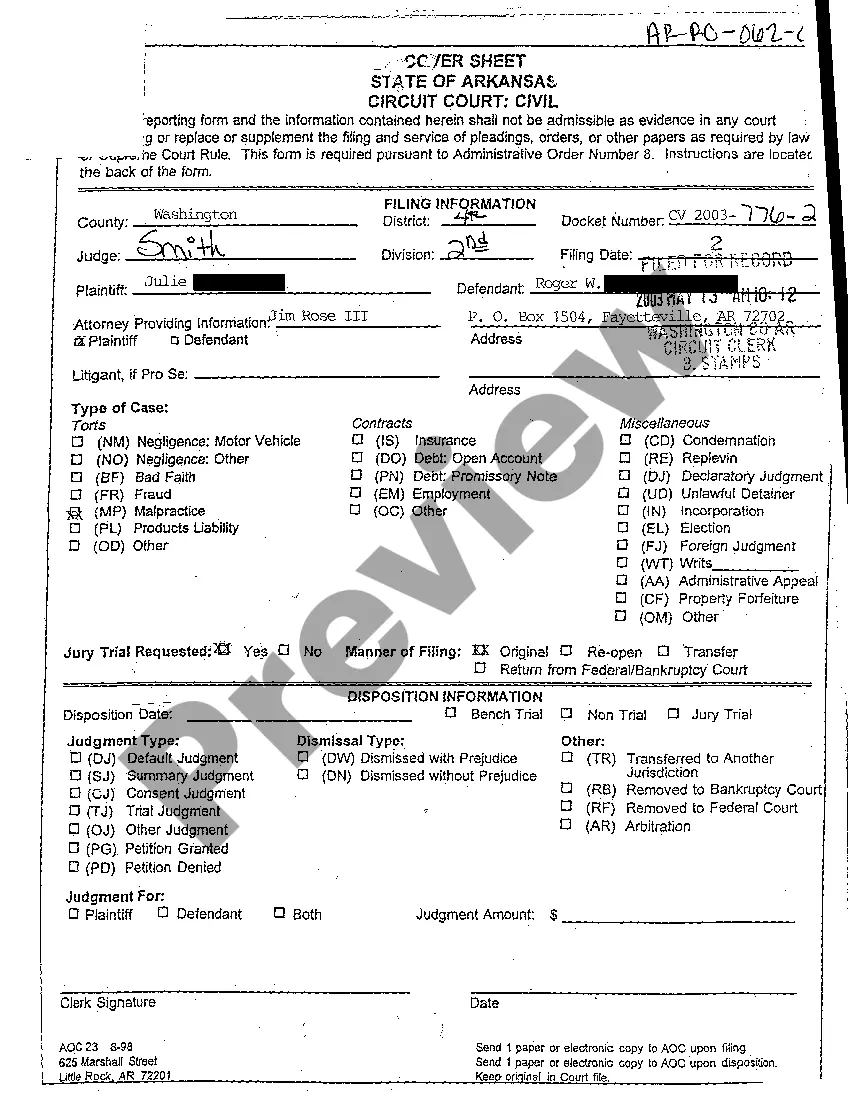

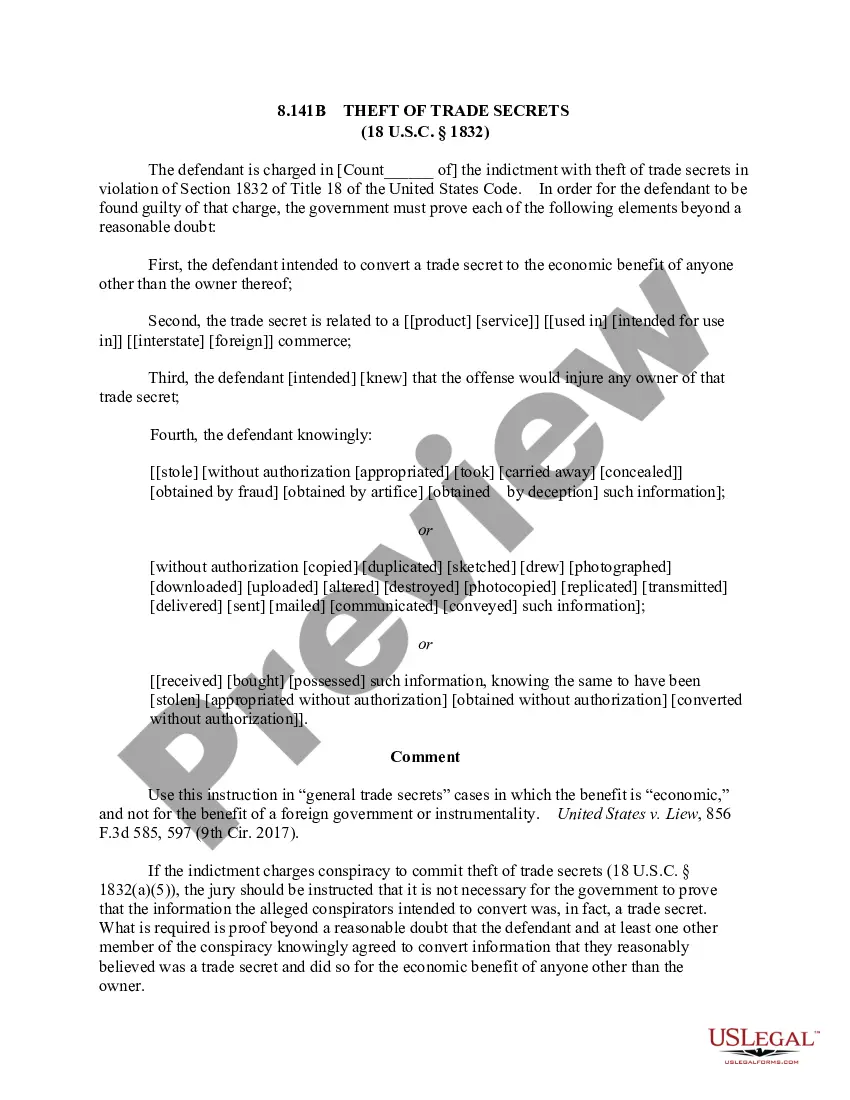

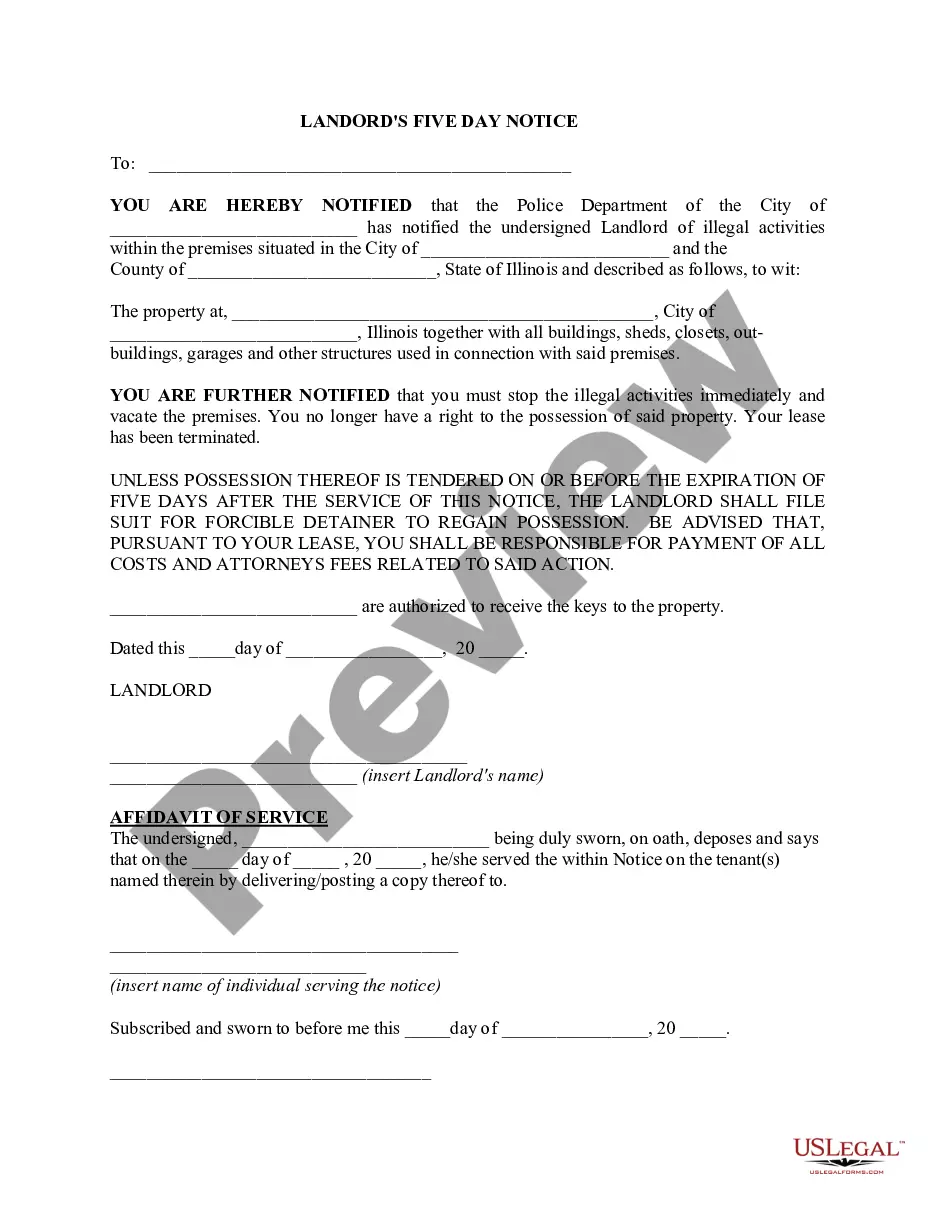

How to fill out Puerto Rico Investors Rights Agreement?

Are you in the placement where you need to have papers for sometimes organization or specific purposes virtually every working day? There are plenty of lawful record templates available on the net, but getting types you can rely isn`t simple. US Legal Forms gives a huge number of develop templates, just like the Puerto Rico Investors Rights Agreement, that are created in order to meet federal and state requirements.

When you are currently familiar with US Legal Forms internet site and get your account, merely log in. Next, you may download the Puerto Rico Investors Rights Agreement web template.

Should you not provide an accounts and wish to begin using US Legal Forms, abide by these steps:

- Discover the develop you require and make sure it is for the correct area/area.

- Make use of the Preview key to check the form.

- Browse the information to ensure that you have selected the proper develop.

- If the develop isn`t what you`re trying to find, take advantage of the Look for area to get the develop that fits your needs and requirements.

- If you find the correct develop, just click Acquire now.

- Pick the prices prepare you would like, fill in the desired details to generate your bank account, and buy the transaction making use of your PayPal or Visa or Mastercard.

- Select a handy data file formatting and download your version.

Discover all of the record templates you might have purchased in the My Forms menu. You may get a extra version of Puerto Rico Investors Rights Agreement whenever, if needed. Just click the required develop to download or produce the record web template.

Use US Legal Forms, by far the most extensive collection of lawful varieties, to save some time and prevent mistakes. The service gives appropriately produced lawful record templates that you can use for a range of purposes. Create your account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

Moving to Puerto Rico may not exempt U.S. citizens from all U.S. income taxes. Any income generated from U.S. sources, or other non-Puerto Rican sources, will still be subject to U.S. income tax. A U.S. citizen becoming a bona fide resident of Puerto Rico may still be required to file and pay U.S. income taxes. Puerto Rico Tax Benefits | Closer Connection Test - Windham Brannon windhambrannon.com ? blog ? puerto-rico-tax-be... windhambrannon.com ? blog ? puerto-rico-tax-be...

Puerto Rico, a U.S. territory of 3.2 million people, began offering sweeping tax breaks in 2012 with the hopes of attracting wealthy Americans who might help boost the economy. Some 5,010 people have moved to the island to enroll in the program, which eliminates all taxes on dividends, interest and capital gains. IRS Pressed to Crack Down on Wealthy Tax Cheats in Puerto Rico cpapracticeadvisor.com ? 2023/11/17 ? irs-p... cpapracticeadvisor.com ? 2023/11/17 ? irs-p...

Along with Puerto Rico Tax Act 20, Puerto Rico adopted an additional incentive, the ?Act to Promote the Relocation of Individual Investors,? Puerto Rico Tax Act 22, to stimulate economic development by offering nonresident individuals 100% tax exemptions on all interest, all dividends, and all long-term capital gains.

The Individual Investors Act (Act 22) seeks to attract new residents to Puerto Rico by providing a total exemption from Puerto Rico income taxes on all passive income realized or accrued after such individuals become bona fide residents of Puerto Rico.

The U.S. tax code (Section 933) allows a bona fide resident of Puerto Rico to exclude Puerto Rico-source income from his or her U.S. gross income for U.S. tax purposes.

If you're a bona fide resident of Puerto Rico during the entire tax year, you generally aren't required to file a U.S. federal income tax return if your only income is from sources within Puerto Rico. Topic No. 901, Is a Person With Income From Puerto Rico Required ... irs.gov ? taxtopics irs.gov ? taxtopics

Specifically, a U.S. citizen who becomes a bona fide Puerto Rico resident and moves his or her business to Puerto Rico (thus, generating Puerto Rico sourced income) may benefit from a 4% corporate tax/fixed income tax rate, a 100% exemption on property taxes, and a 100% exemption on dividends from export services. Tax-Weary Americans Find Haven in Puerto Rico | Frost Law districtofcolumbiataxattorney.com ? articles districtofcolumbiataxattorney.com ? articles

You have to pay regular US capital gain tax on the rest. If you stay in Puerto Rico for 19 years (and Act 60 sticks around), you'll get the 0% rate on 50% of your gain.