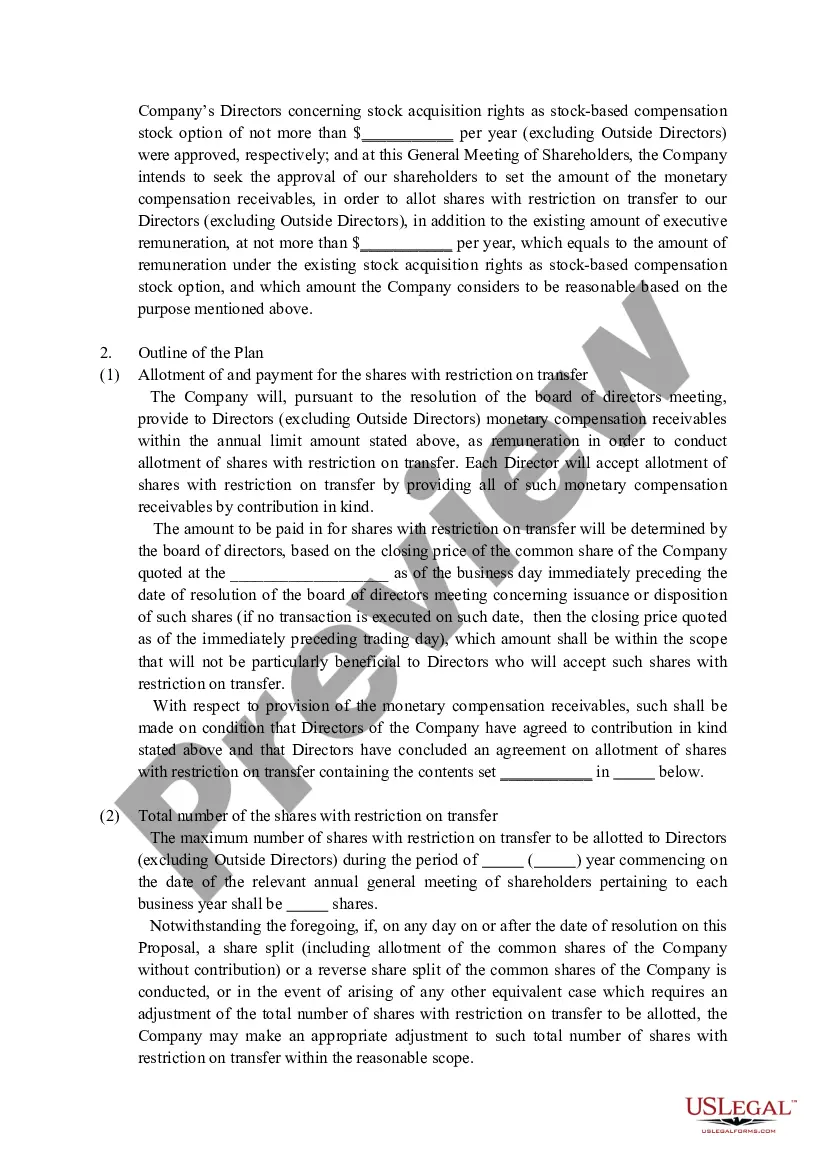

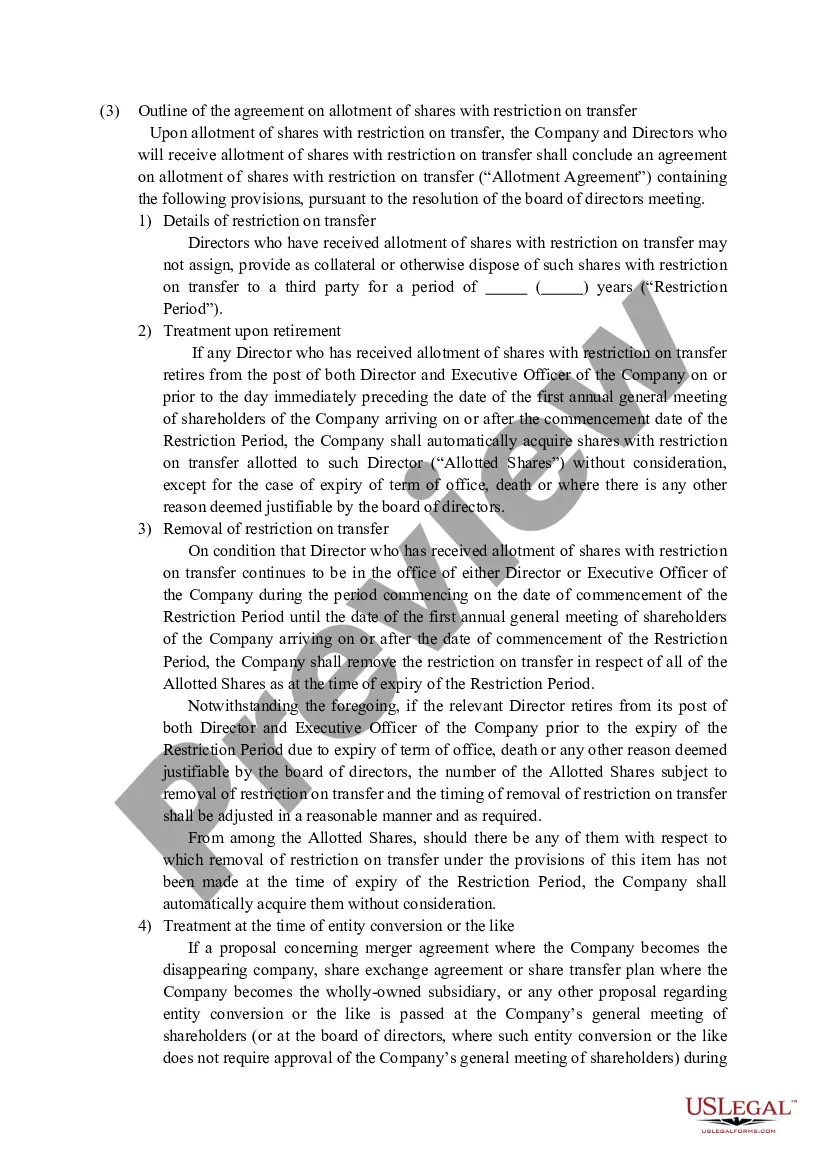

Puerto Rico Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on Transfer

Description

How to fill out Notice Concerning Introduction Of Remuneration Plan For Shares With Restriction On Transfer?

If you wish to full, acquire, or print lawful file templates, use US Legal Forms, the biggest variety of lawful varieties, that can be found on the web. Take advantage of the site`s basic and practical look for to find the papers you want. Different templates for business and individual purposes are categorized by classes and claims, or key phrases. Use US Legal Forms to find the Puerto Rico Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on with a couple of click throughs.

In case you are already a US Legal Forms consumer, log in in your accounts and click on the Obtain button to obtain the Puerto Rico Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on. Also you can gain access to varieties you in the past downloaded inside the My Forms tab of your accounts.

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have selected the form for that right area/region.

- Step 2. Utilize the Review option to look through the form`s articles. Never forget to see the outline.

- Step 3. In case you are unhappy with all the type, take advantage of the Lookup field at the top of the screen to locate other versions of the lawful type template.

- Step 4. When you have located the form you want, click on the Get now button. Choose the costs plan you choose and add your accreditations to register for an accounts.

- Step 5. Method the transaction. You can utilize your credit card or PayPal accounts to complete the transaction.

- Step 6. Pick the format of the lawful type and acquire it on your own system.

- Step 7. Comprehensive, modify and print or indicator the Puerto Rico Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on.

Every lawful file template you acquire is the one you have for a long time. You possess acces to every single type you downloaded with your acccount. Select the My Forms area and choose a type to print or acquire once more.

Be competitive and acquire, and print the Puerto Rico Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on with US Legal Forms. There are many skilled and condition-certain varieties you can use to your business or individual needs.