Puerto Rico Special Meeting Minutes of Shareholders

Description

How to fill out Special Meeting Minutes Of Shareholders?

It is possible to spend hours on the web attempting to find the legal document design which fits the state and federal requirements you will need. US Legal Forms offers a large number of legal types that are evaluated by specialists. It is simple to download or printing the Puerto Rico Special Meeting Minutes of Shareholders from the assistance.

If you already possess a US Legal Forms bank account, it is possible to log in and then click the Obtain option. Afterward, it is possible to complete, revise, printing, or indication the Puerto Rico Special Meeting Minutes of Shareholders. Every single legal document design you acquire is your own permanently. To acquire yet another backup for any obtained form, go to the My Forms tab and then click the related option.

If you are using the US Legal Forms site the very first time, adhere to the basic guidelines under:

- Very first, make sure that you have selected the right document design to the state/town of your choosing. Read the form information to make sure you have picked out the right form. If readily available, utilize the Preview option to look from the document design also.

- If you wish to locate yet another edition of your form, utilize the Search area to obtain the design that meets your needs and requirements.

- After you have found the design you would like, just click Get now to proceed.

- Find the costs strategy you would like, enter your references, and register for an account on US Legal Forms.

- Comprehensive the purchase. You can utilize your charge card or PayPal bank account to cover the legal form.

- Find the file format of your document and download it to the gadget.

- Make changes to the document if possible. It is possible to complete, revise and indication and printing Puerto Rico Special Meeting Minutes of Shareholders.

Obtain and printing a large number of document web templates utilizing the US Legal Forms web site, that offers the most important selection of legal types. Use specialist and express-certain web templates to tackle your small business or specific needs.

Form popularity

FAQ

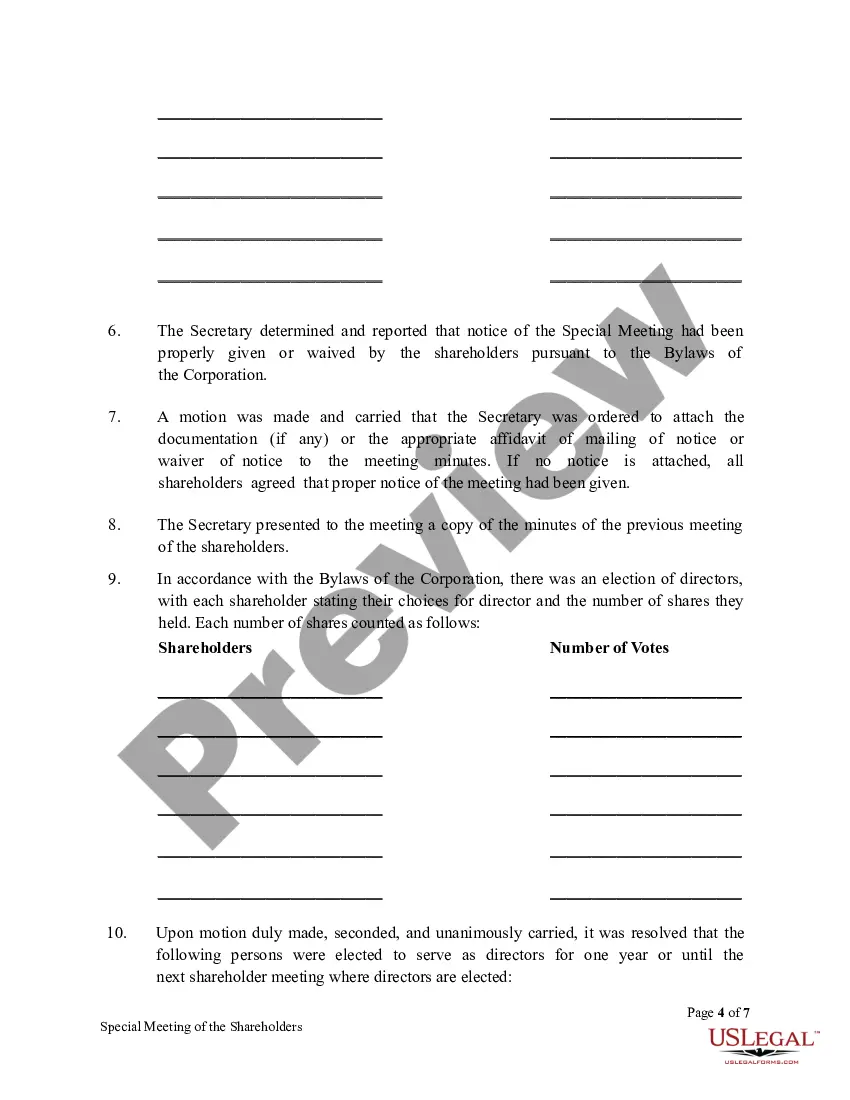

Important: requirements for special resolutions T?hese minutes are drafted for a meeting where one or more special resolutions are voted on. Under the Corporations Act, special resolutions require 75% or more of eligible votes in favour to be passed. Voting on a special resolution is generally conducted by poll.

Include who was present at the meeting as well as their role (if relevant). ?Note decisions that were made. If something is decided upon, always state what decision was made so that future actions can be assigned and held accountable. ?

Minutes of general meeting Agenda item 1: Welcome, attendees and apologies. ... Agenda item 2: Proxy appointments. ... Agenda item 3: Minutes of previous meeting and matters arising. ... Agenda item 4: Business of the meeting. ... Agenda item 7: Special resolution/s (if relevant) ... Agenda item 9: Any other business.

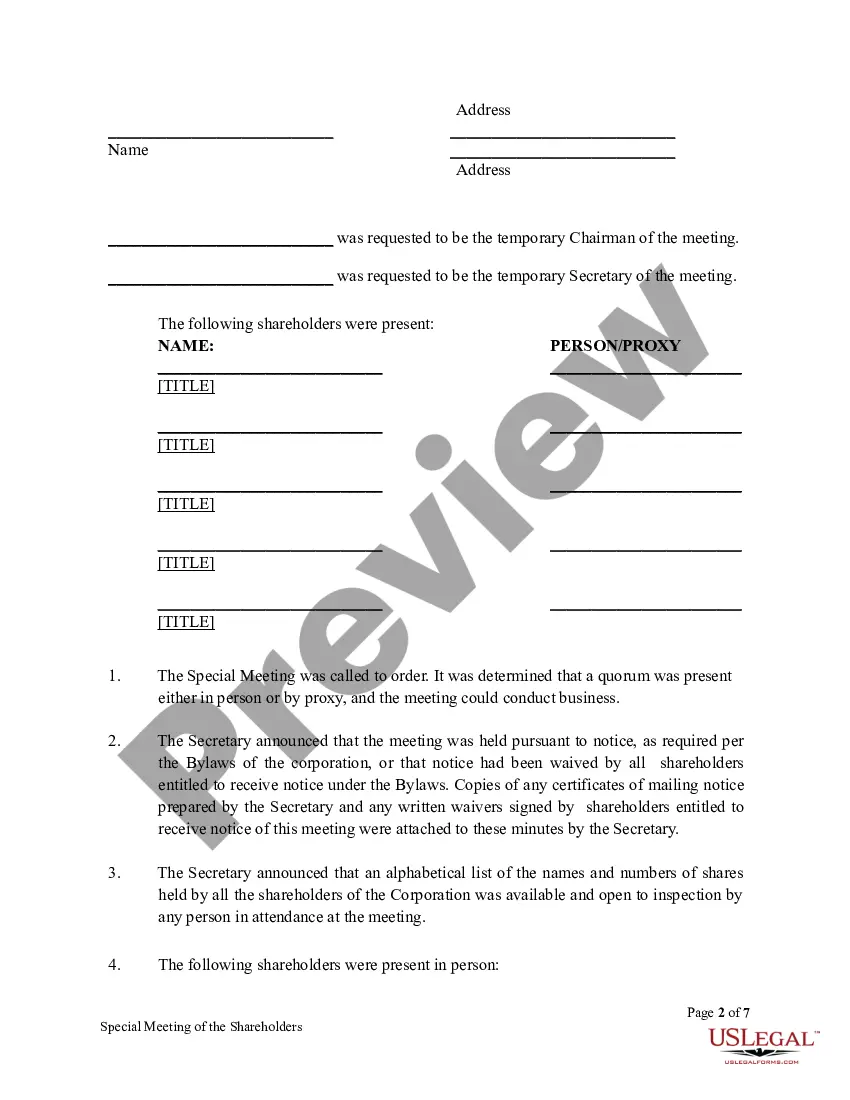

A special meeting allows shareholders to remove the current board of directors and elect a new board. The following is an explanation of the procedures for calling a special meeting of the shareholders. Enclosed are copies of documents, which you can use for your meeting.

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation ...

To take effective meeting minutes, the secretary should include: Date of the meeting. Time the meeting was called to order. Names of the meeting participants and absentees. Corrections and amendments to previous meeting minutes. Additions to the current agenda. Whether a quorum is present. Motions taken or rejected.

It helps to write out your meeting minutes as soon as the meeting concludes so you don't miss anything. 1 Be consistent. It helps to use a template every time you take meeting minutes. ... 2 Record it. ... 3 Make your notes viewable during the meeting. ... 4 Summarize. ... 5 Label comments with initials.