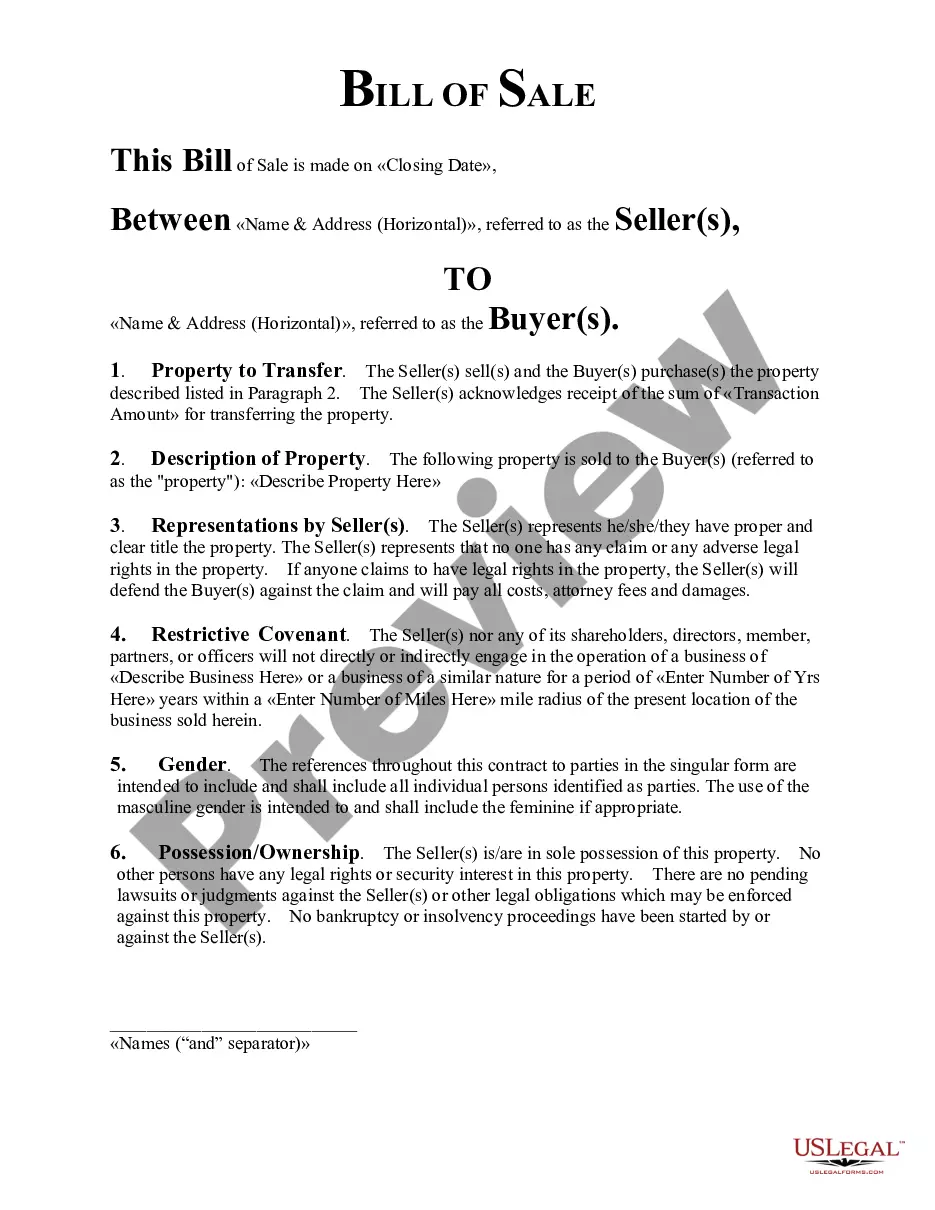

Puerto Rico Bill of Sale Issued Shares

Description

How to fill out Bill Of Sale Issued Shares?

If you need to full, acquire, or printing lawful papers layouts, use US Legal Forms, the most important variety of lawful varieties, that can be found on the web. Make use of the site`s simple and easy convenient look for to obtain the files you will need. A variety of layouts for enterprise and specific reasons are sorted by classes and suggests, or keywords and phrases. Use US Legal Forms to obtain the Puerto Rico Bill of Sale Issued Shares in just a couple of clicks.

When you are currently a US Legal Forms consumer, log in in your accounts and click the Down load switch to obtain the Puerto Rico Bill of Sale Issued Shares. Also you can gain access to varieties you in the past acquired within the My Forms tab of the accounts.

If you work with US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the form for the appropriate city/region.

- Step 2. Make use of the Preview solution to look over the form`s information. Never forget about to read through the information.

- Step 3. When you are unhappy together with the form, make use of the Research field on top of the screen to locate other types of your lawful form design.

- Step 4. Once you have identified the form you will need, select the Purchase now switch. Select the pricing prepare you favor and include your accreditations to sign up for the accounts.

- Step 5. Procedure the deal. You should use your charge card or PayPal accounts to finish the deal.

- Step 6. Find the structure of your lawful form and acquire it in your gadget.

- Step 7. Full, change and printing or indication the Puerto Rico Bill of Sale Issued Shares.

Each and every lawful papers design you purchase is yours permanently. You have acces to every form you acquired in your acccount. Select the My Forms area and select a form to printing or acquire yet again.

Compete and acquire, and printing the Puerto Rico Bill of Sale Issued Shares with US Legal Forms. There are millions of professional and status-distinct varieties you may use for the enterprise or specific demands.

Form popularity

FAQ

Federal taxes. Residents of Puerto Rico are required to pay most types of federal taxes. Specifically, residents of Puerto Rico pay customs taxes, Federal commodity taxes, and all payroll taxes (also known as FICA taxes, which include (a) Social Security, (b) Medicare, and Unemployment taxes).

The Puerto Rico legal system differs greatly from the legal system utilized throughout the Continental United States (with some exceptions). First of all, Puerto Rico's legal system operates in Spanish. It is the only U.S. possession whose legal system operates in a language other than English.

Once you live in Puerto Rico, your passive income is now ?Puerto Rico source income,? and Section 933 of the Internal Revenue Code says you don't have to pay federal taxes on Puerto Rico source income. Act 60 says you don't have to pay Puerto Rico taxes on passive income.

What does this mean? It means that once the person becomes a resident individual investor of Puerto Rico unde Puerto Rico Incentives Code 60 ? and until 1/1/2036 ? any dividend or interest income is exempt from tax in Puerto Rico.

Puerto Rico's status as an unincorporated U.S. territory (like the U.S. Virgin Islands) does not make Puerto Ricans constitutional citizens. The United States does not treat Puerto Rico as fully equal to the states before the law, and Puerto Ricans lack full protection under the U.S. Constitution.

Puerto Rico is an unincorporated territory of the United States. Most but not all federal laws apply to Puerto Rico. In addition to the U.S. Constitution, which is the supreme law of the U.S., federal laws include statutes that are periodically codified in the U.S. Code.

Puerto Rico's Act 20 and Act 22 provide generous tax incentives to U.S. companies and individuals who establish a bona fide residence in Puerto Rico. Under U.S. law, a bona fide resident of Puerto Rico is not subject to U.S. income taxes on income derived from sources within Puerto Rico.

As Puerto Rico is under United States sovereignty, U.S. federal law applies in the territory, and cases of a federal nature are heard in the United States District Court for the District of Puerto Rico.