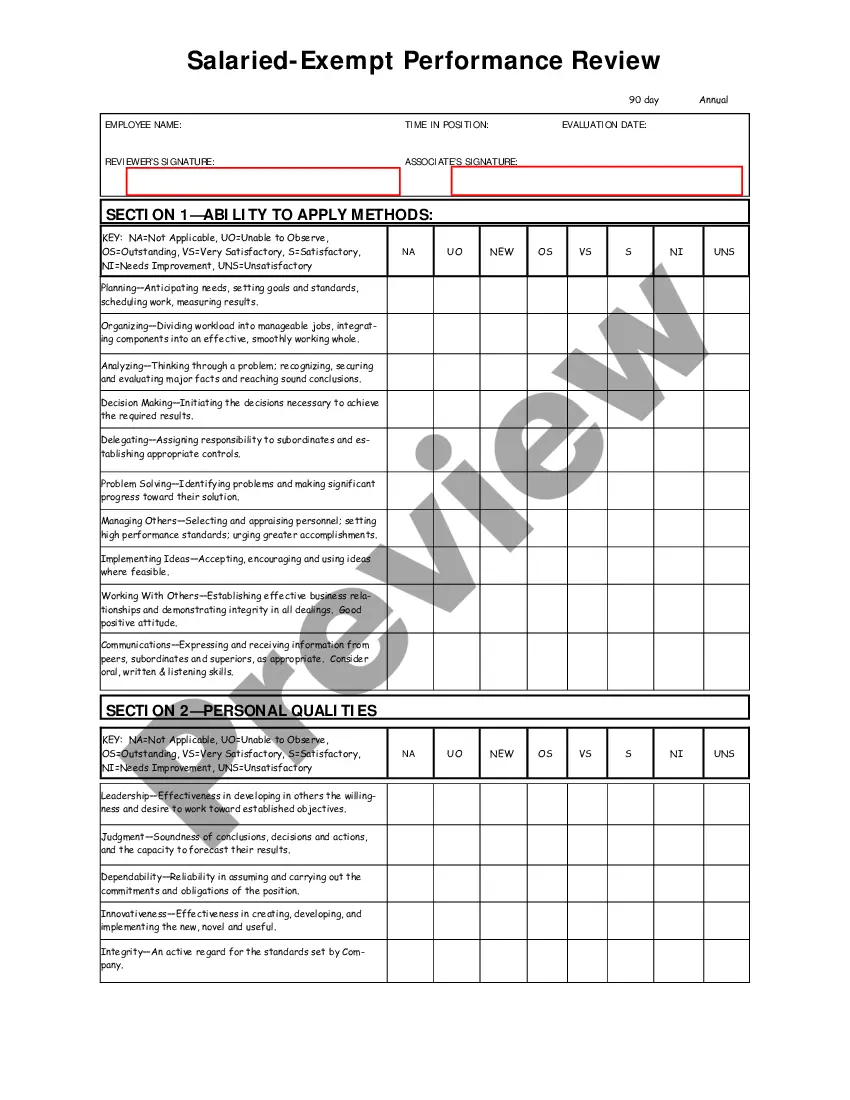

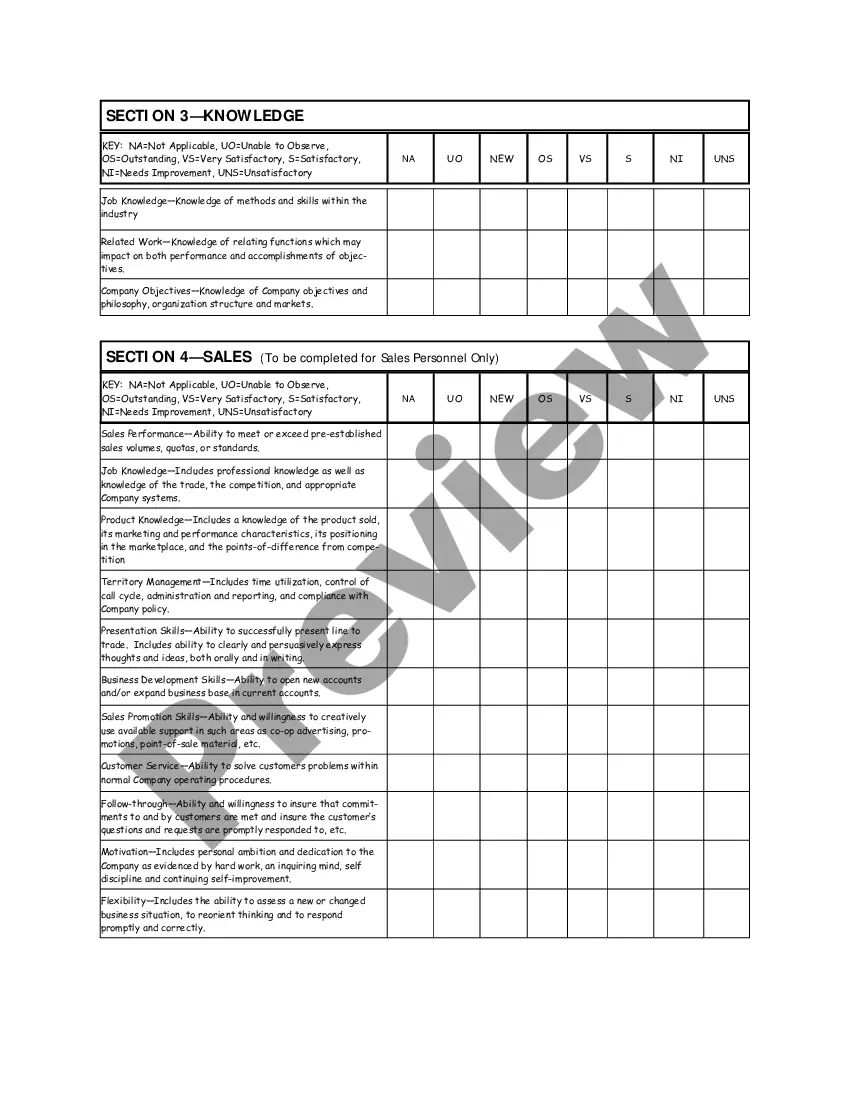

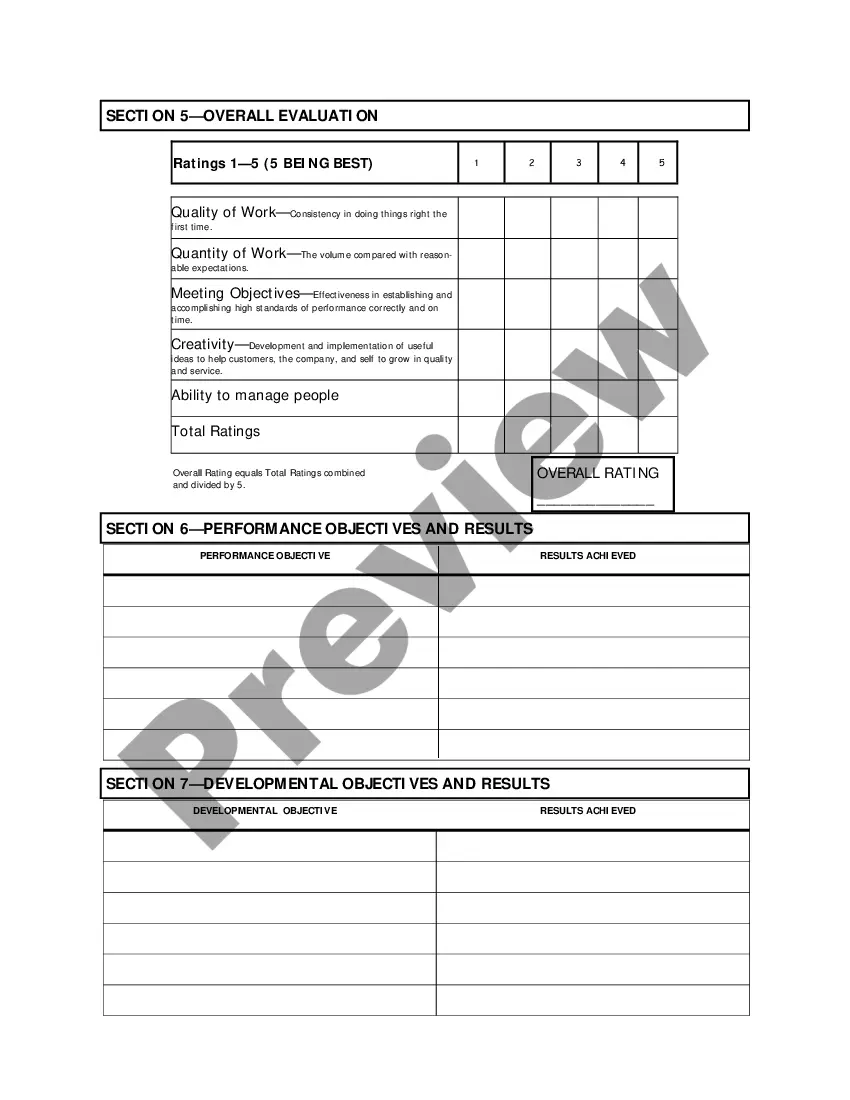

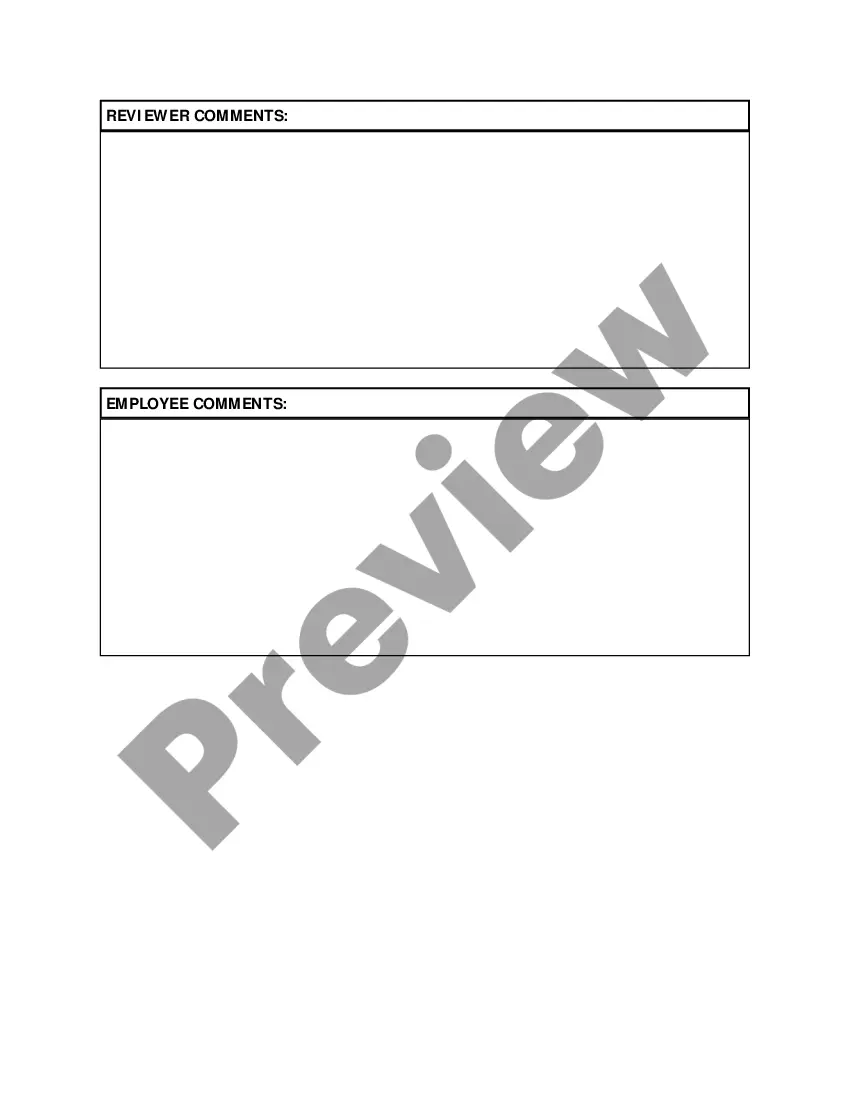

Puerto Rico Salary - Exempt Employee Review and Evaluation Form

Description

How to fill out Puerto Rico Salary - Exempt Employee Review And Evaluation Form?

Discovering the right lawful document design can be a battle. Obviously, there are a lot of web templates available on the net, but how will you get the lawful develop you will need? Take advantage of the US Legal Forms web site. The assistance provides a huge number of web templates, such as the Puerto Rico Salary - Exempt Employee Review and Evaluation Form, that can be used for business and private requires. All the varieties are inspected by professionals and satisfy state and federal requirements.

When you are previously listed, log in to the account and click on the Down load button to obtain the Puerto Rico Salary - Exempt Employee Review and Evaluation Form. Utilize your account to look throughout the lawful varieties you possess ordered in the past. Go to the My Forms tab of your account and acquire one more backup from the document you will need.

When you are a whole new customer of US Legal Forms, listed below are basic guidelines that you can follow:

- First, make sure you have chosen the appropriate develop for your area/area. You can look over the form utilizing the Review button and read the form information to ensure it will be the right one for you.

- In case the develop does not satisfy your needs, utilize the Seach area to obtain the correct develop.

- When you are sure that the form is suitable, go through the Purchase now button to obtain the develop.

- Opt for the pricing program you would like and enter the required information. Build your account and pay money for your order utilizing your PayPal account or charge card.

- Opt for the submit structure and down load the lawful document design to the device.

- Full, change and produce and signal the received Puerto Rico Salary - Exempt Employee Review and Evaluation Form.

US Legal Forms is definitely the greatest library of lawful varieties for which you can find a variety of document web templates. Take advantage of the company to down load skillfully-produced paperwork that follow express requirements.

Form popularity

FAQ

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.

Although the EPA does not apply outside the United States, such claims are covered by Title VII, which also prohibits discrimination in compensation on the basis of sex.

Form 499-R-1C (Adjustments to Income Tax Withheld Worksheet) Form 499R2/W2PR (Withholding Statement) - This withholding statement is the Puerto Rico equivalent of the U.S. Form W2 and should be prepared for every employee.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

ContributionsEmployer. 6.2% FICA Social Security (Federal) 1.45% FICA Medicare (Federal) 0.90%6.20% FICA Social Security (Federal) (Maximum 142,800 USD) 1.45% FICA Medicare (Federal) 0.90%Employee. Employee Income Tax. 0.00% Not over 9,000 USD. 7.00%

If you are a U.S. citizen who is also a bona fide resident of Puerto Rico during the fiscal year but receive income as a U.S. government employee in Puerto Rico, you must file a federal tax return.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

Puerto Rico is not an 'employment at will' jurisdiction. Thus, an indefinite-term employee discharged without just cause is entitled to receive a statutory discharge indemnity (or severance payment) based on the length of service and a statutory formula.