Puerto Rico Diver Services Contract - Self-Employed

Description

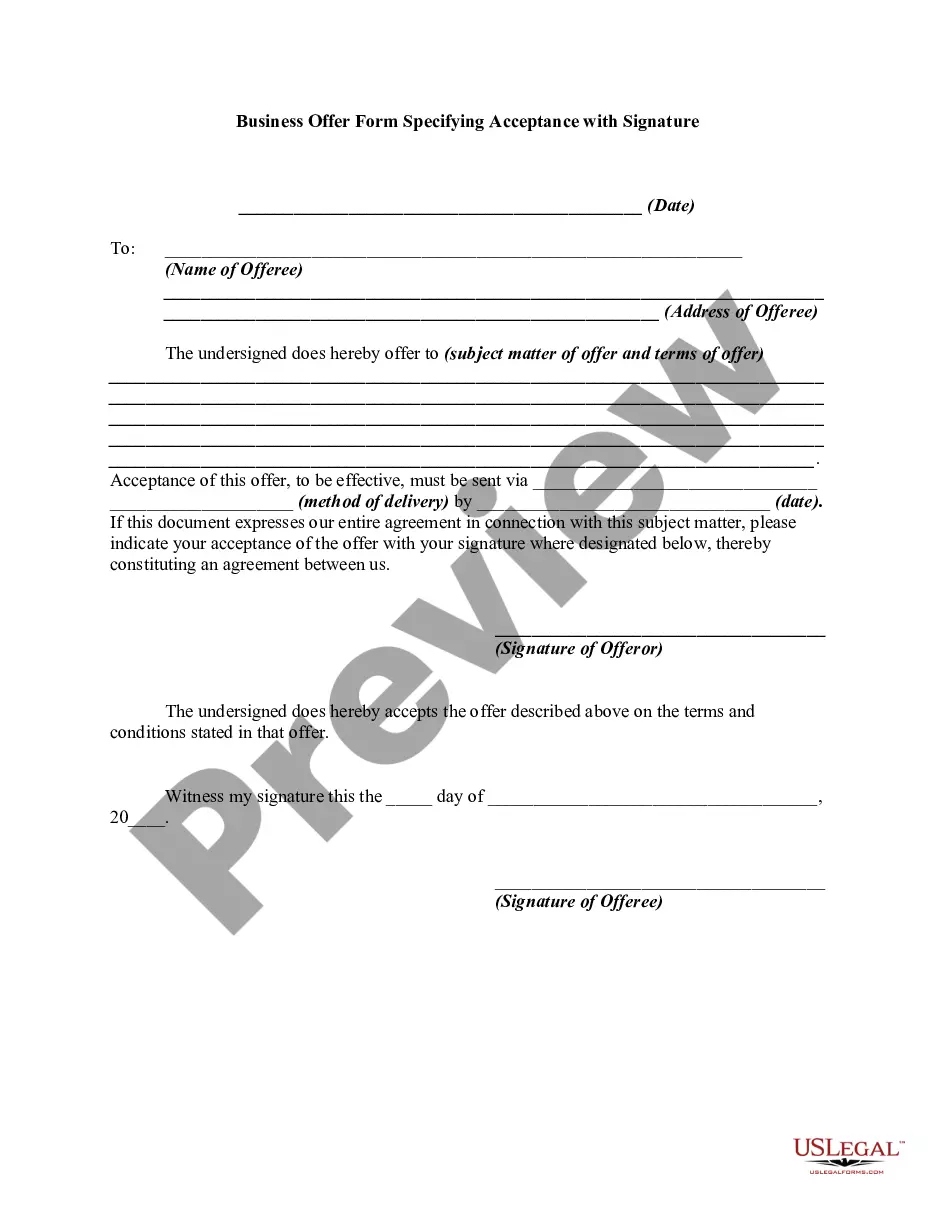

How to fill out Puerto Rico Diver Services Contract - Self-Employed?

You may devote several hours online looking for the legal file format that meets the federal and state demands you need. US Legal Forms offers 1000s of legal forms which are examined by specialists. It is simple to acquire or print out the Puerto Rico Diver Services Contract - Self-Employed from your assistance.

If you already have a US Legal Forms account, you are able to log in and then click the Download option. Following that, you are able to total, change, print out, or indication the Puerto Rico Diver Services Contract - Self-Employed. Each and every legal file format you get is yours eternally. To have one more duplicate of any obtained develop, visit the My Forms tab and then click the related option.

If you work with the US Legal Forms web site the very first time, follow the easy directions beneath:

- Initial, make sure that you have chosen the best file format for your area/metropolis of your choosing. Browse the develop outline to ensure you have picked out the right develop. If available, use the Review option to look with the file format at the same time.

- If you want to find one more edition of your develop, use the Lookup field to discover the format that meets your requirements and demands.

- Once you have discovered the format you want, just click Get now to proceed.

- Pick the pricing program you want, type your credentials, and sign up for a merchant account on US Legal Forms.

- Full the transaction. You can utilize your bank card or PayPal account to pay for the legal develop.

- Pick the file format of your file and acquire it for your gadget.

- Make adjustments for your file if required. You may total, change and indication and print out Puerto Rico Diver Services Contract - Self-Employed.

Download and print out 1000s of file themes using the US Legal Forms website, which provides the greatest collection of legal forms. Use specialist and express-certain themes to take on your small business or specific requires.

Form popularity

FAQ

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

The Contract Work Hours and Safety Standards statute (40 USC 327-333) applies to contracts in excess of $150,000 that will use laborers, mechanics, watchmen, and guards (such as service and construction contracts) and requires that employees be paid time and one-half for all hours worked in excess of 40 per week.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Act 22 of 2012 also known as the Act to Promote the Relocation of Investors to Puerto Rico (Spanish: Ley para Incentivar el Traslado de Inversionistas a Puerto Rico) is an act enacted by the 16th Legislative Assembly of Puerto Rico that fully exempts local taxes on all passive income generated by individuals that

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.