Puerto Rico Self-Employed Independent Contractor Consideration For Hire Form

Description

How to fill out Puerto Rico Self-Employed Independent Contractor Consideration For Hire Form?

You are able to commit hours on the Internet attempting to find the lawful papers design that meets the state and federal specifications you need. US Legal Forms supplies 1000s of lawful forms which are examined by pros. You can actually download or print out the Puerto Rico Self-Employed Independent Contractor Consideration For Hire Form from your assistance.

If you already have a US Legal Forms account, it is possible to log in and click the Download option. After that, it is possible to full, revise, print out, or indication the Puerto Rico Self-Employed Independent Contractor Consideration For Hire Form. Every lawful papers design you purchase is yours for a long time. To get one more backup of the bought type, go to the My Forms tab and click the related option.

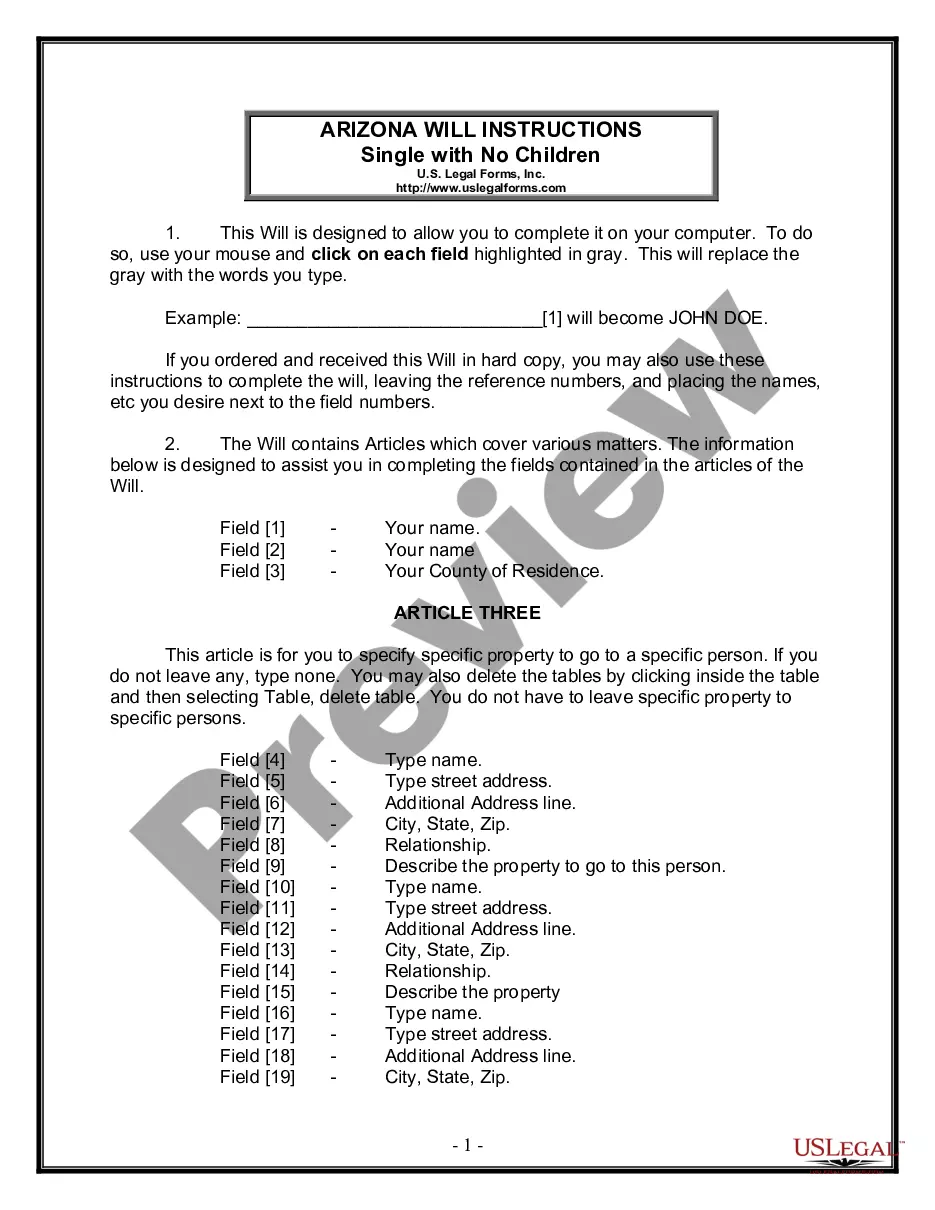

Should you use the US Legal Forms web site the first time, stick to the easy guidelines listed below:

- Initially, ensure that you have selected the right papers design for that state/metropolis that you pick. Browse the type outline to make sure you have chosen the correct type. If readily available, make use of the Preview option to look through the papers design at the same time.

- If you would like find one more model of your type, make use of the Search industry to get the design that meets your requirements and specifications.

- When you have discovered the design you want, click on Buy now to proceed.

- Choose the costs program you want, type your qualifications, and sign up for a merchant account on US Legal Forms.

- Complete the purchase. You can utilize your charge card or PayPal account to cover the lawful type.

- Choose the format of your papers and download it to the product.

- Make alterations to the papers if required. You are able to full, revise and indication and print out Puerto Rico Self-Employed Independent Contractor Consideration For Hire Form.

Download and print out 1000s of papers web templates using the US Legal Forms Internet site, that offers the largest collection of lawful forms. Use skilled and express-specific web templates to handle your business or specific needs.

Form popularity

FAQ

If you're looking to hire employees in Puerto Rico, check out the job bank maintained by the Puerto Rico Department of Labor. It's an entirely free service that allows you to create an employer account and sift through the resumes of potential employees.

Companies looking to hire workers from Puerto Rico must comply with Public Law 87. It requires employers who are recruiting on the island to obtain authorization by the Secretary of Labor and Human Resources of Puerto Rico, according to Odemaris Chacon, a labor attorney with Estrella, based in Puerto Rico.

Form 499-R-1C (Adjustments to Income Tax Withheld Worksheet) Form 499R2/W2PR (Withholding Statement) - This withholding statement is the Puerto Rico equivalent of the U.S. Form W2 and should be prepared for every employee.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Whether you're a seasoned digital nomad or a first-time remote worker, you can relocate to Puerto Rico Opens in new window for a few weeks, a few months, or moreno applications, visas, or passports required for U.S. citizens. Discover how easy, exhilarating, and vibrant work in full color can be.

If you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099-NEC needs to be completed, and a copy of 1099-NEC must be provided to the independent contractor by January 31 of the year following payment.

Companies often hire 1099 employees because they can help complete non-essential tasks quickly and allow businesses to grow and develop more easily. If you're hoping to work with independent contractors, it can be beneficial to understand their major benefits and the most efficient way to hire them.

Because Puerto Ricans are U.S. citizens, there are no federally-required paperwork or VISA applications needed. Additionally, there are no wage requirements other than U.S. state and federal laws to adhere to.