Puerto Rico Drafting Agreement - Self-Employed Independent Contractor

Description

How to fill out Puerto Rico Drafting Agreement - Self-Employed Independent Contractor?

If you need to full, down load, or print legitimate document templates, use US Legal Forms, the biggest selection of legitimate forms, which can be found on the web. Utilize the site`s easy and practical lookup to obtain the papers you require. Numerous templates for organization and person uses are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to obtain the Puerto Rico Drafting Agreement - Self-Employed Independent Contractor with a couple of click throughs.

When you are already a US Legal Forms customer, log in to your bank account and click the Acquire key to obtain the Puerto Rico Drafting Agreement - Self-Employed Independent Contractor. You can even accessibility forms you in the past saved in the My Forms tab of the bank account.

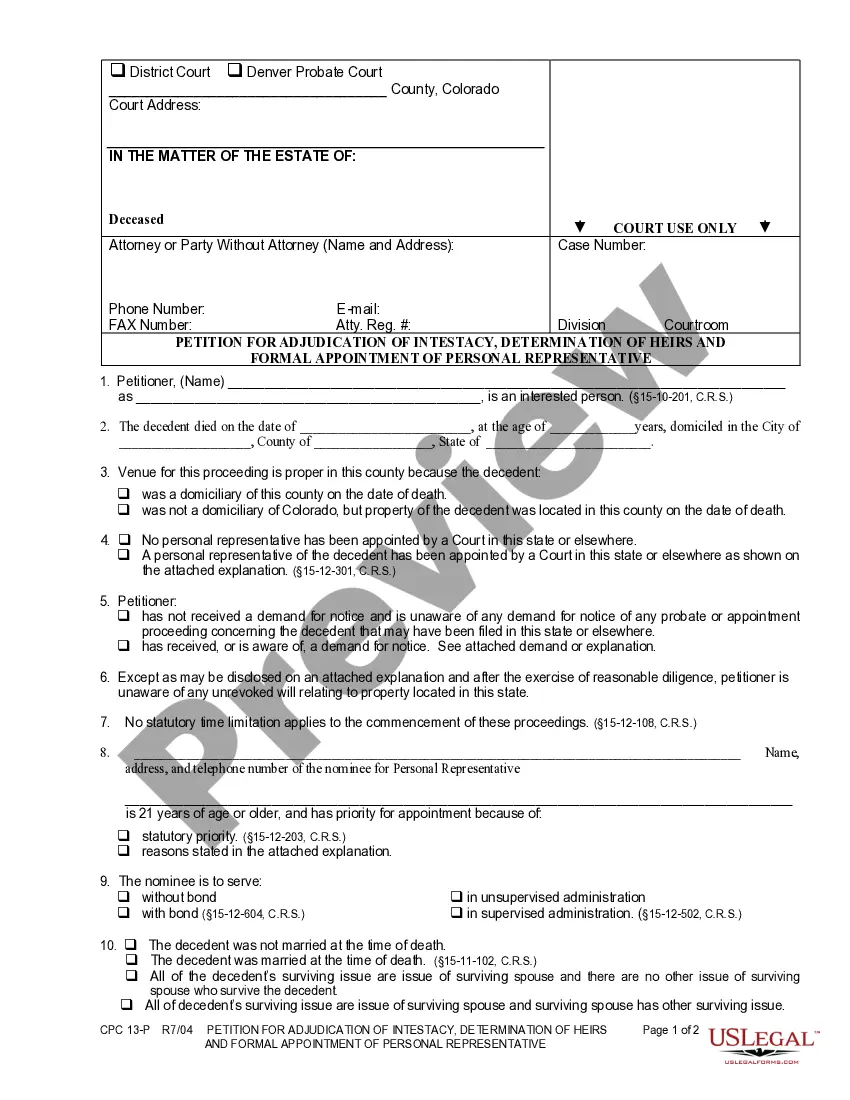

Should you use US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have selected the shape to the right metropolis/nation.

- Step 2. Take advantage of the Preview solution to look over the form`s content. Never neglect to read the outline.

- Step 3. When you are not happy together with the type, utilize the Research area towards the top of the display to locate other models of your legitimate type template.

- Step 4. Upon having discovered the shape you require, click on the Purchase now key. Select the prices program you favor and add your credentials to register on an bank account.

- Step 5. Process the deal. You can use your credit card or PayPal bank account to complete the deal.

- Step 6. Pick the formatting of your legitimate type and down load it on the product.

- Step 7. Full, modify and print or indication the Puerto Rico Drafting Agreement - Self-Employed Independent Contractor.

Every legitimate document template you get is the one you have permanently. You have acces to every type you saved within your acccount. Click the My Forms section and decide on a type to print or down load once more.

Contend and down load, and print the Puerto Rico Drafting Agreement - Self-Employed Independent Contractor with US Legal Forms. There are thousands of skilled and status-certain forms you can utilize to your organization or person requirements.

Form popularity

FAQ

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Some of the common characteristics of an independent contractor include:Furnishes equipment and has control over that equipment.Submits bids for jobs, contracts, or fixes the price in advance.Has the capacity to accept or refuse an assignment or work.Pay relates more to completion of a job.More items...

As in the United States, the National Labor Relations Act (NLRA) applies in Puerto Rico to covered employers engaged in interstate commerce.

The 5 personality traits that make a successful contractorConfidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.07-Mar-2018

Wage and hour coverage in Puerto Rico for non-exempt employees is governed by the US Fair Labor Standards Act (FLSA) as well as local laws.

The NLRA applies to most private sector employers, including manufacturers, retailers, private universities, and health care facilities.

During President Donald Trump's administration, the DOL issued a final rule clarifying when workers are independent contractors versus employees. The rule applied an economic-reality test that primarily considers whether the worker operates his or her own business or is economically dependent on the hiring entity.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

Court cases have established three broad categories of factors for determining employee classification:Behavioral control. Do you, as the employer, have a right to direct and control how the worker does the task that you hired them for?Financial control.Relationship between parties.20-Nov-2014

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.