Puerto Rico Telephone Systems Service Contract - Self-Employed

Description

How to fill out Puerto Rico Telephone Systems Service Contract - Self-Employed?

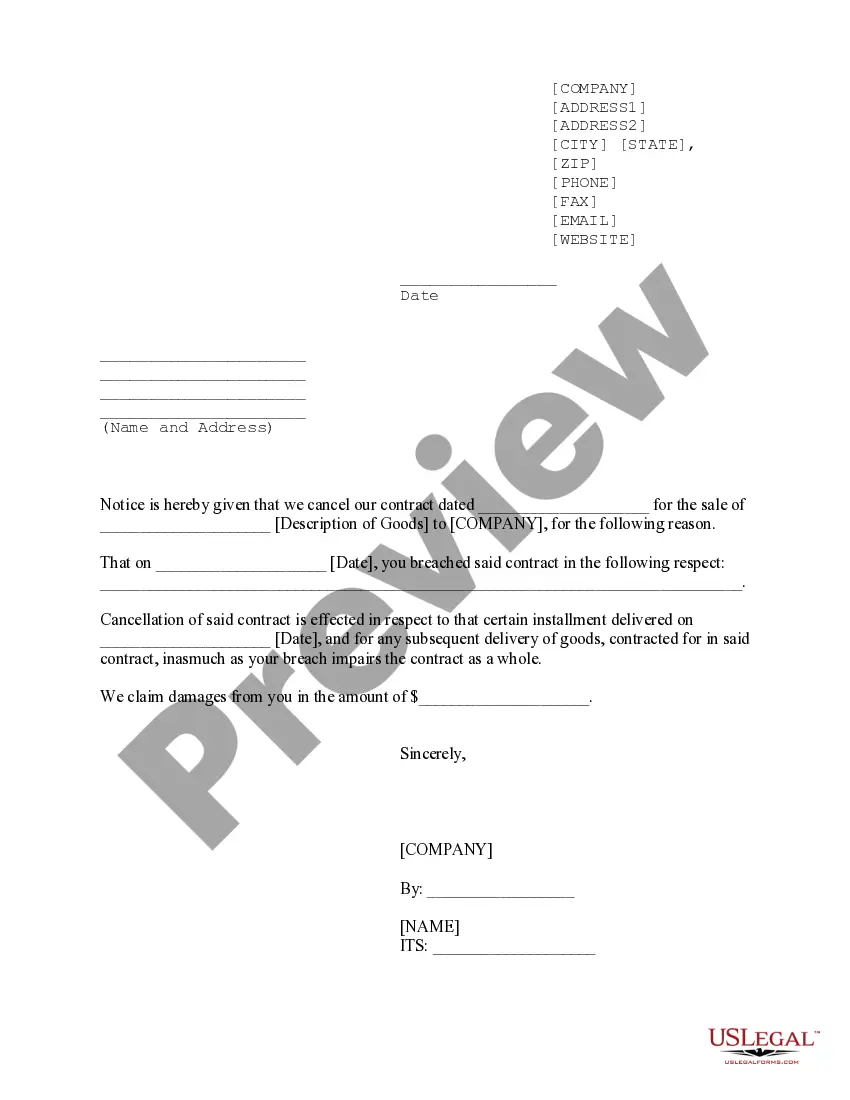

Finding the right legal papers web template can be quite a have a problem. Naturally, there are a variety of layouts available online, but how can you find the legal form you need? Utilize the US Legal Forms web site. The service delivers thousands of layouts, for example the Puerto Rico Telephone Systems Service Contract - Self-Employed, that you can use for enterprise and private requirements. All of the types are examined by pros and meet up with federal and state needs.

If you are already registered, log in in your bank account and click on the Down load button to get the Puerto Rico Telephone Systems Service Contract - Self-Employed. Use your bank account to appear throughout the legal types you possess bought earlier. Check out the My Forms tab of your bank account and have another backup of your papers you need.

If you are a fresh consumer of US Legal Forms, listed below are simple instructions that you should adhere to:

- First, make sure you have chosen the proper form for the city/region. It is possible to look through the shape using the Review button and look at the shape explanation to ensure it will be the best for you.

- In case the form is not going to meet up with your requirements, take advantage of the Seach industry to find the correct form.

- When you are certain the shape would work, select the Purchase now button to get the form.

- Choose the prices strategy you want and enter in the essential information. Build your bank account and buy the order making use of your PayPal bank account or charge card.

- Pick the submit file format and download the legal papers web template in your system.

- Full, revise and produce and indication the attained Puerto Rico Telephone Systems Service Contract - Self-Employed.

US Legal Forms is the largest local library of legal types where you can discover various papers layouts. Utilize the service to download appropriately-manufactured files that adhere to state needs.

Form popularity

FAQ

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

If you choose to pay yourself as a contractor, you need to file IRS Form W-9 with the LLC and the LLC will file an IRS Form 1099-MISC at the end of the year. You will be responsible for paying self-employment taxes on the amount earned.

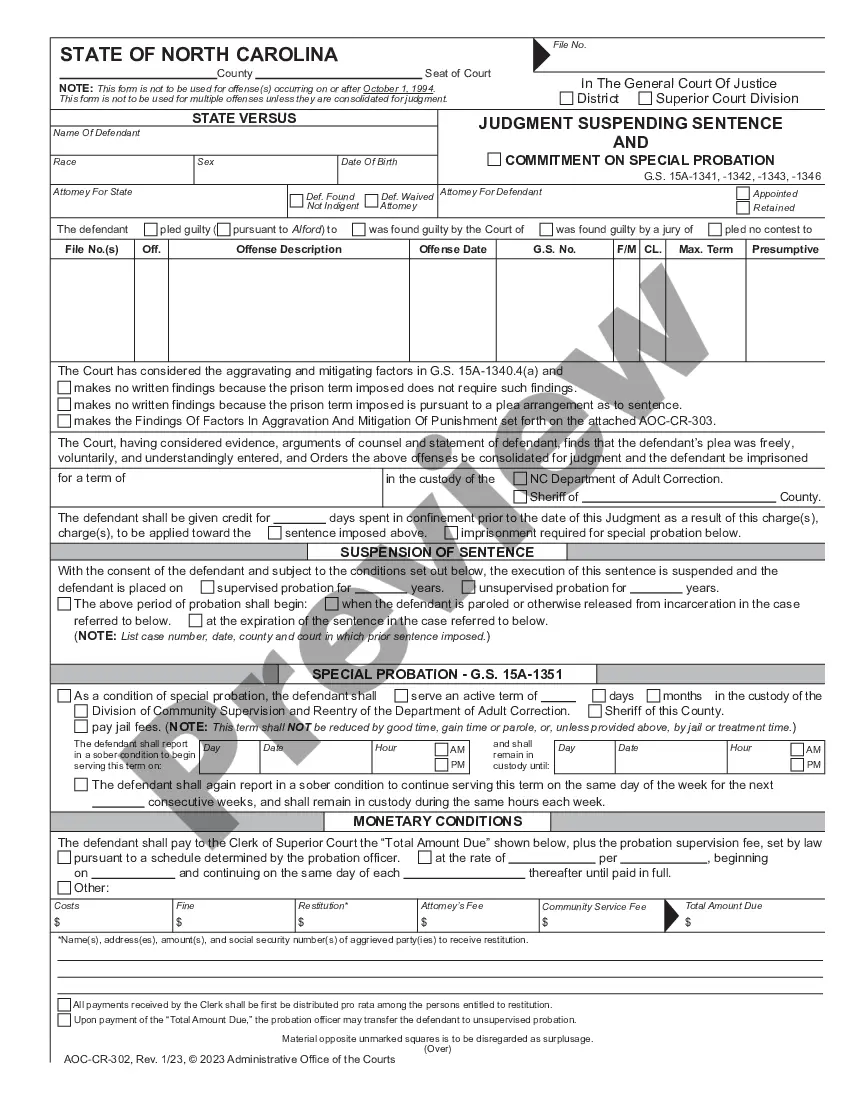

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

This agreement should clearly state what tasks the contractor is to perform. The agreement will also include what tasks will be performed and how much the contractor will be paid for his or her work. A contractor agreement can also help demonstrate that the person is truly an independent contractor and not an employee.

The 5 personality traits that make a successful contractorConfidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

It seems obvious, but make sure that you include in the contract the contractor's name, physical address, phone number, insurance company and account and license numbers.

First up: Get your tax forms in orderStep 1: Ask your independent contractor to fill out Form W-9.Step 2: Fill out two 1099-NEC forms (Copy A and B)Ask your independent contractor for invoices.Add your freelancer to payroll.Keep records like a boss.Tools to check out:

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.7 Sept 2021