Puerto Rico Self-Employed Technician Services Contract

Description

How to fill out Puerto Rico Self-Employed Technician Services Contract?

US Legal Forms - one of several greatest libraries of lawful varieties in America - provides a wide array of lawful file themes you may obtain or printing. While using internet site, you can find 1000s of varieties for organization and personal purposes, categorized by types, suggests, or keywords.You will discover the most up-to-date versions of varieties much like the Puerto Rico Self-Employed Technician Services Contract in seconds.

If you already possess a monthly subscription, log in and obtain Puerto Rico Self-Employed Technician Services Contract in the US Legal Forms collection. The Download option can look on each and every develop you see. You have accessibility to all in the past downloaded varieties inside the My Forms tab of the account.

If you would like use US Legal Forms the first time, listed below are simple instructions to help you started:

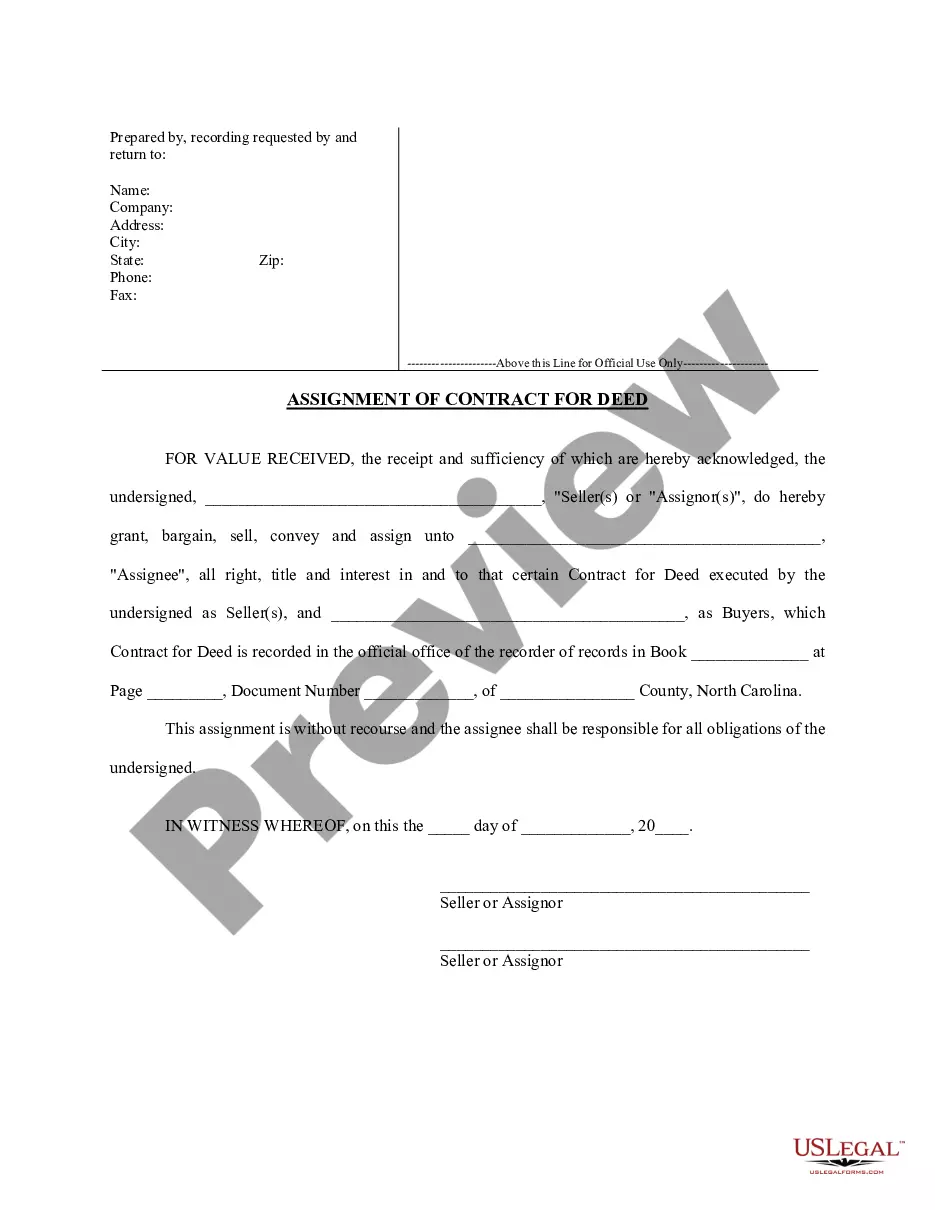

- Be sure you have picked out the proper develop for your personal area/area. Click the Preview option to review the form`s content material. Look at the develop explanation to ensure that you have chosen the correct develop.

- In case the develop doesn`t suit your needs, take advantage of the Search field towards the top of the screen to find the one who does.

- Should you be pleased with the shape, affirm your selection by clicking the Acquire now option. Then, select the costs program you want and offer your accreditations to register for the account.

- Approach the deal. Make use of your bank card or PayPal account to finish the deal.

- Find the formatting and obtain the shape on your gadget.

- Make modifications. Fill up, modify and printing and indicator the downloaded Puerto Rico Self-Employed Technician Services Contract.

Every single format you included with your bank account does not have an expiration day and is the one you have for a long time. So, if you would like obtain or printing another backup, just proceed to the My Forms area and click on the develop you require.

Get access to the Puerto Rico Self-Employed Technician Services Contract with US Legal Forms, probably the most considerable collection of lawful file themes. Use 1000s of professional and express-certain themes that fulfill your company or personal requires and needs.

Form popularity

FAQ

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

In short, because Puerto Rican workers are U.S. citizens, the process is quite simple. This process can include using a third-party recruiting agency or sourcing directly from the island, which bear varying levels of cost.

More In Forms and Instructions One purpose of the form is to report net earnings from self-employment (SE) to the United States and, if necessary, pay SE tax on that income. The Social Security Administration (SSA) uses this information to figure your benefits under the social security program.

If you are a bona fide resident of Puerto Rico during the entire tax year, you'll file the following returns: A Puerto Rico tax return (Form 482) reporting your worldwide income. A U.S. tax return (Form 1040) reporting your worldwide income. However, this 1040 will exclude your Puerto Rico income.

Whether you're a seasoned digital nomad or a first-time remote worker, you can relocate to Puerto Rico Opens in new window for a few weeks, a few months, or moreno applications, visas, or passports required for U.S. citizens. Discover how easy, exhilarating, and vibrant work in full color can be.

Companies looking to hire workers from Puerto Rico must comply with Public Law 87. It requires employers who are recruiting on the island to obtain authorization by the Secretary of Labor and Human Resources of Puerto Rico, according to Odemaris Chacon, a labor attorney with Estrella, based in Puerto Rico.

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico. For stateside employers, that is the easy part.

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

All in all, even if you have to hire employees in Puerto Rico, the process is relatively simple and straightforward. You can take advantage of a highly skilled labor force that works for significantly lower wages than in the US while enjoying Puerto Rico's generous tax incentives.

More info

How it Works 1. Download the Sample Agreement Template by clicking the Download Sample Agreement button at the top of the page: 2.