This Formula System for Distribution of Earnings to Partners provides a list of provisions to conside when making partner distribution recommendations. Some of the factors to consider are: Collections on each partner's matters, acquisition and development of new clients, profitablity of matters worked on, training of associates and paralegals, contributions to the firm's marketing practices, and others.

Puerto Rico Formula System for Distribution of Earnings to Partners

Description

How to fill out Formula System For Distribution Of Earnings To Partners?

Finding the right authorized papers web template might be a struggle. Obviously, there are plenty of layouts accessible on the Internet, but how would you find the authorized develop you need? Utilize the US Legal Forms internet site. The services provides thousands of layouts, for example the Puerto Rico Formula System for Distribution of Earnings to Partners, that can be used for enterprise and personal requires. Every one of the varieties are checked by professionals and fulfill federal and state demands.

If you are currently authorized, log in in your bank account and click the Obtain option to get the Puerto Rico Formula System for Distribution of Earnings to Partners. Use your bank account to look with the authorized varieties you might have ordered formerly. Go to the My Forms tab of the bank account and have one more backup of the papers you need.

If you are a fresh user of US Legal Forms, listed here are simple directions that you should follow:

- First, be sure you have chosen the correct develop for your metropolis/county. You may check out the form using the Preview option and browse the form information to guarantee it is the right one for you.

- In the event the develop will not fulfill your requirements, utilize the Seach discipline to get the right develop.

- Once you are sure that the form is proper, click the Get now option to get the develop.

- Choose the costs prepare you desire and enter in the essential info. Make your bank account and pay for the order with your PayPal bank account or bank card.

- Choose the file formatting and download the authorized papers web template in your gadget.

- Total, modify and printing and indicator the received Puerto Rico Formula System for Distribution of Earnings to Partners.

US Legal Forms will be the largest local library of authorized varieties where you can find a variety of papers layouts. Utilize the service to download skillfully-made papers that follow status demands.

Form popularity

FAQ

In the general partnership, the limited liability partnership, the limited liability limited partnership and the limited partnership, profits and losses are passed through to the partners as specified in the partnership agreement. If left unspecified, profits and losses are shared equally among the partners.

Generally, a partnership doesn't pay tax on its income but ?passes through? any profits or losses to its partners. Partners must include partnership items on their tax returns.

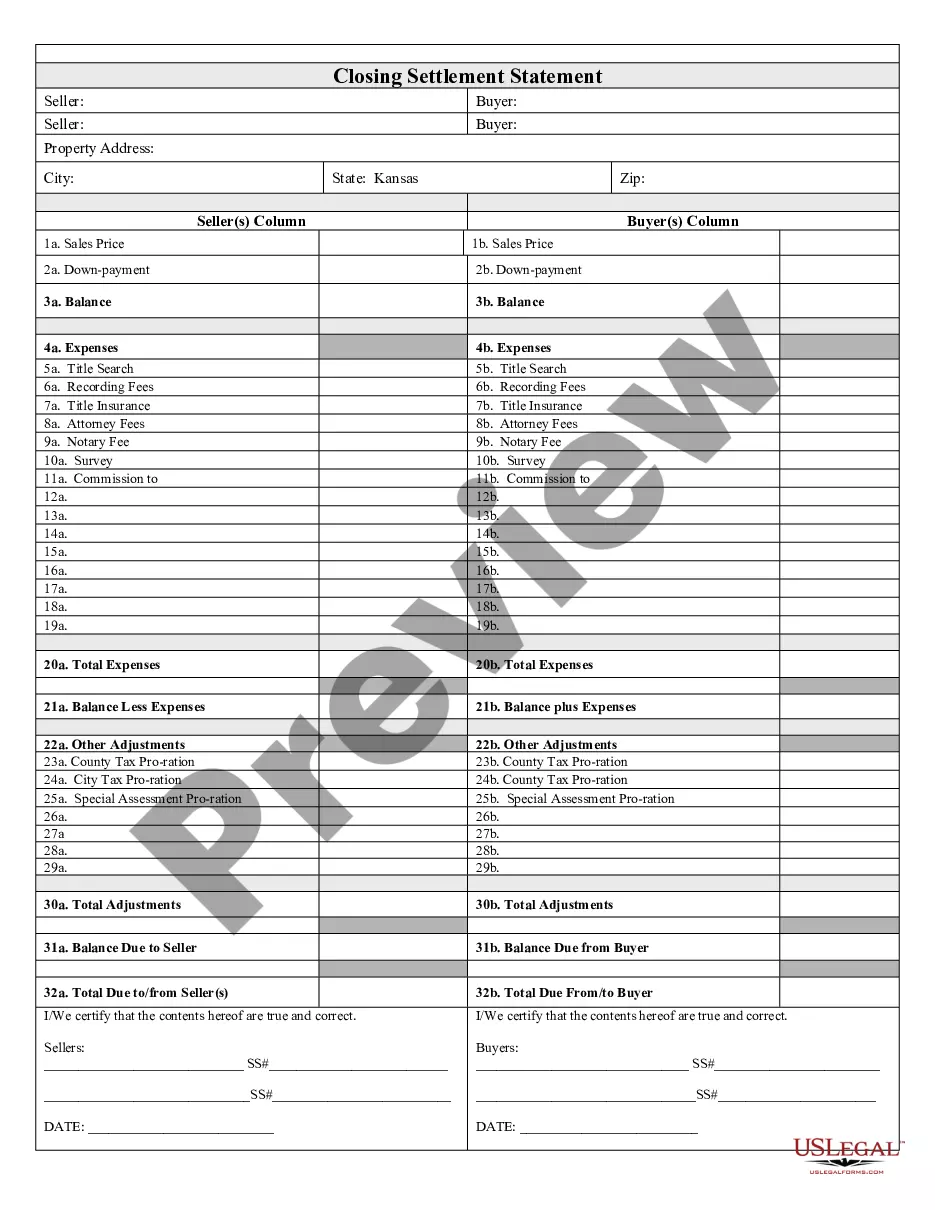

A current distribution occurs when a partnership distributes money or other property to a partner who continues to own an interest in the partnership after the distribution.

The net income for a partnership is divided between the partners as called for in the partnership agreement. The income summary account is closed to the respective partner capital accounts. The respective drawings accounts are closed to the partner capital accounts.

Specifically, the partners' distributive shares represent the allocation among them under the partnership agreement of (1) the partnership's separately stated items of taxable income, gain, loss, deduction, and (2) non-separately stated items.

Most operating agreements provide that a member's distributive share is in proportion to their percentage interest in the business. For instance, if Jimmy owns 60% of the LLC, and Luana owns the other 40%, Jimmy will be entitled to 60% of the LLC's profits and losses, and Luana will be entitled to 40%.

Net Income of the partnership is calculated by subtracting total expenses from total revenues. After that salary and interest allowances are subtracted from Net Income, and the result is Remaining Income, which is divided equally in ance with the partnership agreement.

Partnerships are considered pass-through entities. That means that any income or losses are passed through the partnership to the individual owners, who are then responsible to account for that income or loss on their income tax returns.