Puerto Rico Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer

Description

How to fill out Mineral Deed With Grantor Reserving Executive Rights In The Interest Conveyed - Transfer?

It is possible to commit hrs on the web searching for the lawful file web template which fits the state and federal requirements you require. US Legal Forms offers a huge number of lawful kinds that are reviewed by specialists. It is possible to acquire or print out the Puerto Rico Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer from my services.

If you already have a US Legal Forms bank account, you may log in and click the Down load button. Next, you may total, edit, print out, or signal the Puerto Rico Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer. Each lawful file web template you acquire is your own property for a long time. To have another copy of any bought develop, proceed to the My Forms tab and click the corresponding button.

If you use the US Legal Forms internet site for the first time, stick to the simple guidelines under:

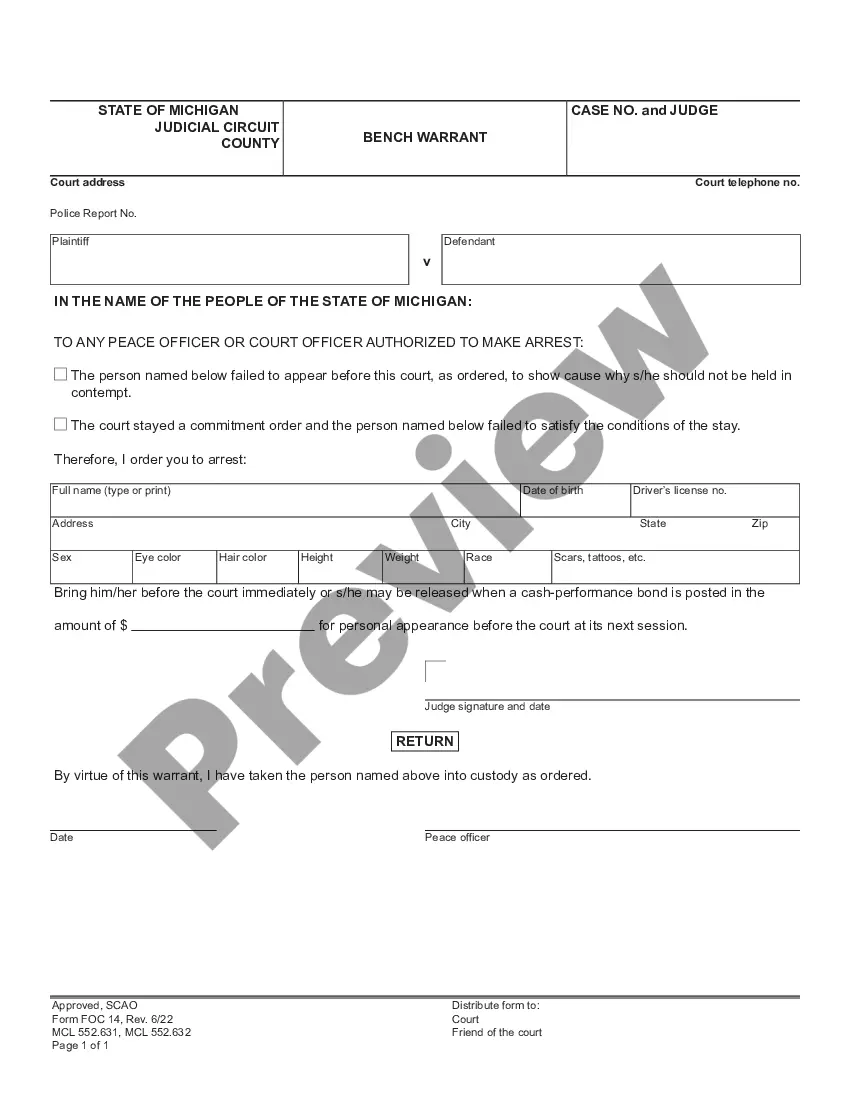

- First, make sure that you have chosen the correct file web template to the state/town of your liking. Read the develop outline to make sure you have chosen the appropriate develop. If readily available, take advantage of the Review button to search with the file web template also.

- If you wish to get another variation of the develop, take advantage of the Search industry to find the web template that meets your requirements and requirements.

- Upon having located the web template you would like, just click Acquire now to carry on.

- Select the costs prepare you would like, enter your references, and sign up for a free account on US Legal Forms.

- Comprehensive the deal. You can use your Visa or Mastercard or PayPal bank account to pay for the lawful develop.

- Select the format of the file and acquire it in your system.

- Make changes in your file if possible. It is possible to total, edit and signal and print out Puerto Rico Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer.

Down load and print out a huge number of file web templates utilizing the US Legal Forms site, which offers the greatest selection of lawful kinds. Use expert and condition-specific web templates to tackle your company or person requirements.

Form popularity

FAQ

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

Mineral interests are defined by the Texas Property Tax Code as real property and are subject to taxes the same as all other real property. When do mineral interests become taxable? Mineral interests become taxable on January 1 of the year following the first production of the unit.

After confirming your legal ownership with an attorney at law, you need to draw up a deed of transfer form in your name and register it with the county records office as the mineral owner. The land transaction, leasing transaction, and royalty compliance go through the county office.

Whether mineral rights transfer with the property depends on the estate type. If it's a severed estate, surface rights and mineral rights are separate and do not transfer together. However, if it's a unified estate, the land and the mineral rights can be conveyed with the property.

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.

Mineral rights convey means to change the ownership of your mineral rights and transfer it to someone else. You can convey or transfer mineral rights using a will, a deed, or a lease. However, the process you choose determines what you intend to do with your rights.

In Texas, Oklahoma, Colorado and Montana, mineral owners can own the mineral rights indefinitely and there is no way for them to passively revert to the surface owner. If a surface owner wants to own the mineral rights under their land, they must find and contact the mineral owners and offer to purchase them.

In general terms, the executive right holder is the party who has the right to take or authorize actions which affect the exploration and development of the mineral estate, including the right to execute oil and gas leases. Non-executive mineral interest owners do not have the power to lease the minerals.