The Puerto Rico Waiver of Call on Production is a legal document that grants individuals or companies the right to waive certain regulations or requirements related to the production of goods or services in Puerto Rico. This waiver allows flexibility and ease of doing business in the country, encouraging investment and promoting economic growth. One type of Puerto Rico Waiver of Call on Production is the Tax Incentives Waiver. Under this waiver, businesses can receive tax benefits and incentives provided by the government to stimulate economic development. These incentives may include reduced corporate tax rates, tax exemptions or credits, and special deductions on expenses related to production. Another type of Puerto Rico Waiver of Call on Production is the Labor Regulations Waiver. This allows companies to have more flexibility in terms of labor laws, such as minimum wage requirements, overtime pay, and employee benefits. This waiver aims to attract businesses by offering lower labor costs and creating a favorable environment for employers. Additionally, the Environmental Regulations Waiver is another type of Puerto Rico Waiver of Call on Production. This waiver reduces or eliminates certain environmental regulations and permits, making it easier for companies to comply with environmental laws and regulations. This waiver ensures smoother and quicker production processes, benefiting both the business and the environment. The Puerto Rico Waiver of Call on Production is a powerful tool that enables businesses to benefit from waived regulations and requirements, ultimately encouraging investment and economic growth in Puerto Rico. By leveraging these waivers, companies can capitalize on tax incentives, enjoy flexibility in labor regulations, and navigate environmental regulations more efficiently.

Puerto Rico Waiver of Call on Production

Description

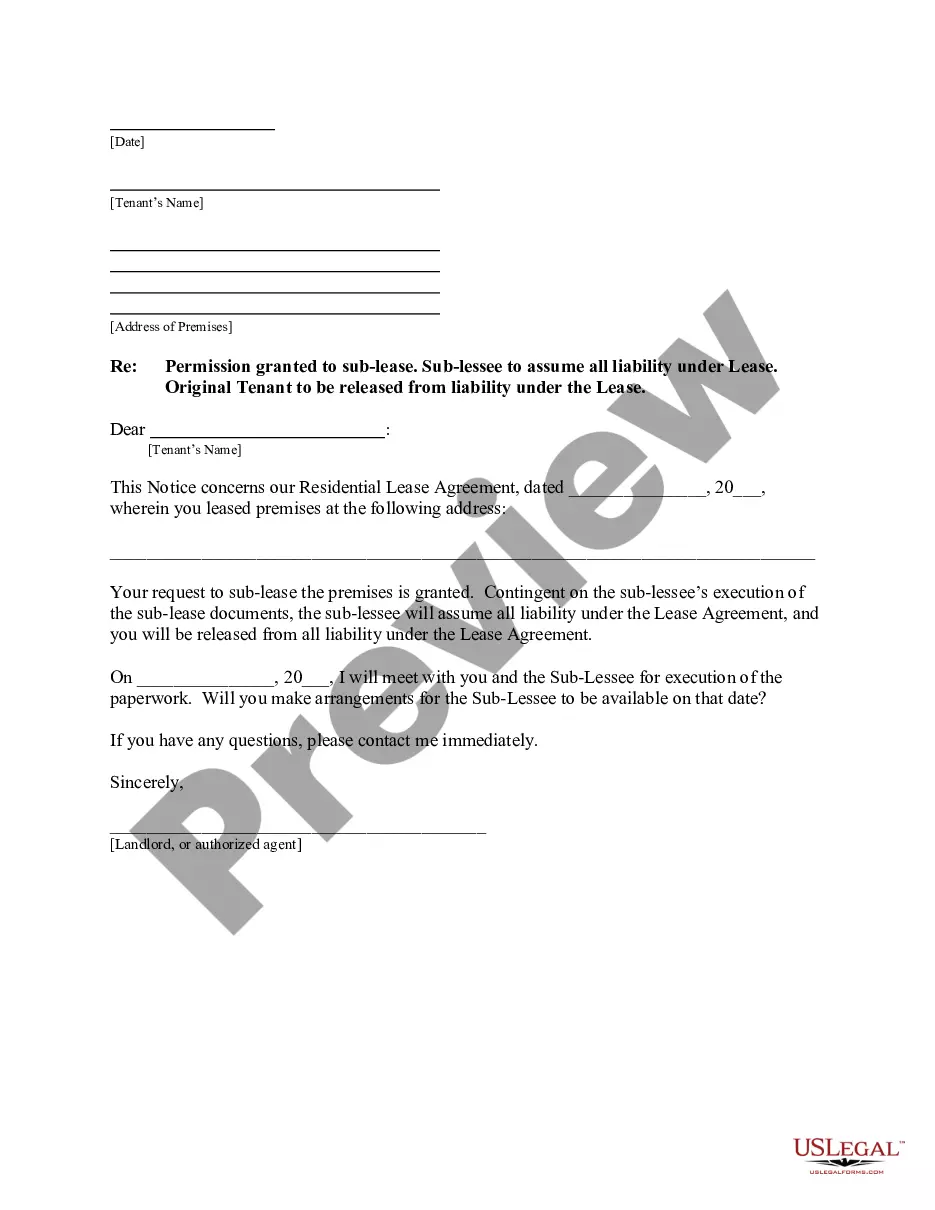

How to fill out Puerto Rico Waiver Of Call On Production?

If you wish to full, obtain, or print legal document themes, use US Legal Forms, the most important variety of legal kinds, which can be found on the Internet. Utilize the site`s simple and easy convenient research to get the files you want. Various themes for business and individual uses are sorted by classes and states, or keywords and phrases. Use US Legal Forms to get the Puerto Rico Waiver of Call on Production with a number of mouse clicks.

In case you are already a US Legal Forms customer, log in to the accounts and click on the Obtain button to find the Puerto Rico Waiver of Call on Production. You may also accessibility kinds you earlier saved inside the My Forms tab of your accounts.

Should you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape to the correct metropolis/land.

- Step 2. Take advantage of the Review choice to check out the form`s content. Do not forget about to read the explanation.

- Step 3. In case you are unhappy with all the kind, use the Lookup field near the top of the display to get other versions of your legal kind template.

- Step 4. Once you have identified the shape you want, go through the Purchase now button. Select the costs plan you favor and add your credentials to sign up for an accounts.

- Step 5. Method the deal. You can use your Мisa or Ьastercard or PayPal accounts to complete the deal.

- Step 6. Choose the format of your legal kind and obtain it on your own product.

- Step 7. Complete, change and print or signal the Puerto Rico Waiver of Call on Production.

Every single legal document template you get is yours eternally. You might have acces to every single kind you saved in your acccount. Go through the My Forms segment and decide on a kind to print or obtain once again.

Be competitive and obtain, and print the Puerto Rico Waiver of Call on Production with US Legal Forms. There are thousands of skilled and status-particular kinds you can use to your business or individual needs.