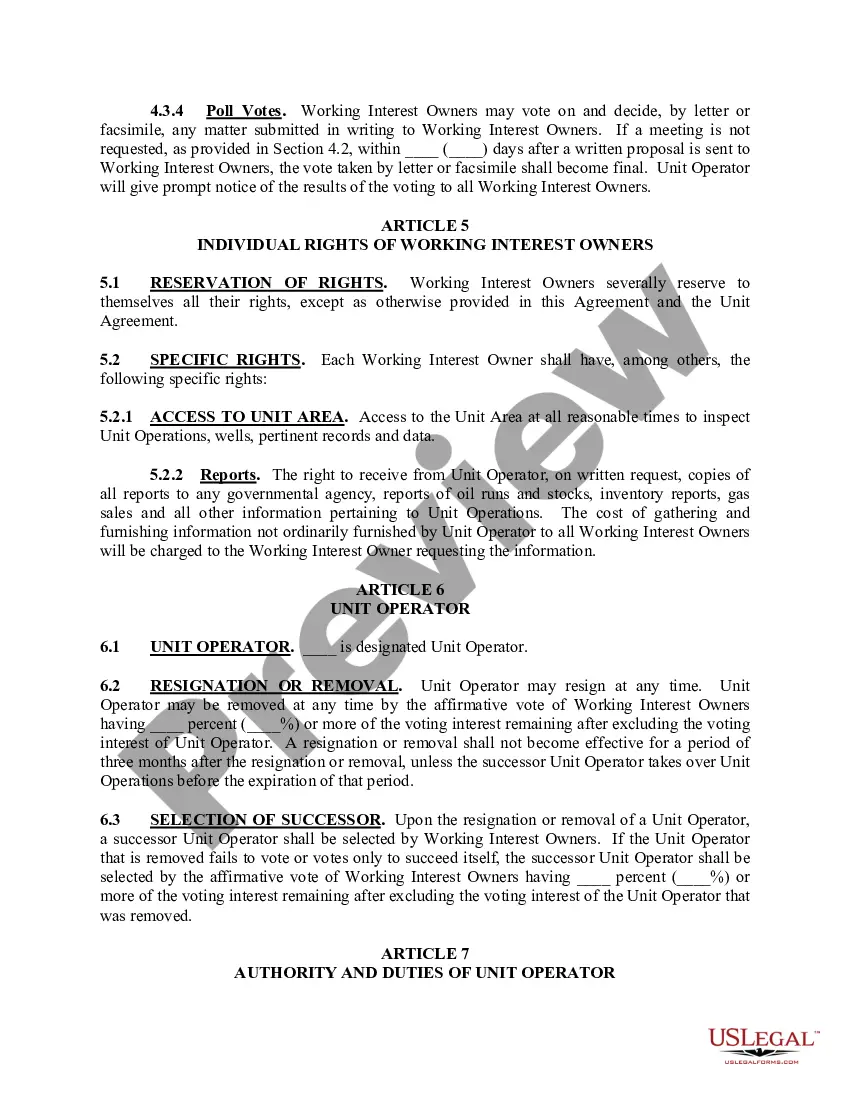

Puerto Rico Unit Operating Agreement

Description

How to fill out Unit Operating Agreement?

It is possible to invest hrs on the Internet searching for the lawful document template that fits the state and federal specifications you require. US Legal Forms provides a huge number of lawful varieties that happen to be reviewed by professionals. It is simple to download or printing the Puerto Rico Unit Operating Agreement from my assistance.

If you currently have a US Legal Forms bank account, you are able to log in and click the Down load key. Following that, you are able to full, modify, printing, or indication the Puerto Rico Unit Operating Agreement. Each and every lawful document template you acquire is your own for a long time. To get an additional version associated with a purchased kind, proceed to the My Forms tab and click the related key.

If you are using the US Legal Forms site initially, keep to the easy directions beneath:

- Initial, make certain you have selected the proper document template for that state/area of your choice. Read the kind outline to make sure you have chosen the right kind. If accessible, use the Review key to look with the document template too.

- If you would like find an additional model of your kind, use the Lookup industry to get the template that meets your requirements and specifications.

- Upon having found the template you desire, just click Purchase now to move forward.

- Find the costs prepare you desire, type in your accreditations, and sign up for an account on US Legal Forms.

- Full the transaction. You should use your charge card or PayPal bank account to cover the lawful kind.

- Find the structure of your document and download it in your system.

- Make adjustments in your document if necessary. It is possible to full, modify and indication and printing Puerto Rico Unit Operating Agreement.

Down load and printing a huge number of document web templates using the US Legal Forms web site, which offers the greatest assortment of lawful varieties. Use professional and status-particular web templates to deal with your business or specific requirements.

Form popularity

FAQ

Annual reports must be filed electronically by accessing the Department of State website at .estado.pr.gov. A $150 annual fee is payable when filing the report. The payment method is a major credit card or any other method provided at the Department of State website.

Application for Registration CostDescriptionDownload$150.00 o 5.00Foreign Corporation - Certificated of Authorization to do businessDownload$150.00Close CorporationDownload$150.00Professional CorporationDownload$110.00Limited Liability SocietyDownload2 more rows

Because of the advantages of forming an LLC in Puerto Rico, new LLCs are formed in the state each year. Should you wish to have more flexibility and protection, you may instead form a Delaware LLC, even if you operate in Puerto Rico.

The initial cost to start an LLC in Puerto Rico is $250 to register your business with the Department of State. After that, you'll have a yearly recurring cost of $150 for your Annual Fee, which keeps your LLC current with the state.

An operating agreement, also known in some states as a limited liability company (LLC) agreement, is a contract that describes how a business plans to operate. Think of it as a legal business plan that reads like a prenup.

Ingly if an LLC is organized under the laws of Puerto Rico it is taxed as a domestic corporation and if organized under the laws of any other country, including the United States, it is taxed as a foreign corporation. A Puerto Rico LLC is a foreign eligible entity for U.S. federal income taxes.

If your LLC is taxed as a Puerto Rico corporation, you'll need to pay corporate income tax. Puerto Rico's corporate tax rate is 37.5%. However, under the Puerto Rico Incentives Code (Act 60), businesses based in Puerto Rico only need to pay a 4% corporate income tax on goods and services exported from the commonwealth.