This office lease form is a provision from a negotiated perspective. The landlord shall provide to the tenant in substantial detail each year the calculations, accounts and averages performed to determine the building operating costs.

Puerto Rico Tenant Audit Provision Fairer Negotiated Provision

Description

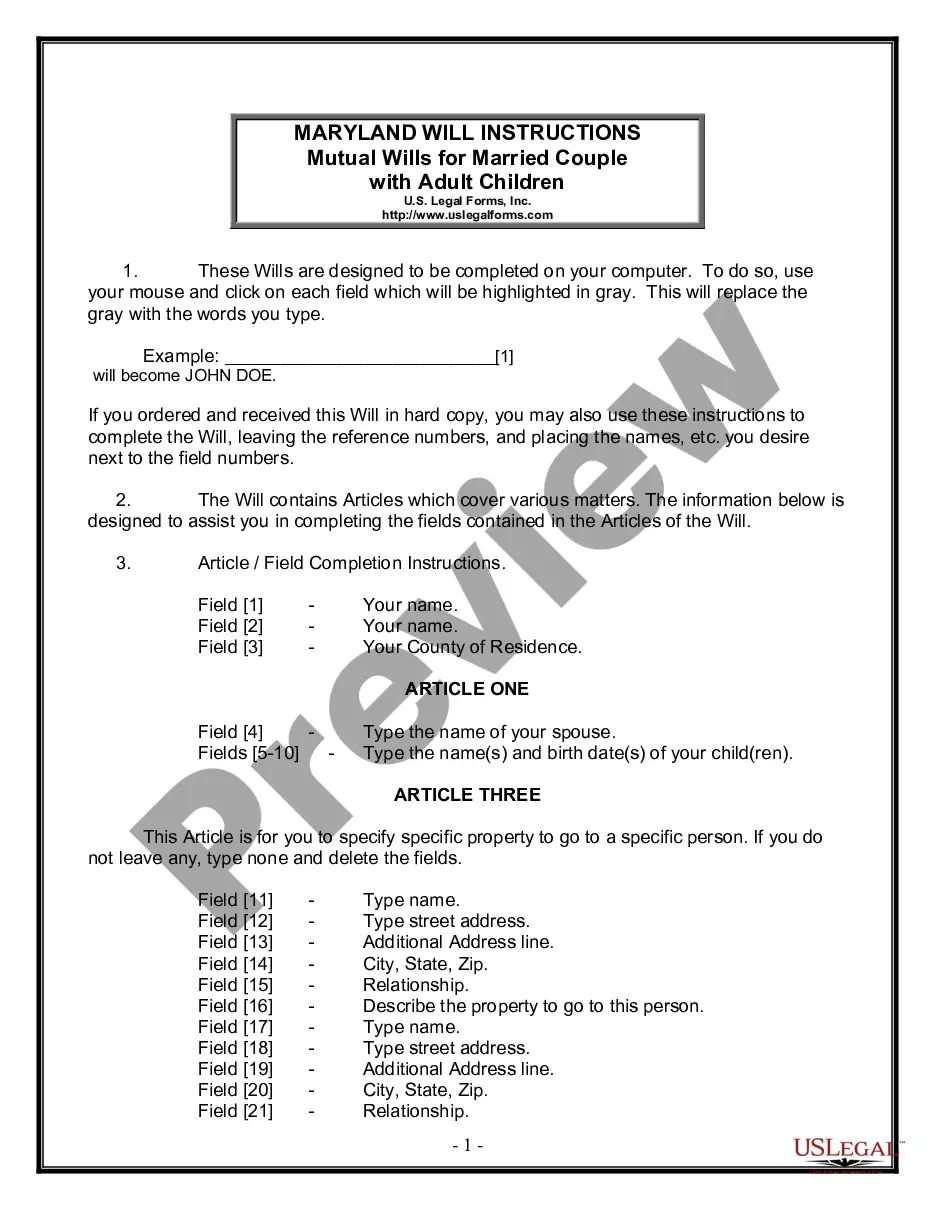

How to fill out Tenant Audit Provision Fairer Negotiated Provision?

You may invest hrs on the Internet attempting to find the authorized document web template that meets the federal and state specifications you need. US Legal Forms provides 1000s of authorized kinds that are reviewed by experts. You can easily obtain or printing the Puerto Rico Tenant Audit Provision Fairer Negotiated Provision from our services.

If you already have a US Legal Forms account, it is possible to log in and click on the Acquire button. Following that, it is possible to total, modify, printing, or signal the Puerto Rico Tenant Audit Provision Fairer Negotiated Provision. Each and every authorized document web template you get is your own for a long time. To obtain an additional copy of the purchased type, proceed to the My Forms tab and click on the corresponding button.

If you use the US Legal Forms internet site initially, stick to the simple guidelines beneath:

- Initial, make sure that you have chosen the best document web template for the county/city of your choice. Browse the type explanation to make sure you have picked out the right type. If accessible, make use of the Review button to appear with the document web template at the same time.

- If you would like get an additional edition of the type, make use of the Look for industry to discover the web template that fits your needs and specifications.

- After you have identified the web template you need, simply click Get now to carry on.

- Find the rates strategy you need, key in your qualifications, and sign up for a free account on US Legal Forms.

- Full the transaction. You can utilize your Visa or Mastercard or PayPal account to purchase the authorized type.

- Find the formatting of the document and obtain it to your system.

- Make adjustments to your document if required. You may total, modify and signal and printing Puerto Rico Tenant Audit Provision Fairer Negotiated Provision.

Acquire and printing 1000s of document themes making use of the US Legal Forms site, that offers the biggest selection of authorized kinds. Use professional and status-specific themes to handle your organization or individual needs.

Form popularity

FAQ

The tax home test intends to prevent U.S. taxpayers from abusing the foreign earned income exclusion. ing to the tax home test, you don't qualify for the foreign earned income exclusion if you have a tax home or abode in the U.S. (the IRS says an abode is one's home, habitation, residence, or place of dwelling).

The Tax Home or Abode (Residence) Test Typically, you live in your tax home, and therefore, this minor distinction is not relevant. But if you travel a lot on business/pleasure it could be relevant. If your regular or principal place of business, employment or duty post is PR, then that is your Tax Home.

The IRS defines your tax home as the "entire city or general area" of your workplace. If you work in Pittsburgh, for example, then your tax home is the entire Pittsburgh metro area.

To qualify as a bona fide resident of Puerto Rico for any tax year, a person must satisfy each of three distinct tests: (1) the ?Presence Test?; (2) the ?Tax Home Test?; and (3) the ?Closer Connection Test?. [4] It is not enough merely to be present in Puerto Rico for 183 days in a given tax year.

Accounting records must be prepared in ance with the GAAP followed in the United States.

You must spend more time in Puerto Rico than the US during the tax year. If you are aiming to satisfy the presence test by spending at least 549 days within a three-year period in Puerto Rico, you still must be physically present in Puerto Rico for 60 days per year.