Puerto Rico Contribution Agreement Form

Description

How to fill out Contribution Agreement Form?

Choosing the best lawful file design might be a have a problem. Of course, there are a variety of web templates available on the Internet, but how would you obtain the lawful form you will need? Take advantage of the US Legal Forms web site. The service offers a large number of web templates, including the Puerto Rico Contribution Agreement Form, that can be used for company and personal requires. Every one of the types are checked by specialists and fulfill state and federal demands.

In case you are previously signed up, log in to your account and click on the Down load option to have the Puerto Rico Contribution Agreement Form. Utilize your account to appear from the lawful types you might have bought previously. Proceed to the My Forms tab of your own account and acquire an additional duplicate in the file you will need.

In case you are a new user of US Legal Forms, listed below are simple guidelines that you can follow:

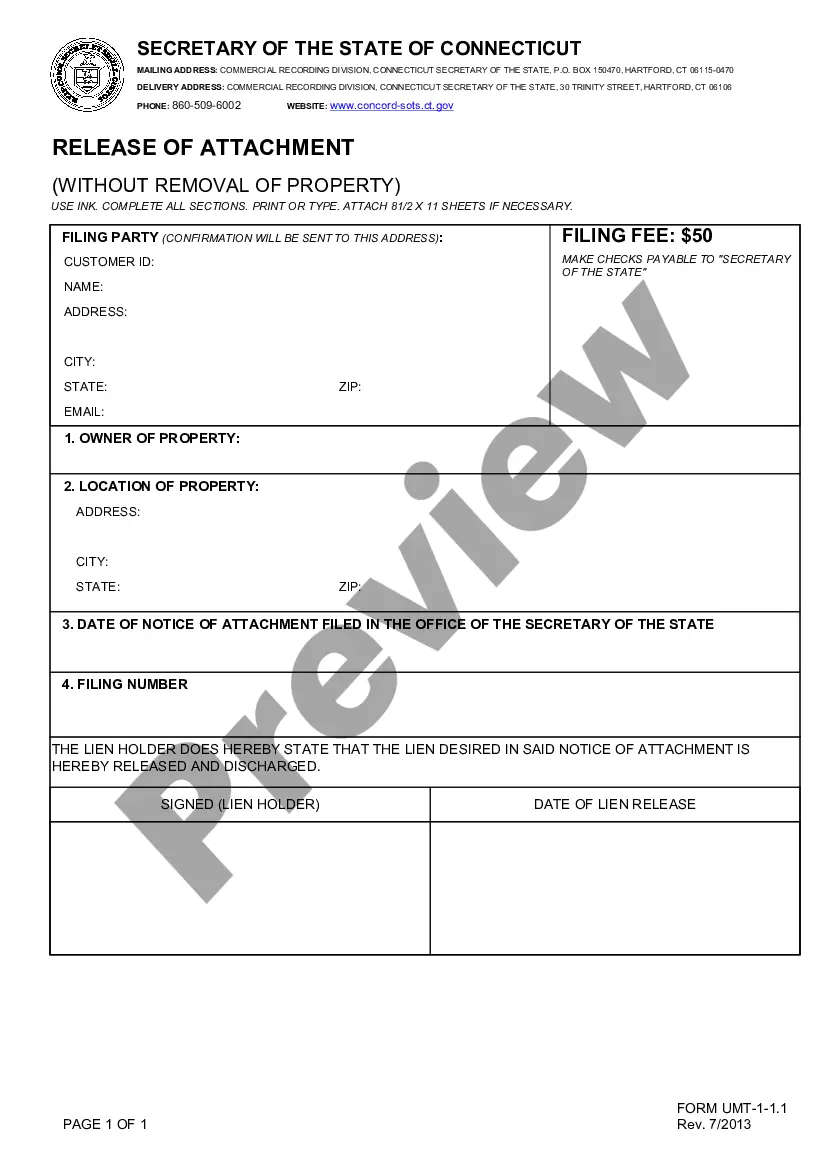

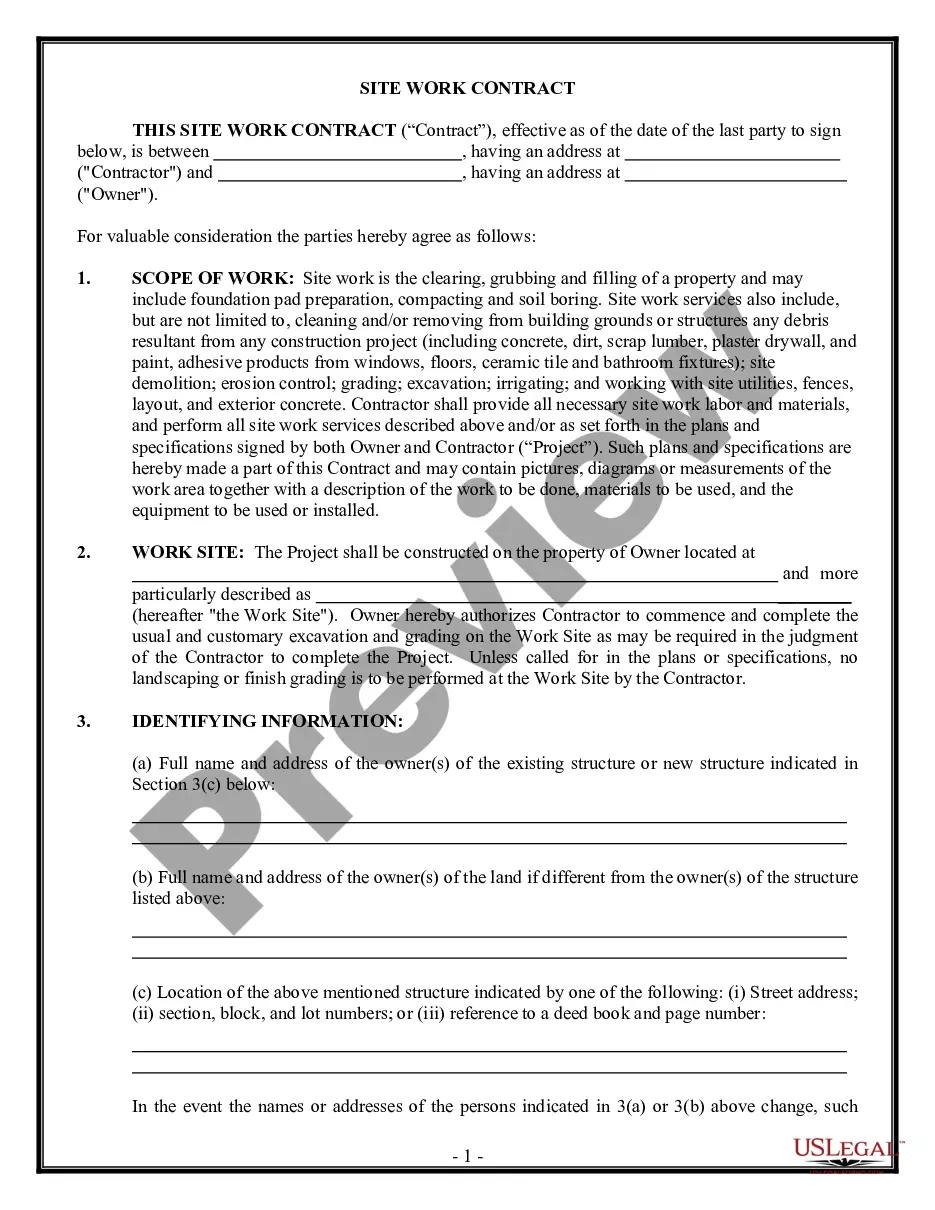

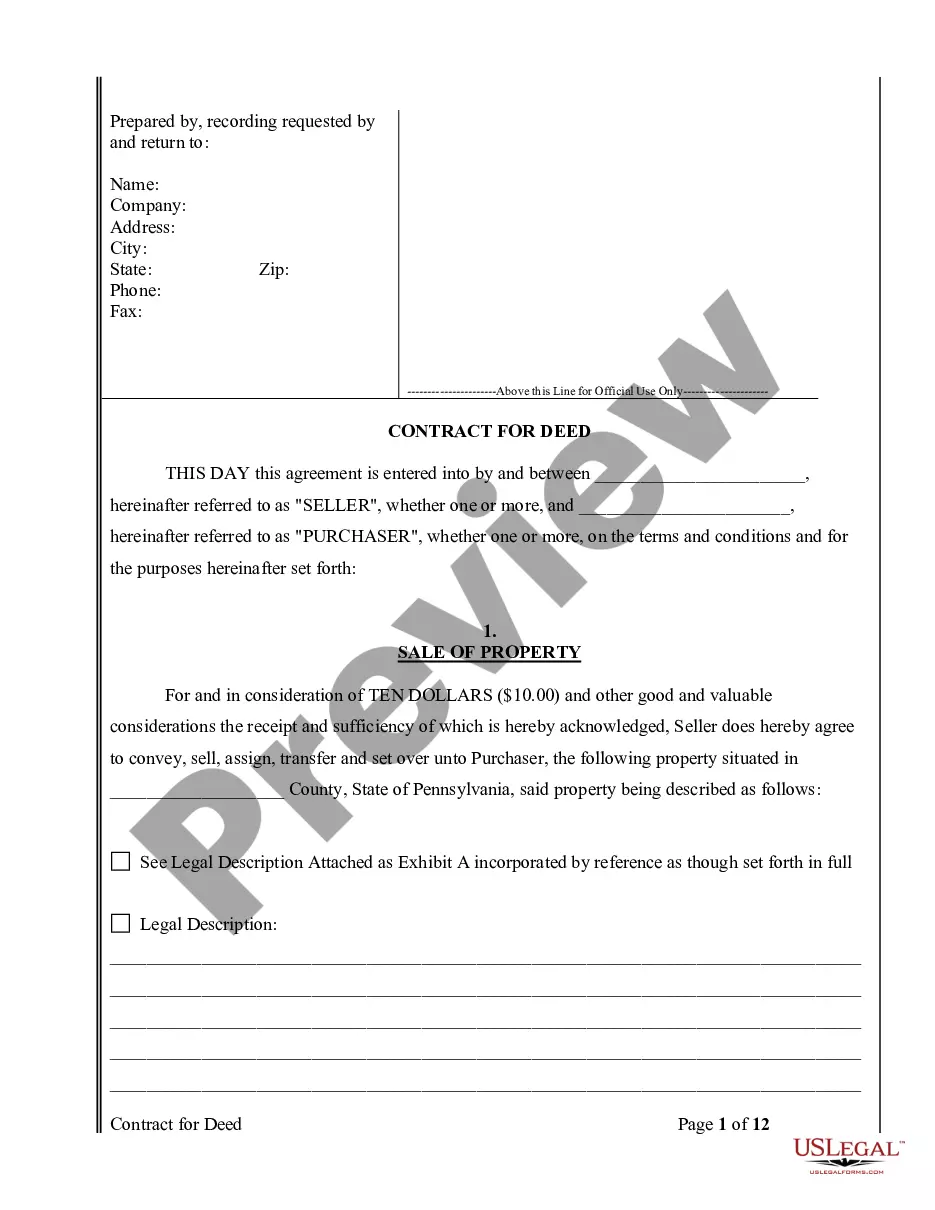

- First, be sure you have selected the correct form for your city/state. You may look through the form using the Preview option and look at the form description to make certain this is the best for you.

- If the form will not fulfill your requirements, utilize the Seach field to discover the right form.

- When you are positive that the form would work, select the Acquire now option to have the form.

- Choose the rates prepare you desire and enter the needed info. Design your account and purchase the transaction making use of your PayPal account or charge card.

- Select the data file formatting and acquire the lawful file design to your device.

- Full, edit and print and indicator the attained Puerto Rico Contribution Agreement Form.

US Legal Forms will be the largest local library of lawful types that you can find numerous file web templates. Take advantage of the service to acquire professionally-created files that follow condition demands.

Form popularity

FAQ

Along with Puerto Rico Tax Act 20, Puerto Rico adopted an additional incentive, the ?Act to Promote the Relocation of Individual Investors,? Puerto Rico Tax Act 22, to stimulate economic development by offering nonresident individuals 100% tax exemptions on all interest, all dividends, and all long-term capital gains.

An individual is considered to be a bona fide resident of Puerto Rico only if he or she satisfies all of the following three conditions: (1) physical presence test, (2) tax home test, and (3) closer connection test.

Personal exemptions The personal exemption is USD 3,500 per individual and USD 7,000 for married taxpayers living together and filing jointly. The exemption for each dependant is USD 2,500. The veteran's exemption is USD 1,500. Puerto Rican non-resident foreign nationals are not allowed any exemptions.

A distribution from a US traditional IRA to a Puerto Rico resident would be taxed by both the US and Puerto Rican governments unless the IRA is liquidated and the proceeds are used to contribute (up to the contribution limits) to a Puerto Rican traditional IRA.

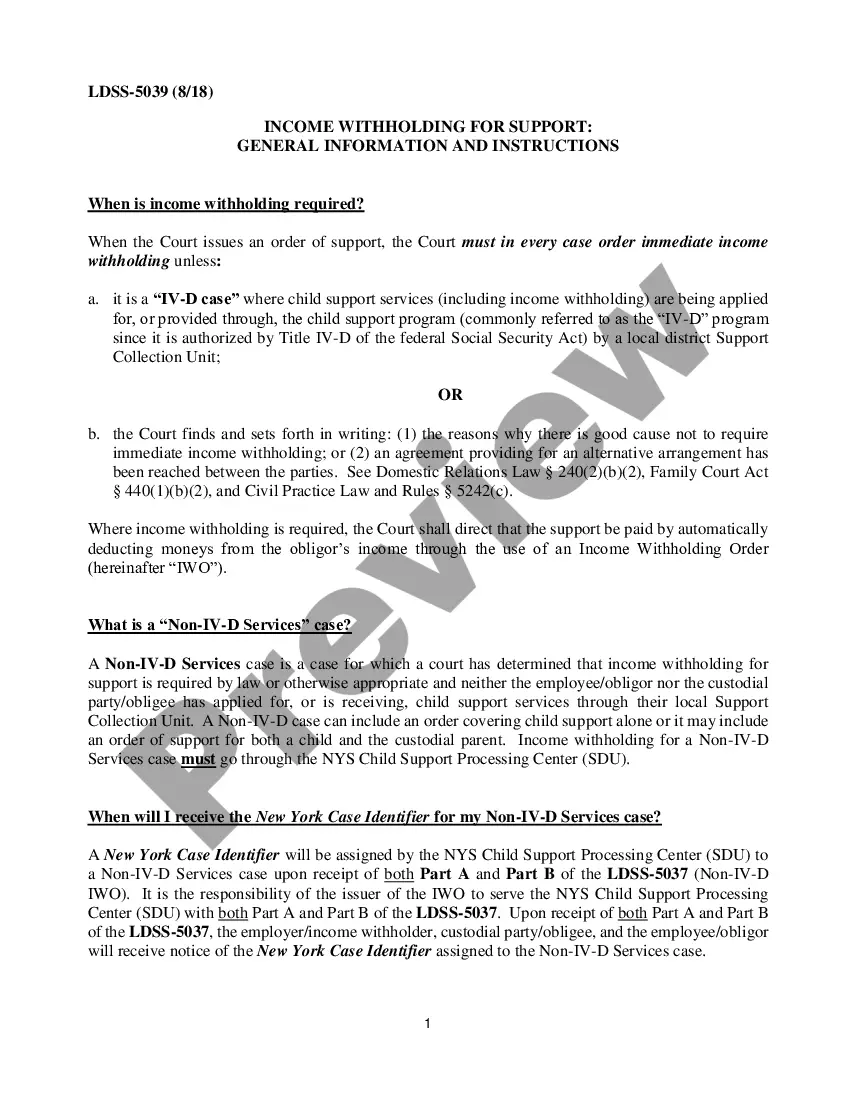

An exemption of the income tax withholding is provided for employees from ages 16 to 26 on the first $40,000 of taxable wages. The withholding rates depend upon the personal exemption and credits for dependents claimed in the withholding exemption certificate (Form 499R4l) to be completed by every employee.

Every young person resident of Puerto Rico, who is a salaried employee and is between the ages of sixteen (16) and twenty-six (26) may benefit from the $40,000 Exemption from wages earned during the taxable year.