Puerto Rico Subscription Agreement for an Equity Fund: A Comprehensive Guide Introduction: The Puerto Rico Subscription Agreement for an Equity Fund is a crucial legal contract that defines the terms and conditions of investment in an equity fund within Puerto Rico. This contract outlines the rights and responsibilities of both the investor and the fund manager, ensuring a transparent and efficient investment process. In this detailed description, we will explore the key components, types, and significance of the Puerto Rico Subscription Agreement for an Equity Fund. Key Components: 1. Parties involved: The agreement specifies the names and contact details of the equity fund manager or general partner (GP) and the investor(s) subscribing to the fund. 2. Subscription terms: The document highlights the amount of capital the investor commits to the equity fund to acquire ownership or subscription units. 3. Capital Contributions: The agreement outlines the payment schedule, fund allocation strategy, and investor's obligations to contribute capital. 4. Limited Partnership Interest (LPI): The LPI details the investor's proportional ownership in the equity fund, granting them voting rights, profit distribution entitlement, and liability limitations. 5. Management of the Fund: The agreement addresses the fund manager's roles and responsibilities, including investment decision-making, reporting requirements, and the establishment of a governing structure. 6. Confidentiality and Non-Disclosure: To protect proprietary information, the agreement outlines the confidentiality obligations of both parties regarding fund strategies, performance data, and any sensitive information shared during the course of the investment. 7. Transferability provisions: The agreement may contain provisions that govern the transferability of subscription units, including any restrictions, permissions, or conditions, based on the specific terms agreed upon by the parties. 8. Termination and Liquidation: This section covers the circumstances and procedures for terminating the agreement or liquidating the equity fund, including the distribution of assets to investors. Types of Puerto Rico Subscription Agreements for an Equity Fund: 1. Open-Ended Equity Fund Subscription Agreement: This type of agreement allows investors to subscribe or redeem shares at any time, providing liquidity and flexibility to investors. 2. Closed-Ended Equity Fund Subscription Agreement: In contrast, this agreement restricts investors from redeeming their shares until a specified maturity date, promoting long-term investment and stability. 3. Institutional Equity Fund Subscription Agreement: Specifically designed for institutional investors, this agreement may include additional customizations to accommodate large-scale investments and address institutional requirements. 4. Retail Equity Fund Subscription Agreement: Designed for individual retail investors, this agreement may involve simplified terms, lower minimum investment amounts, and regulatory disclosures specified by local authorities. Significance of the Puerto Rico Subscription Agreement for an Equity Fund: The Puerto Rico Subscription Agreement for an Equity Fund is essential for several reasons: 1. Legal Protection: It ensures legal protection for all parties involved, spelling out their rights, obligations, and dispute resolution mechanisms. 2. Transparency and Clarity: The agreement promotes transparency by providing detailed information on investment terms, capital allocation, and fund management strategies. 3. Investor Confidence: It helps build investor confidence by demonstrating a clear framework for decision-making, reporting, and ensuring proper management of the equity fund. 4. Risk Mitigation: The agreement identifies potential risks, liability limitations, and exit strategies, reducing uncertainties for investors. 5. Regulatory Compliance: It ensures compliance with Puerto Rican laws and regulations governing equity fund investments, protecting both investors and fund managers. Conclusion: The Puerto Rico Subscription Agreement for an Equity Fund is a critical document that outlines the terms, rights, and obligations between investors and fund managers. By defining the legal framework and procedures, this agreement fosters transparency, mitigates risks, and ensures compliance with local regulations. Given the various types of subscription agreements available, investors and fund managers can choose the one that best suits their specific investment goals and requirements.

Puerto Rico Subscription Agreement for an Equity Fund

Description

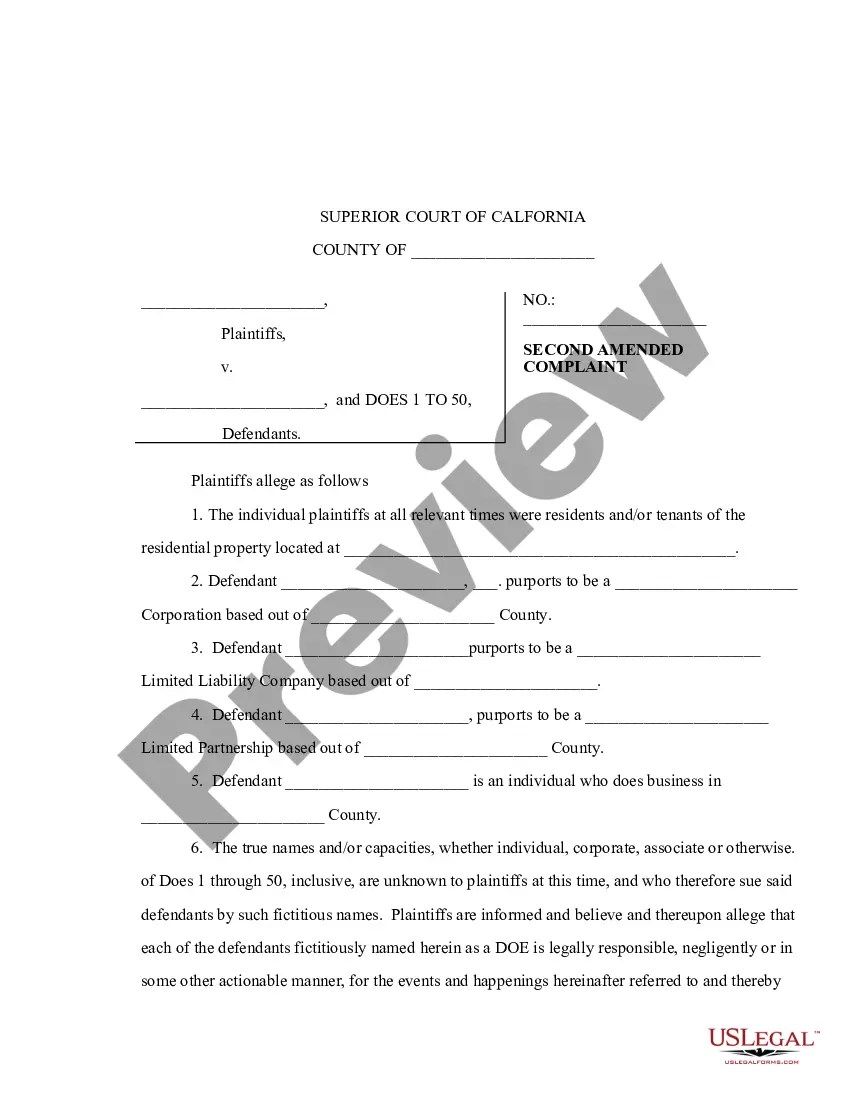

How to fill out Puerto Rico Subscription Agreement For An Equity Fund?

Discovering the right lawful record template can be quite a have a problem. Needless to say, there are a lot of web templates available on the Internet, but how do you find the lawful kind you will need? Take advantage of the US Legal Forms website. The services provides thousands of web templates, like the Puerto Rico Subscription Agreement for an Equity Fund, that you can use for business and personal requirements. Every one of the varieties are checked by experts and meet federal and state needs.

Should you be previously authorized, log in to your profile and click on the Down load key to have the Puerto Rico Subscription Agreement for an Equity Fund. Use your profile to check with the lawful varieties you might have bought previously. Check out the My Forms tab of the profile and acquire one more copy of your record you will need.

Should you be a whole new end user of US Legal Forms, allow me to share basic instructions for you to adhere to:

- First, ensure you have selected the correct kind to your metropolis/region. You can check out the form utilizing the Preview key and browse the form explanation to guarantee this is the right one for you.

- When the kind does not meet your expectations, utilize the Seach industry to get the right kind.

- Once you are sure that the form is proper, click the Purchase now key to have the kind.

- Choose the prices strategy you want and type in the essential info. Design your profile and pay money for an order using your PayPal profile or credit card.

- Select the submit formatting and down load the lawful record template to your product.

- Comprehensive, revise and print out and indication the obtained Puerto Rico Subscription Agreement for an Equity Fund.

US Legal Forms is the most significant collection of lawful varieties where you will find a variety of record web templates. Take advantage of the company to down load expertly-manufactured papers that adhere to state needs.

Form popularity

FAQ

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

Subscription Documents mean any subscription agreements (or the equivalent), investor questionnaires, purchase applications, related agreements and similar materials (and any forms, correspondence and other documents ancillary thereto) relating to a Fund's investments in Portfolio Funds.

A simple agreement for future equity (SAFE) is a financing contract that may be used by a start-up company to raise capital in its seed financing rounds. The instrument is viewed by some as a more founder-friendly alternative to convertible notes because a SAFE is quicker and easier to negotiate and has fewer terms.

A simple agreement for future equity (SAFE) is a contract between an investor and a portfolio company that provides rights to the investor for future equity in the company. It does this without determining a specific price per share when the investment is made.

How is a Subscription Agreement different from a Private Placement Memorandum (PPM)? The PPM goes into the specifics of the offering, whereas the Subscription Agreement acts as the purchase agreement to acquire interests in the offering.

Specifically, the ?Subscription Agreement for Future Equity ? Discount only? enables investors to pay in advance the subscription price for company shares/quotas (typically pre-seed and seed funding) with such shares/quotas to be issued by the company receiving the investment at a later date, so that valuation of the ...

A simple agreement for future equity delays valuation of a company until it has more performance data on which to base a valuation. At the same time, it promises an investor the right to buy future equity when a valuation is made. A SAFE can be converted into preferred stock in the future.

A simple agreement for future equity or SAFE is a financing agreement between the company and an investor which grants the investor the right to receive shares at a point in the future, based on the valuation of the company at that point (usually the next funding round, often series A).