This pamphlet provides an overview on the dissolution of a limited liability company (LLC). Topics included cover the reasons for dissolution, different types of dissolution, and steps needed to dissolve an LLC.

Puerto Rico USLegal Pamphlet on Dissolving an LLC

Description

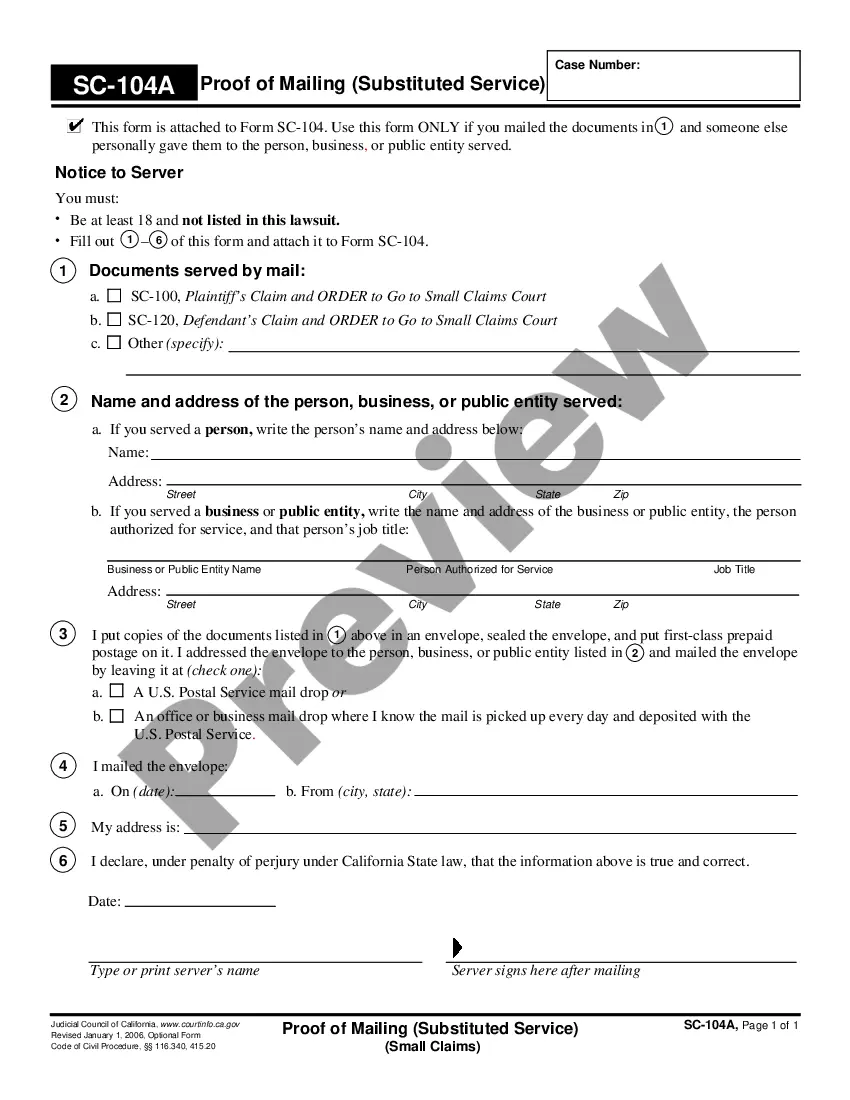

How to fill out Puerto Rico USLegal Pamphlet On Dissolving An LLC?

Finding the right authorized papers format can be a battle. Naturally, there are a lot of web templates accessible on the Internet, but how can you discover the authorized develop you require? Take advantage of the US Legal Forms site. The service offers 1000s of web templates, including the Puerto Rico USLegal Pamphlet on Dissolving an LLC, that you can use for business and private requires. All the varieties are inspected by professionals and meet federal and state needs.

Should you be presently signed up, log in for your bank account and then click the Obtain switch to find the Puerto Rico USLegal Pamphlet on Dissolving an LLC. Make use of your bank account to look through the authorized varieties you possess acquired in the past. Check out the My Forms tab of your respective bank account and have another version of the papers you require.

Should you be a whole new customer of US Legal Forms, here are simple instructions that you should follow:

- Initial, be sure you have chosen the correct develop for your personal area/region. You are able to look through the shape making use of the Review switch and read the shape description to ensure it is the right one for you.

- In case the develop does not meet your preferences, use the Seach industry to find the appropriate develop.

- When you are sure that the shape is proper, select the Acquire now switch to find the develop.

- Opt for the costs prepare you want and enter in the necessary details. Make your bank account and buy the order with your PayPal bank account or credit card.

- Opt for the data file structure and acquire the authorized papers format for your system.

- Complete, modify and print and indication the attained Puerto Rico USLegal Pamphlet on Dissolving an LLC.

US Legal Forms will be the most significant catalogue of authorized varieties that you will find various papers web templates. Take advantage of the company to acquire expertly-created paperwork that follow express needs.

Form popularity

FAQ

Dissolution is the first step in the termination process is to dissolve the LLC. Although some people confuse dissolution and termination, dissolution does not terminate an LLC's existence. What it does is change the purpose of its existence.

Dissolution, also called winding up, is a process that members of an LLC will go through in preparation to cancel with the secretary of state and terminate the existence of the LLC. Cancellation is on the secretary of state's side, which terminates the rights, privileges, and powers of an LLC.

A corporation cannot distribute its assets, nor may it dissolve, until its officers have paid or made provisions for all known debts and obligations. Under Corporations Code section 1905, to make provisions for a debt, another person or entity must either assume the debt, or personally guarantee its payment.

By dissolving an LLC properly, it means that the LLC is no longer a legal business entity so you won't be expected to pay any fees or taxes, or file any more documents. Despite no longer operating, it is possible for members to create a new LLC and run it in the same way as the dissolved company.

Dissolution is permitted by an authorised officer of a business entity can dissolve the registered corporation. A corporate resolution at the time of the dissolution action must be filed. When dissolution is made effective, the name of the corporation is reserved for a maximum of 30 days since the day of dissolution.

Filing and forming an LLC in Puerto Rico requires a $250 filing fee. Under Puerto Rico law, an LLC uses a limited liability company agreement, or LLCA, to govern the internal affairs and administration of the LLC.

The report must be filed electronically accessing the Commonwealth of Puerto Rico portal, and/or accessing directly the Registry of Corporations at or through the Department of State page at .

The first step in dissolving a corporation usually involves having your board of directors and shareholders vote to approve the dissolution. Under most state rules, you start by holding a meeting of the board of directors to vote on a resolution to approve the dissolution of the corporation.

Follow these steps to closing your business:Decide to close.File dissolution documents.Cancel registrations, permits, licenses, and business names.Comply with employment and labor laws.Resolve financial obligations.Maintain records.

An LLC that is dissolving its business must file Form 966. Form 1040 (U.S. Individual Income Tax Return) and Schedule C (Profit or Loss from Business (Sole Proprietorship) are for a single-member LLC. These forms are the same forms that individual W-2 employees file by PM of April 15th of each year.