Are you presently inside a place that you require files for possibly enterprise or person functions just about every time? There are tons of authorized file templates available on the Internet, but discovering ones you can rely is not effortless. US Legal Forms offers a huge number of type templates, such as the Puerto Rico Business Incorporation Questionnaire, that are written to fulfill federal and state demands.

In case you are already knowledgeable about US Legal Forms website and get your account, merely log in. After that, it is possible to down load the Puerto Rico Business Incorporation Questionnaire format.

If you do not provide an profile and would like to begin using US Legal Forms, follow these steps:

- Discover the type you will need and make sure it is for the correct town/state.

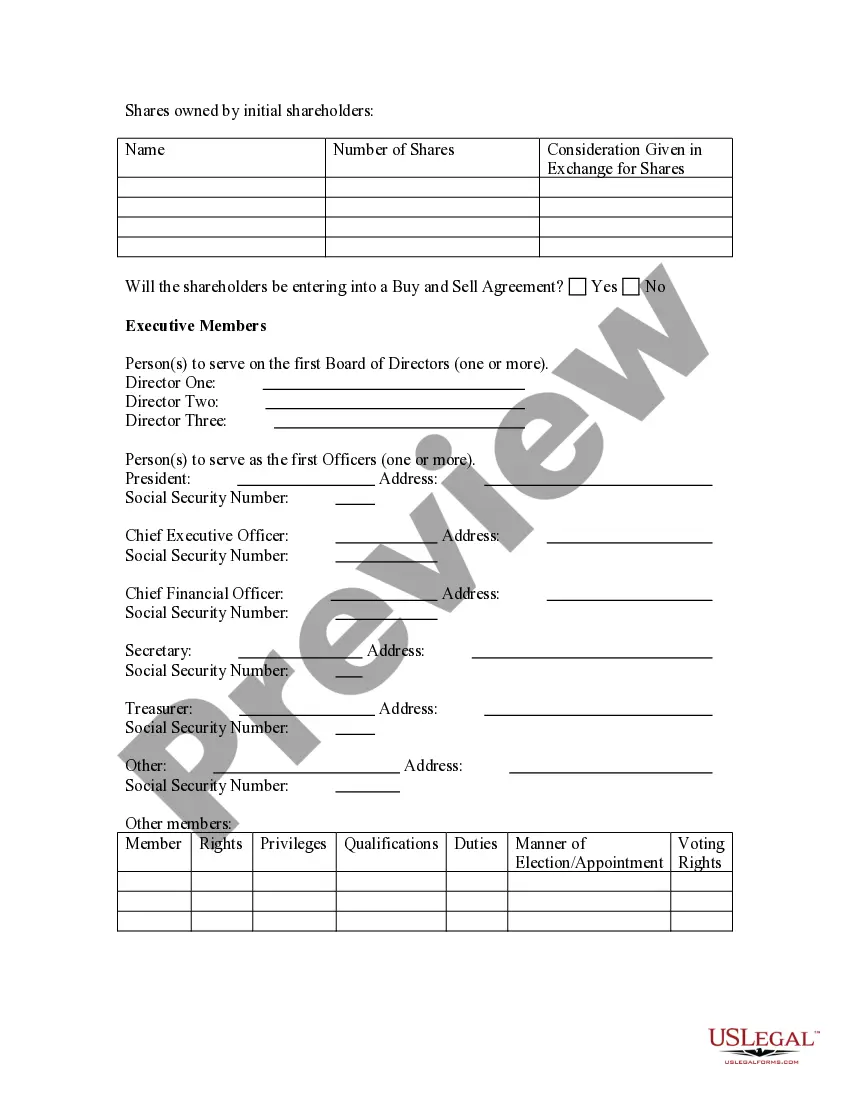

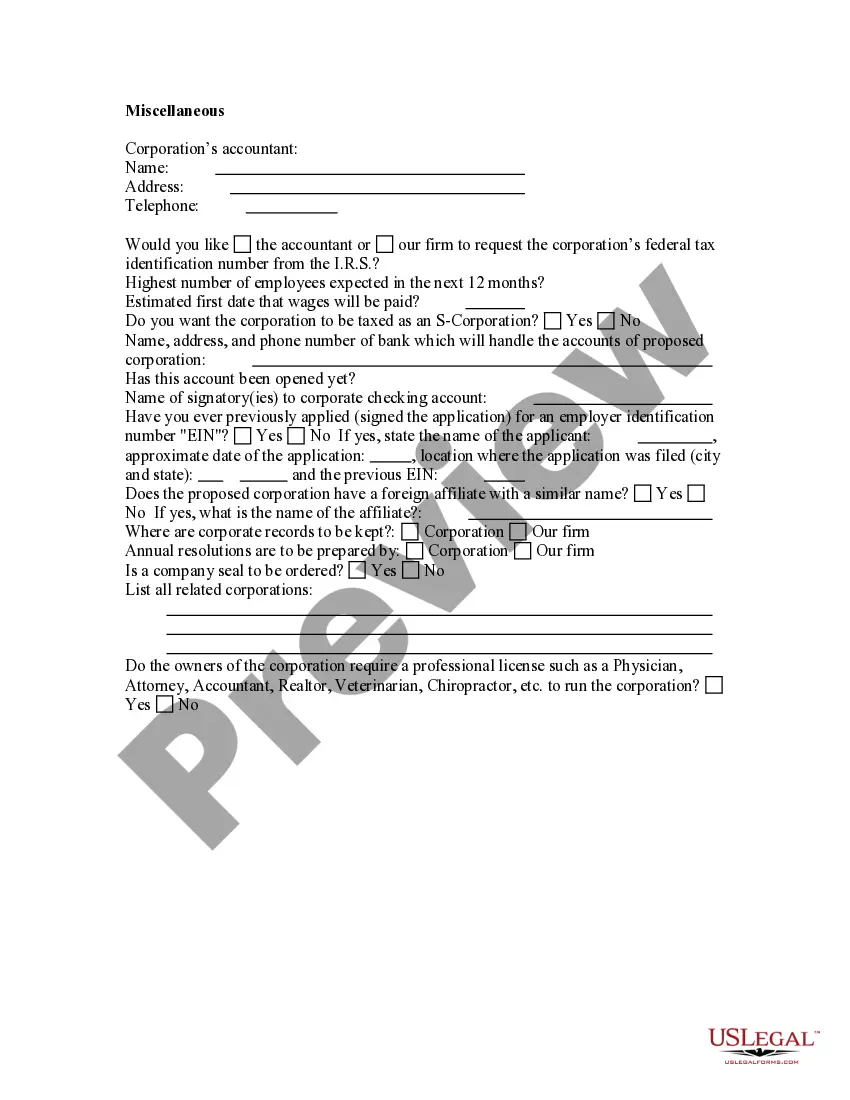

- Use the Review button to review the form.

- Browse the outline to ensure that you have selected the correct type.

- In the event the type is not what you`re seeking, utilize the Research industry to obtain the type that meets your needs and demands.

- When you obtain the correct type, simply click Acquire now.

- Select the costs strategy you need, submit the necessary information to produce your bank account, and buy an order with your PayPal or charge card.

- Choose a convenient file file format and down load your backup.

Locate all the file templates you might have purchased in the My Forms menu. You may get a additional backup of Puerto Rico Business Incorporation Questionnaire any time, if needed. Just click the needed type to down load or print out the file format.

Use US Legal Forms, the most considerable selection of authorized varieties, to conserve time and prevent mistakes. The service offers skillfully made authorized file templates which can be used for an array of functions. Produce your account on US Legal Forms and start making your lifestyle easier.

Your business must appoint a Puerto Rico registered agent to receive documentsSign up for registered agent service and file using the state forms and ... For income tax purposes, limited liability companies will be taxed in the same manner as corporations. Nevertheless, LLCs may elect to be treated as partnership ...21 pages

For income tax purposes, limited liability companies will be taxed in the same manner as corporations. Nevertheless, LLCs may elect to be treated as partnership ...Browse sample American Community Survey (ACS) and Puerto Rico Community Survey (PRCS) forms (or questionnaires) in English and Spanish with ... If you would like to register to test, you will need to create or sign in to your ETS account, or complete the appropriate registration form:. The test takes 4.5 hours to complete and is offered year round by Prometric test centers in the United States, its territories (including Guam, Puerto Rico ... Puerto Rico has a long history of using tax incentives and credits astheir operations to Puerto Rico by reducing Puerto Rican corporate ... With income tax rates as high as 39% for corporations and 33% for individuals, aside from several other municipal and state taxes, businesses ... The following information is summarized from the Puerto Rico Federal Affairs Administration: Birth Certificate Law and frequently asked questions (FAQs), ...