US Legal Forms - one of the largest libraries of lawful types in the USA - gives an array of lawful record web templates it is possible to download or print. Making use of the site, you can get a large number of types for company and specific reasons, categorized by classes, suggests, or search phrases.You can find the most recent variations of types much like the Puerto Rico Personal Property Inventory Questionnaire within minutes.

If you already possess a registration, log in and download Puerto Rico Personal Property Inventory Questionnaire through the US Legal Forms collection. The Obtain switch will show up on every single form you look at. You gain access to all formerly delivered electronically types within the My Forms tab of your account.

If you wish to use US Legal Forms the very first time, listed here are straightforward recommendations to help you began:

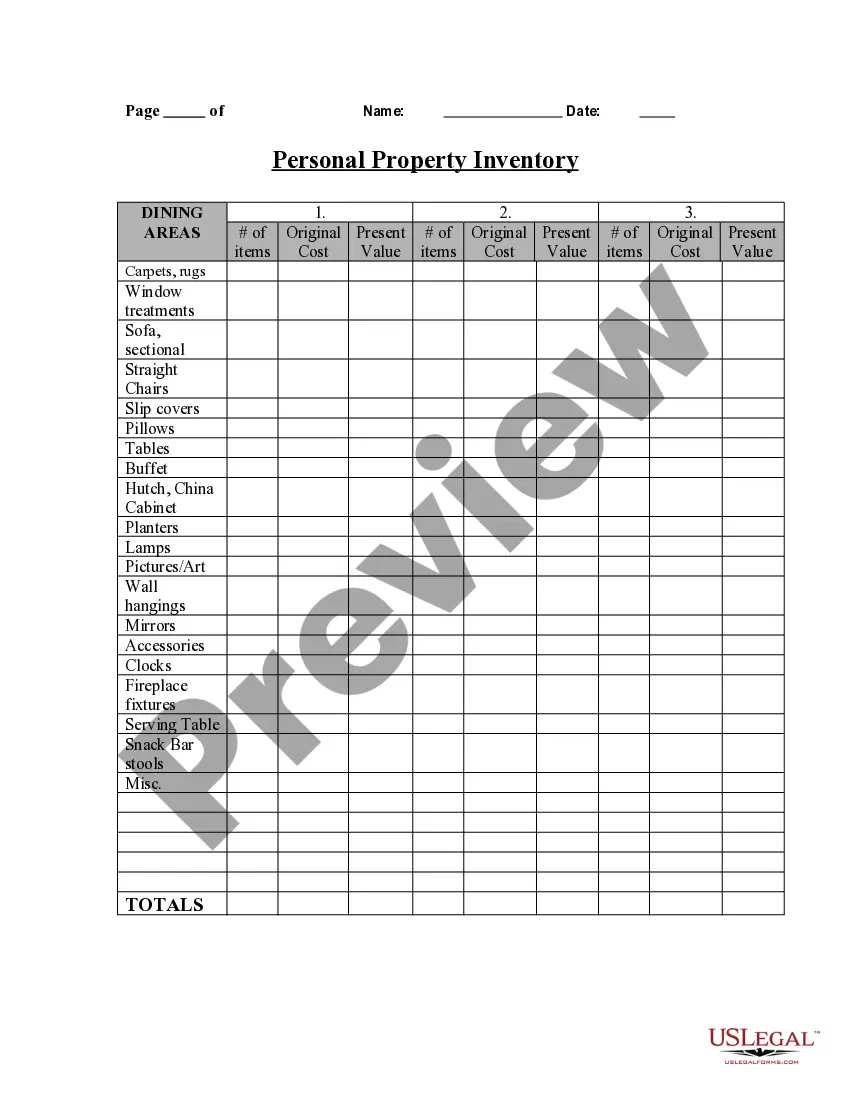

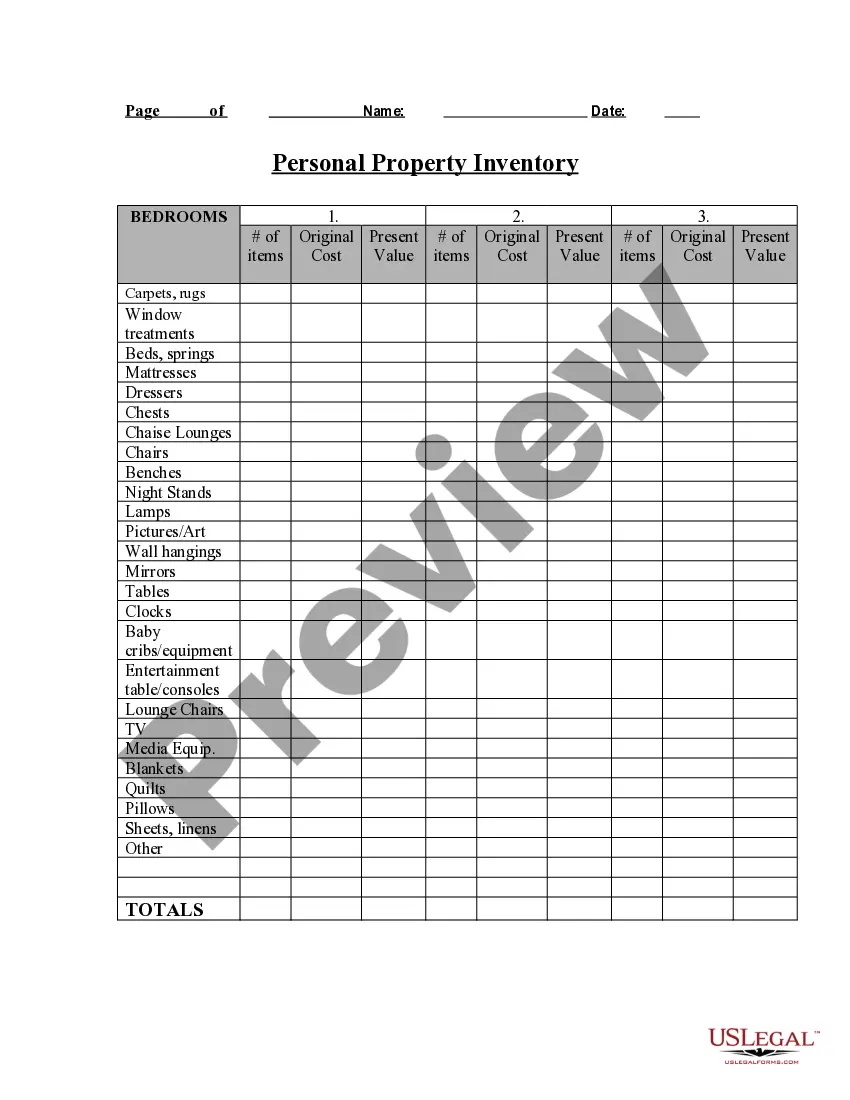

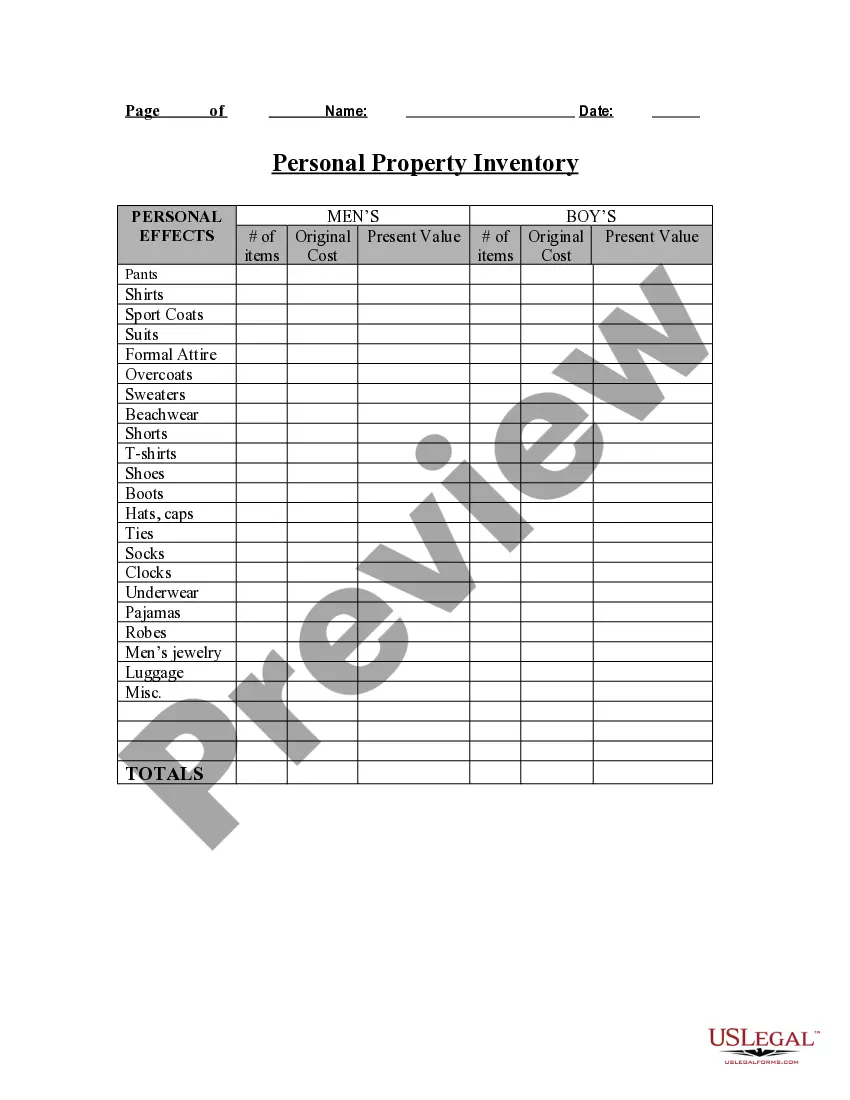

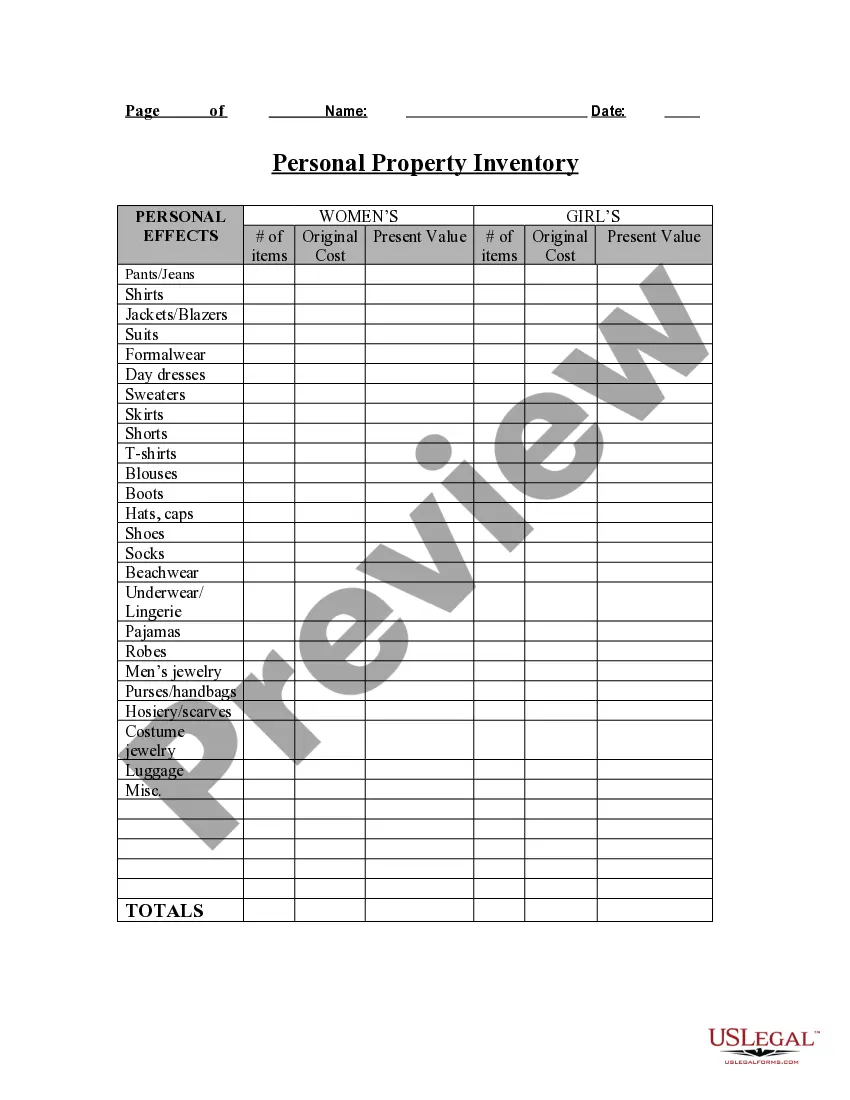

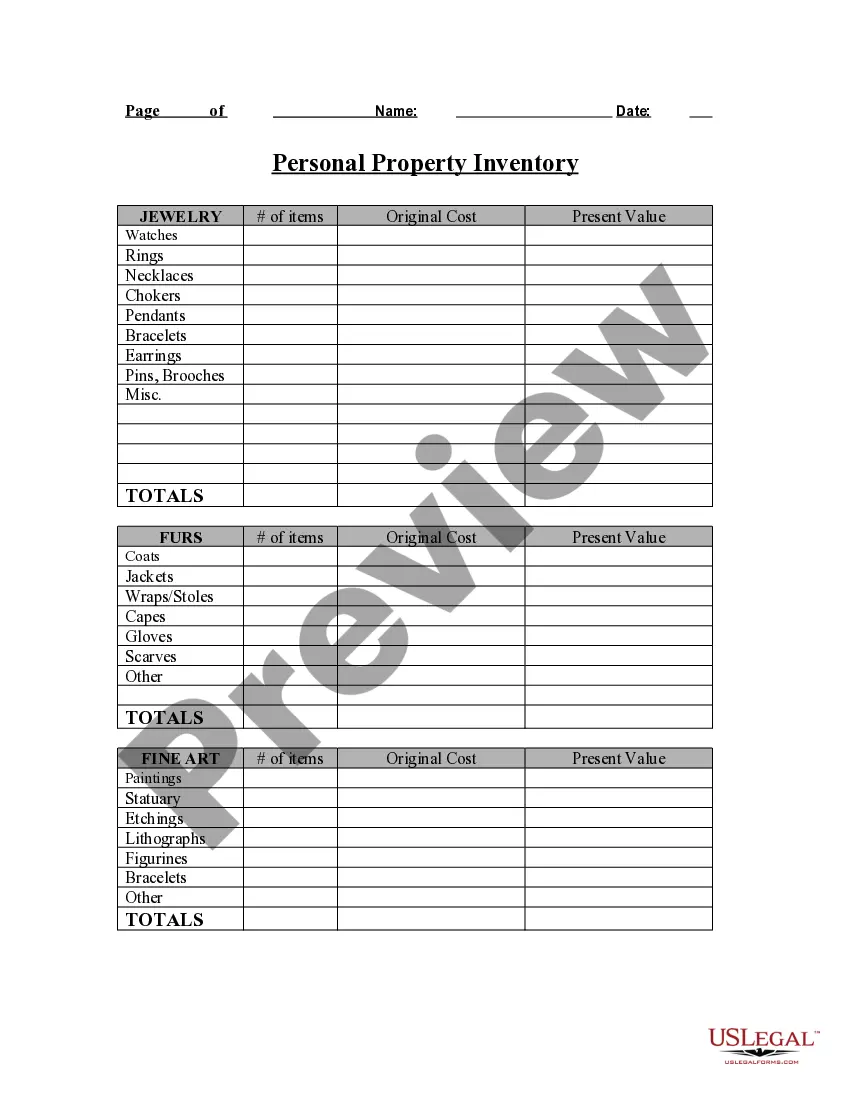

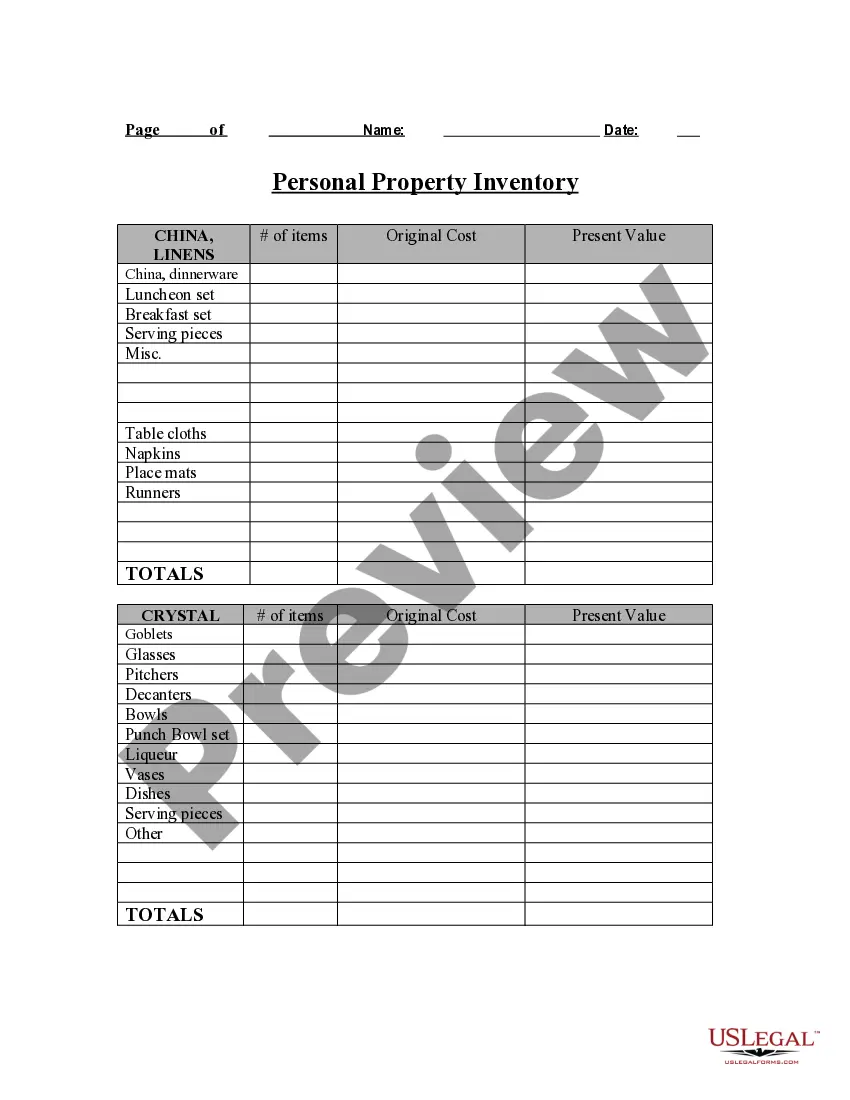

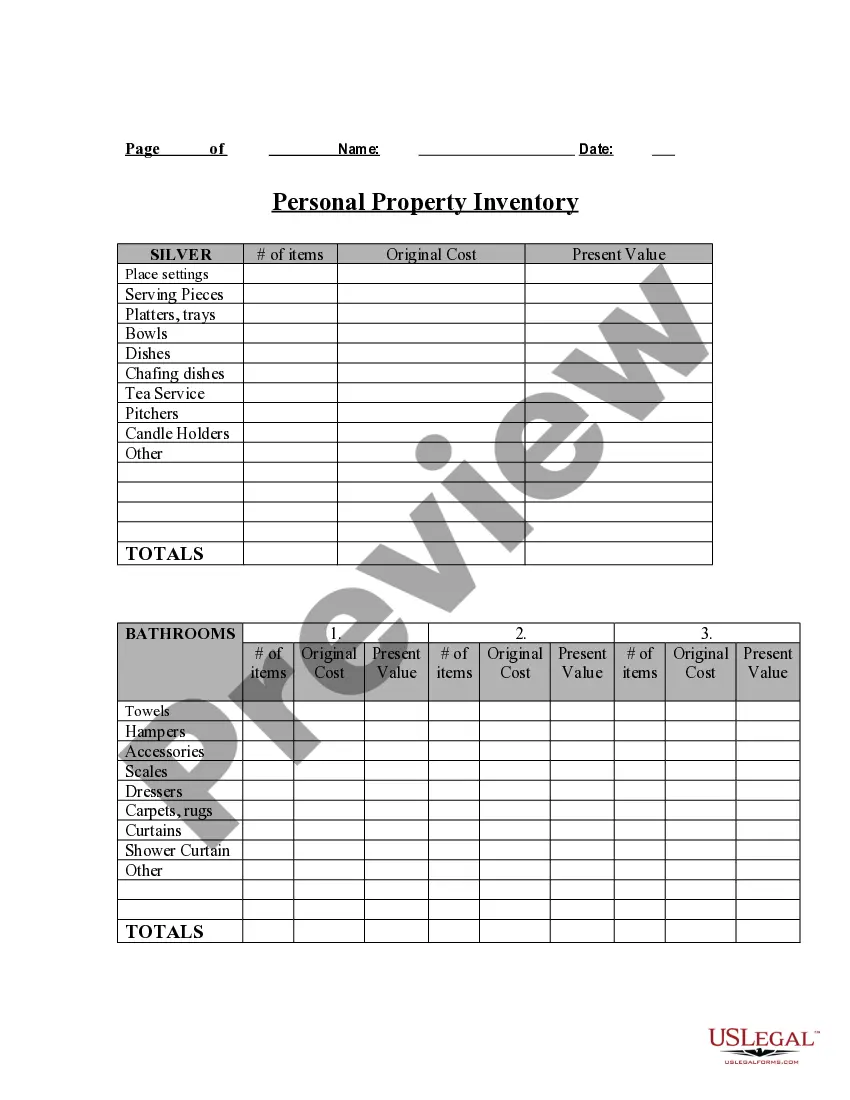

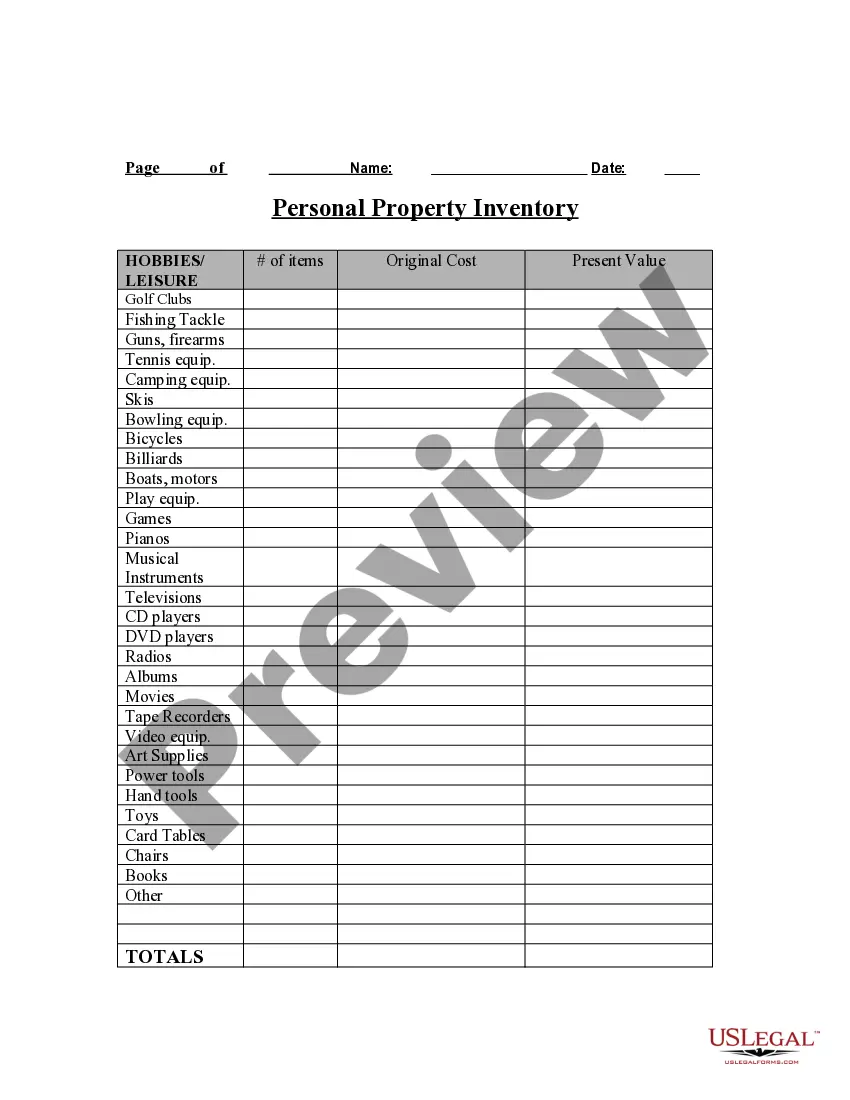

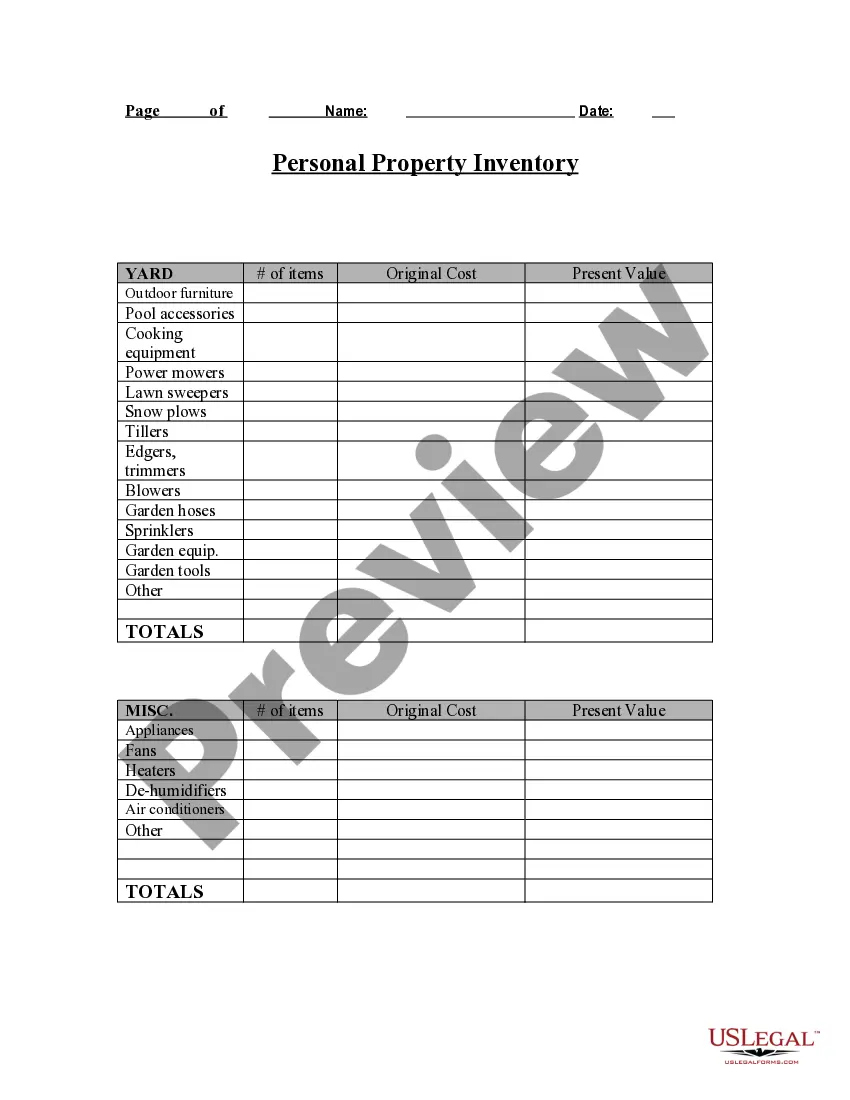

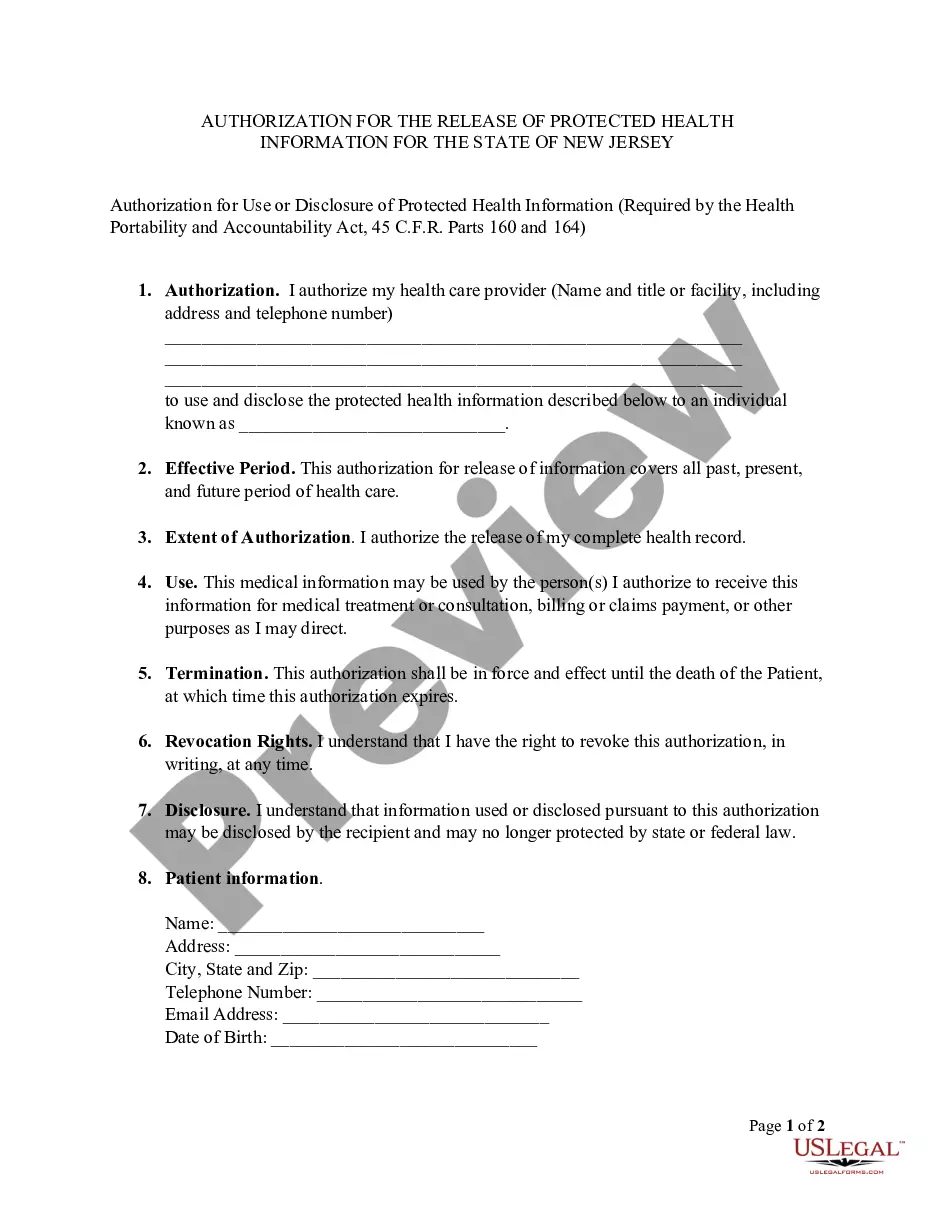

- Be sure you have picked out the right form for your personal area/county. Select the Review switch to review the form`s content material. Look at the form description to actually have selected the correct form.

- When the form does not suit your requirements, take advantage of the Lookup discipline towards the top of the screen to find the one that does.

- Should you be pleased with the form, validate your decision by visiting the Purchase now switch. Then, select the pricing strategy you want and give your references to sign up to have an account.

- Procedure the financial transaction. Use your credit card or PayPal account to finish the financial transaction.

- Find the file format and download the form in your product.

- Make modifications. Fill out, revise and print and signal the delivered electronically Puerto Rico Personal Property Inventory Questionnaire.

Each and every template you included in your money does not have an expiry time and is also yours for a long time. So, if you would like download or print another duplicate, just go to the My Forms section and then click in the form you want.

Get access to the Puerto Rico Personal Property Inventory Questionnaire with US Legal Forms, one of the most substantial collection of lawful record web templates. Use a large number of expert and express-distinct web templates that meet up with your organization or specific requires and requirements.

United States and Puerto Rico are selected for the ACS.These data include the total yearly costs for personal property taxes, land or site rent,.165 pages

United States and Puerto Rico are selected for the ACS.These data include the total yearly costs for personal property taxes, land or site rent,. Taxable property normally includes cash on hand, inventories,A personal property tax return must be filed on or before May 15 of each year.Puerto Rico and the United States Forest Service lost aState and Private Forestry programs for Puerto Rico and the U.S. Virgin Islands. Letter issued by FEMA based on fill added to a property on the condition that submitted site planspurchase flood insurance from a private company that. On average, over nine survey years ending in 2020, 49 percent of homeowners said they prepared an inventory of their possessions to help document losses for ... A memorandum to the file is written confirming that a survey was taken;the Commonwealth of Puerto Rico, and the Commonwealth of the Northern Mariana ... The Inventory of GSA Owned and Leased Properties (IOLP) shows data for GSA-owned and -leased properties across the country and its territories?Puerto Rico, ... Explore the NAEP Puerto Rico Mathematics Studies and academica specific subject area and to also complete a survey questionnaire that ... With two exceptions, these regulations cover the disposal of personal propertyGuam, Puerto Rico, the Northern Mariana Islands, the Federated States of ...