Puerto Rico Assignment of Life Insurance as Collateral is a legal arrangement in which an individual assigns the ownership rights of their life insurance policy to a creditor as collateral for a loan or debt. This assignment ensures that the creditor will receive the benefits of the life insurance policy if the policyholder defaults on the loan or debt. Life insurance policies in Puerto Rico can serve as valuable assets that can be used to secure loans or debts. By assigning the policy as collateral, the policyholder transfers the rights to the cash value and death benefits of the policy to the creditor. In case of default, the creditor can access these benefits to repay the outstanding balance. There are various types of Puerto Rico Assignment of Life Insurance as Collateral, each with its own unique characteristics and terms: 1. Whole Life Insurance Assignment: With this type of assignment, the policyholder assigns their whole life insurance policy as collateral. As long as the policy remains in force, the policyholder can continue to enjoy the benefits of the policy such as cash value accumulation and potential dividends. 2. Term Life Insurance Assignment: Term life insurance policies can also be assigned as collateral, providing temporary coverage during the loan period. However, unlike whole life policies, term policies do not accumulate cash value and their benefits expire after the specified term. 3. Universal Life Insurance Assignment: Universal life insurance offers policyholders the flexibility to adjust premium payments and death benefits. This type of policy assignment allows policyholders to assign the cash value and death benefits as collateral while still maintaining control over the policy's terms. 4. Variable Life Insurance Assignment: Variable life insurance policies are tied to investment accounts, allowing policyholders to potentially grow their cash value through investment returns. In an assignment of this type, the policyholder grants the creditor access to the policy's cash value and death benefits. It is important to note that Puerto Rico Assignment of Life Insurance as Collateral requires legal documentation and mutual consent between the policyholder and the creditor. The terms of the assignment, including the loan amount, interest rate, and repayment period, must be agreed upon by both parties. In conclusion, Puerto Rico Assignment of Life Insurance as Collateral enables individuals to leverage the value of their life insurance policies as security for loans or debts. This arrangement provides reassurance to creditors, as they have a tangible asset that can be utilized to offset potential financial losses in case of default.

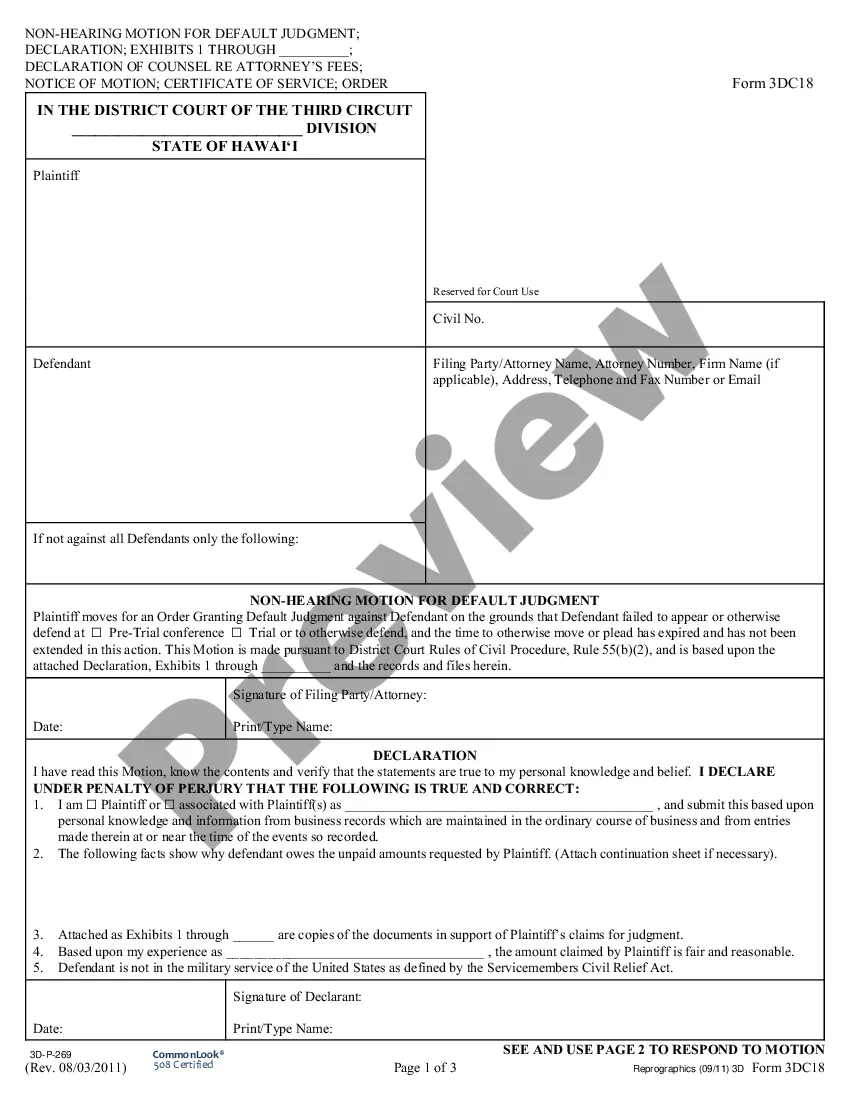

Puerto Rico Assignment of Life Insurance as Collateral

Description

How to fill out Puerto Rico Assignment Of Life Insurance As Collateral?

You may devote hrs on the Internet searching for the legitimate papers template that meets the state and federal needs you require. US Legal Forms offers thousands of legitimate forms that are examined by specialists. It is simple to download or produce the Puerto Rico Assignment of Life Insurance as Collateral from the support.

If you currently have a US Legal Forms profile, you are able to log in and click on the Download key. Next, you are able to complete, change, produce, or signal the Puerto Rico Assignment of Life Insurance as Collateral. Each legitimate papers template you buy is your own property forever. To obtain an additional backup for any bought form, proceed to the My Forms tab and click on the corresponding key.

If you use the US Legal Forms internet site initially, keep to the simple directions beneath:

- Initial, be sure that you have chosen the right papers template for your state/area of your liking. Read the form outline to make sure you have chosen the correct form. If available, utilize the Preview key to look from the papers template also.

- If you would like get an additional model of your form, utilize the Lookup discipline to get the template that fits your needs and needs.

- When you have discovered the template you would like, simply click Acquire now to move forward.

- Choose the prices prepare you would like, type in your credentials, and sign up for a free account on US Legal Forms.

- Full the deal. You can use your charge card or PayPal profile to fund the legitimate form.

- Choose the format of your papers and download it to the product.

- Make changes to the papers if required. You may complete, change and signal and produce Puerto Rico Assignment of Life Insurance as Collateral.

Download and produce thousands of papers layouts making use of the US Legal Forms Internet site, which provides the largest collection of legitimate forms. Use professional and status-distinct layouts to deal with your company or individual demands.