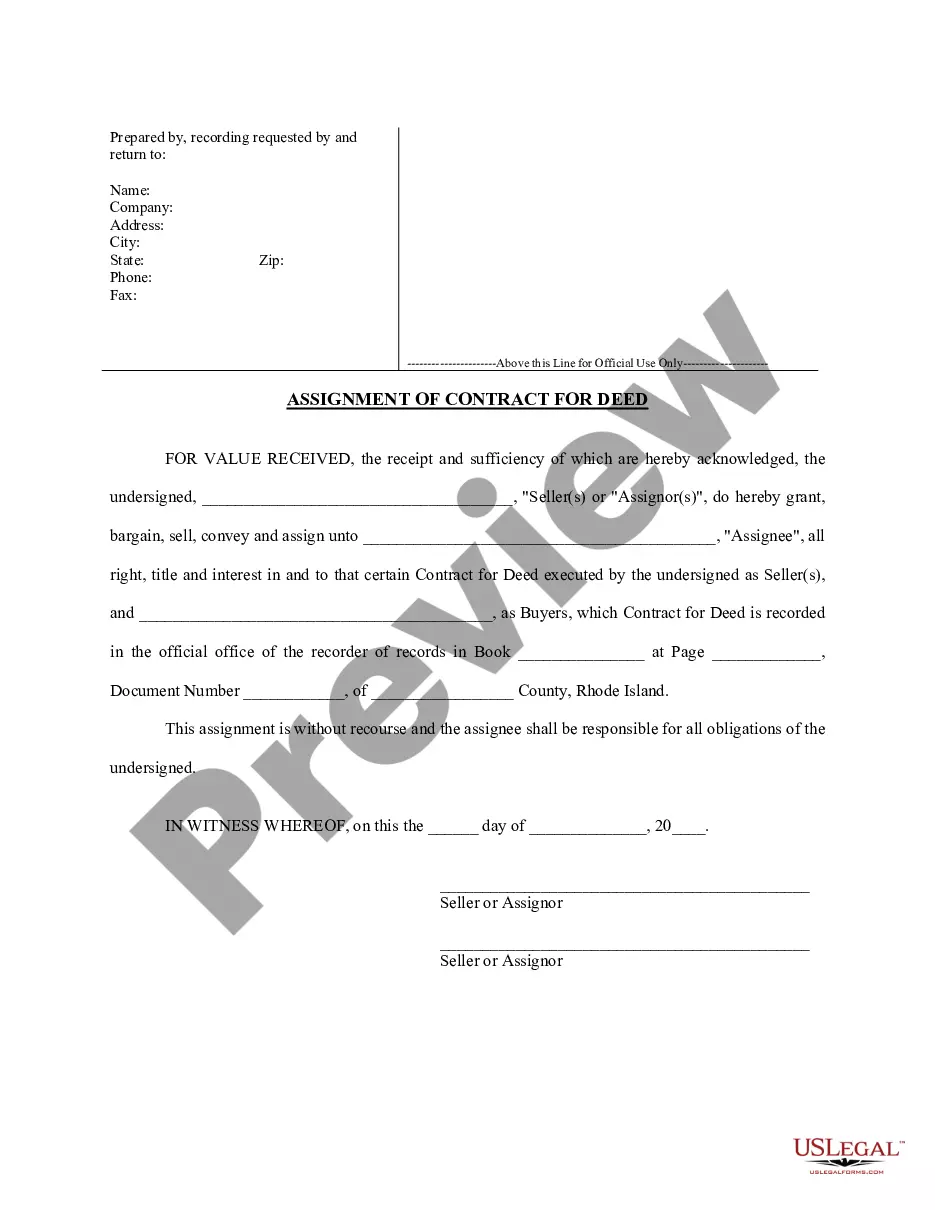

Rhode Island Assignment of Contract for Deed by Seller

Description

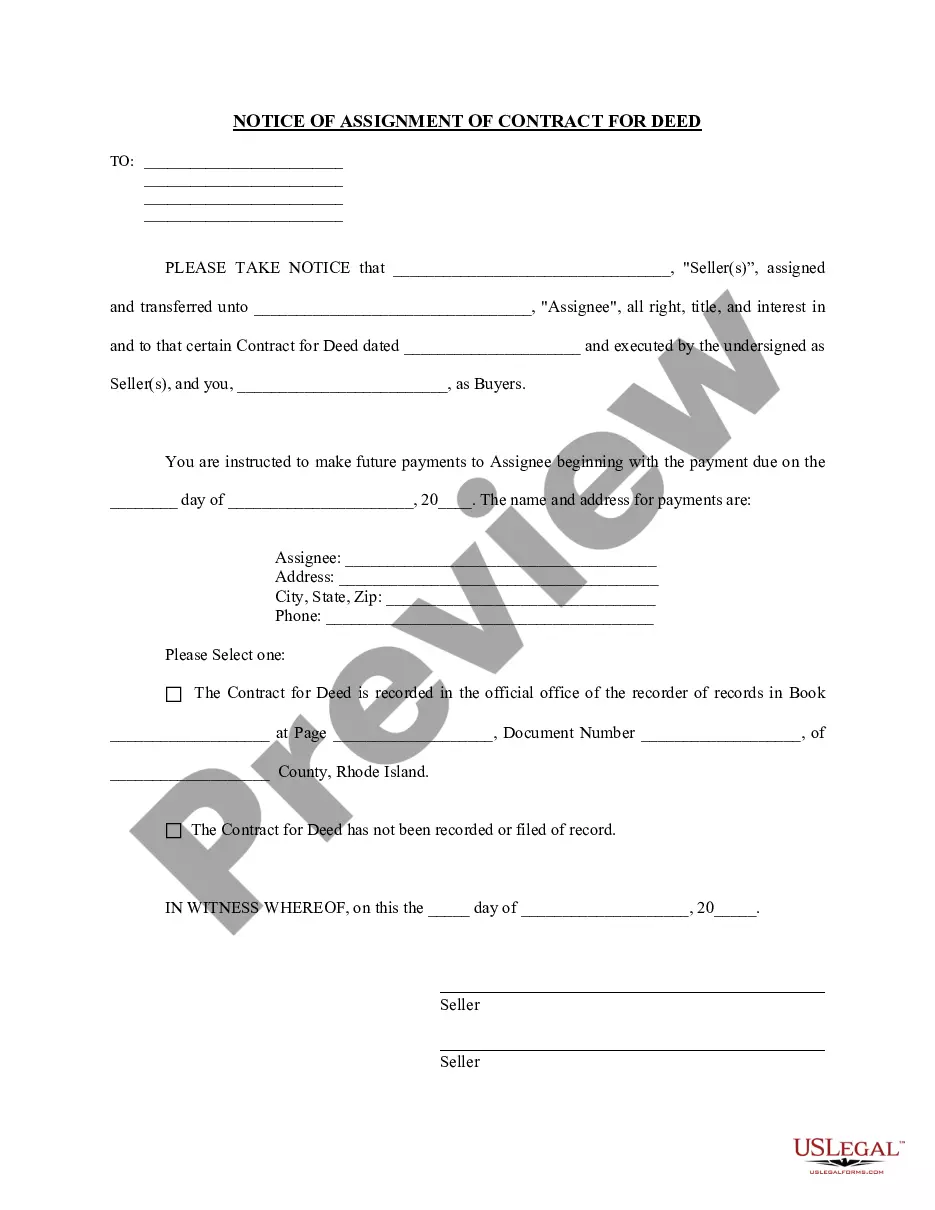

How to fill out Rhode Island Assignment Of Contract For Deed By Seller?

Creating documents isn't the most uncomplicated process, especially for people who almost never work with legal papers. That's why we recommend using correct Rhode Island Assignment of Contract for Deed by Seller templates made by skilled lawyers. It gives you the ability to avoid problems when in court or handling formal institutions. Find the documents you require on our site for top-quality forms and accurate information.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will automatically appear on the template webpage. Soon after downloading the sample, it’ll be saved in the My Forms menu.

Users with no an active subscription can quickly get an account. Make use of this short step-by-step guide to get your Rhode Island Assignment of Contract for Deed by Seller:

- Make certain that the sample you found is eligible for use in the state it is required in.

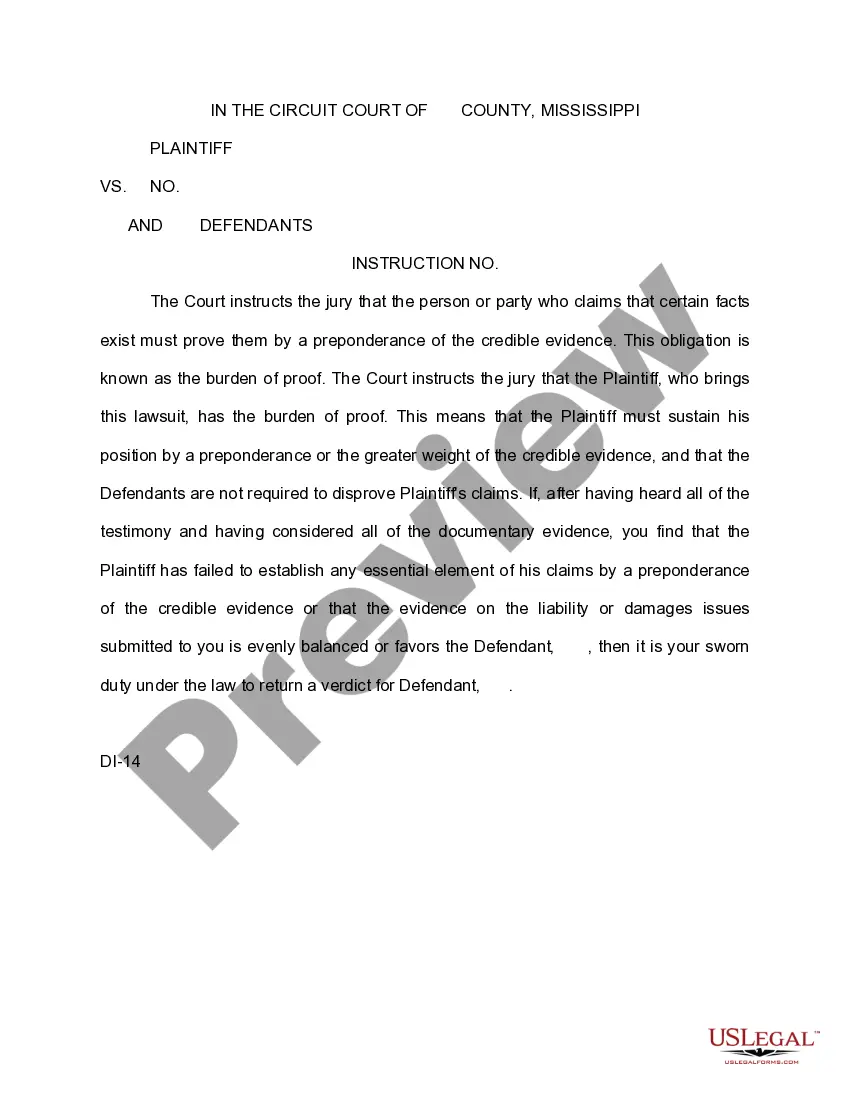

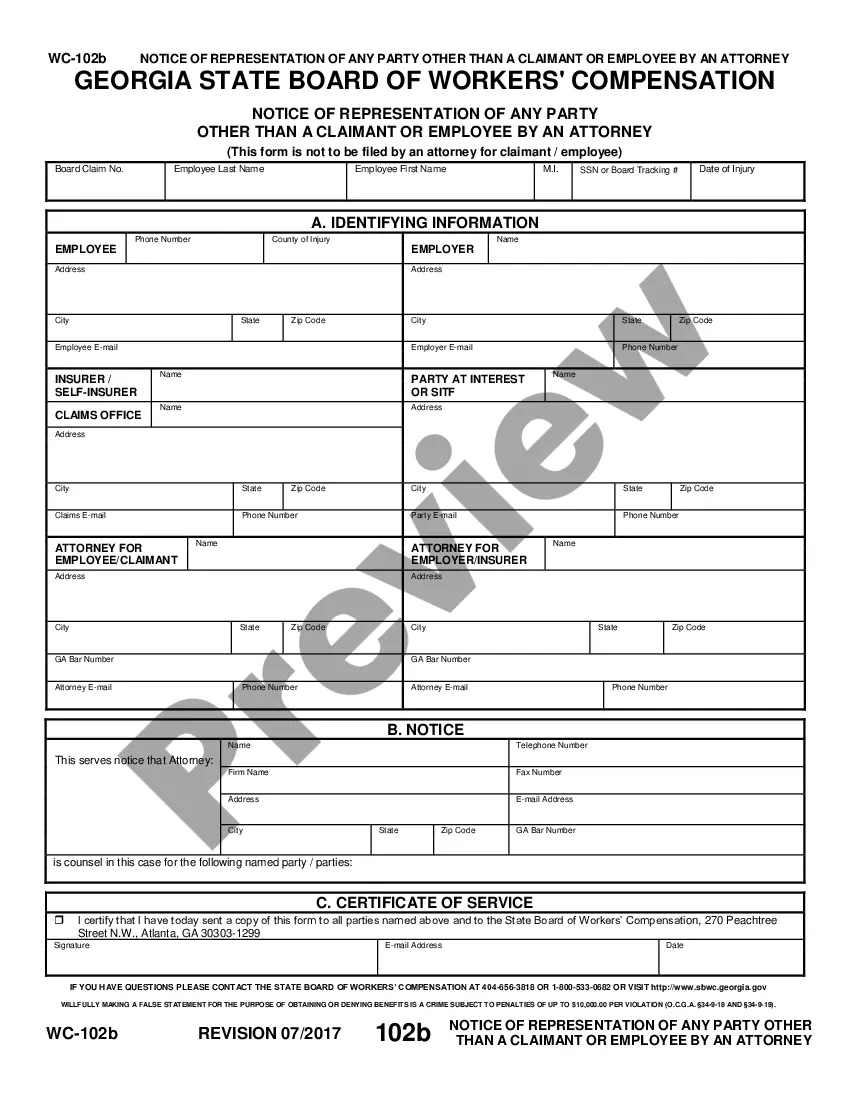

- Confirm the file. Use the Preview feature or read its description (if readily available).

- Buy Now if this template is what you need or go back to the Search field to find a different one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After finishing these easy actions, it is possible to complete the sample in an appropriate editor. Recheck completed info and consider asking a legal representative to examine your Rhode Island Assignment of Contract for Deed by Seller for correctness. With US Legal Forms, everything becomes much easier. Try it now!

Form popularity

FAQ

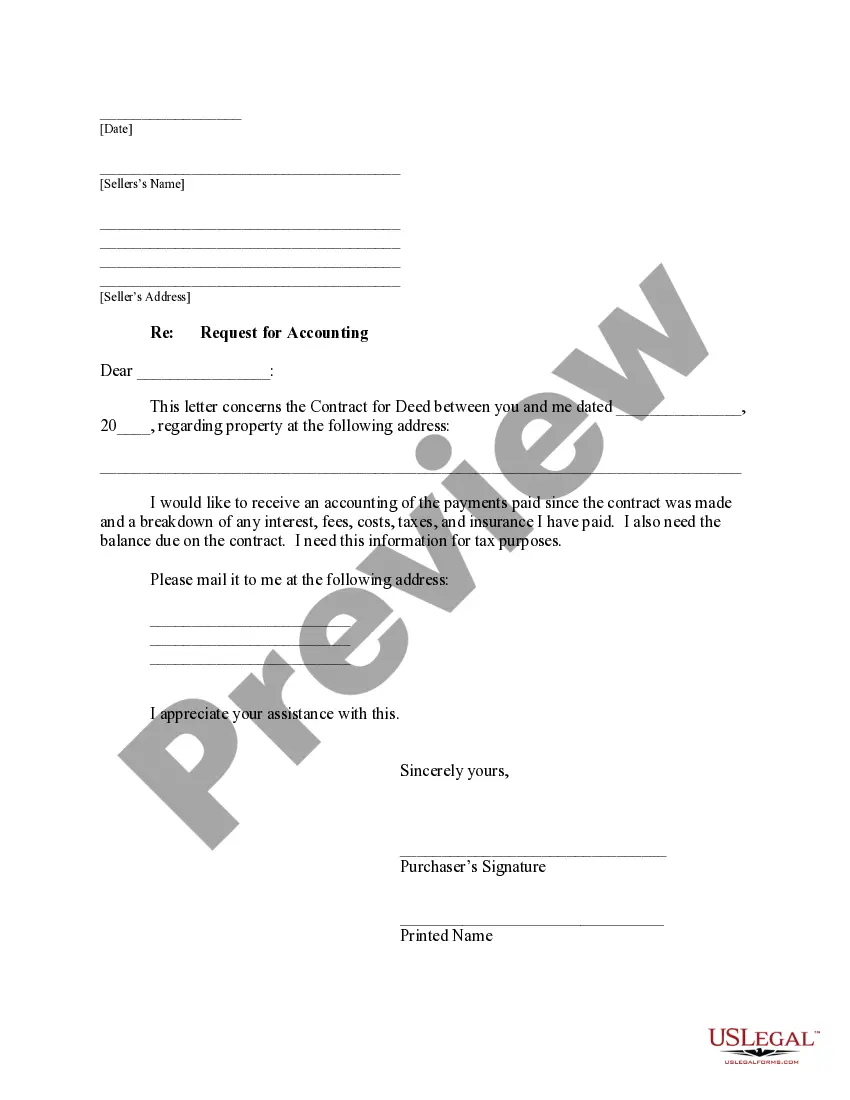

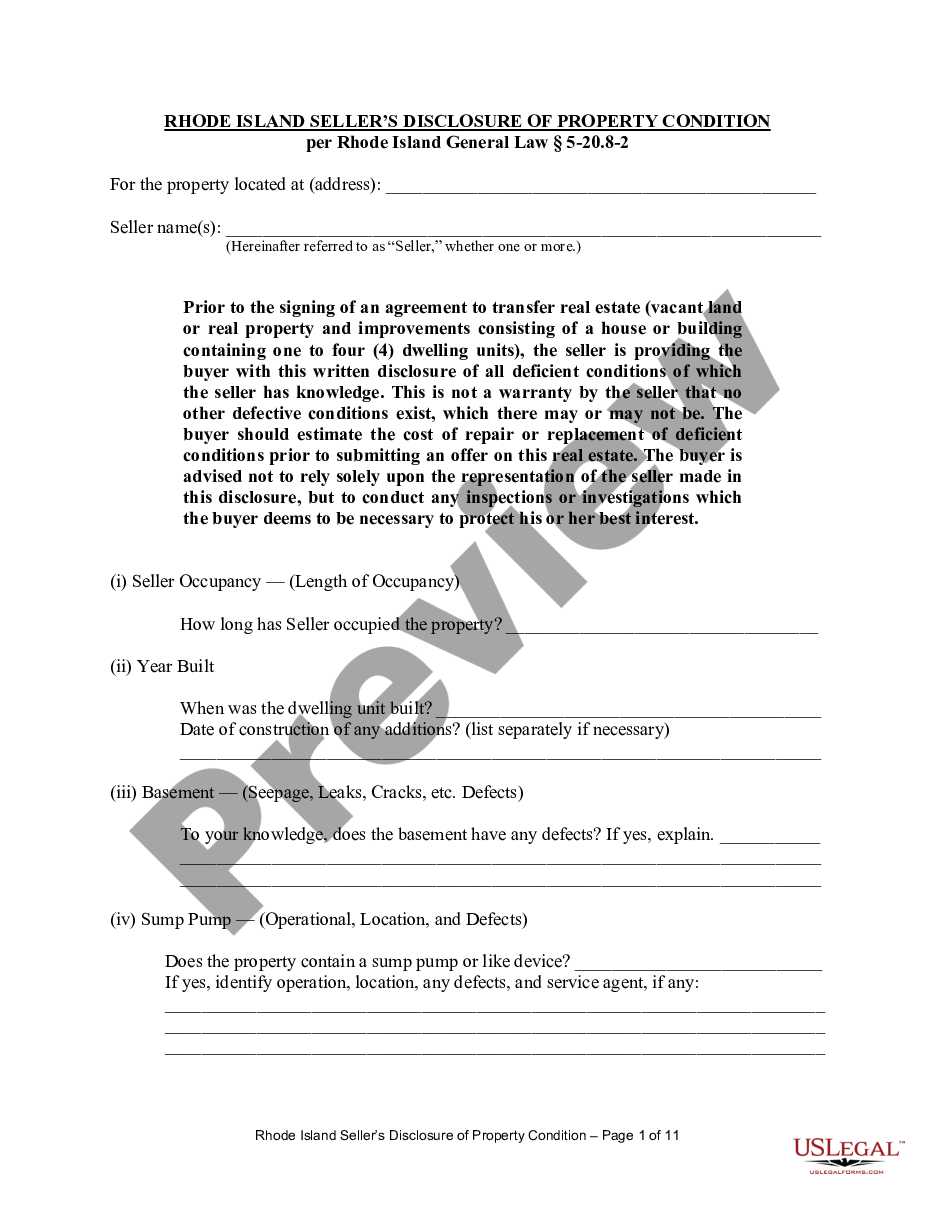

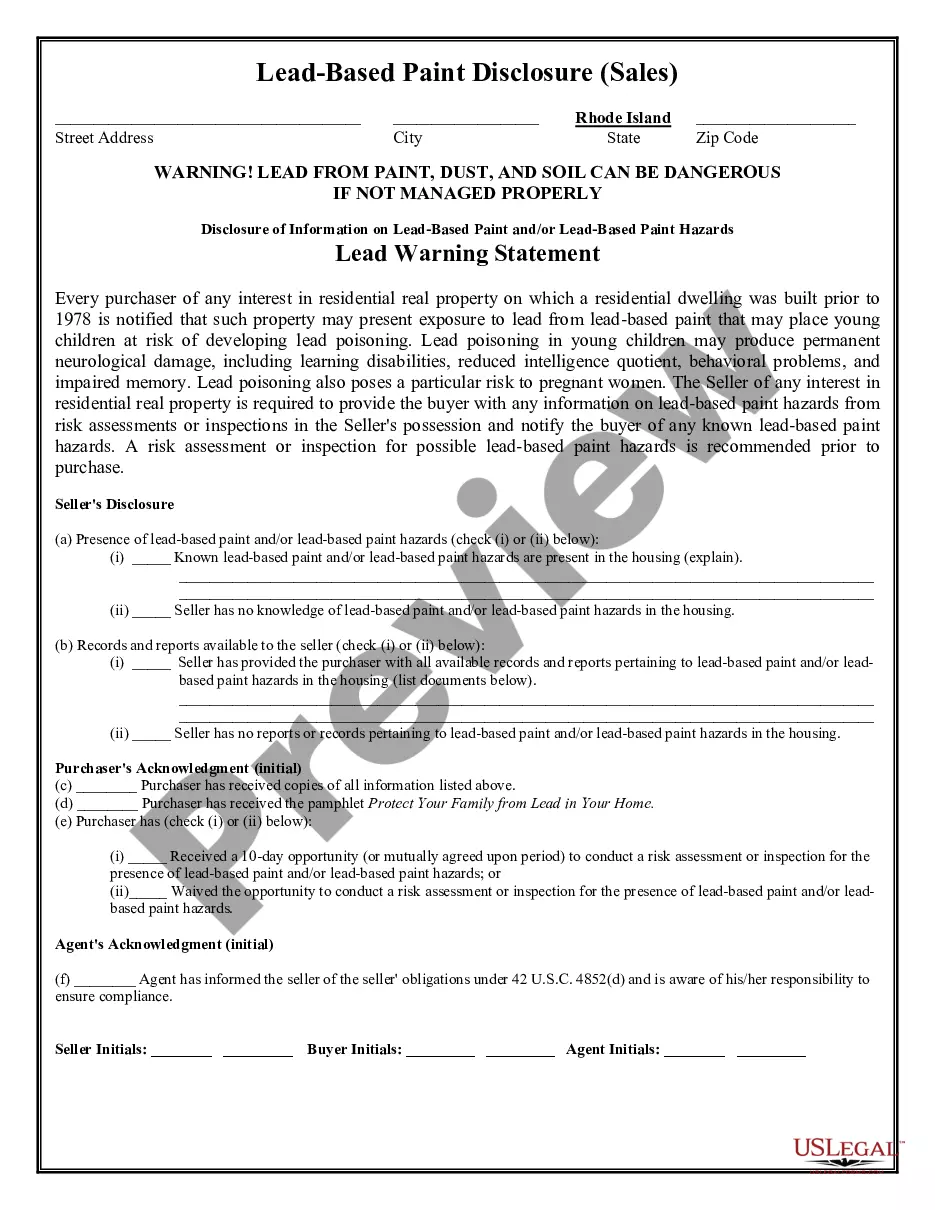

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

Contract for Deed Seller Financing. A contract for deed is used by some sellers who finance the sale of their homes. Seller's Ownership Liability. Buyer Default Risk. Seller Performance. Property Liens Could Hinder Purchase.

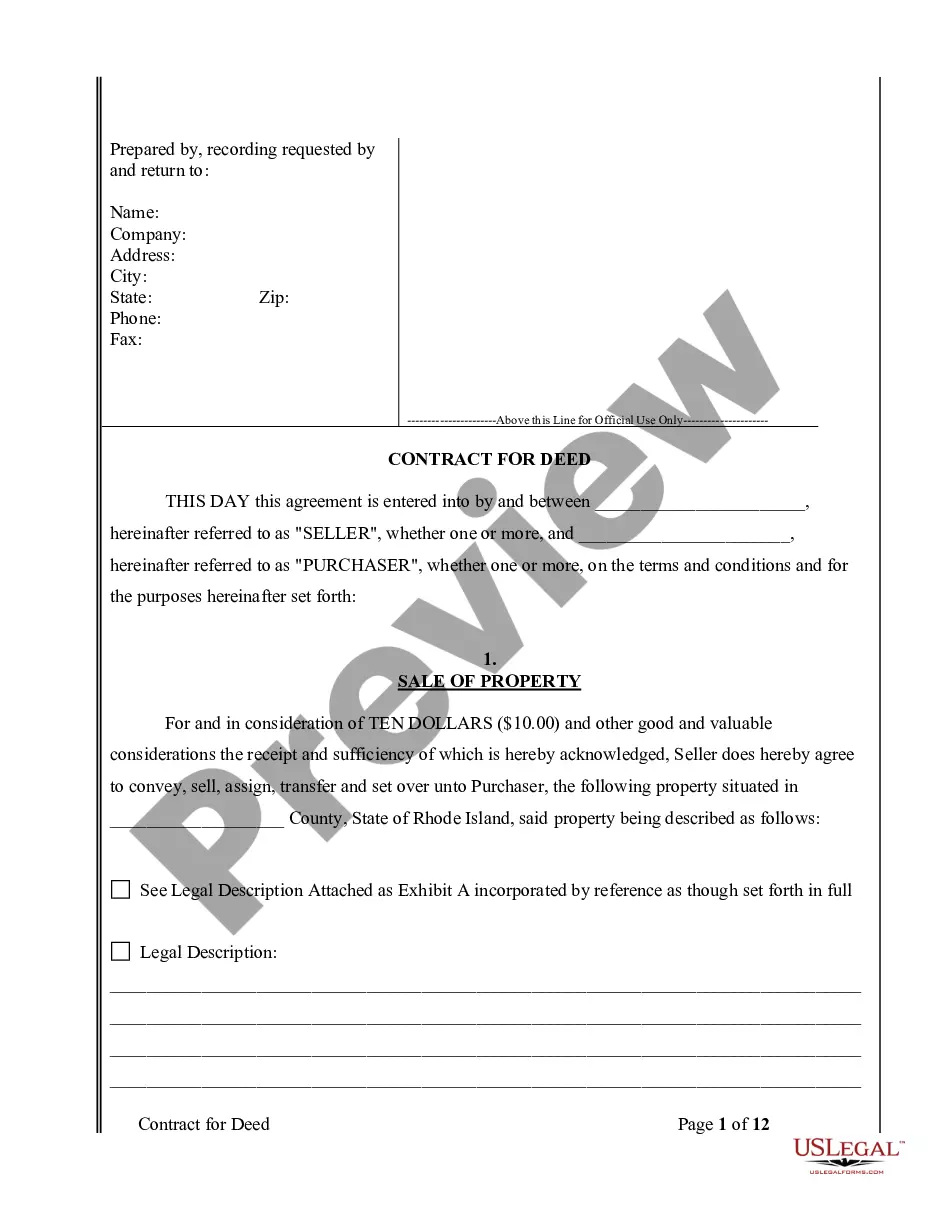

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

Generally, the seller will look for a down payment anywhere from 10% to 20% of the purchase price. The interest on a contract for deed could be anywhere from 1% to 2.5% higher than the current market rate.