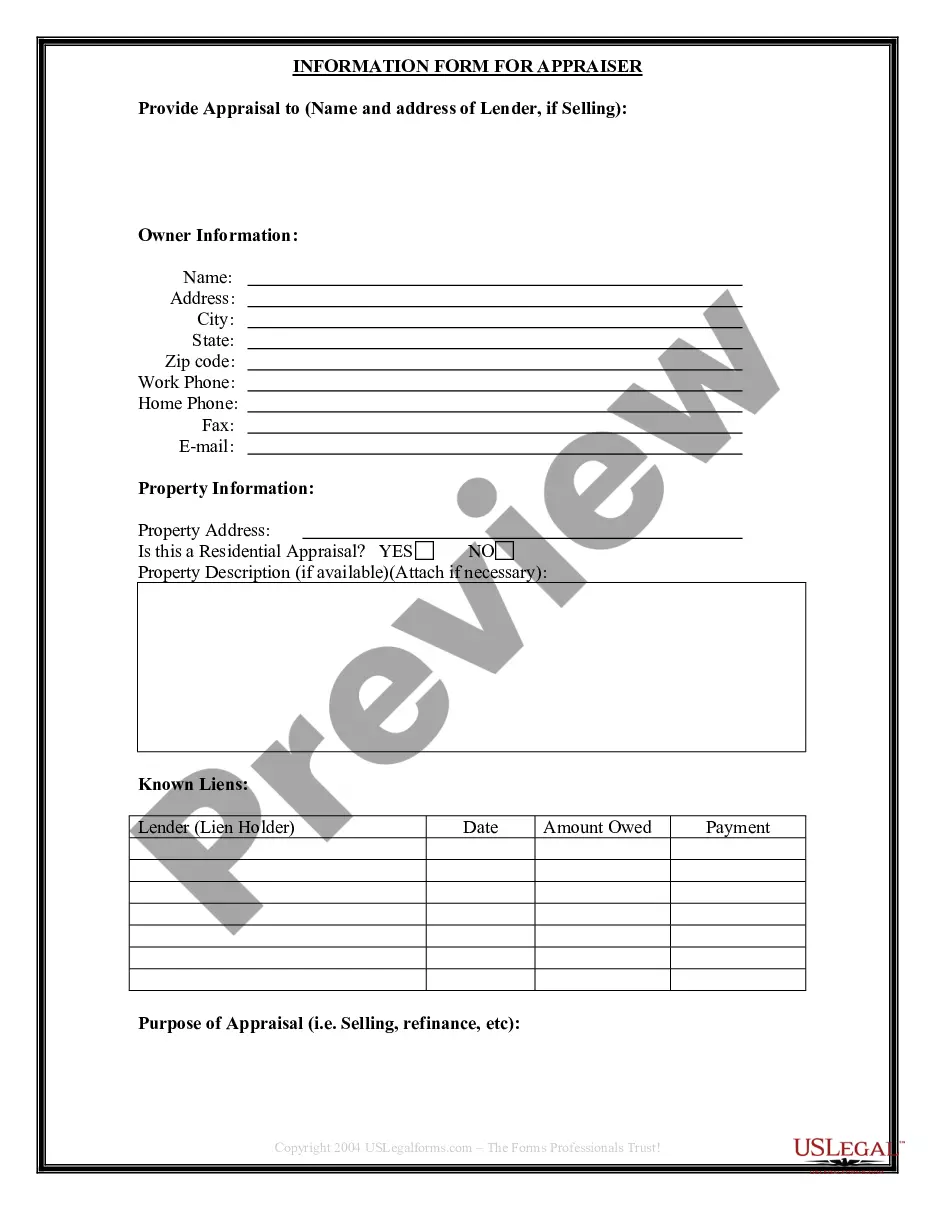

Rhode Island Seller's Information for Appraiser provided to Buyer

Description

How to fill out Rhode Island Seller's Information For Appraiser Provided To Buyer?

Among numerous paid and free templates that you can find on the net, you can't be certain about their accuracy and reliability. For example, who created them or if they are qualified enough to take care of what you need those to. Always keep relaxed and make use of US Legal Forms! Locate Rhode Island Seller's Information for Appraiser provided to Buyer samples developed by professional attorneys and prevent the high-priced and time-consuming procedure of looking for an lawyer and after that paying them to draft a document for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button near the file you are looking for. You'll also be able to access all your previously acquired files in the My Forms menu.

If you are using our platform the first time, follow the guidelines below to get your Rhode Island Seller's Information for Appraiser provided to Buyer fast:

- Ensure that the document you discover applies where you live.

- Review the template by reading the information for using the Preview function.

- Click Buy Now to begin the ordering procedure or look for another template utilizing the Search field located in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

Once you have signed up and paid for your subscription, you can utilize your Rhode Island Seller's Information for Appraiser provided to Buyer as many times as you need or for as long as it remains active in your state. Edit it with your favored editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

A property deed is a legal document that transfers the ownership of real estate from a seller to a buyer. For a deed to be legal it must state the name of the buyer and the seller, describe the property that is being transferred, and include the signature of the party that is transferring the property.

Who Must Make These Seller Disclosures in California. As a broad rule, all sellers of residential real estate property containing one to four units in California must complete and provide written disclosures to the buyer.

Buyers must sign off on all disclosures and reports. So it's important to review them carefully and ask questions if you need to. Full disclosure upfront is the way to go. Providing full disclosure can help a seller.

As a general rule it certainly is not a good idea for a buyer and seller to talk directly with each other during negotiations.Good communications between the buyer and seller are important, and that also means that both Realtors need to be good communicators, too.

The initial escrow disclosure statement. This document, which home buyers usually sign at closing, shows the specific charges you will pay into your escrow account each month (in accordance with the terms of your mortgage agreement). An escrow account is a special kind of account used to pay property-related expenses.

A property deed is an official document used to transfer ownership from the buyer to the seller. The deed should not be confused with the house title, which refers to a home's history of ownership. During closing, the newly signed deed is collected by the county recorder and made public.

For sellers, it can also be advantageous to pre-sign all necessary documents to expedite the funding process on the day of closing. Although it is often thought of as customary for sellers to wait to sign until after the buyer has signed, this is unnecessary and can delay the process.

While your lender will typically arrange for an appraisal, the buyer is ultimately responsible for the cost. Generally appraisal fees range between $450 and $750, depending on the size and location of your property.

Keys, codes, and garage door openers to the house. Cashier's checks for closing costs and repair credits. Personal checkbook. Time, date, and location of the closing. Government-issued identification. Your writing hand (and maybe your lucky pen)