Rhode Island Articles of Incorporation for Domestic Nonprofit Corporation

Description

How to fill out Rhode Island Articles Of Incorporation For Domestic Nonprofit Corporation?

The work with papers isn't the most straightforward process, especially for people who almost never deal with legal papers. That's why we recommend using accurate Rhode Island Articles of Incorporation for Domestic Nonprofit Corporation samples created by skilled attorneys. It gives you the ability to prevent problems when in court or dealing with official institutions. Find the documents you require on our site for high-quality forms and accurate information.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you are in, the Download button will automatically appear on the file web page. Soon after getting the sample, it will be saved in the My Forms menu.

Customers without an activated subscription can easily create an account. Use this short step-by-step help guide to get the Rhode Island Articles of Incorporation for Domestic Nonprofit Corporation:

- Make sure that the sample you found is eligible for use in the state it is required in.

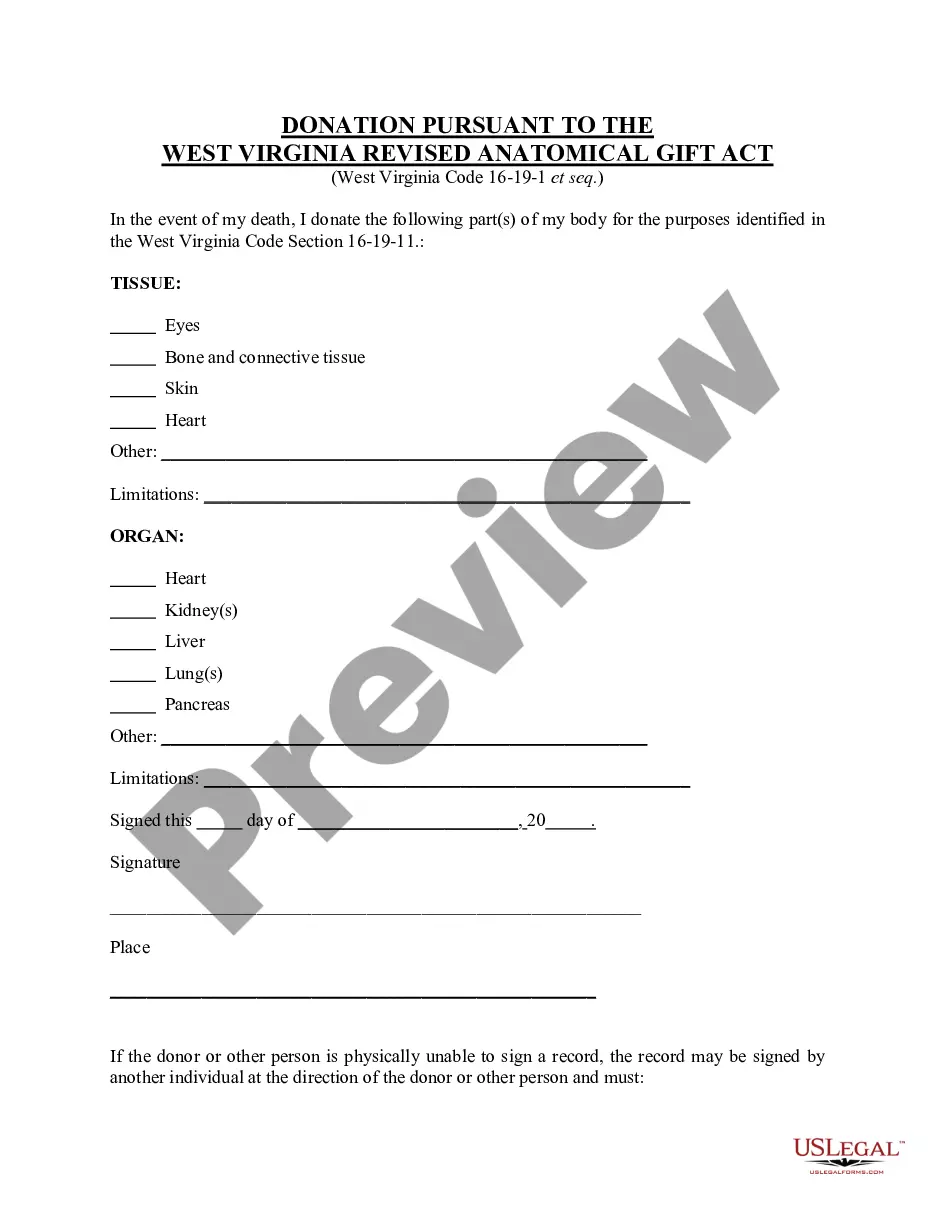

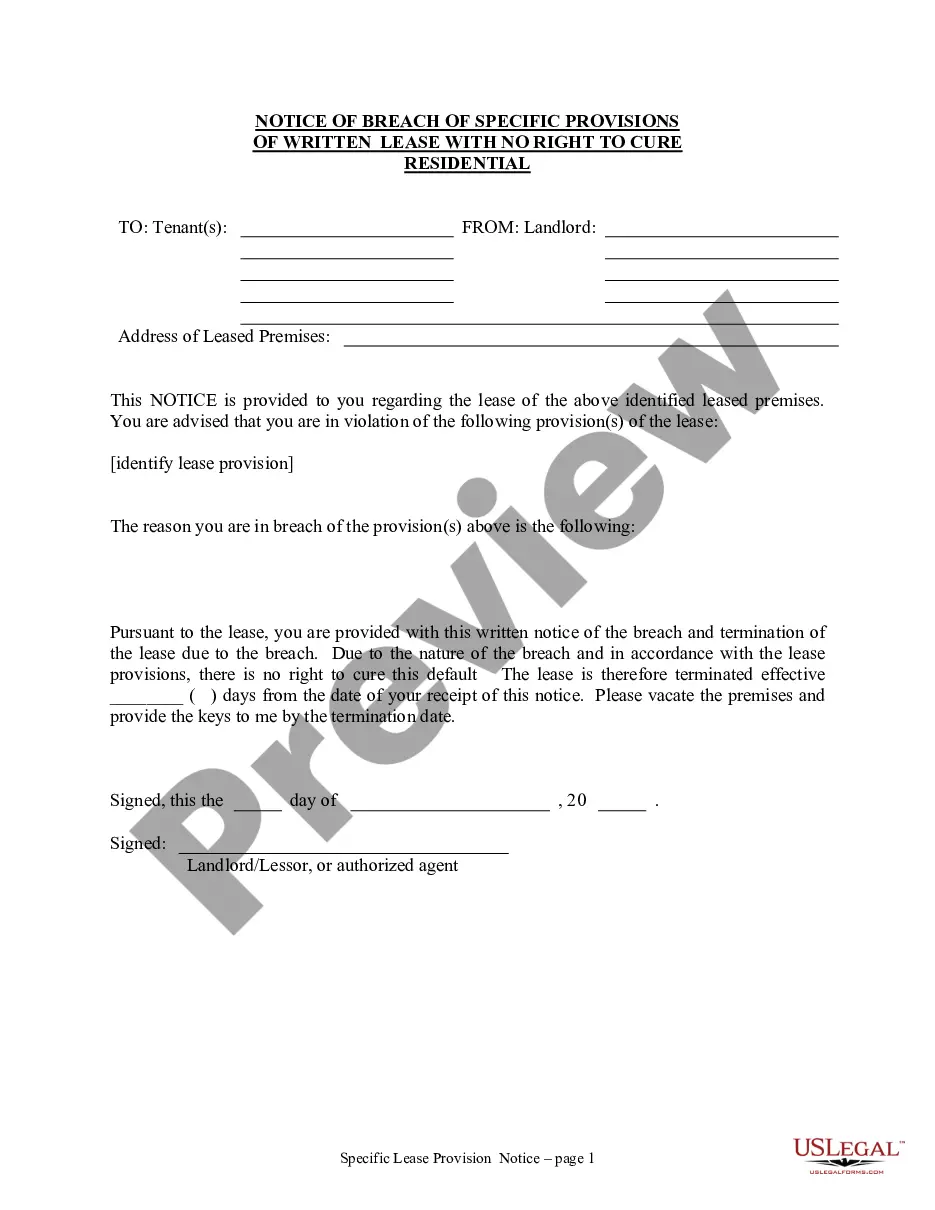

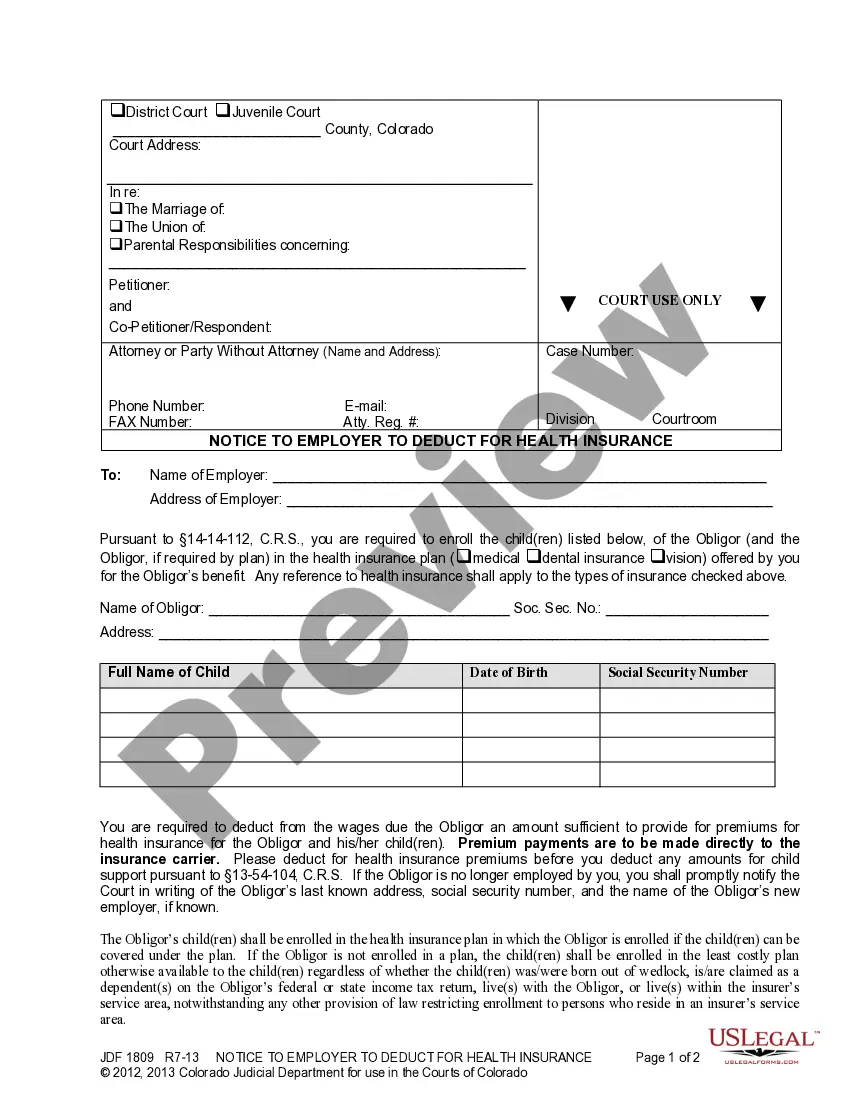

- Verify the file. Utilize the Preview option or read its description (if offered).

- Buy Now if this file is the thing you need or use the Search field to find a different one.

- Select a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a required format.

Right after completing these easy actions, it is possible to complete the sample in an appropriate editor. Recheck filled in data and consider requesting an attorney to examine your Rhode Island Articles of Incorporation for Domestic Nonprofit Corporation for correctness. With US Legal Forms, everything gets much simpler. Give it a try now!

Form popularity

FAQ

Both the IRS and the nonprofit corporation are required to disclose the information they provide on Form 990 to the public. This means that nonprofits must make their records available for public inspection during regular business hours at their principal office.

Legal Name of the Organization (Not taken by other companies in your State) Address of the Organization (Should be in the Incorporating State) Incorporator of the Nonprofit Organization.

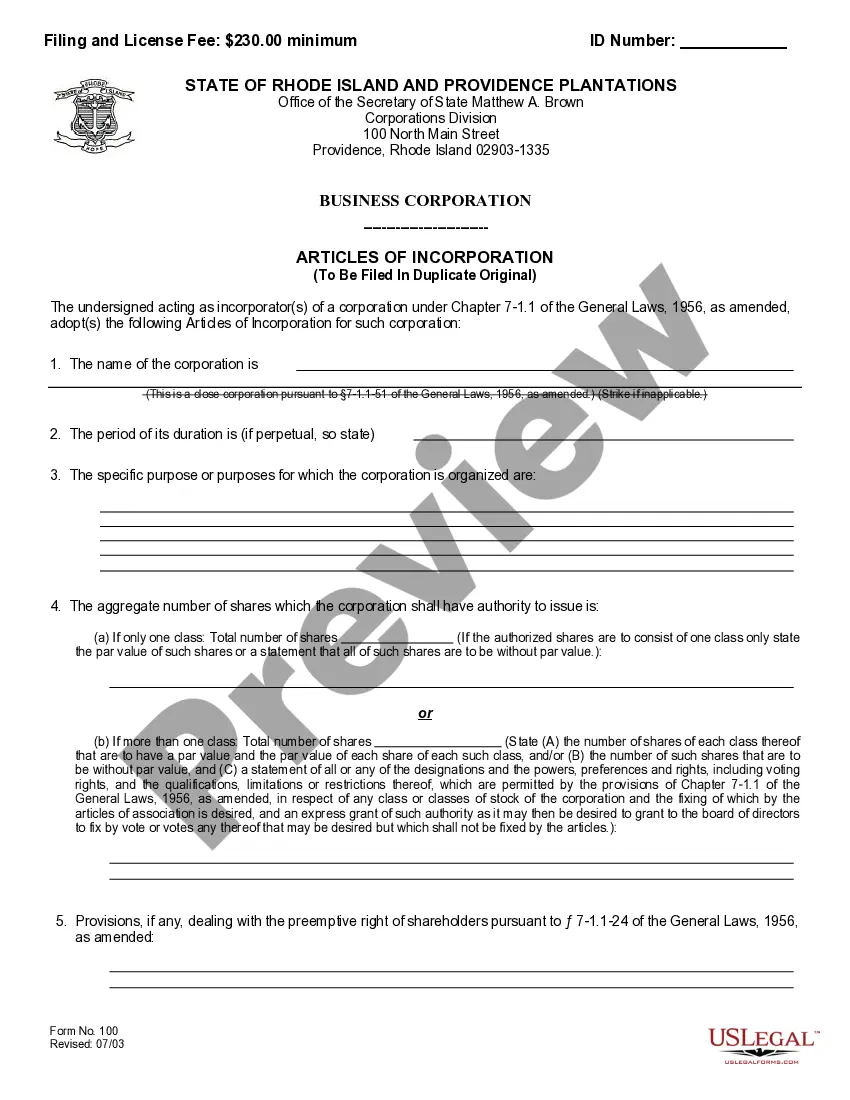

In order to form a nonprofit corporation, you must file articles of incorporation (sometimes called a "certificate of incorporation" or "charter document" or "articles of organization") with the state and pay a filing fee.

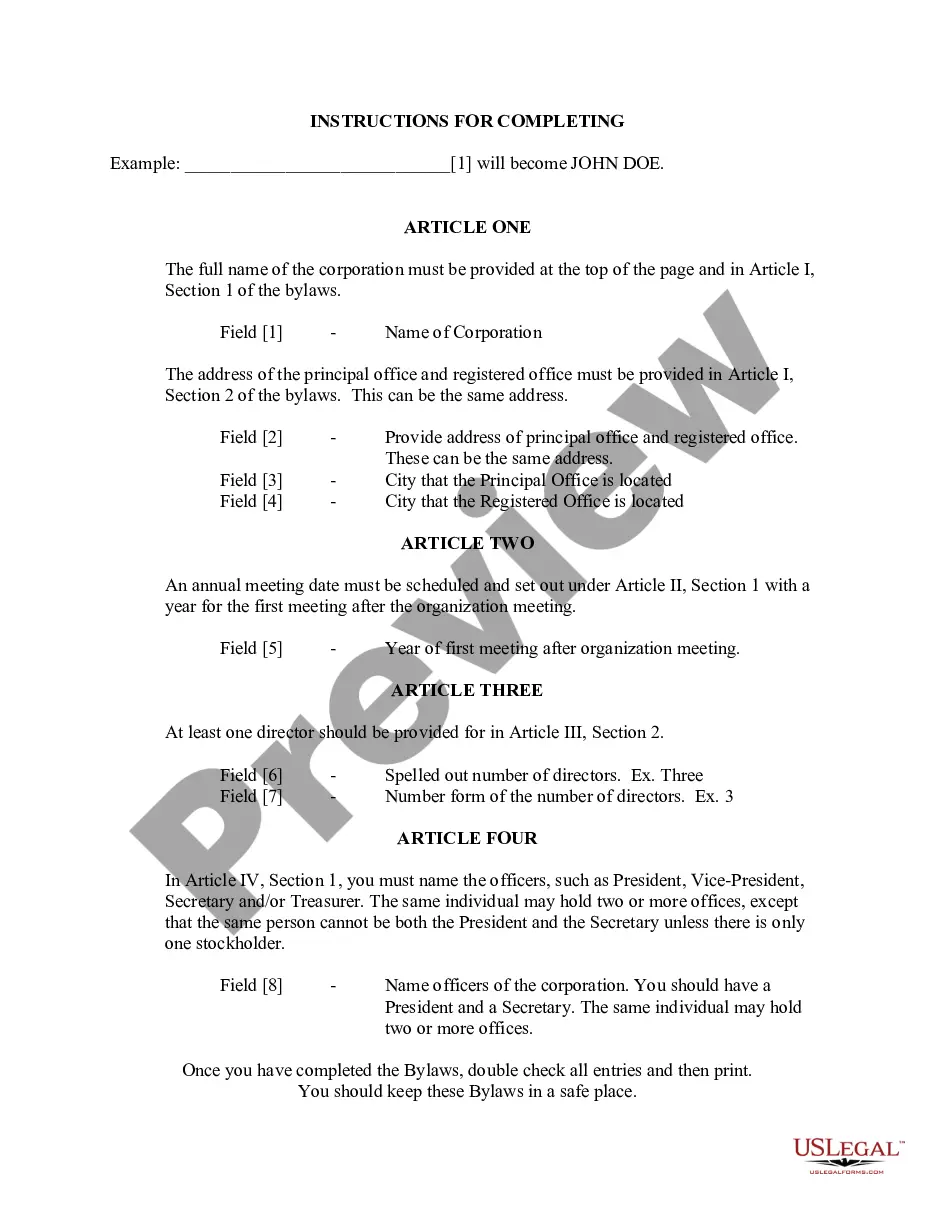

Name Your Organization. Recruit Incorporators and Initial Directors. Appoint a Registered Agent. Prepare and File Articles of Incorporation. File Initial Report. Obtain an Employer Identification Number (EIN) Store Nonprofit Records. Establish Initial Governing Documents and Policies.

The name of your corporation. your corporation's principal place of business. the name and address of your corporation's registered agent. a statement of the corporation's purpose. the corporation's duration. information about the number of shares and classes of stock the corporation is authorized to issue.

Broadly, articles of incorporation should include the company's name, type of corporate structure, and number and type of authorized shares. Bylaws work in conjunction with the articles of incorporation to form the legal backbone of the business.

Nonprofit incorporation usually involves these steps: Choose a business name that is legally available in your state and file for an EIN (Employment Identification Number) Prepare and file your articles of incorporation with your state's corporate filing office, and pay a filing fee.

Your nonprofit articles of incorporation is a legal document filed with the secretary of state to create your nonprofit corporation. This process is called incorporating. In some states, the articles of incorporation is called a certificate of incorporation or corporate charter.

All states require nonprofit corporations to have a registered agent in the state of formation. The registered agent is responsible for receiving legal and tax documents, must have a physical address (no P.O.Note that supplying the nonprofit's principal office address is optional in many states, but some require it.