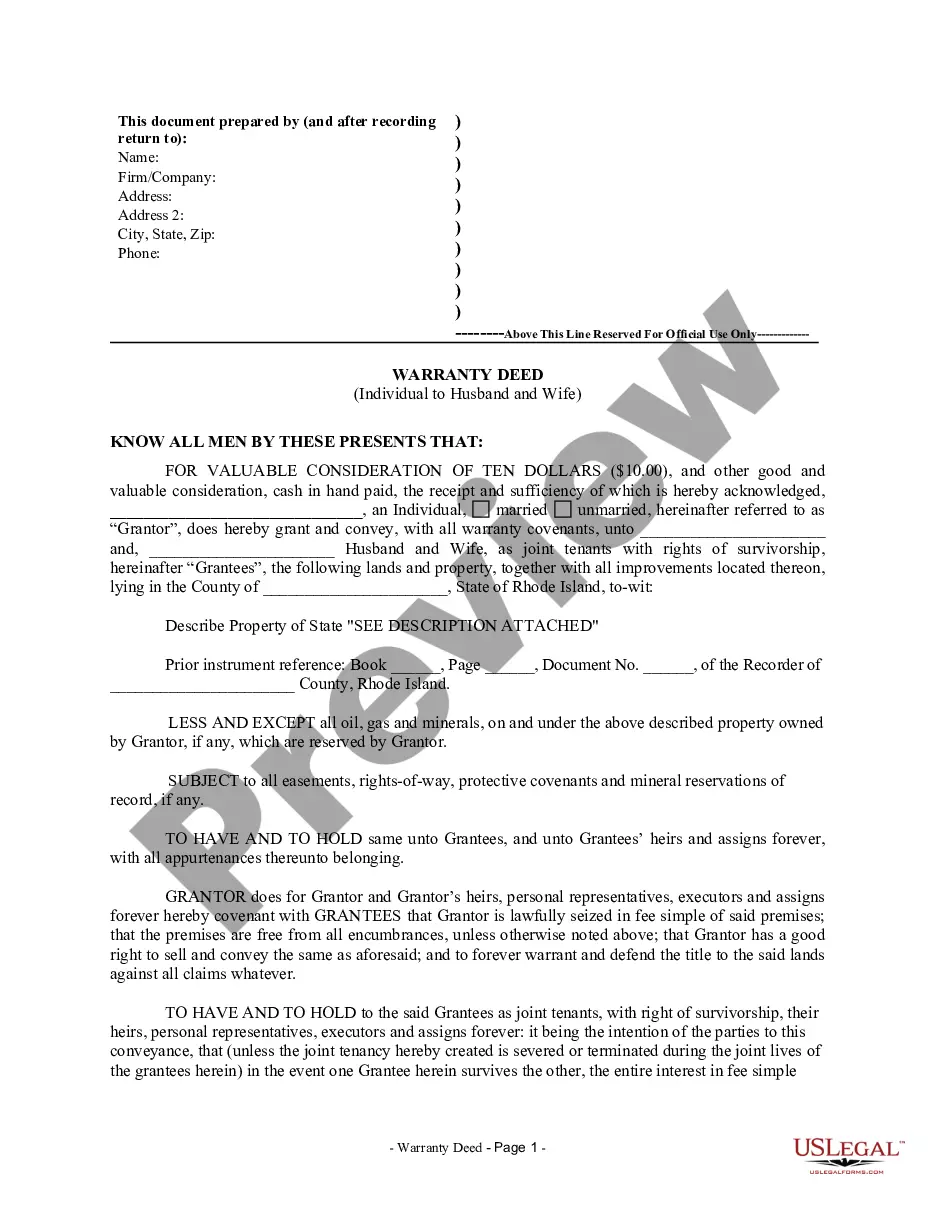

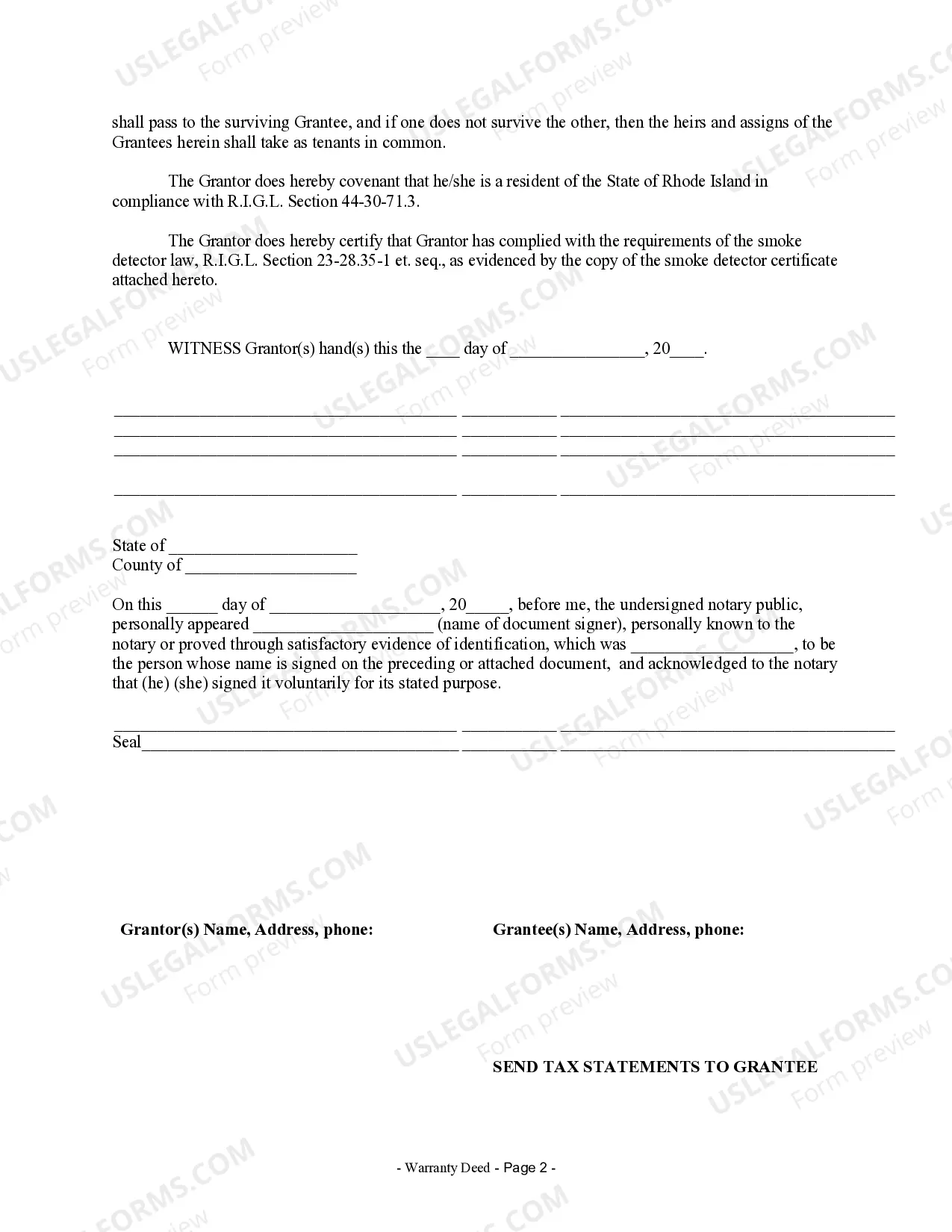

Rhode Island Warranty Deed from Individual to Husband and Wife

Description

How to fill out Rhode Island Warranty Deed From Individual To Husband And Wife?

Creating papers isn't the most simple process, especially for those who almost never work with legal papers. That's why we advise utilizing correct Rhode Island Warranty Deed from Individual to Husband and Wife samples made by professional lawyers. It allows you to avoid problems when in court or working with official organizations. Find the documents you need on our site for top-quality forms and correct explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will immediately appear on the template webpage. After accessing the sample, it will be stored in the My Forms menu.

Customers without a subscription can easily get an account. Look at this simple step-by-step guide to get your Rhode Island Warranty Deed from Individual to Husband and Wife:

- Make sure that the sample you found is eligible for use in the state it is needed in.

- Verify the document. Utilize the Preview option or read its description (if readily available).

- Buy Now if this file is the thing you need or go back to the Search field to get a different one.

- Select a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

After finishing these simple steps, you are able to fill out the sample in a preferred editor. Recheck filled in info and consider requesting an attorney to examine your Rhode Island Warranty Deed from Individual to Husband and Wife for correctness. With US Legal Forms, everything gets easier. Test it now!

Form popularity

FAQ

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

You may be able to transfer your interest in the property through a quitclaim deed, where you relinquish all ownership of the property to someone else. Your lender may also agree to add another name to the mortgage. In this case, someone else would be able to legally make payments on the mortgage.

You can gift property to spouse, child or any relative and register the same. Under section 122 of the Transfer of Property Act, 1882, you can transfer immovable property through a gift deed. The deed should contain your details as well as those of the recipient.

When it comes to reasons why you shouldn't add your new spouse to the Deed, the answer is simple divorce and equitable distribution. If you choose not to put your spouse on the Deed and the two of you divorce, the entire value of the home is not subject to equitable distribution.

Two of the most common ways to transfer property in a divorce are through an interspousal transfer deed or quitclaim deed. When spouses own property together, but then one spouse executes an interspousal transfer or a quitclaim deed, this is known as transmutation.

The easiest way to grant your spouse title to your home is via a quitclaim deed (Californians generally use an interspousal grant deed). With a quitclaim deed, you can name your spouse as the property's joint owner. The quitclaim deed must include the property's description, including its boundary lines.