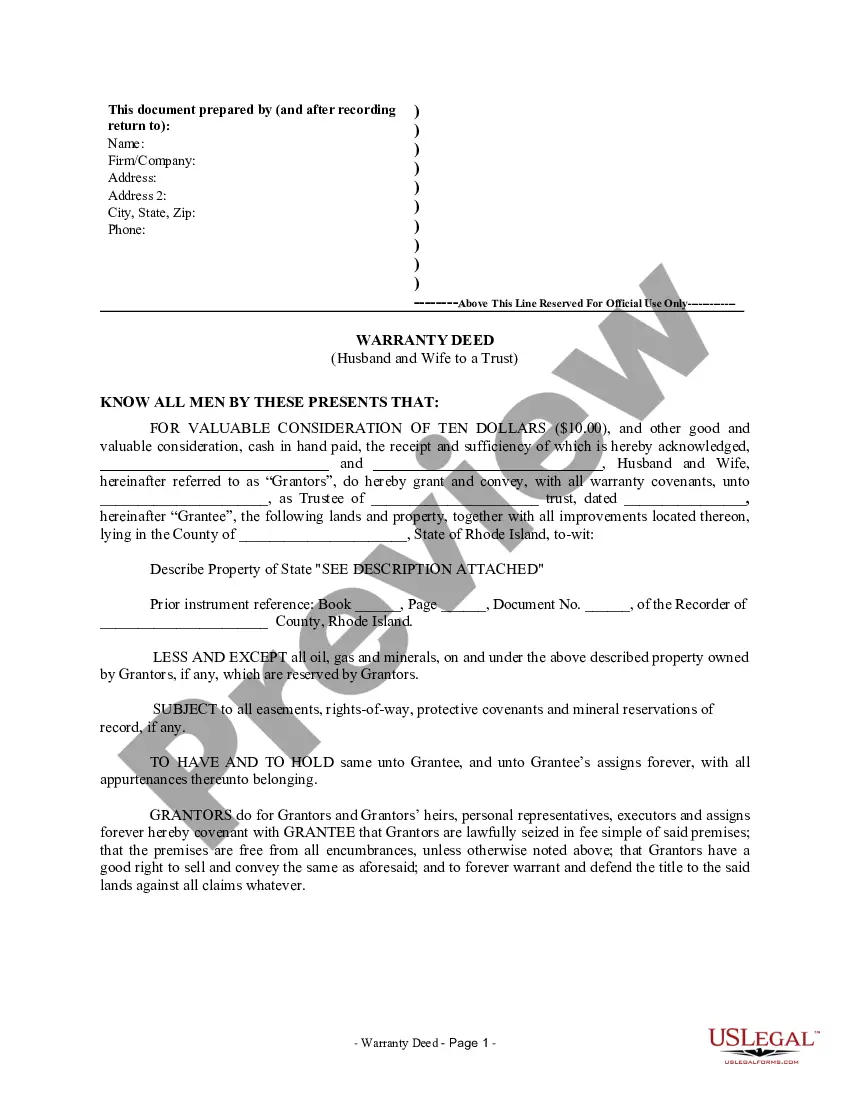

Rhode Island Warranty Deed from Husband and Wife to a Trust

Description

How to fill out Rhode Island Warranty Deed From Husband And Wife To A Trust?

Creating papers isn't the most uncomplicated job, especially for people who rarely deal with legal paperwork. That's why we advise utilizing correct Rhode Island Warranty Deed from Husband and Wife to a Trust templates created by skilled lawyers. It gives you the ability to stay away from problems when in court or dealing with formal institutions. Find the files you want on our website for top-quality forms and accurate explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will immediately appear on the file webpage. Right after accessing the sample, it’ll be stored in the My Forms menu.

Users with no an active subscription can quickly create an account. Follow this simple step-by-step help guide to get the Rhode Island Warranty Deed from Husband and Wife to a Trust:

- Ensure that file you found is eligible for use in the state it’s needed in.

- Confirm the document. Utilize the Preview feature or read its description (if readily available).

- Buy Now if this file is what you need or use the Search field to find a different one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a required format.

After completing these easy actions, it is possible to complete the form in a preferred editor. Check the completed information and consider asking a legal representative to examine your Rhode Island Warranty Deed from Husband and Wife to a Trust for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

Form popularity

FAQ

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

No, California does not require that the Grantee sign a warranty deed. However, some states and counties require that the deed be signed by the Grantee in addition to the Grantor.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

Grantor's signature: The grantor must sign the deed for it to be valid. Usually, if more than one person owns a property, all the owners must sign. In some states a husband or wife who own property by themselves may have to have the spouse also sign the deed even though the spouse does not have title to the property.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

The easiest way to grant your spouse title to your home is via a quitclaim deed (Californians generally use an interspousal grant deed). With a quitclaim deed, you can name your spouse as the property's joint owner. The quitclaim deed must include the property's description, including its boundary lines.

No, in most states, the Grantee is not required to sign the Quitclaim Deed. However, some counties do require that the Quitclaim Deed be signed by the Grantee in addition to the Grantor.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.