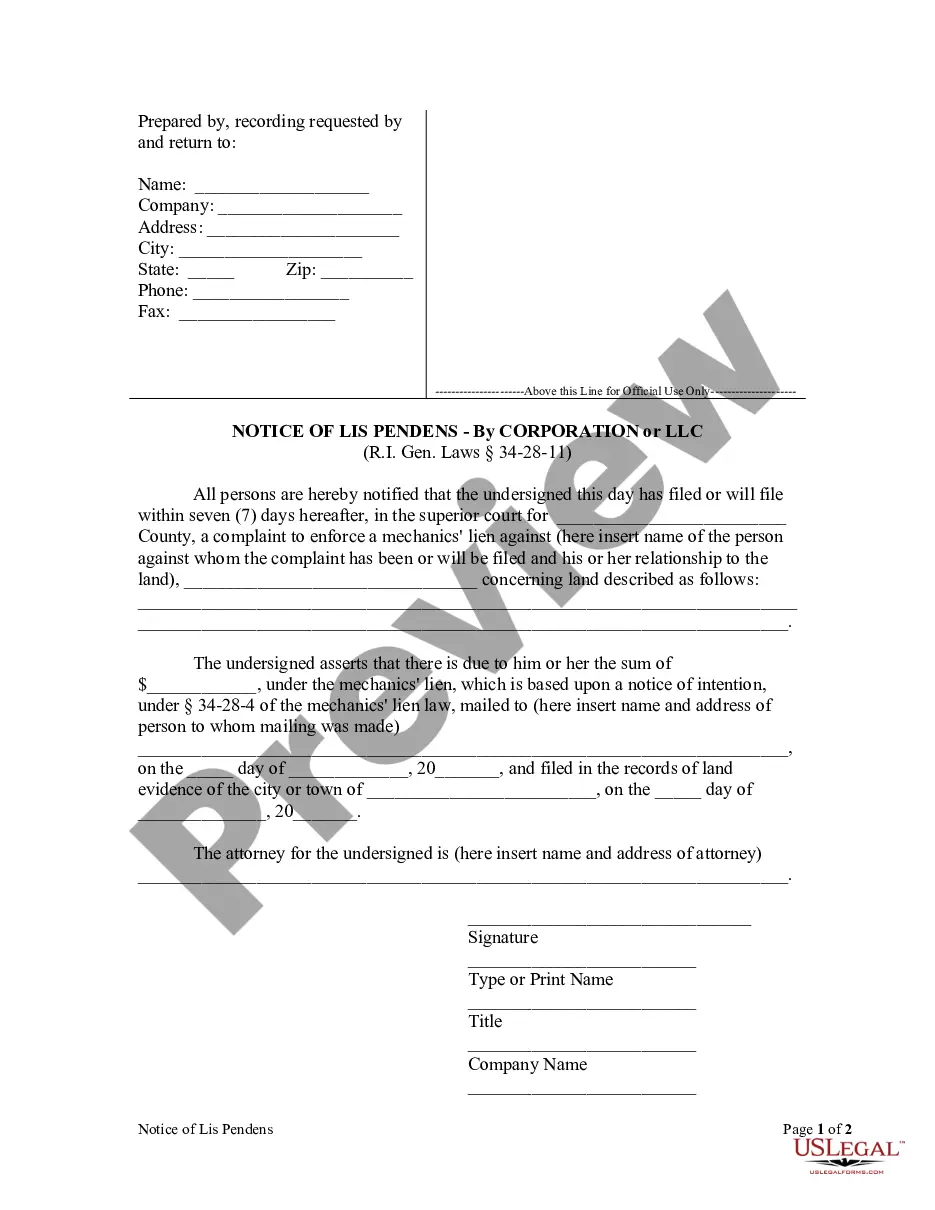

Any and all liens under the provisions of § 34-28-1, 34-28-2, 34-28-3, or 34-28-7 regardless of the mailing and filing of a notice of intention under § 34-28-4 or any exemption therefrom, shall be void and wholly lost to any person claiming a lien under those sections, unless the person shall file a petition to enforce the lien, described in § 34-28-13, in the superior court for the county in which is situated the land upon which the building, canal, turnpike, railroad, or other improvement is being or has been constructed, erected, altered, or repaired, and unless such person shall also file in the records of land evidence in the city or town in which such land is located a notice of lis pendens, described in § 34-28-11, the petition to be filed on the same day as the notice of lis pendens, or within seven (7) days thereafter, and both the petition and the notice of lis pendens to be filed within one hundred and twenty (120) days of the date of the recording of the notice of intention provided in § 34-28-4 and § 34-28-7. The lien of any person under § 34-28-1, 34-28-2, 34-28-3 or 34-28-7 who fails to file a petition and notice of lis pendens under this section within the required one hundred and twenty (120) day period, shall be void and wholly lost as to work done or materials furnished prior to the one hundred and twenty (120) day period, regardless of the fact that the person may thereafter do other work or furnish other materials in the course of the same construction, erection, alteration, or reparation.

Rhode Island Notice of Lis Pendens - Corporation

Description

How to fill out Rhode Island Notice Of Lis Pendens - Corporation?

The work with documents isn't the most straightforward process, especially for people who almost never work with legal papers. That's why we advise using accurate Rhode Island Notice of Lis Pendens - Corporation or LLC templates created by professional attorneys. It gives you the ability to avoid problems when in court or handling formal institutions. Find the documents you want on our website for high-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. When you are in, the Download button will automatically appear on the template webpage. Right after downloading the sample, it’ll be saved in the My Forms menu.

Users without a subscription can quickly get an account. Follow this brief step-by-step guide to get the Rhode Island Notice of Lis Pendens - Corporation or LLC:

- Be sure that the form you found is eligible for use in the state it’s necessary in.

- Confirm the document. Utilize the Preview feature or read its description (if offered).

- Click Buy Now if this sample is what you need or return to the Search field to get a different one.

- Select a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after completing these straightforward steps, it is possible to fill out the form in your favorite editor. Check the filled in details and consider asking a lawyer to examine your Rhode Island Notice of Lis Pendens - Corporation or LLC for correctness. With US Legal Forms, everything becomes much simpler. Give it a try now!

Form popularity

FAQ

How does a creditor go about getting a judgment lien in Rhode Island? To attach the lien, the creditor must request execution of attachment within 48 hours after entry of the judgment, then file the execution with the town clerk or recorder of deeds in the Rhode Island town where the debtor's property is located.

A LIS PENDENS IS NOT A LAWSUIT A Lis Pendens is filed with the County Recorder in the county where the piece of property that the law suit involves is located. When any document is recorded with the County Recorder, it puts the world on notice of its contents.

Releasing a lis pendens in California requires that the party that signed the original lis pendens, or their successor in interest, must sign and record the notice of release of lis pendens . The signature on the notice of release of a lis pendens must be notarized.

A lis pendens may be removed through a motion to expunge. A motion to expunge may be granted if the underlying lawsuit or other court action does not contain a real property claim that has probable validity. The motion will be granted it if is more likely than not that the underlying lawsuit or claim will fail.

Lis Pendens Reminder Checklist: Serve by certified mail. Include both the proof of service and the notarized acknowledgement in the filing and recording.

The State of Rhode Island Division of Taxation accepts online payments made by credit card. Alternatively, you can pay by mailed check or money order. In this case, send your payment with your return and Form 1040V to Rhode Island Division of Taxation, Dept #85, PO Box 9703, Providence, RI 02940-9703.

Rhode Island State Tax Quick Facts Income tax: 3.75% - 5.99% Sales tax: 7%

Every part-year individual who was a resident for a period of less than 12 months is required to file a Rhode Island return if he or she is required to file a federal return.

If you are a part year Rhode Island resident and are required to file a federal return, you must file a Rhode Island return. If you are a Rhode Island nonresident who has to file a federal return and has income from Rhode Island sources, you must file a Rhode Island return.