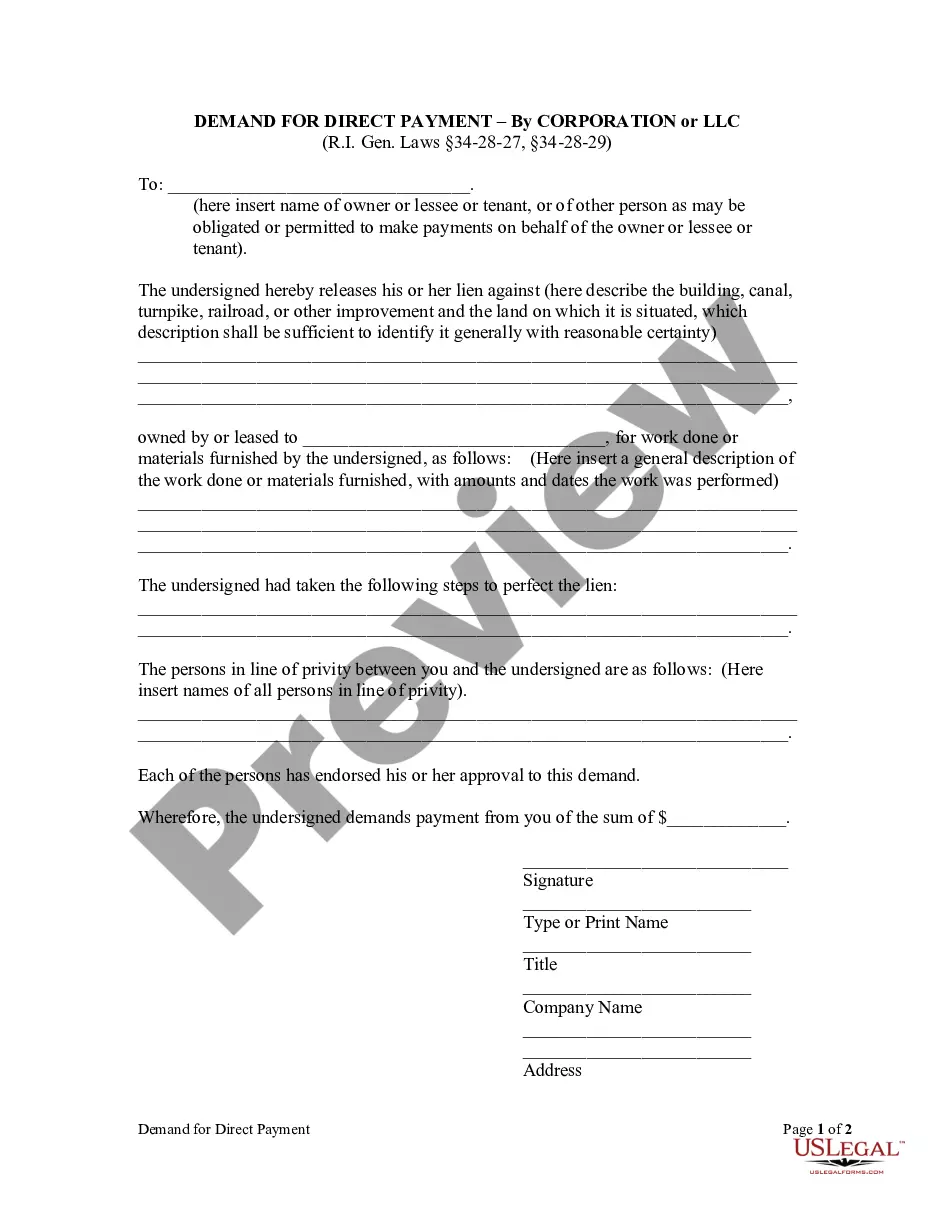

Any person entitled to any lien under § 34-28-1, 34-28-2 or 34-28-3 who releases the lien before receiving payment for the work done or materials furnished forming the basis of the lien, shall be entitled to demand and receive direct payment therefor from the owner or lessee or tenant or other person as may be obligated or permitted to make the payment on behalf of the owner or lessee or tenant, provided that the person entitled to the lien first obtains the written consent of all persons in line of privity between him or her and the owner or other person; on presentation of a proper demand for the payment, the owner or lessee or tenant or other person shall, if satisfied as to the amount thereof, make payment, on proper receipt therefor, and credit shall be given therefor by all persons in line of privity between the owner or other person and the person releasing the lien.

Rhode Island Demand For Direct Payment - Corporation

Description Llc Liability Company

How to fill out Rhode Island Demand For Direct Payment - Corporation?

Creating papers isn't the most straightforward process, especially for people who almost never deal with legal papers. That's why we recommend using correct Rhode Island Demand For Direct Payment - Corporation or LLC samples created by skilled lawyers. It gives you the ability to stay away from troubles when in court or dealing with official institutions. Find the documents you want on our website for top-quality forms and exact descriptions.

If you’re a user having a US Legal Forms subscription, simply log in your account. As soon as you’re in, the Download button will automatically appear on the file webpage. Right after accessing the sample, it’ll be saved in the My Forms menu.

Customers without an active subscription can easily get an account. Make use of this brief step-by-step help guide to get your Rhode Island Demand For Direct Payment - Corporation or LLC:

- Make sure that file you found is eligible for use in the state it is necessary in.

- Verify the file. Utilize the Preview option or read its description (if readily available).

- Click Buy Now if this template is what you need or use the Search field to find another one.

- Choose a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a required format.

Right after completing these simple steps, you can fill out the form in your favorite editor. Double-check completed details and consider requesting a legal representative to review your Rhode Island Demand For Direct Payment - Corporation or LLC for correctness. With US Legal Forms, everything becomes easier. Give it a try now!

Rhode Island Llc Form popularity

Rhode Island Corporation Other Form Names

FAQ

Steps to Starting a Business in Rhode Island. Step 1: Choose a Business Idea. Step 2: Write a Business Plan. Step 3: Select a Business Entity. Step 4: Register a Business Name. Step 5: Get an EIN. Step 6: Open a Business Bank Account. Step 7: Apply for Business Licenses & Permits.

Step 1: Choose a Business Idea. Step 2: Write a Business Plan. Step 3: Select a Business Entity. Step 4: Register a Business Name. Step 5: Get an EIN. Step 6: Open a Business Bank Account. Step 7: Apply for Business Licenses & Permits. Step 8: Find Financing.

Forming an LLC in Rhode Island is simple. Search your Rhode Island LLC name in the state database and select your RI Resident Agent. Then file your Articles of Organization with the Rhode Island Secretary of State and wait for your LLC to be approved. You can file your LLC by mail, online, or walk-in filing.

Step 1: Choose a Business Idea. Step 2: Write a Business Plan. Step 3: Select a Business Entity. Step 4: Register a Business Name. Step 5: Get an EIN. Step 6: Open a Business Bank Account. Step 7: Apply for Business Licenses & Permits. Step 8: Find Financing.

Rhode Island Small Business Information. Get One or More Business Licenses. File Records For Your Form of Business. Obtain Professional Licensing. Register an Assumed or Fictitious Business Name.

C Corporations, S Corporations, and Partnerships - A federal extension obtained by filing Form 7004 with the Internal Revenue Service does not automatically extend the time to file the Rhode Island return.Form RI-7004 is on the main menu of the Rhode Island C Corp, S Corp, and Partnership returns.

Decide on a business name. Establish and publish a DBA (Fictitious Business Name) statement. Get a federal employer identification number (EIN). Determine if you need a permit or license for the type of business you have. Create a separate bank account for your business.

Decide on a name for your business. Assign a registered agent for service of process. Get an Employer Identification Number (EIN) from the IRS. Create an operating agreement. File for pass-through withholding tax.

Choose a business name. File an assumed business name with the city or town clerk. Obtain licenses, permits, and zoning clearance. Obtain an Employer Identification Number.