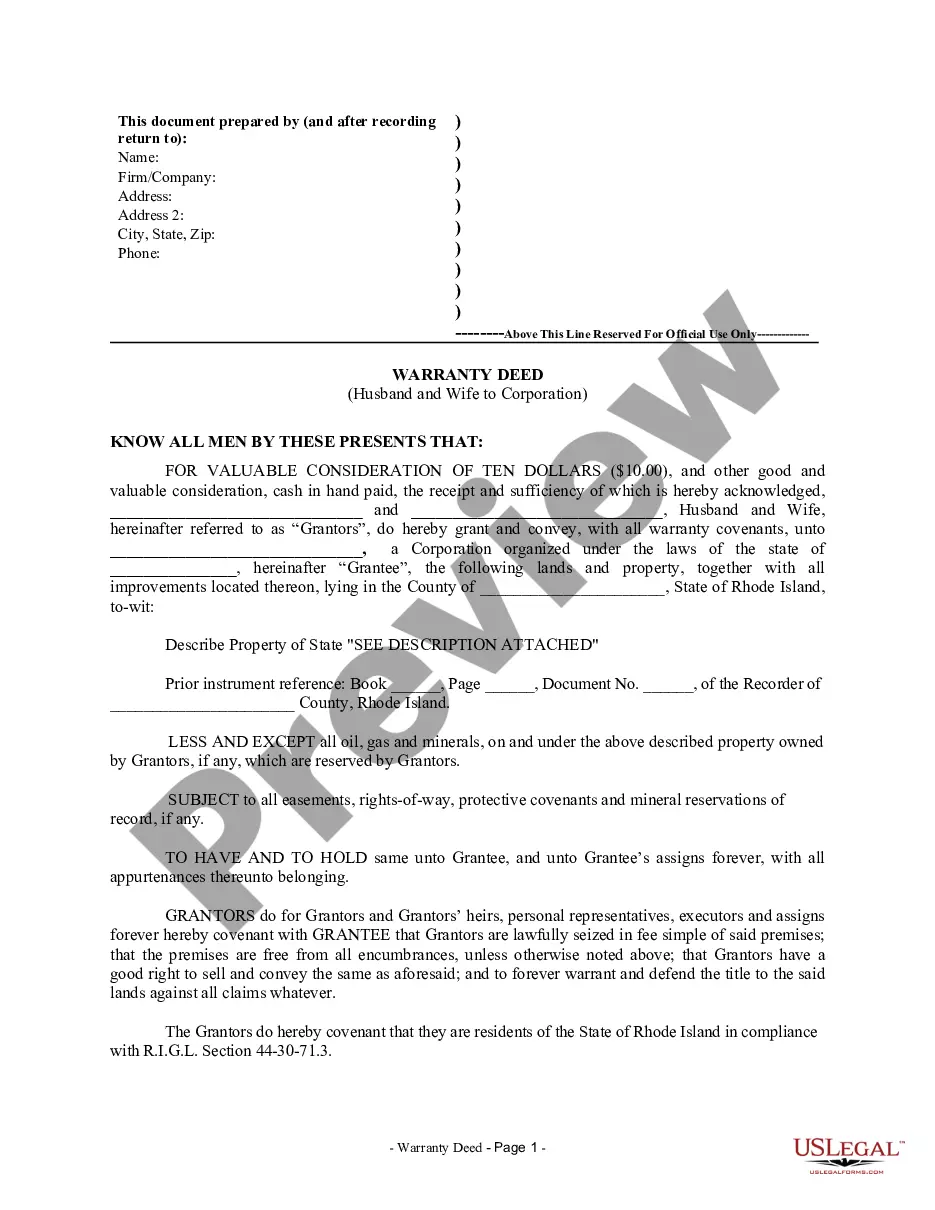

Rhode Island Warranty Deed from Husband and Wife to Corporation

Description

How to fill out Rhode Island Warranty Deed From Husband And Wife To Corporation?

The work with papers isn't the most easy job, especially for people who rarely work with legal papers. That's why we recommend utilizing correct Rhode Island Warranty Deed from Husband and Wife to Corporation samples created by professional attorneys. It gives you the ability to prevent difficulties when in court or working with formal organizations. Find the samples you need on our site for top-quality forms and exact information.

If you’re a user with a US Legal Forms subscription, simply log in your account. As soon as you’re in, the Download button will automatically appear on the template page. Right after accessing the sample, it will be stored in the My Forms menu.

Users without an activated subscription can quickly create an account. Make use of this short step-by-step help guide to get the Rhode Island Warranty Deed from Husband and Wife to Corporation:

- Make certain that the form you found is eligible for use in the state it is necessary in.

- Confirm the file. Utilize the Preview feature or read its description (if readily available).

- Buy Now if this template is the thing you need or use the Search field to get a different one.

- Choose a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

After completing these easy steps, you can fill out the sample in your favorite editor. Double-check completed information and consider requesting an attorney to examine your Rhode Island Warranty Deed from Husband and Wife to Corporation for correctness. With US Legal Forms, everything gets easier. Test it now!

Form popularity

FAQ

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

A In order to make your partner a joint owner you will need to add his name at the Land Registry, for which there is a fee of £280 (assuming you transfer half the house to him). You won't, however, have to pay capital gains tax, as gifts between civil partners (and spouses) are tax free.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

Corporate warranty deeds offer the seller's guarantee to the buyer in regards to the validity of the chain of title. Generally, special warranty deeds only protect against problems occurring since the seller purchased the property.