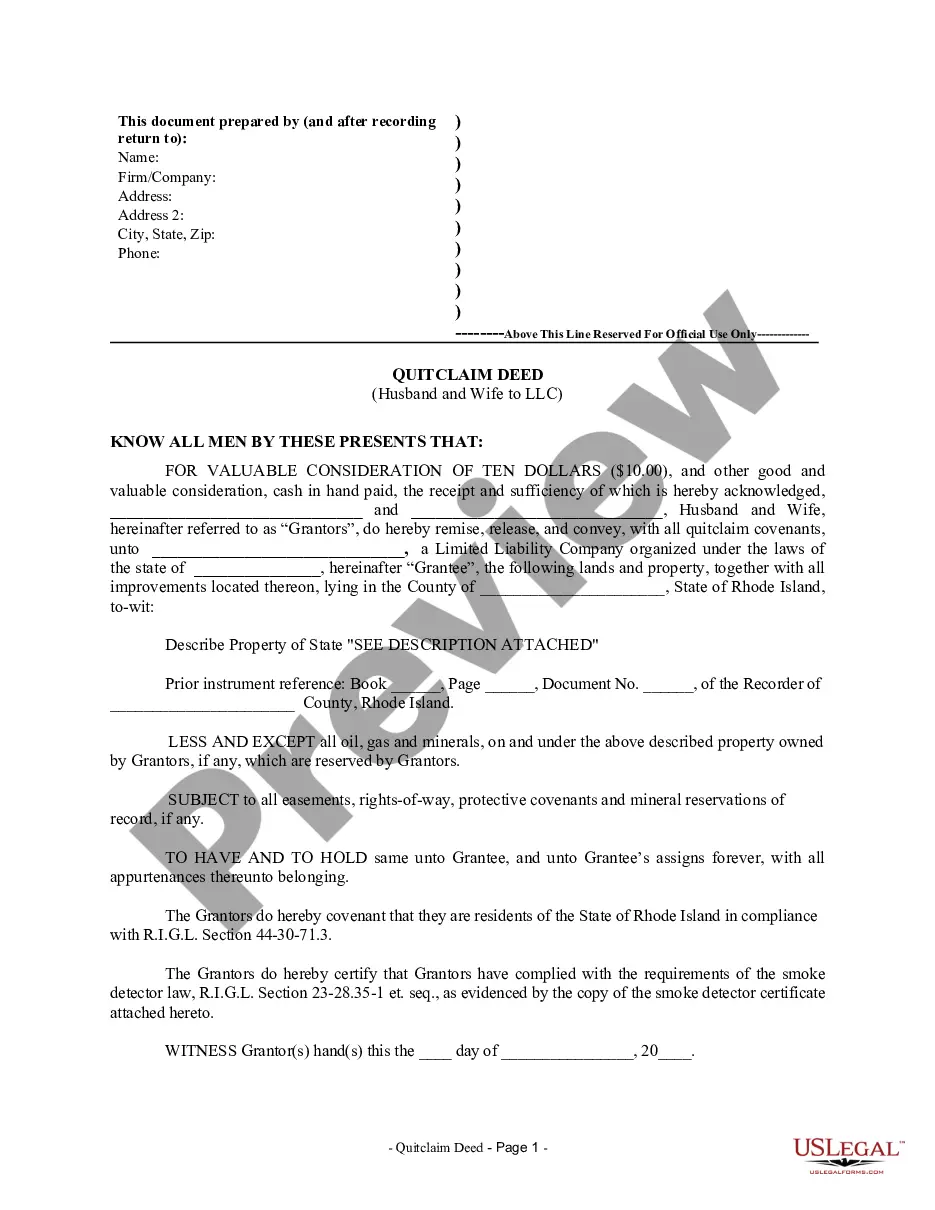

Rhode Island Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out Rhode Island Quitclaim Deed From Husband And Wife To LLC?

Creating papers isn't the most uncomplicated task, especially for people who rarely deal with legal paperwork. That's why we advise utilizing accurate Rhode Island Quitclaim Deed from Husband and Wife to LLC templates created by skilled attorneys. It gives you the ability to prevent troubles when in court or working with formal institutions. Find the files you want on our site for top-quality forms and exact descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. As soon as you are in, the Download button will automatically appear on the template page. Soon after accessing the sample, it’ll be saved in the My Forms menu.

Users without a subscription can quickly create an account. Use this simple step-by-step guide to get the Rhode Island Quitclaim Deed from Husband and Wife to LLC:

- Ensure that the form you found is eligible for use in the state it is necessary in.

- Confirm the document. Utilize the Preview option or read its description (if available).

- Click Buy Now if this form is the thing you need or use the Search field to get another one.

- Select a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a required format.

After completing these easy steps, you can complete the sample in your favorite editor. Check the completed info and consider asking an attorney to examine your Rhode Island Quitclaim Deed from Husband and Wife to LLC for correctness. With US Legal Forms, everything becomes much easier. Test it now!

Form popularity

FAQ

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

Quitclaim Does Not Release Debts Signing a quitclaim deed and giving up all rights to the property doesn't release you from any financial obligations you may have. It only removes you from the title, not from the mortgage, and you are still responsible for making payments.

Quitclaim deeds are most often used to transfer property between family members.Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners divorce and one spouse's name is removed from the title or deed.

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.