Rhode Island Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

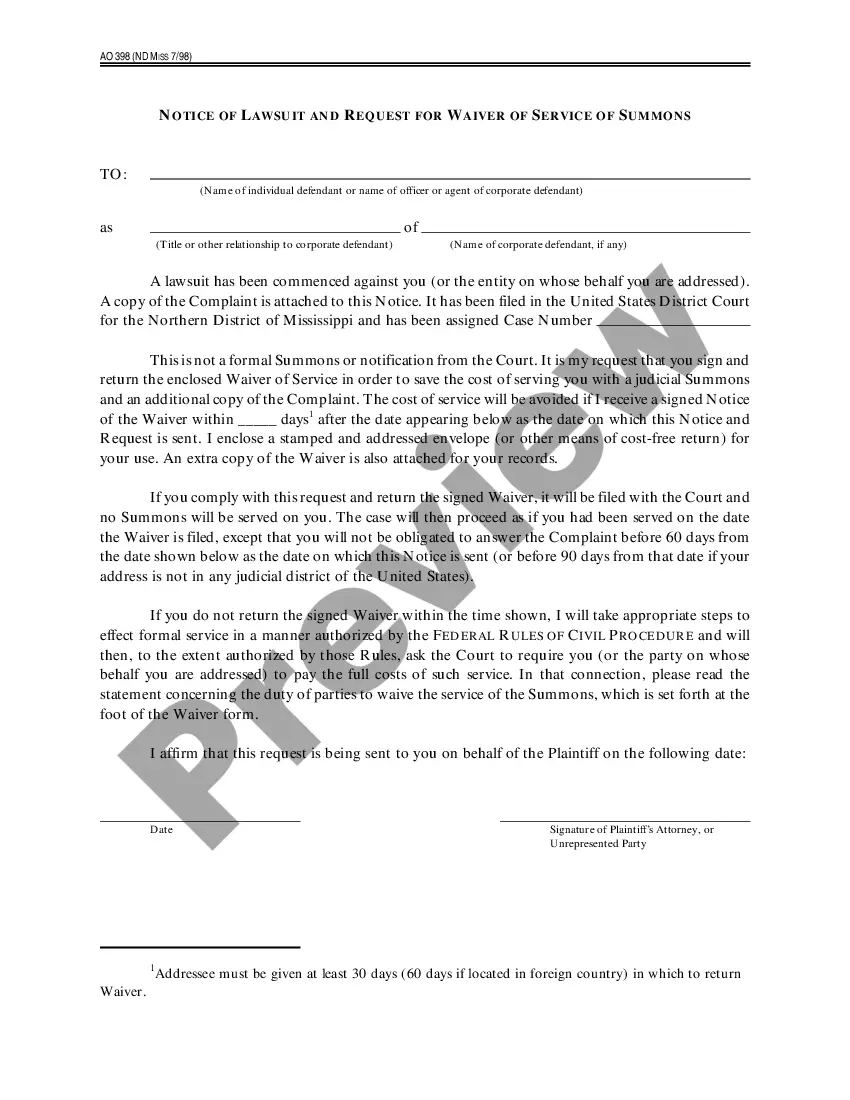

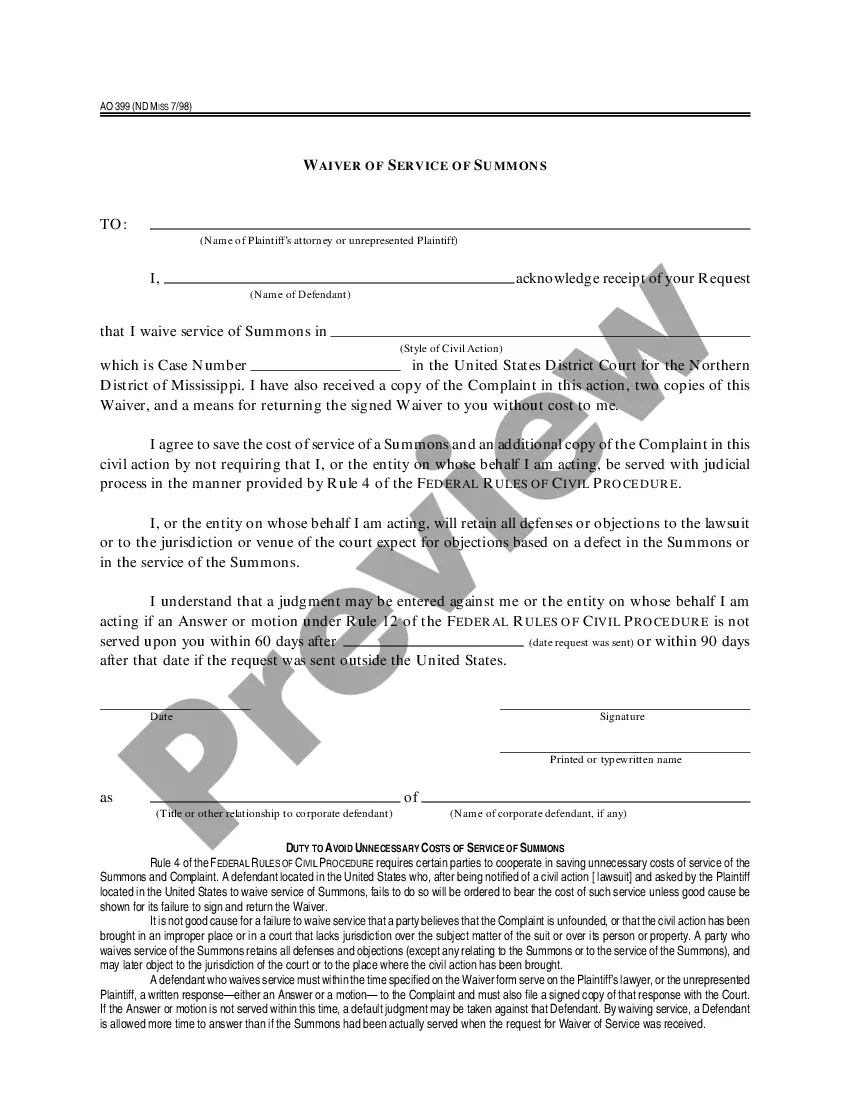

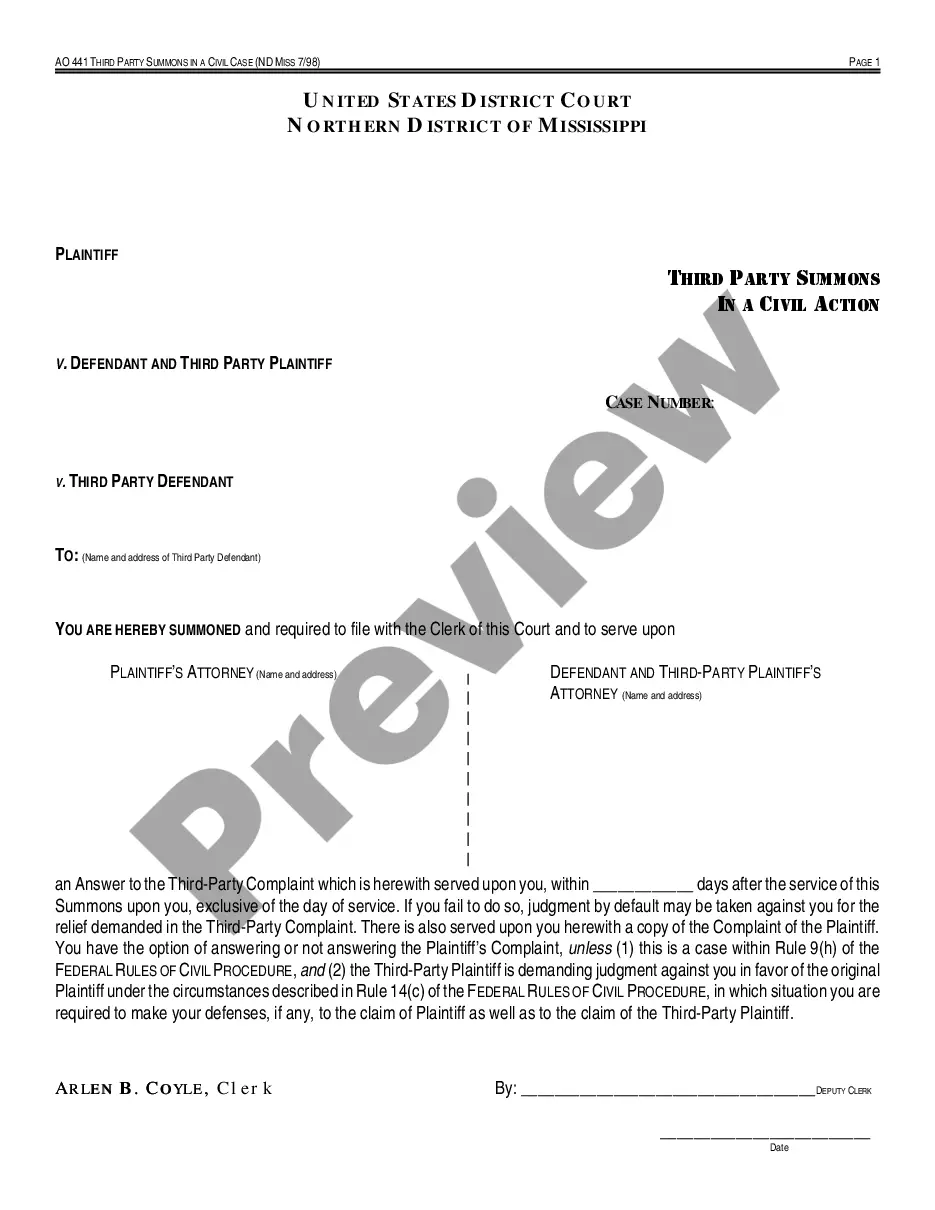

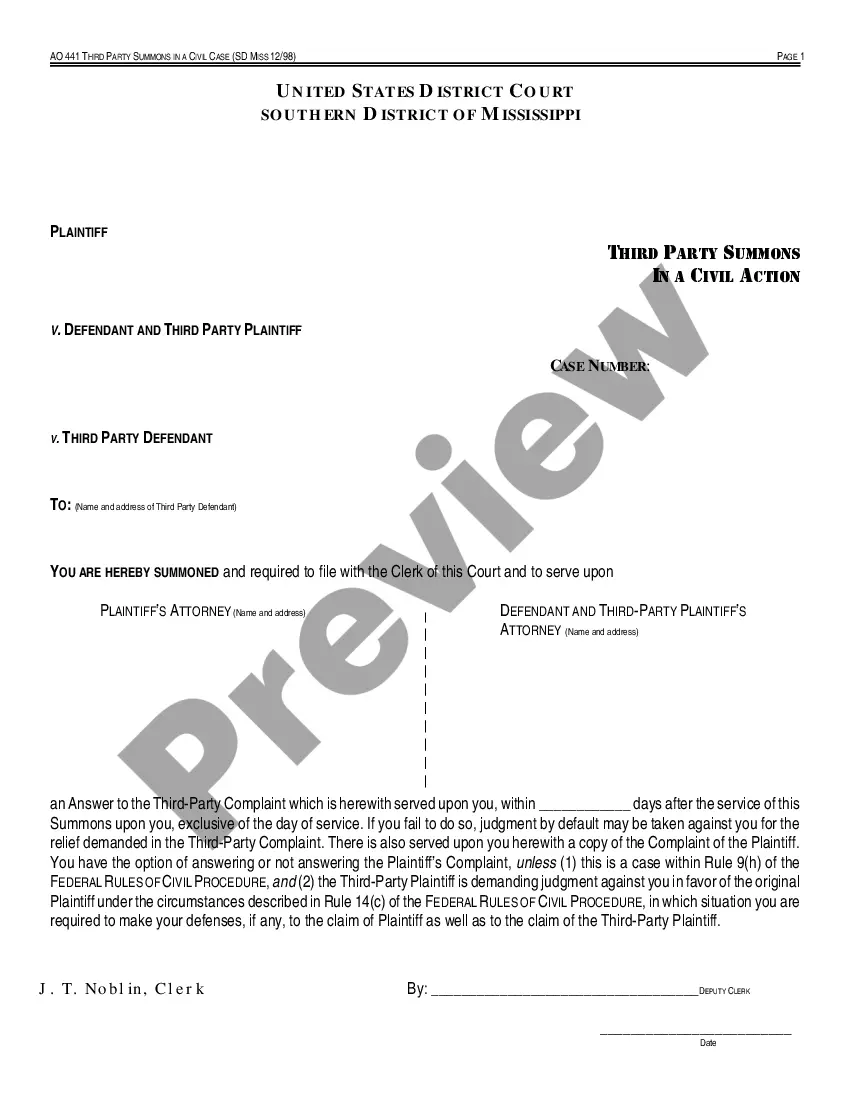

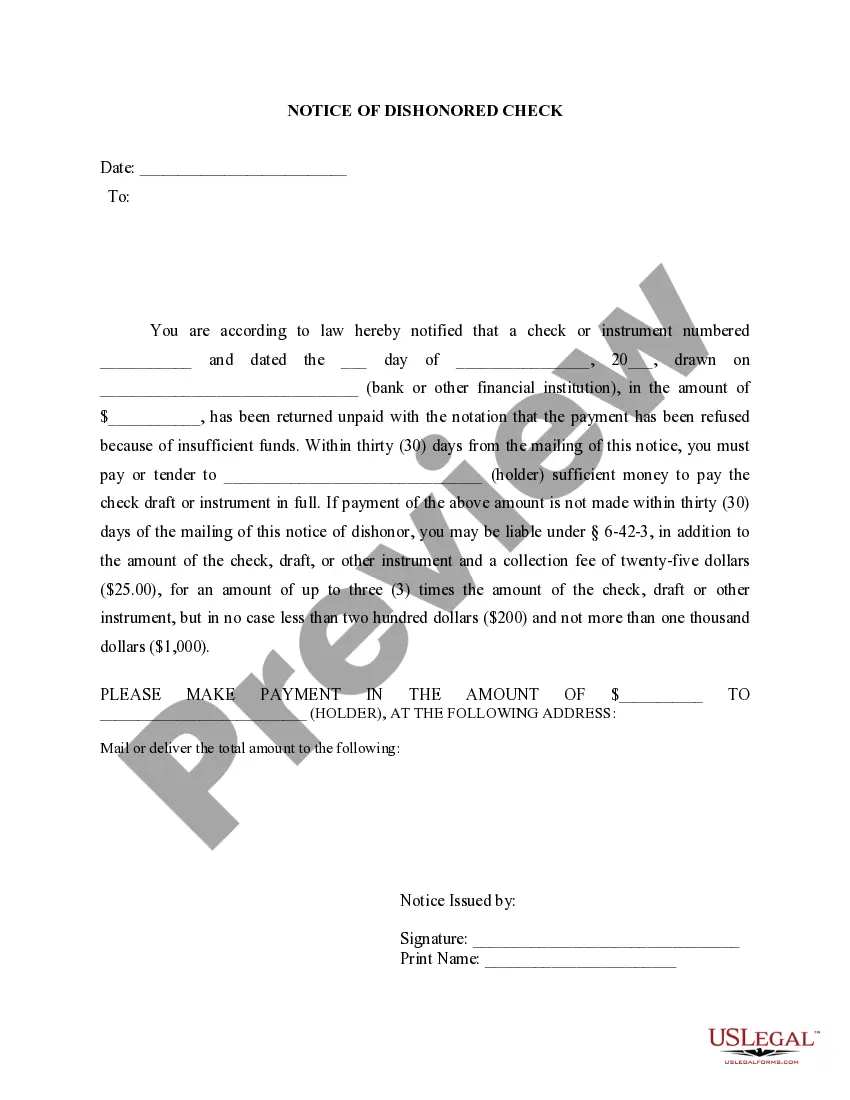

How to fill out Rhode Island Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

The work with papers isn't the most straightforward job, especially for those who almost never work with legal paperwork. That's why we advise making use of correct Rhode Island Notice of Dishonored Check - Civil - Keywords: bad check, bounced check templates created by skilled attorneys. It gives you the ability to stay away from problems when in court or working with formal institutions. Find the samples you require on our site for top-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will automatically appear on the file web page. Right after downloading the sample, it will be saved in the My Forms menu.

Users without an activated subscription can easily create an account. Use this short step-by-step guide to get the Rhode Island Notice of Dishonored Check - Civil - Keywords: bad check, bounced check:

- Make certain that the sample you found is eligible for use in the state it is required in.

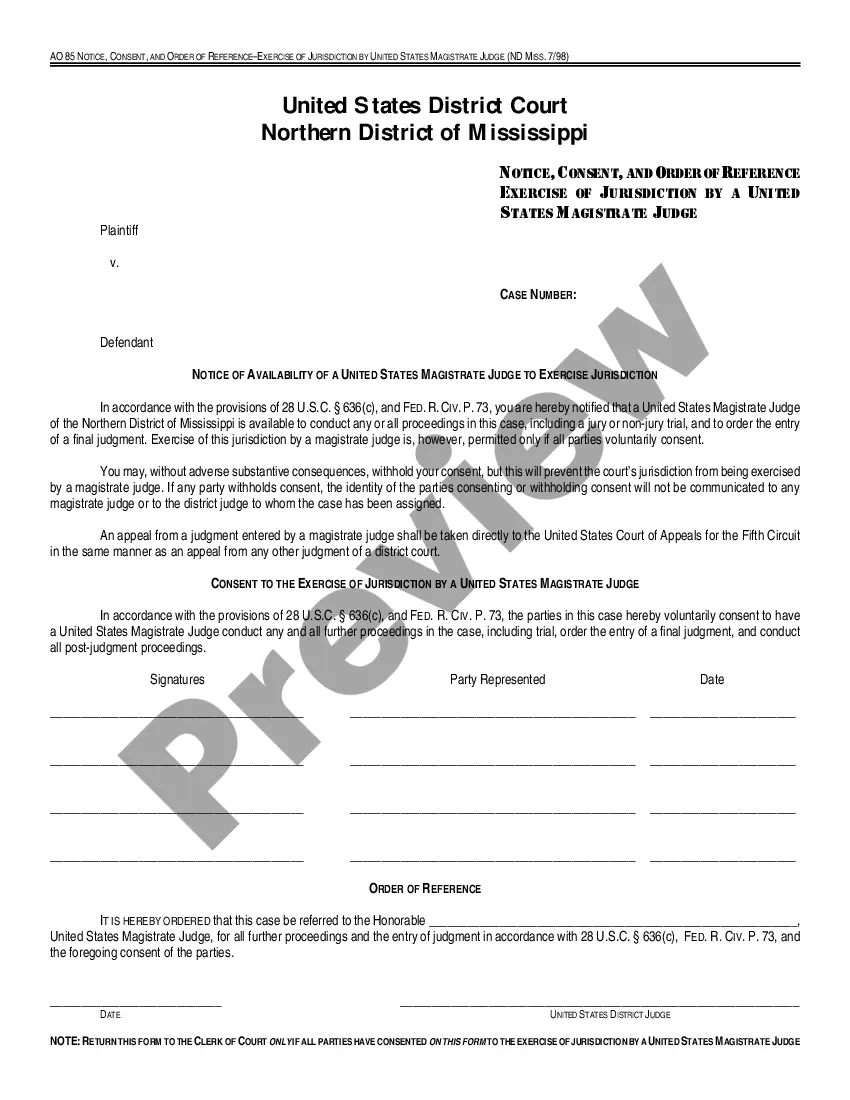

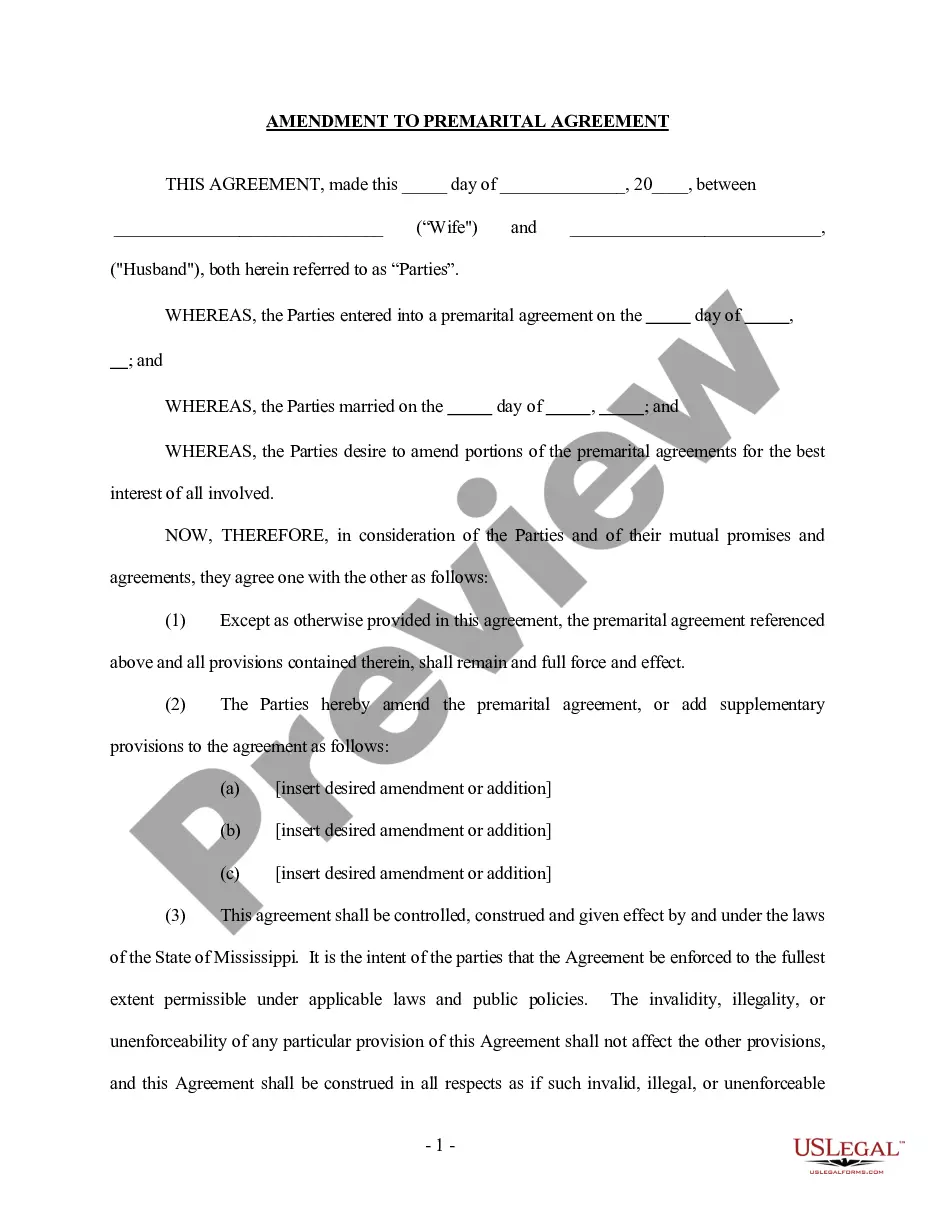

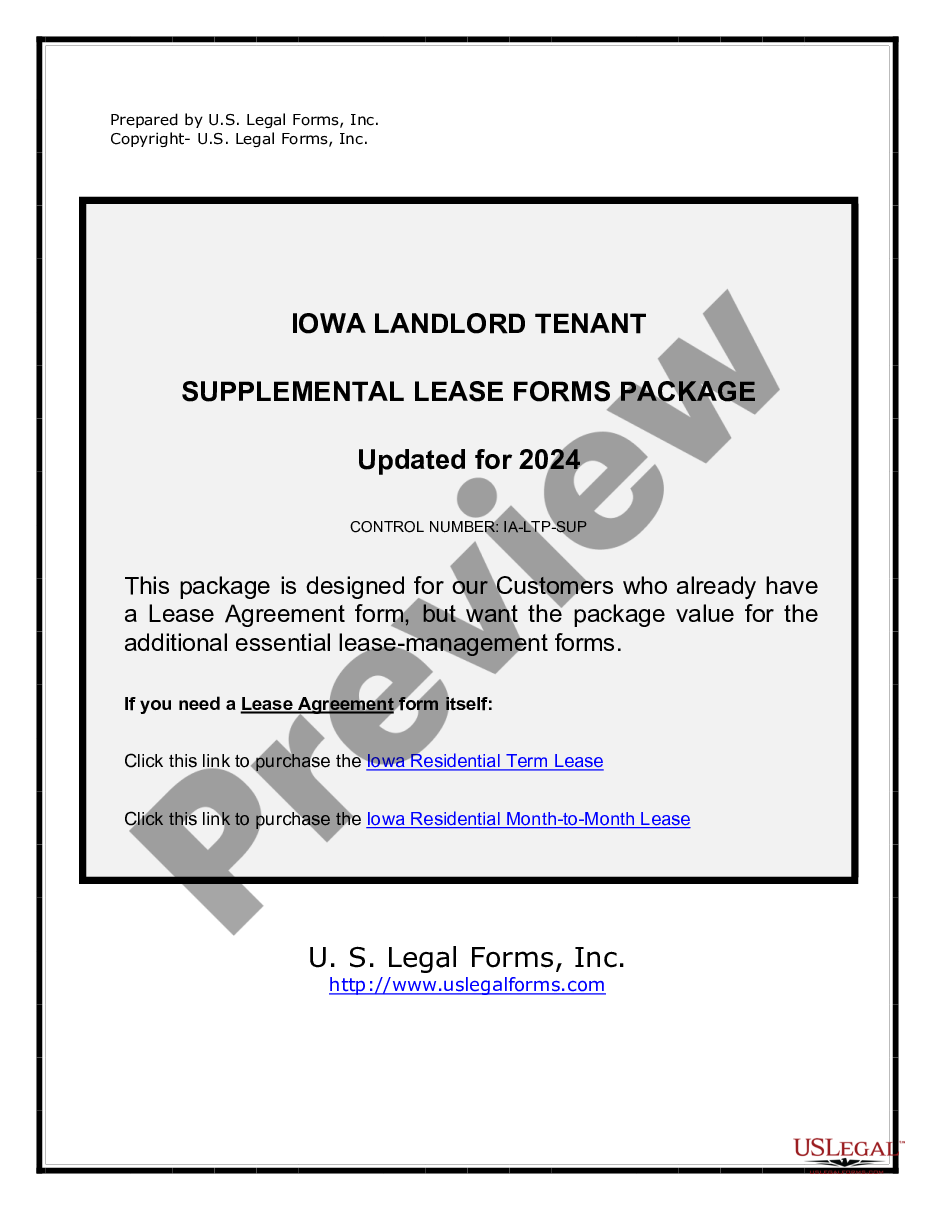

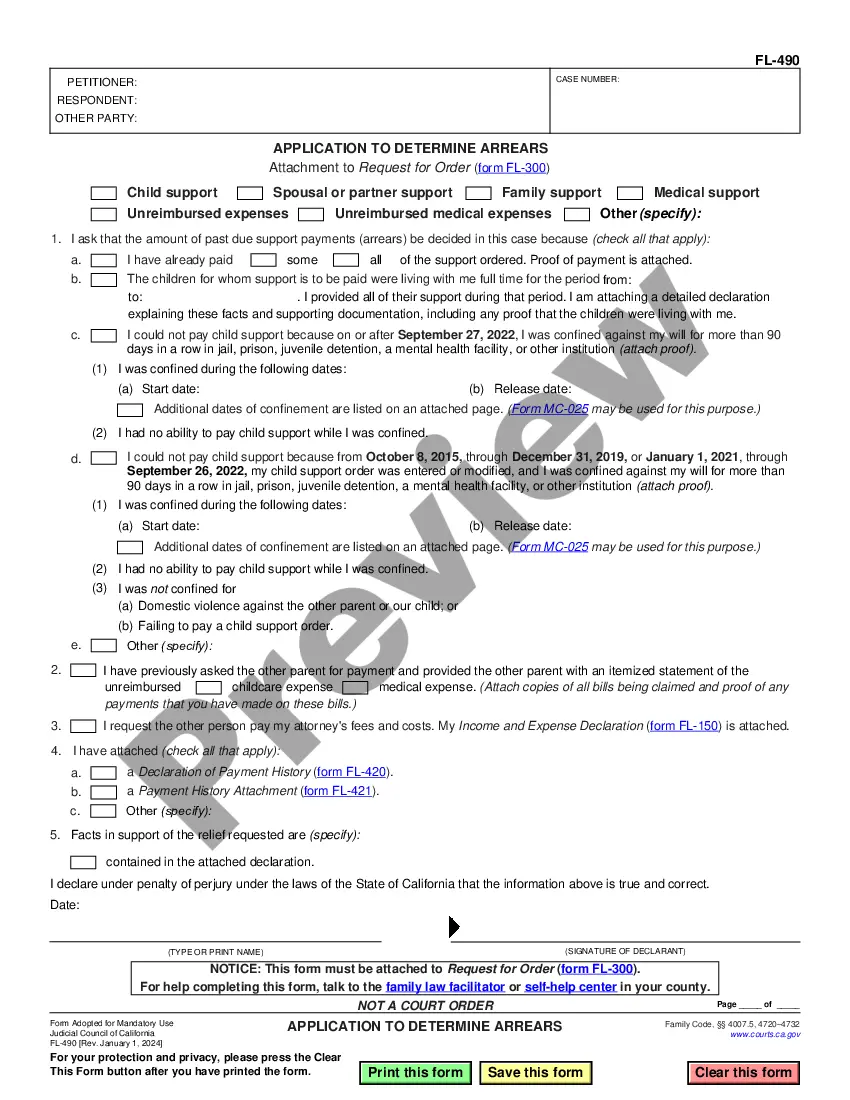

- Confirm the document. Make use of the Preview option or read its description (if offered).

- Click Buy Now if this template is what you need or use the Search field to find a different one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after finishing these easy actions, it is possible to fill out the form in an appropriate editor. Check the completed data and consider requesting an attorney to examine your Rhode Island Notice of Dishonored Check - Civil - Keywords: bad check, bounced check for correctness. With US Legal Forms, everything gets much simpler. Try it now!

Form popularity

FAQ

Writing a bad check, also known as a hot check, is illegal. Banks normally charge a fee to anyone who writes a bad check unintentionally. The punishment for trying to pass a bad check intentionally ranges from a misdemeanor to a felony.

Penal Code 476a PC is the California statute that makes it a crime for a person to write or pass a bad check, knowing there are insufficient funds to cover payment of the check. The offense can be charged as a felony if the value of the bad checks is more than $950.00. Otherwise, the offense is only a misdemeanor.

When there are insufficient funds in an account, and a bank decides to bounce a check, it charges the account holder an NSF fee. If the bank accepts the check, but it makes the account negative, the bank charges an overdraft (OD) fee. If the account stays negative, the bank may charge an extended overdraft fee.

Bouncing a check can happen to anyone. Write one and you'll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount.

If you are given a bad check, you can sue for the amount of the check plus bank fees. You can also add damages to your claim.

People who write bad checks are normally charged fees by their banks and could be on the hook for any fees incurred by the payee. Knowingly writing a bad check may constitute a misdemeanor or felony, depending on the amount of the check and the state in which it was written.

A bounced check occurs when the writer of the check has insufficient funds available to fulfill the payment amount on the check to the payee. When a check bounces, they are not honored by the depositor's bank, and may result in fees and banking restrictions.

If the tellers at the checks bank tell you there ARE sufficient funds you have three options: cash the check immediately (actually get cash - probably not recommended if it's several thousand dollars), take the check to YOUR bank and deposit the funds (this will take 2-3 days for the check to clear - not recommended),

Writing bad checks can lead to several theft charges, but with the help of a skilled defense attorney, you can work to reduce or even dismiss charges.