Rhode Island Commercial Rental Lease Application Questionnaire

Description

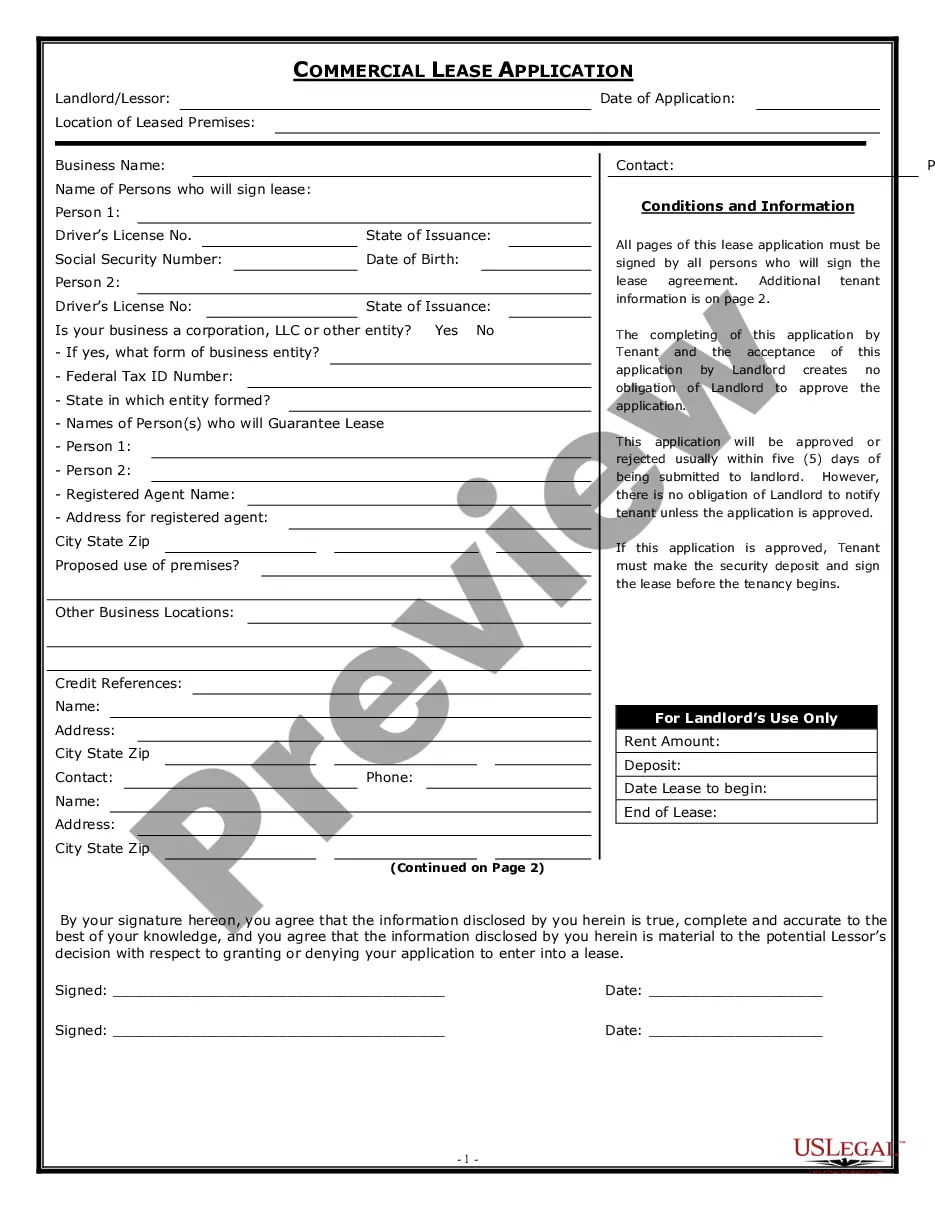

How to fill out Rhode Island Commercial Rental Lease Application Questionnaire?

Creating documents isn't the most straightforward process, especially for those who almost never work with legal papers. That's why we recommend utilizing accurate Rhode Island Commercial Rental Lease Application Questionnaire templates created by professional attorneys. It allows you to avoid troubles when in court or working with formal institutions. Find the templates you require on our site for high-quality forms and exact information.

If you’re a user with a US Legal Forms subscription, simply log in your account. As soon as you are in, the Download button will immediately appear on the file page. After downloading the sample, it will be saved in the My Forms menu.

Users without an active subscription can easily create an account. Make use of this brief step-by-step help guide to get the Rhode Island Commercial Rental Lease Application Questionnaire:

- Be sure that the document you found is eligible for use in the state it’s necessary in.

- Verify the file. Use the Preview option or read its description (if offered).

- Click Buy Now if this form is the thing you need or go back to the Search field to find a different one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a required format.

Right after finishing these straightforward steps, you can complete the form in a preferred editor. Recheck filled in info and consider asking an attorney to review your Rhode Island Commercial Rental Lease Application Questionnaire for correctness. With US Legal Forms, everything becomes much easier. Give it a try now!

Form popularity

FAQ

This means that a private lease agreement will be covered by the CPA.The CPA does not apply to transactions where the consumer is a company, close corporation or a trust with an annual turnover or net asset value of R2M.

Under the Act, the landlord pays the full cost of preparing the lease, including the mortgagee consent fee.

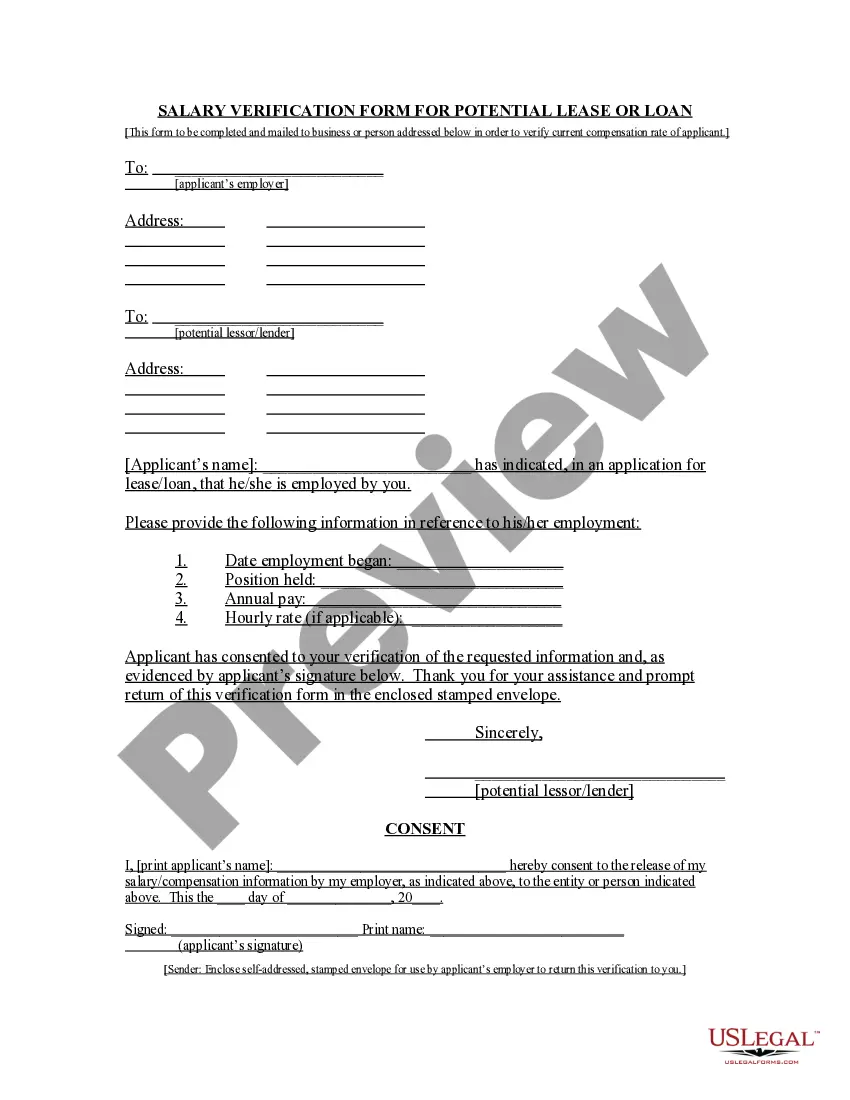

A letter of intent is used to alert a property owner that you're interested in leasing or purchasing a commercial real estate property. Also, it provides the landlord with a more concrete view of how you'll use the property should they commit to a lease agreement with you.

The Letter of Intent should include the names of the parties negotiating, such as the name of the Tenant and the Property Owner/Landlord, and a list of industry standard list items. You should also include items that are important to your business when leasing commercial real estate.

The Consumer Protection Act (CPA) does NOT apply to all lease agreements (or rental agreements). This is really important to know because the Consumer Protection Act has a big influence on the lease and changes the legal position between the landlord and tenant significantly.Tenants already have lots of protection.

Commercial leases fall within the ambit of the CPA and refer to an agreement between a landlord and a business setting out terms and conditions governing a property rental. The CPA applies to contracts entered with natural persons and juristic persons with an annual turnover or asset value of less than R2 million.

The Person Liable for the Lease. Your Business Structure. How Long You Have Been in Business. The Nature of Your Business. Contact Information. Your Proposed Terms (or, Counter Offer) The Length of the Lease. Condition of the Property.

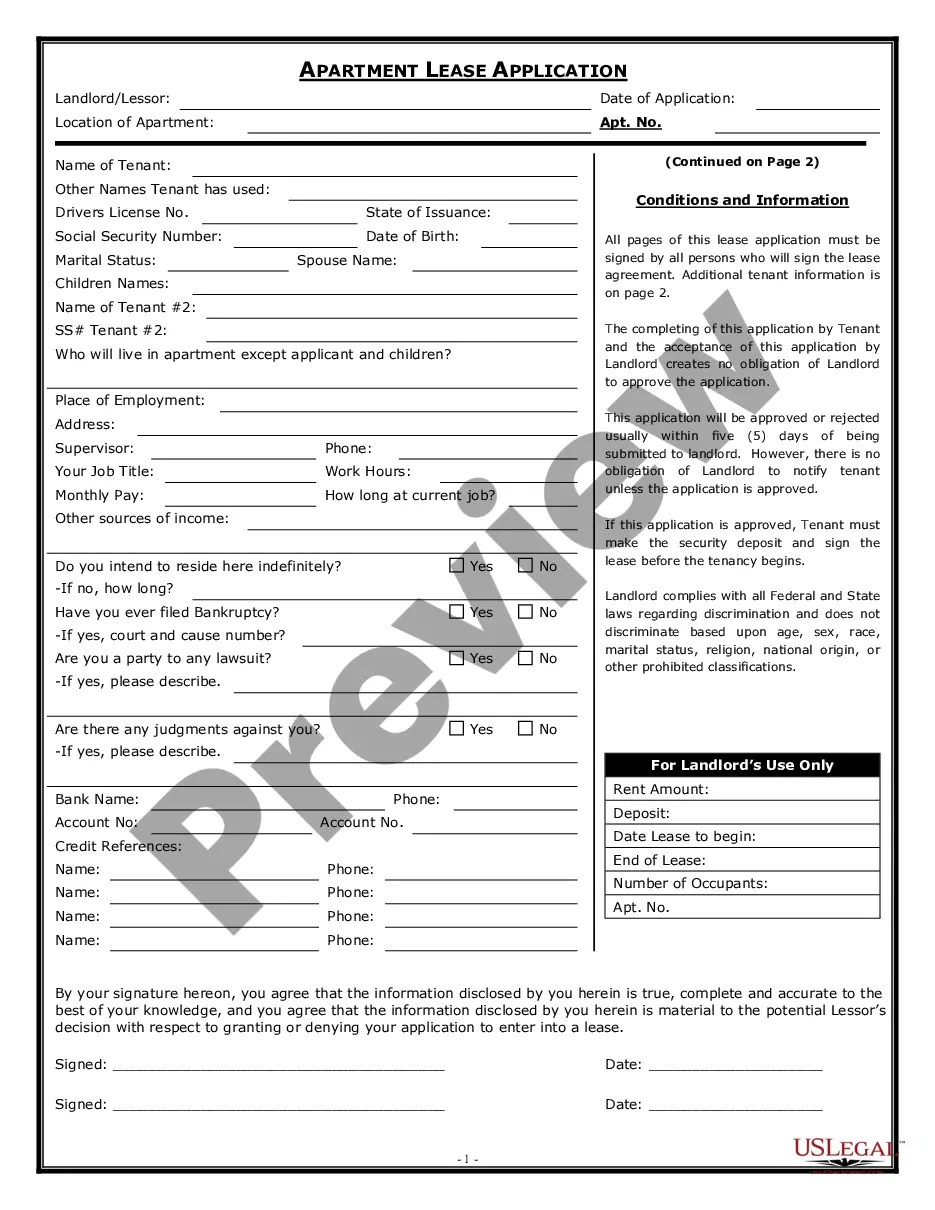

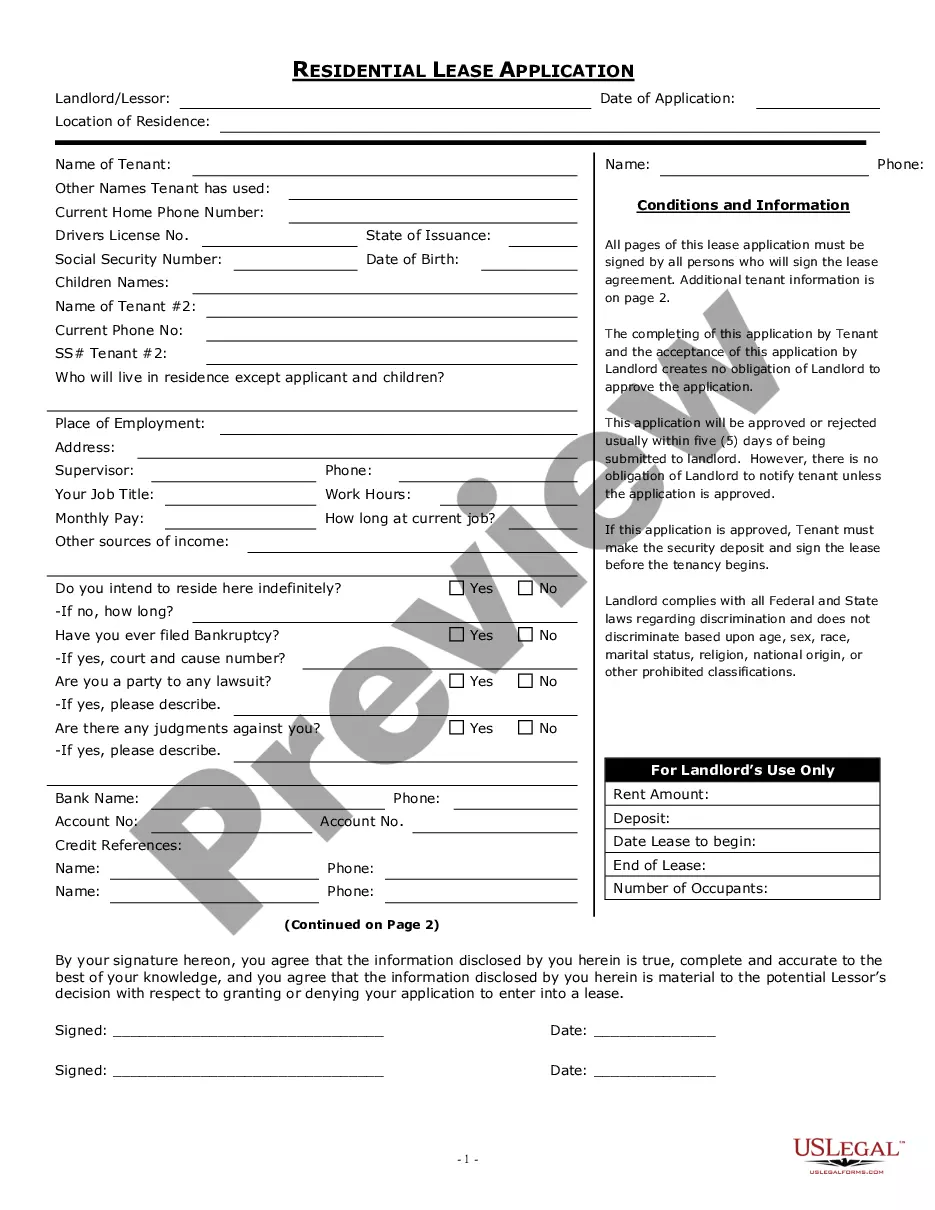

Names of all tenants. Limits on occupancy. Term of the tenancy. Rent. Deposits and fees. Repairs and maintenance. Entry to rental property. Restrictions on tenant illegal activity.

In New South Wales (NSW), a shop that is less than 1,000 square metres in size, sells and supplies goods and services and is a retail business is covered by the Retail Leases Act 1994 (the Act). The lease needs to be for six months and less than 25 years.