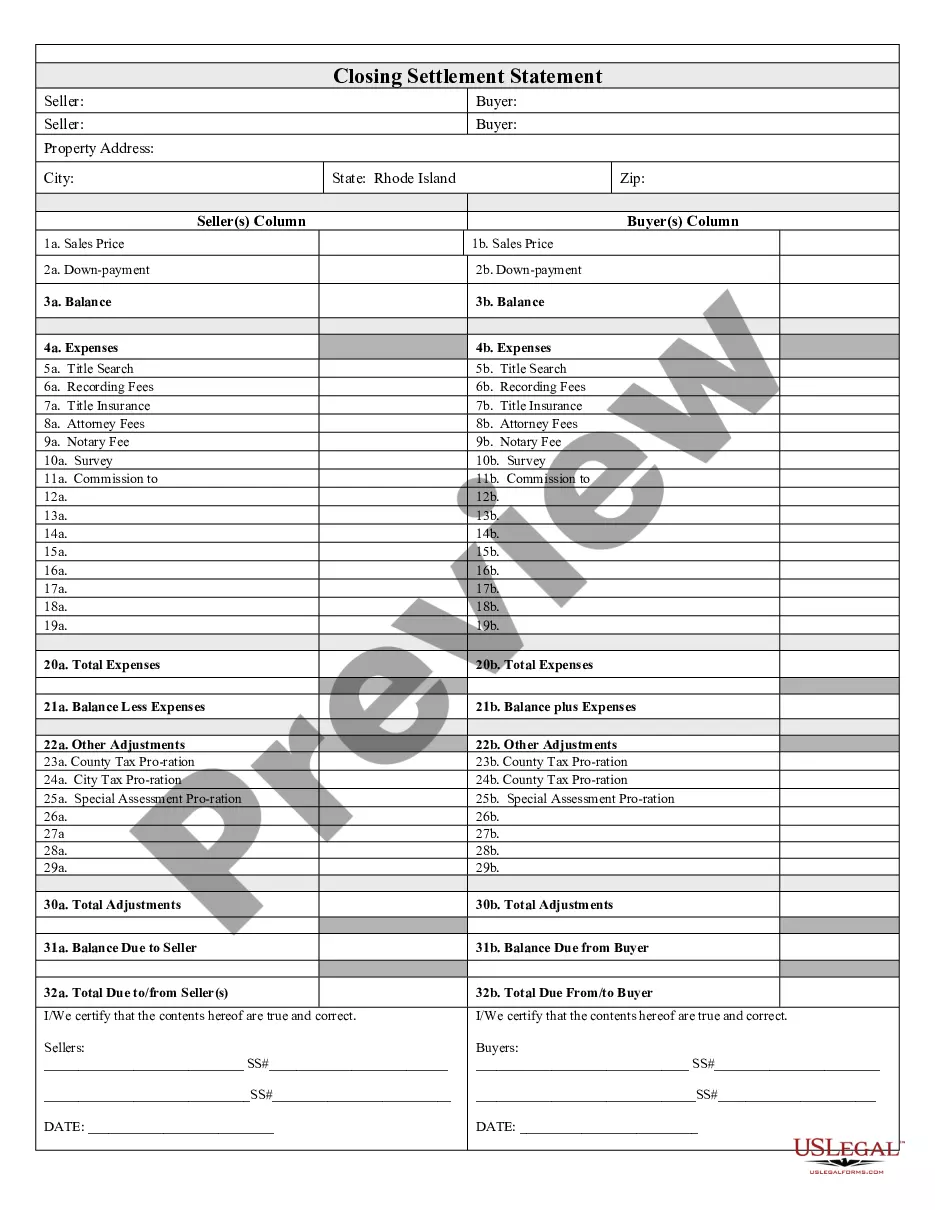

Rhode Island Closing Statement

Description

How to fill out Rhode Island Closing Statement?

The work with papers isn't the most simple process, especially for people who almost never deal with legal papers. That's why we recommend using correct Rhode Island Closing Statement templates created by professional lawyers. It allows you to eliminate problems when in court or dealing with formal organizations. Find the documents you require on our site for high-quality forms and exact descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will immediately appear on the template page. Soon after accessing the sample, it will be stored in the My Forms menu.

Users without a subscription can easily create an account. Utilize this short step-by-step guide to get the Rhode Island Closing Statement:

- Make sure that the form you found is eligible for use in the state it’s necessary in.

- Confirm the document. Make use of the Preview feature or read its description (if offered).

- Buy Now if this file is what you need or use the Search field to find another one.

- Select a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a required format.

Right after finishing these easy actions, it is possible to fill out the sample in your favorite editor. Double-check completed data and consider requesting a legal professional to review your Rhode Island Closing Statement for correctness. With US Legal Forms, everything gets much simpler. Test it now!

Form popularity

FAQ

In Rhode Island, an uncontested divorce may be granted in as little as 75 daysand some divorces may be granted even sooner if they qualify for expedited processing. However, wait times are often longer if the court imposes a waiting period, the parties cannot agree, or there are other complexities.

If you don't close an LLC, your state may continue to impose taxes, fees and late fees on the company. If you don't terminate your existing contracts and leases, you'll have to keep paying them, too.

If a case is truly uncontested, with no children and no assets to divide, a divorce will cost around $600.00 plus costs ( filing fee to clerk of $120.00 and cost to have other spouse served which is usually about $40).

A divorce is filed by submitting to the family court clerk the following forms: a complaint, a DR6, two statements listing the children of the divorce, a family services counseling report form, a report of divorce, a copy of the marriage certificate, the summons, and the filing fee.

Most of the forms you will need are available from the family court clerk where you file. Some forms may also be available online at the Rhode Island Judiciary website.

How Do I Find Divorce Records in Rhode Island? Rhode Island divorce records can be obtained by querying the office of the Clerk of Family Court in the judicial district where the divorce was granted.

To close your business in Rhode Island, you must satisfy all filing obligations with both the RI Division of Taxation and the RI Department of State. To dissolve your business, it must be active and up to date with all filings with the RI Department of State. To verify your status, email corporations@sos.ri.gov.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

Decide on a name for your business. Assign a registered agent for service of process. Get an Employer Identification Number (EIN) from the IRS. Create an operating agreement. File for pass-through withholding tax.