Rhode Island Flood Zone Statement and Authorization

Description

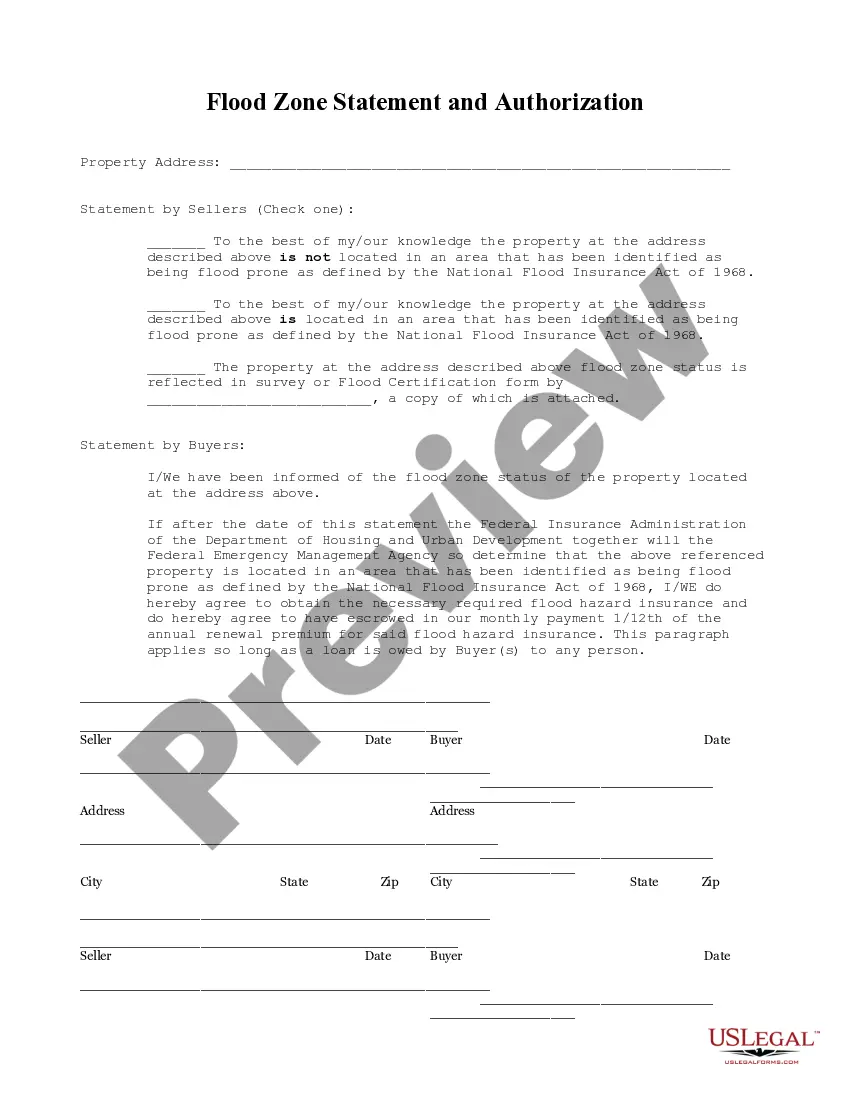

How to fill out Rhode Island Flood Zone Statement And Authorization?

Creating documents isn't the most uncomplicated process, especially for people who almost never deal with legal paperwork. That's why we advise making use of accurate Rhode Island Flood Zone Statement and Authorization templates created by skilled attorneys. It allows you to eliminate problems when in court or dealing with official organizations. Find the files you want on our site for top-quality forms and accurate descriptions.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you are in, the Download button will automatically appear on the file page. Right after getting the sample, it will be stored in the My Forms menu.

Users without an active subscription can easily create an account. Make use of this short step-by-step guide to get the Rhode Island Flood Zone Statement and Authorization:

- Make sure that the form you found is eligible for use in the state it is needed in.

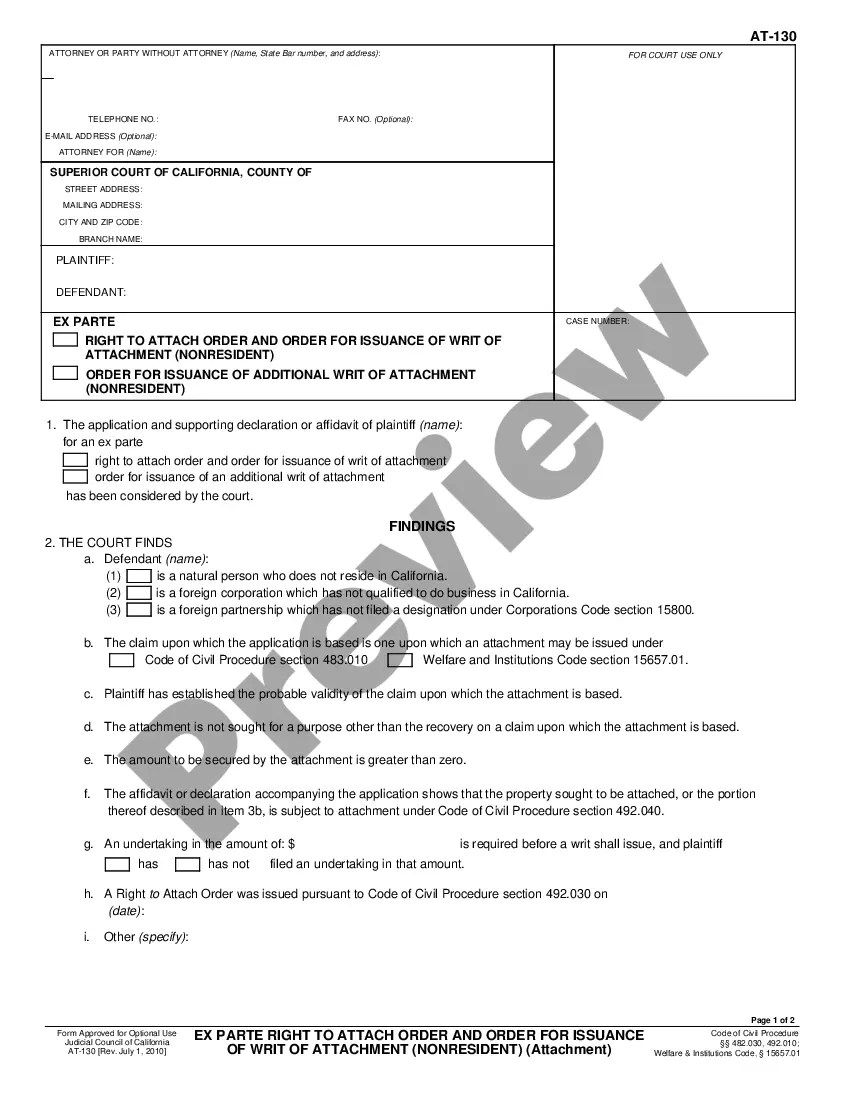

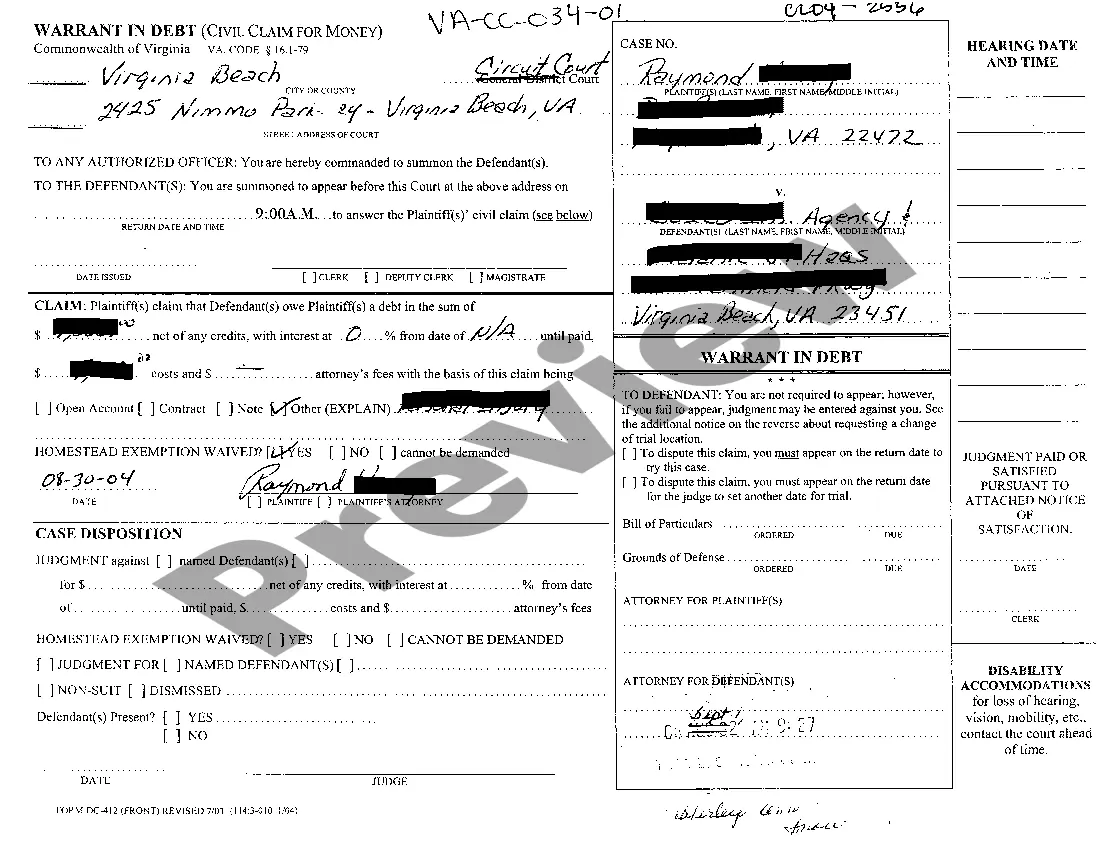

- Verify the file. Make use of the Preview feature or read its description (if readily available).

- Click Buy Now if this sample is the thing you need or return to the Search field to find another one.

- Select a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

After finishing these simple actions, it is possible to complete the form in your favorite editor. Check the filled in information and consider asking a legal representative to examine your Rhode Island Flood Zone Statement and Authorization for correctness. With US Legal Forms, everything becomes much easier. Give it a try now!

Form popularity

FAQ

AE flood zones are areas that present a 1% annual chance of flooding and a 26% chance over the life of a 30-year mortgage, according to FEMA.Since these areas are prone to flooding, homeowners with mortgages from federally regulated lenders are required to purchase flood insurance through the NFIP.

Flood zone AE (high-risk flood zone) The practical meaning of flood zone AE is your mortgage lender is required by federal law to force you to buy a flood insurance policy. Flood zone is also called the 100-year flood zone or special flood hazard area.

Zone VE. Zone VE is the flood insurance rate zone that corresponds to areas within the I-percent annual chance coastal floodplain that have additional hazards associated with storm waves. Base Flood Elevations derived from the detailed hydraulic analyses are shown at selected intervals within this zone.

Evidence of flood insurance Completed and executed NFIP Flood Insurance Application PLUS a copy of the Borrower's premium check or agent's paid receipt.

"velocity" zone includes the potential for wave action associated with the potential flood hazard.Obviously, the higher the risk, then the higher the flood insurance premium. X zone premiums (if you elect to carry) cost next to nothing, AE zone premiums are reasonable, and VE zones are the most expensive.

Zone A. Zone A is the flood insurance rate zone that corresponds to the I-percent annual chance floodplains that are determined in the Flood Insurance Study by approximate methods of analysis.

AE flood zones are areas that present a 1% annual chance of flooding and a 26% chance over the life of a 30-year mortgage, according to FEMA.Since these areas are prone to flooding, homeowners with mortgages from federally regulated lenders are required to purchase flood insurance through the NFIP.

The designation AE indicates areas at high risk for flooding and provides the base flood elevations (BFEs) for them. The AE designation replaced the old designations of A1 to A30, known as the numbered A zones.