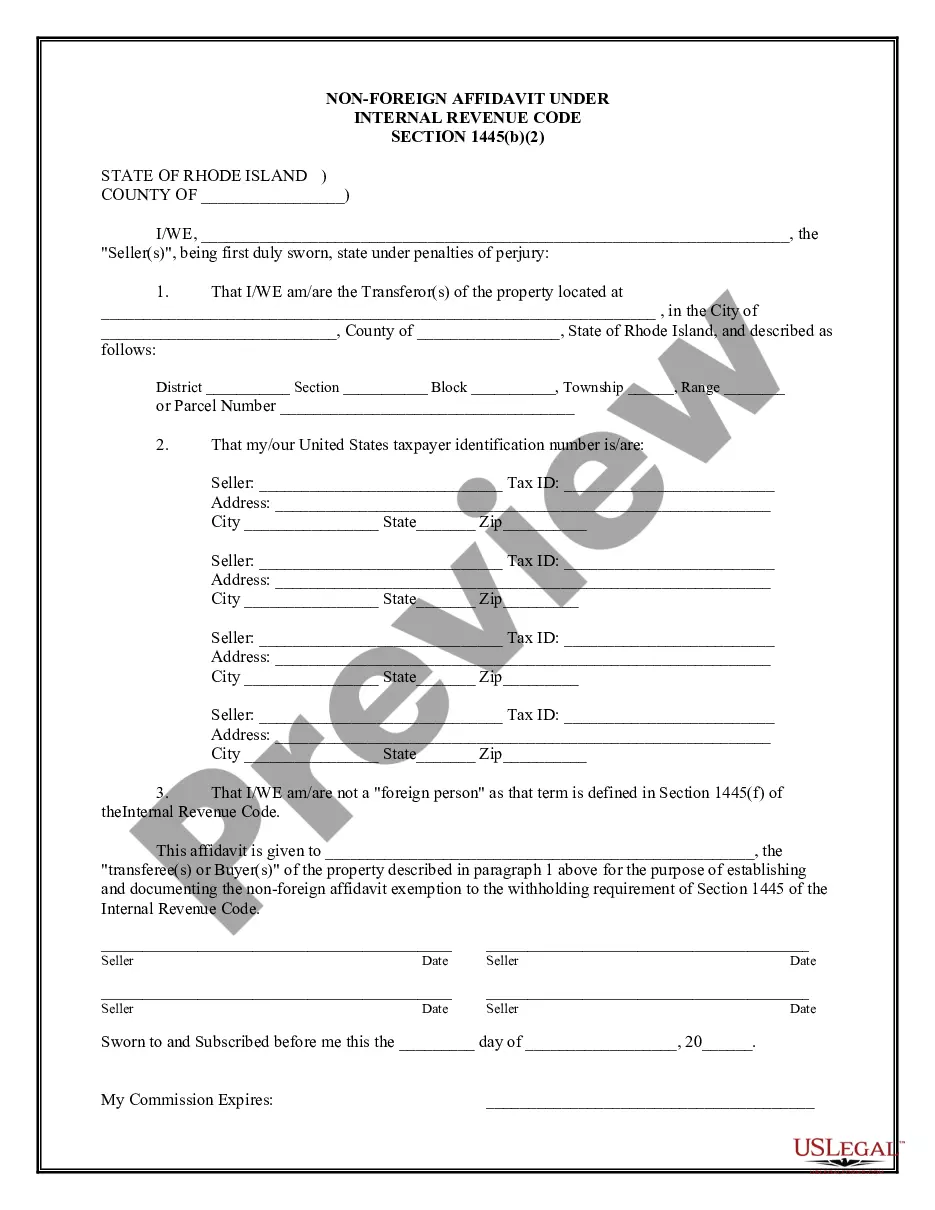

Rhode Island Non-Foreign Affidavit Under IRC 1445

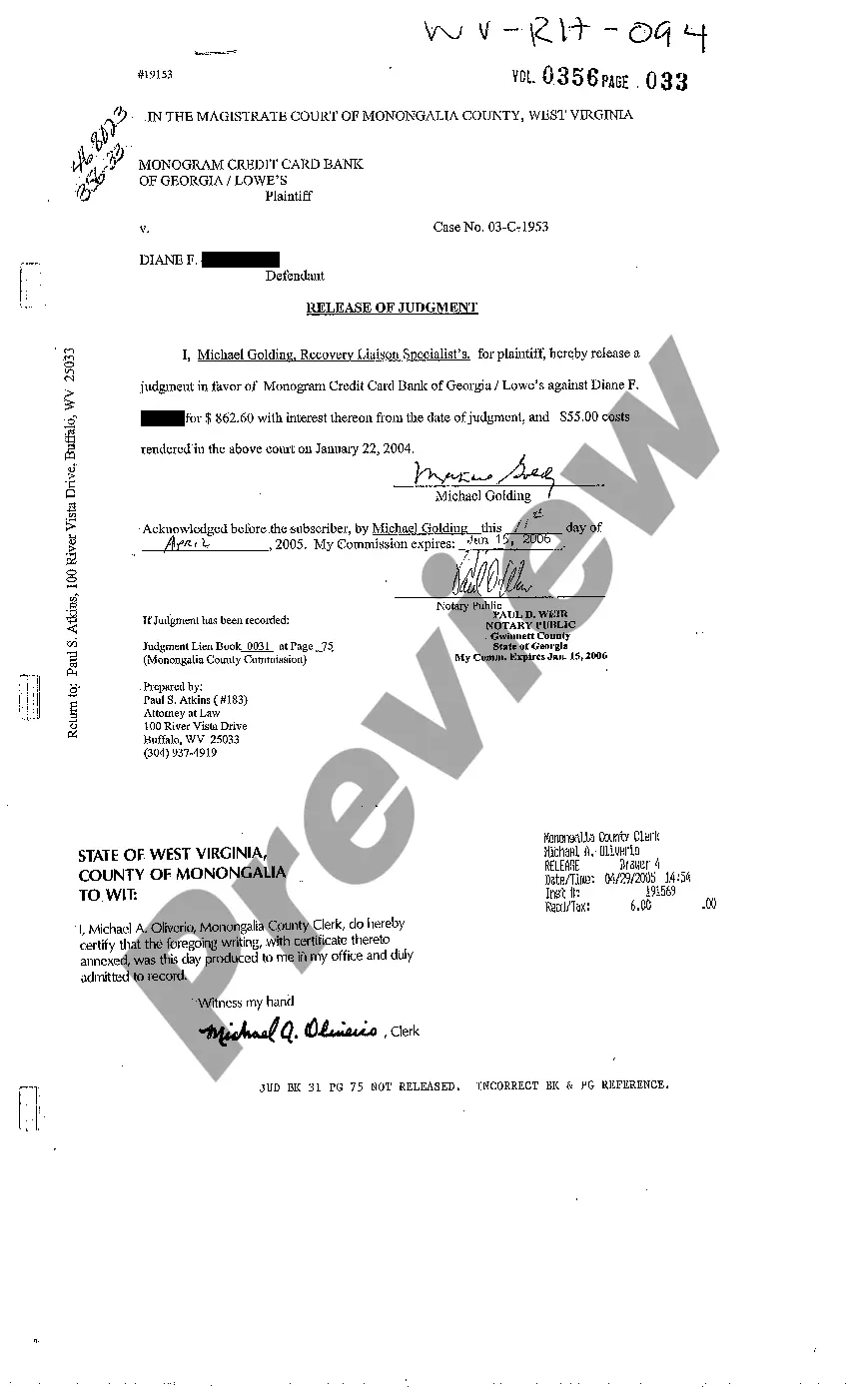

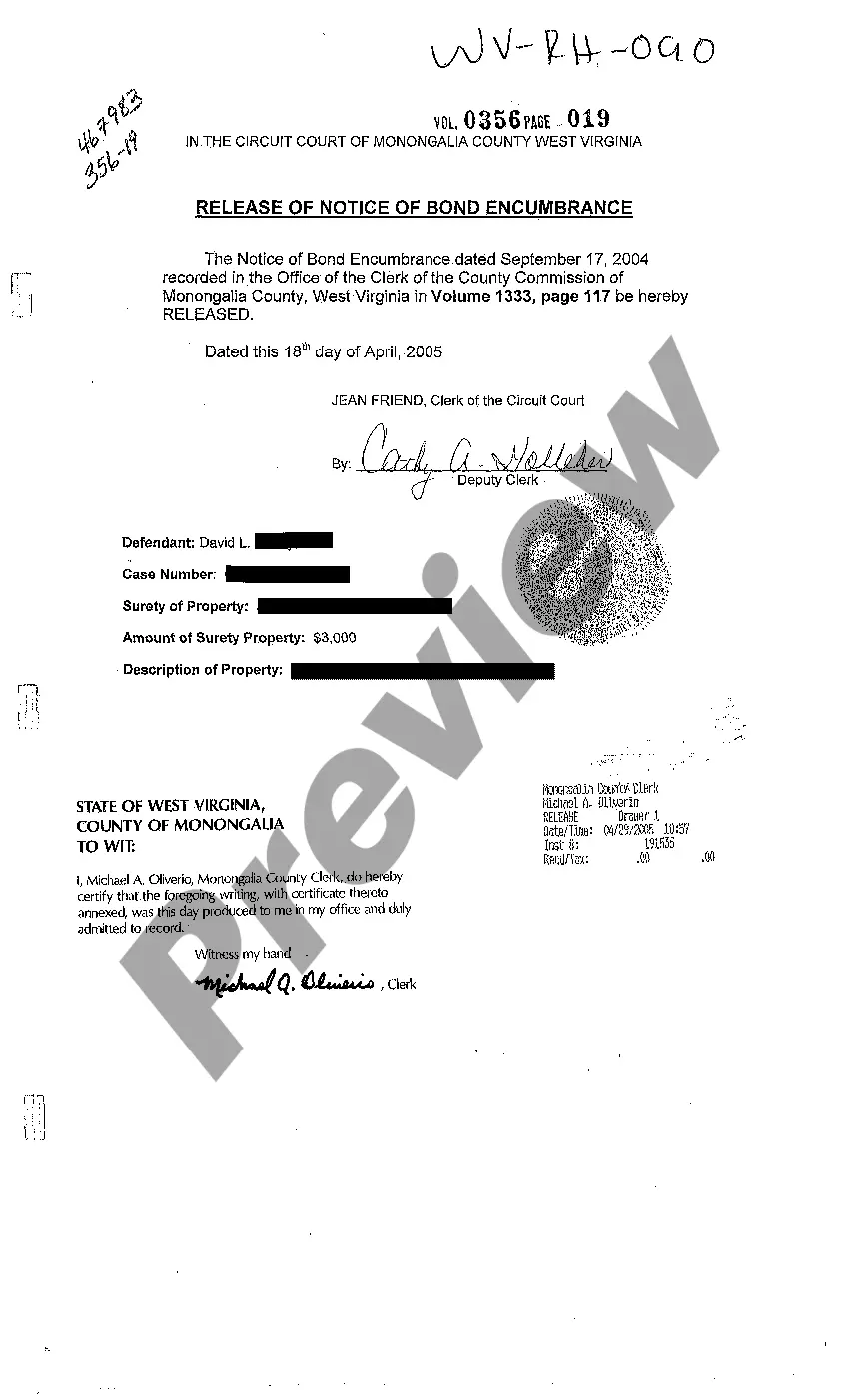

Description

How to fill out Rhode Island Non-Foreign Affidavit Under IRC 1445?

Creating papers isn't the most easy task, especially for people who rarely deal with legal papers. That's why we recommend utilizing correct Rhode Island Non-Foreign Affidavit Under IRC 1445 templates created by professional attorneys. It gives you the ability to eliminate troubles when in court or handling official organizations. Find the samples you want on our website for high-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will automatically appear on the template page. After accessing the sample, it’ll be stored in the My Forms menu.

Users with no an active subscription can quickly create an account. Use this short step-by-step help guide to get your Rhode Island Non-Foreign Affidavit Under IRC 1445:

- Be sure that file you found is eligible for use in the state it is needed in.

- Confirm the file. Use the Preview feature or read its description (if offered).

- Click Buy Now if this sample is what you need or go back to the Search field to get a different one.

- Choose a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a required format.

After finishing these simple actions, you can fill out the form in an appropriate editor. Double-check filled in data and consider requesting an attorney to examine your Rhode Island Non-Foreign Affidavit Under IRC 1445 for correctness. With US Legal Forms, everything becomes easier. Try it now!

Form popularity

FAQ

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.

FIRPTA is a federal tax law that ensures that foreign sellers pay income tax on the sale of real property in the United States.

The Foreign Investment in Real Property Transfer Act (FIRPTA) requires any buyer of a U.S. real property interest to withhold ten percent of the amount realized by a foreign seller. 26 USC § 1445(a).

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

CERTIFICATE OF NON FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person.

Foreign affidavit is an affidavit involving a matter of concern in one state but taken in another state or country before an officer of that state or country.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445).Withholding is required on certain distributions and other transactions by domestic or foreign corporations, partnerships, trusts, and estates.