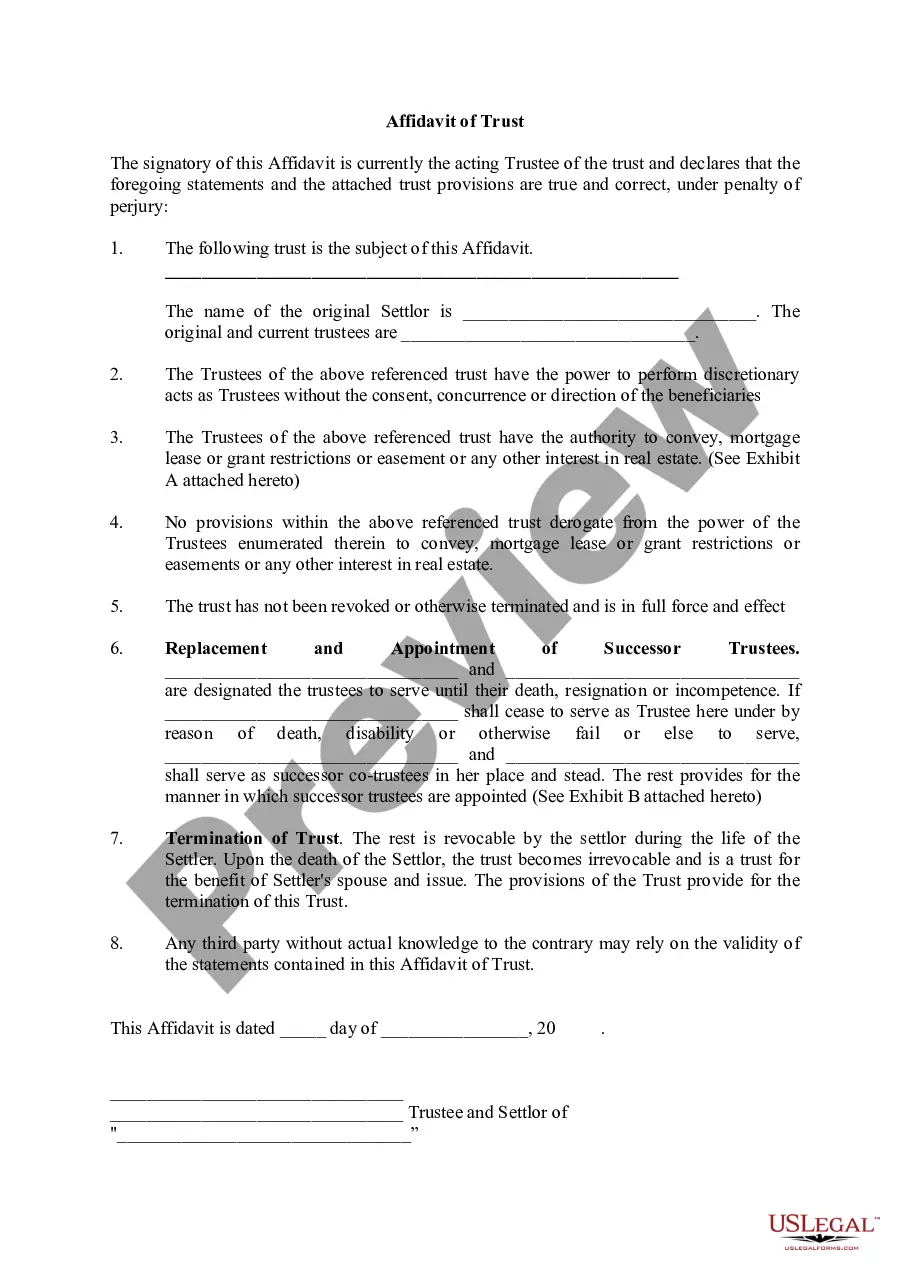

Rhode Island Affidavit of Trust

Description Rhode Island Trust

co- trustee if the original trustee shall cease to serve by reason of death,

disability or otherwise fail or else to serve.

How to fill out Rhode Island Affidavit Of Trust?

Creating papers isn't the most straightforward job, especially for those who rarely deal with legal paperwork. That's why we recommend making use of accurate Rhode Island Affidavit of Trust samples created by professional lawyers. It allows you to stay away from troubles when in court or dealing with formal institutions. Find the samples you require on our site for high-quality forms and correct information.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you are in, the Download button will automatically appear on the template webpage. After accessing the sample, it will be saved in the My Forms menu.

Customers with no an active subscription can easily create an account. Follow this brief step-by-step guide to get the Rhode Island Affidavit of Trust:

- Make sure that file you found is eligible for use in the state it’s required in.

- Confirm the document. Utilize the Preview option or read its description (if offered).

- Buy Now if this file is the thing you need or go back to the Search field to get a different one.

- Choose a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

After completing these simple actions, it is possible to complete the sample in a preferred editor. Double-check completed details and consider requesting a legal representative to review your Rhode Island Affidavit of Trust for correctness. With US Legal Forms, everything gets much simpler. Give it a try now!

Form popularity

FAQ

Individual beneficiaries have no rights to assets until the trustees exercise a discretion in their favour. Consequently, an obligation for trustees to act impartially while managing trust assets for the benefit of all beneficiaries is reasonable and appropriate.

In most cases, a trustee cannot remove a beneficiary from a trust. This power of appointment generally is intended to allow the surviving spouse to make changes to the trust for their own benefit, or the benefit of their children and heirs.

A certification of trust (or "trust certificate") is a short document signed by the trustee that simply states the trust's essential terms and certifies the trust's authority without revealing private details of the trust that aren't relevant to the pending transaction.

A trust document isn't required to be filed. If you are transferring real estate into a trust, a deed will need oo be filed at the county recorder's office.The declaration will detail the terms and conditions of the living trust, including who will serve as the Trustee.

A trustee has a duty to report and account to the trust beneficiaries. If you are a trust beneficiary, you have a right to information about the trust, your interest in the trust, and the various assets of the trust and how they are being administered, invested and distributed.

Based on these rules, upon creation of a trust, title to trust property is split between the trustee and the beneficiaries. The trustee holds legal title to the property and the beneficiaries hold equitable title. Because the trustee holds legal title to the property, that property must be held in the trustee's name.

Trusts and trustees in California are governed by the California Probate Code and court cases decided which interpret the probate code.If a trustee is holding back money and not paying the beneficiaries then the trustee needs to have documented and businesslike reasons for withholding payment.

A Certificate of Trust is recorded in the Official Records of the county in which any trust real property is located. It aids in clearing title to the property. Generally, where the trust owns no real property, there is no need to record a Certificate...

Generally speaking, beneficiaries have a right to see trust documents which set out the terms of the trusts, the identity of the trustees and the assets within the trust as well as the trust deed, any deeds of appointment/retirement and trust accounts.