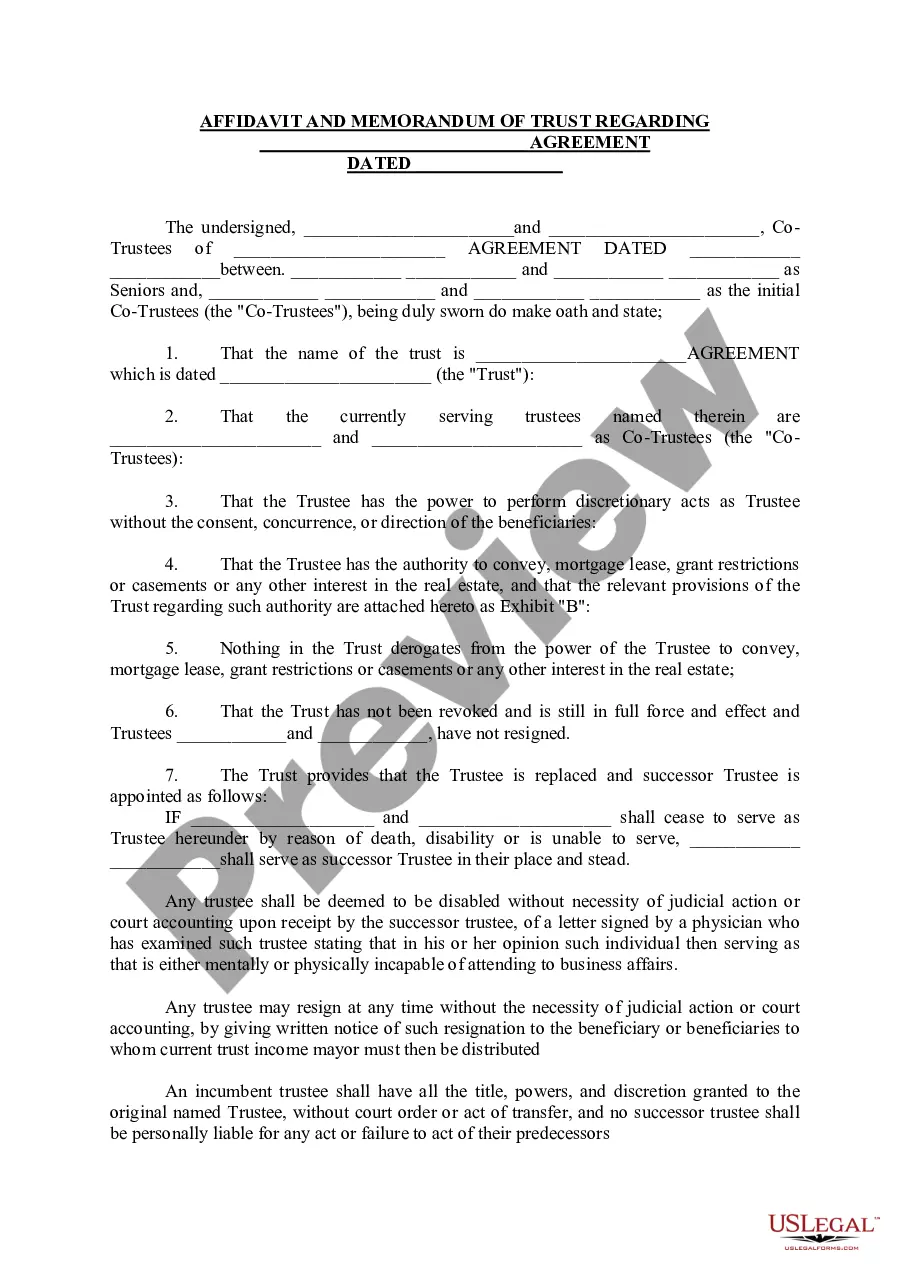

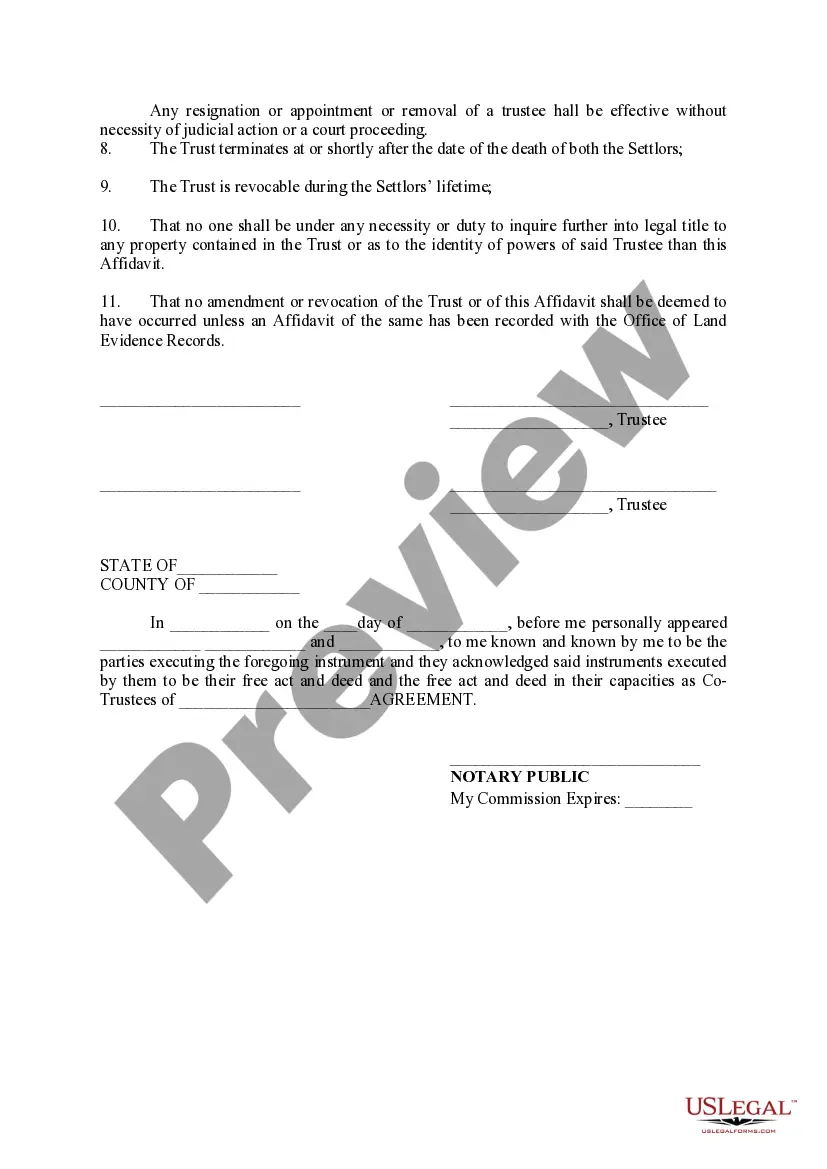

Rhode Island Affidavit and Memorandum of Trust

Description Memorandum Of Trust Sample

successor. Also, a trustor may reserve, or a beneficiary may

be given the power to change trustees. This form is a sample of a trustor appointing a successor trustee.

How to fill out Rhode Island Affidavit And Memorandum Of Trust?

Creating documents isn't the most uncomplicated task, especially for those who rarely work with legal papers. That's why we advise making use of correct Rhode Island Affidavit and Memorandum of Trust templates created by skilled attorneys. It allows you to prevent troubles when in court or dealing with formal institutions. Find the documents you want on our site for top-quality forms and correct explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will automatically appear on the file webpage. Right after getting the sample, it will be stored in the My Forms menu.

Customers without an active subscription can easily get an account. Make use of this short step-by-step help guide to get your Rhode Island Affidavit and Memorandum of Trust:

- Ensure that the form you found is eligible for use in the state it is needed in.

- Confirm the file. Utilize the Preview option or read its description (if available).

- Click Buy Now if this form is the thing you need or go back to the Search field to get another one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after completing these easy actions, you can fill out the sample in an appropriate editor. Double-check filled in information and consider requesting a legal representative to review your Rhode Island Affidavit and Memorandum of Trust for correctness. With US Legal Forms, everything becomes easier. Give it a try now!

Form popularity

FAQ

A declaration of trust under U.S. law is a document or an oral statement appointing a trustee to oversee assets being held for the benefit of one or more other individuals. These assets are held in a trust.The declaration of trust is sometimes referred to as a nominee declaration.

A: An affidavit of trust and a certificate of trust are essentially the same thing. At least they serve the same functions. Simply put, an affidavit of trust is an abbreviated version of the trust agreement that provides general information about the terms of the trust.

A Memorandum of Trust is a synopsis of a trust that is used when transferring real property into a trust.A Certification of Trust is used in place of the actual trust to open up an account on behalf of a trust at a financial institution.

Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.Understanding the 3 primary types of trusts - The Des Moines Register\nwww.desmoinesregister.com > money > business > columnists > 2015/08/31

If you have a trust in Michigan, state law provides that you can register the trust. Registering a Michigan trust is not required (except for certain charitable trusts, as discussed below). Even for non-charitable trusts, there are good reasons that a trust should be registered.

A Certificate of Trust is recorded in the Official Records of the county in which any trust real property is located. It aids in clearing title to the property. Generally, where the trust owns no real property, there is no need to record a Certificate...

A trust document isn't required to be filed. If you are transferring real estate into a trust, a deed will need oo be filed at the county recorder's office.The declaration will detail the terms and conditions of the living trust, including who will serve as the Trustee.

A certification of trust (or "trust certificate") is a short document signed by the trustee that simply states the trust's essential terms and certifies the trust's authority without revealing private details of the trust that aren't relevant to the pending transaction.