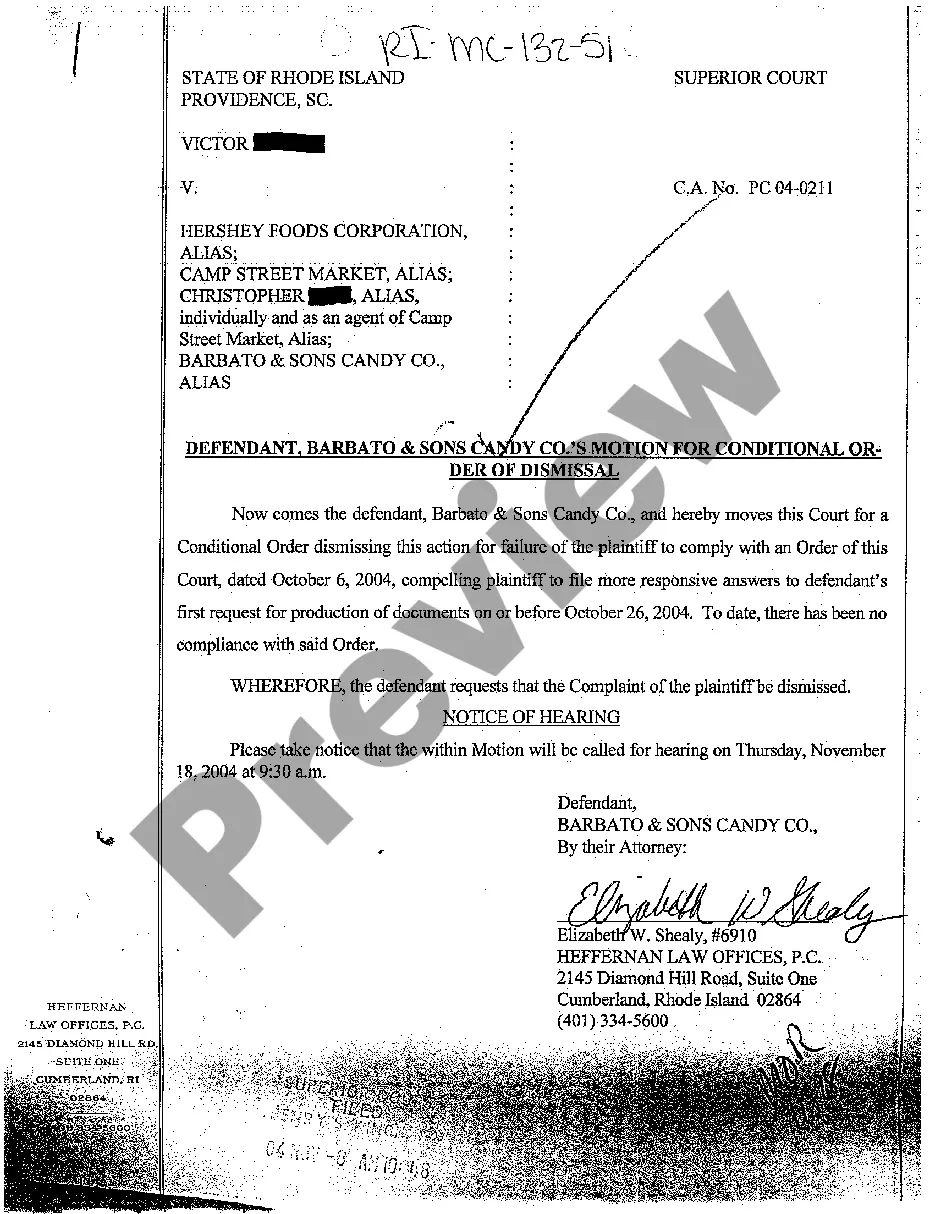

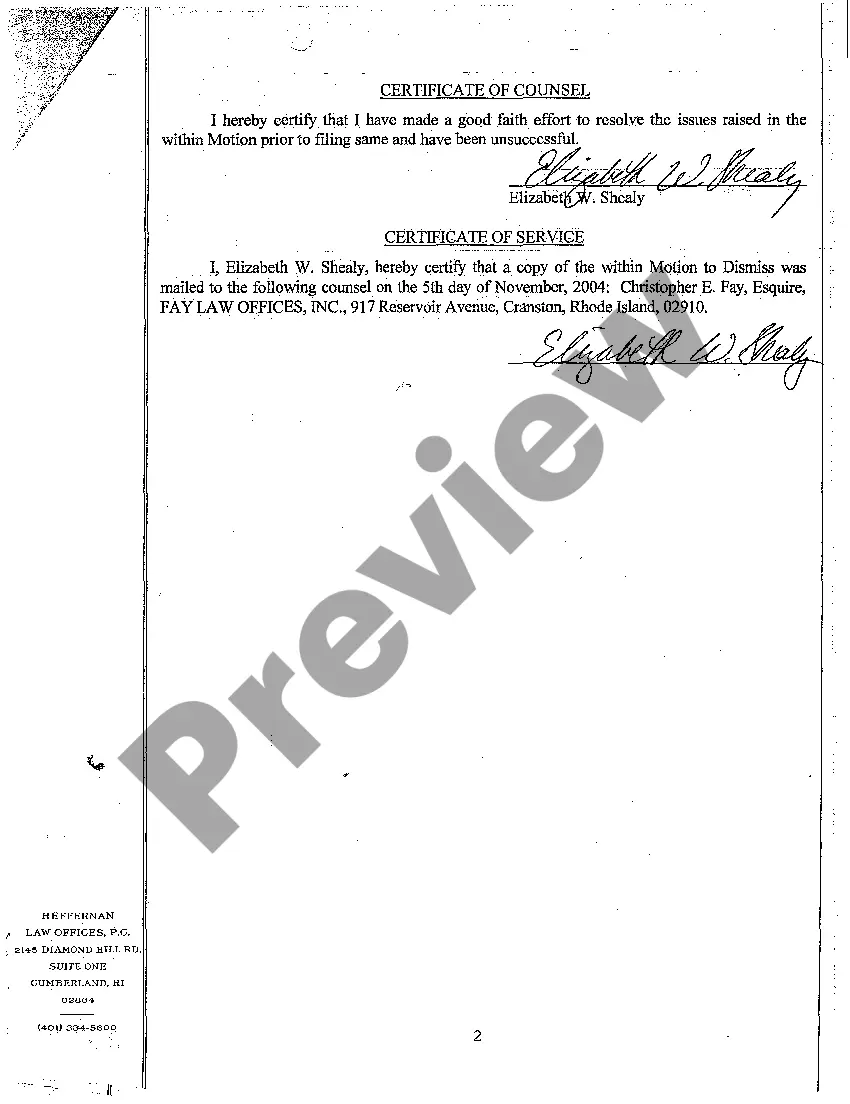

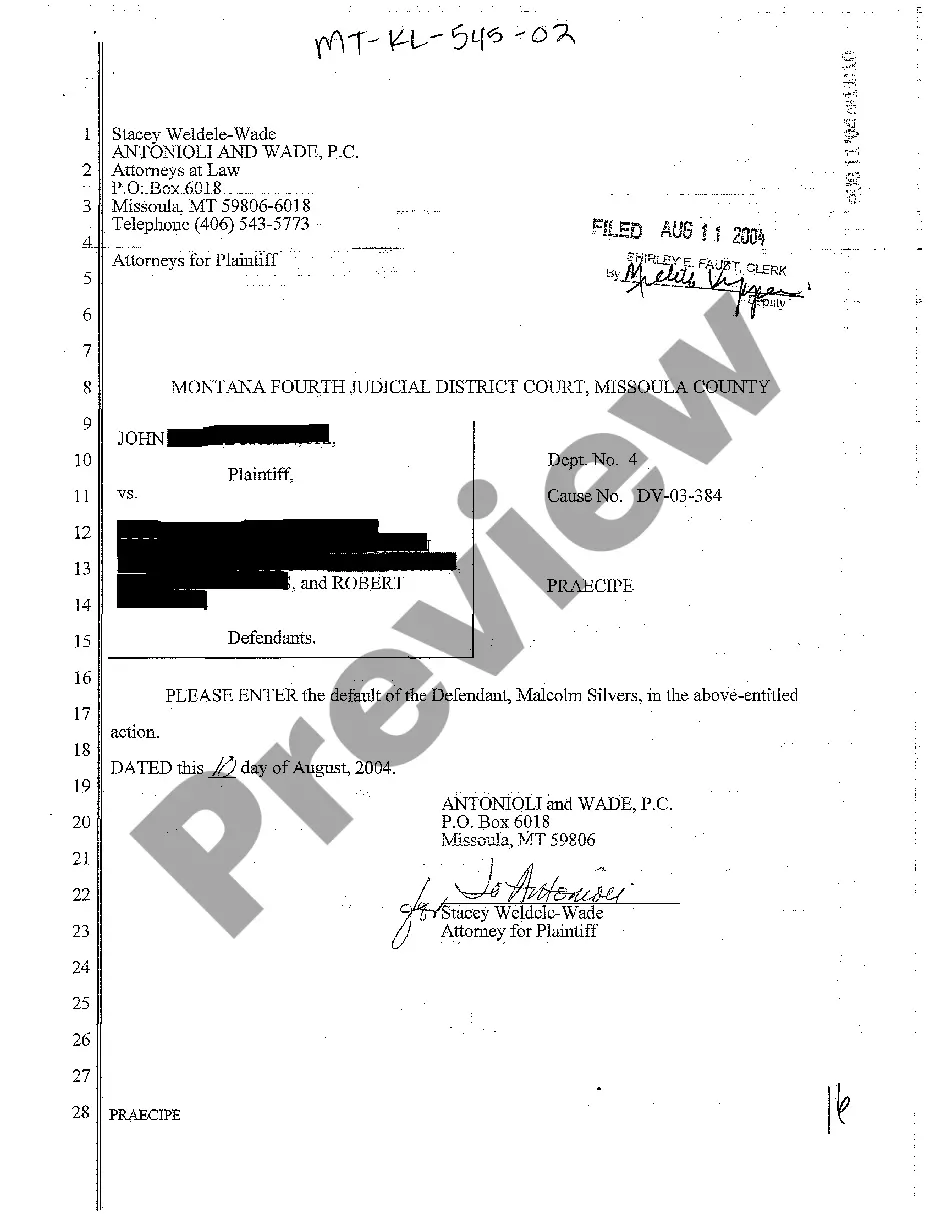

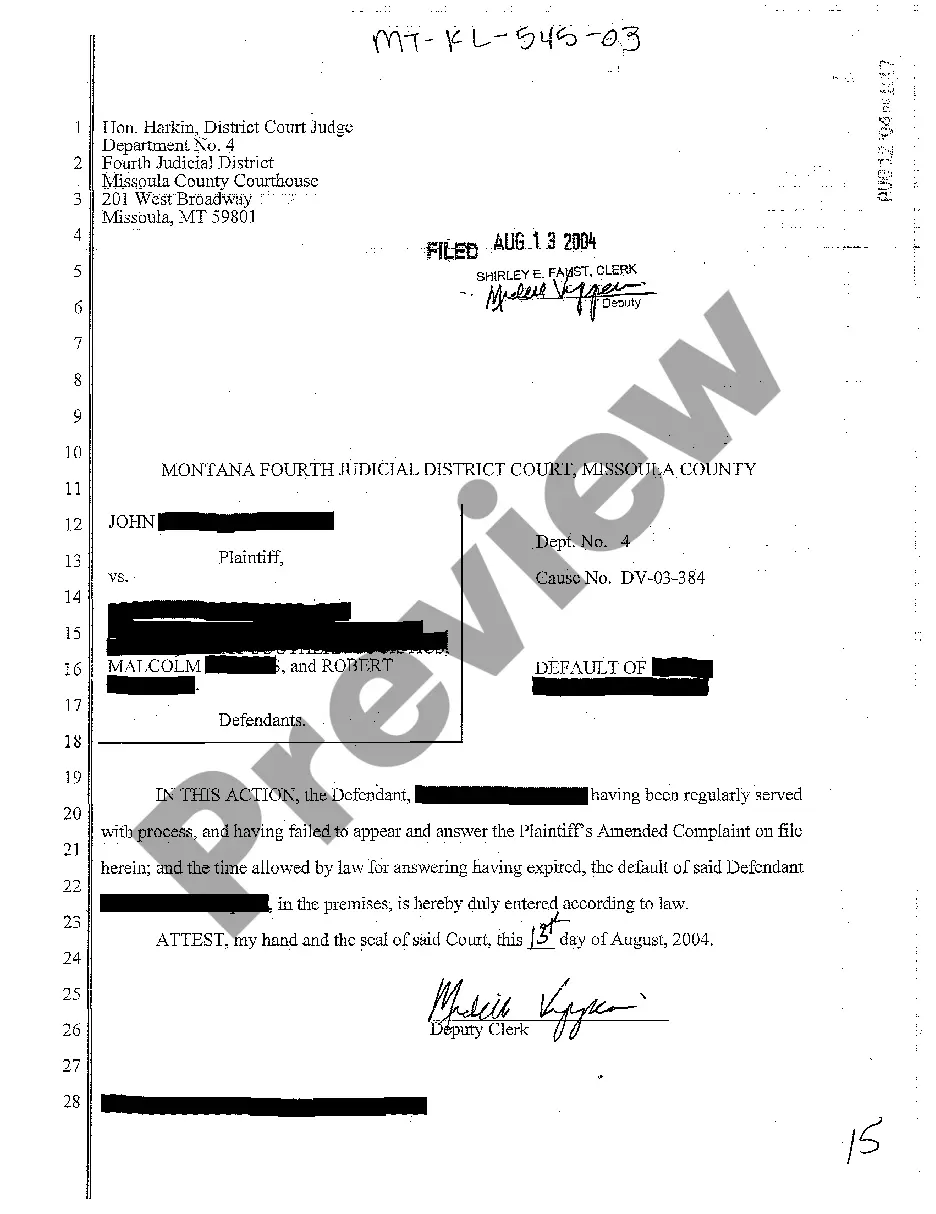

Rhode Island Defendant Candy Store's Motion for Conditional Order of Dismissal

Description

How to fill out Rhode Island Defendant Candy Store's Motion For Conditional Order Of Dismissal?

Among lots of free and paid templates which you find on the internet, you can't be sure about their reliability. For example, who created them or if they are qualified enough to take care of what you require those to. Always keep calm and use US Legal Forms! Get Rhode Island Defendant Candy Store's Motion for Conditional Order of Dismissal samples made by skilled legal representatives and prevent the high-priced and time-consuming procedure of looking for an lawyer or attorney and then paying them to write a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button near the file you’re seeking. You'll also be able to access all your earlier downloaded examples in the My Forms menu.

If you’re utilizing our website for the first time, follow the guidelines listed below to get your Rhode Island Defendant Candy Store's Motion for Conditional Order of Dismissal fast:

- Make certain that the file you see is valid where you live.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing process or look for another sample using the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

When you have signed up and purchased your subscription, you can use your Rhode Island Defendant Candy Store's Motion for Conditional Order of Dismissal as many times as you need or for as long as it remains active where you live. Change it in your preferred offline or online editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

BO and CO are blocked in currency options because they are already highly leveraged and allowing more leverage on it is highly risky to you as clients and us as brokers.

Here, AMO stands for After Market Order, CO for Cover Order and OCO for One Cancels the Other order. AMO is a special order that can be placed before and after the market hours i.e. before the market opens between 4 am and 9 am & after the market closes between pm and 12 am.

A conditional order can be placed online by logging into your CommSec account and navigating to Trading > Conditional Orders > Placed Conditional Order. When you place a conditional order, you set a 'trigger price' and a 'limit price'.

What is a One-Cancels-the-Other Order (OCO) A one-cancels-the-other order (OCO) is a pair of conditional orders stipulating that if one order executes, then the other order is automatically canceled. An OCO order often combines a stop order with a limit order on an automated trading platform.

An OSO (Order Sends Order) order consists of a primary order that will send one or more secondary orders when the primary order is filled. For example, there is an OSO order consisting of three orders.

OCO (One Cancels the Other) trigger When you buy stocks, you can place an OCO trigger where you can set a stop-loss and target trigger %. When either of the triggers is hit, the order is placed at the exchange and the other trigger is cancelled. You will get the GTT trigger option when you place a CNC buy order.

A conditional order allows you to set order triggers for stocks and options based on the price movement of stocks, indexes, or options contracts. There are 5 types: contingent, multi-contingent, one-triggers-the-other (OTO), one-cancels-the-other (OCO), and one-triggers-a-one-cancels-the-other (OTOCO).

Blast All. Submits up to eight orders simultaneously, each independent of the others. 1st Triggers Sequence. The first order entered in the Order Entry screen triggers a series of up to seven more orders that are not filled until the next order in the queue is filled.

Conditional orders are NAV tracking orders. Similar to stocks, you can place orders to purchase funds based on NAV i.e you can purchase at particular NAV that you decide. The conditional order feature can only be used for lump sum investments and not for SIPs.A conditional order can't be edited once placed.