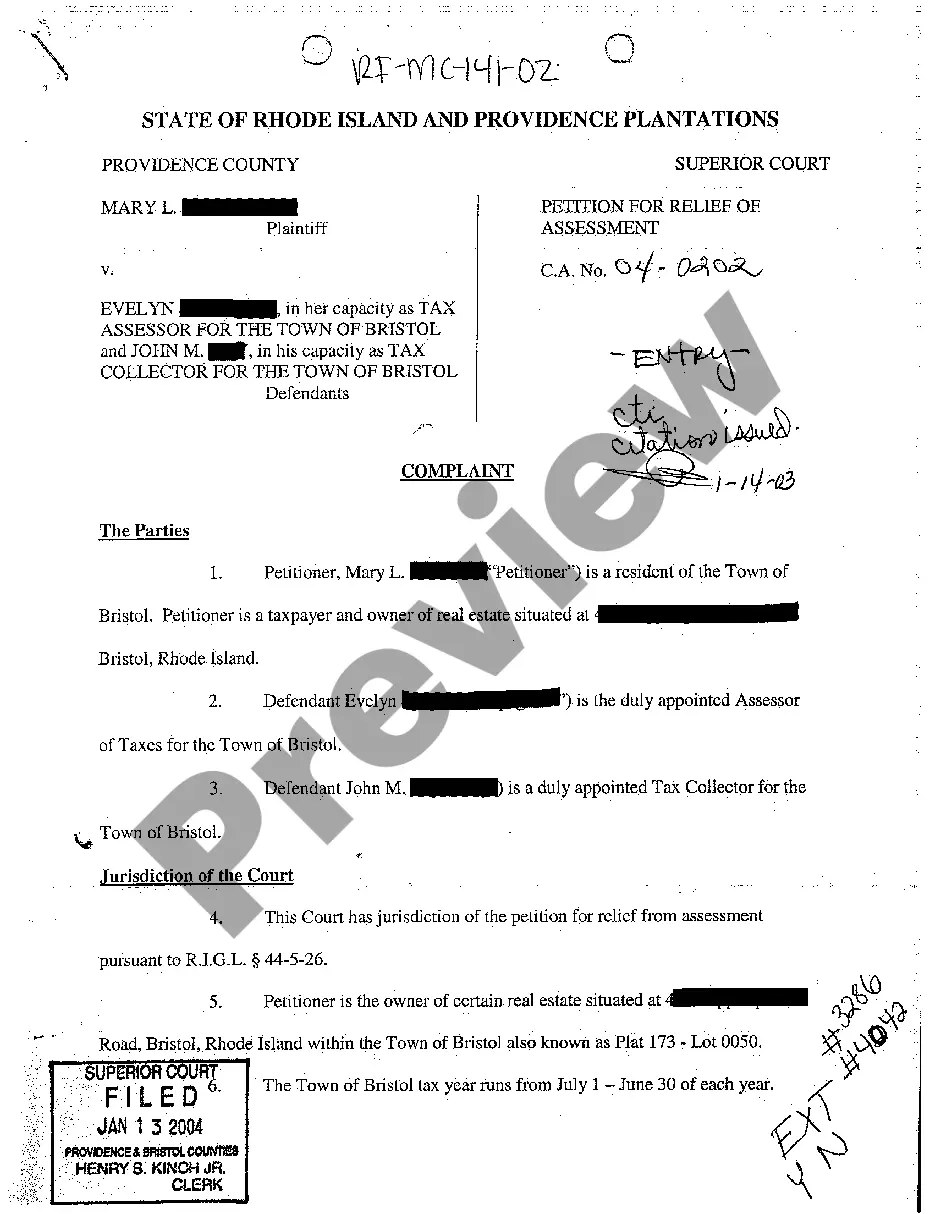

Rhode Island Complaint for Excessive Property Tax Against Tax Assessor and Tax Collector

Description

How to fill out Rhode Island Complaint For Excessive Property Tax Against Tax Assessor And Tax Collector?

Among lots of paid and free examples which you find online, you can't be sure about their accuracy and reliability. For example, who made them or if they’re competent enough to deal with what you require them to. Keep relaxed and utilize US Legal Forms! Find Rhode Island Complaint for Excessive Property Tax Against Tax Assessor and Tax Collector samples made by skilled attorneys and avoid the costly and time-consuming procedure of looking for an attorney and after that having to pay them to draft a document for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button next to the file you’re looking for. You'll also be able to access your earlier downloaded templates in the My Forms menu.

If you are making use of our website the first time, follow the guidelines listed below to get your Rhode Island Complaint for Excessive Property Tax Against Tax Assessor and Tax Collector quick:

- Make certain that the document you find applies in your state.

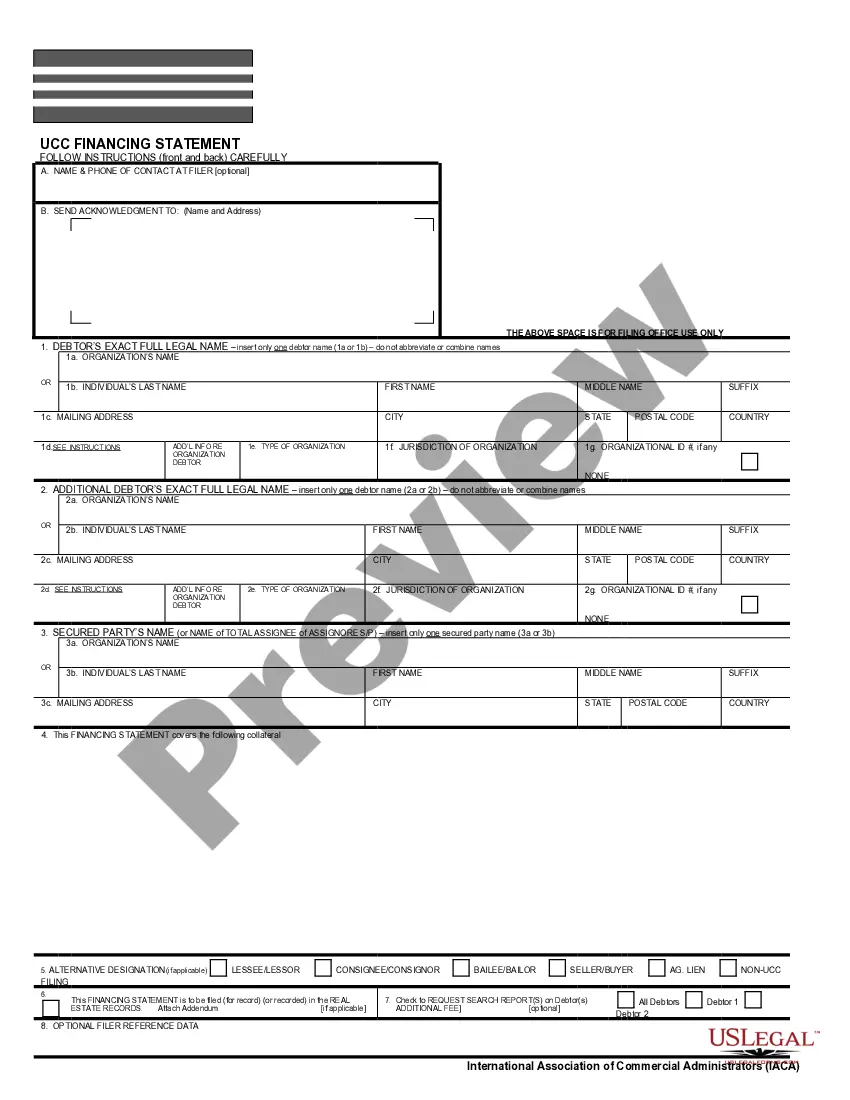

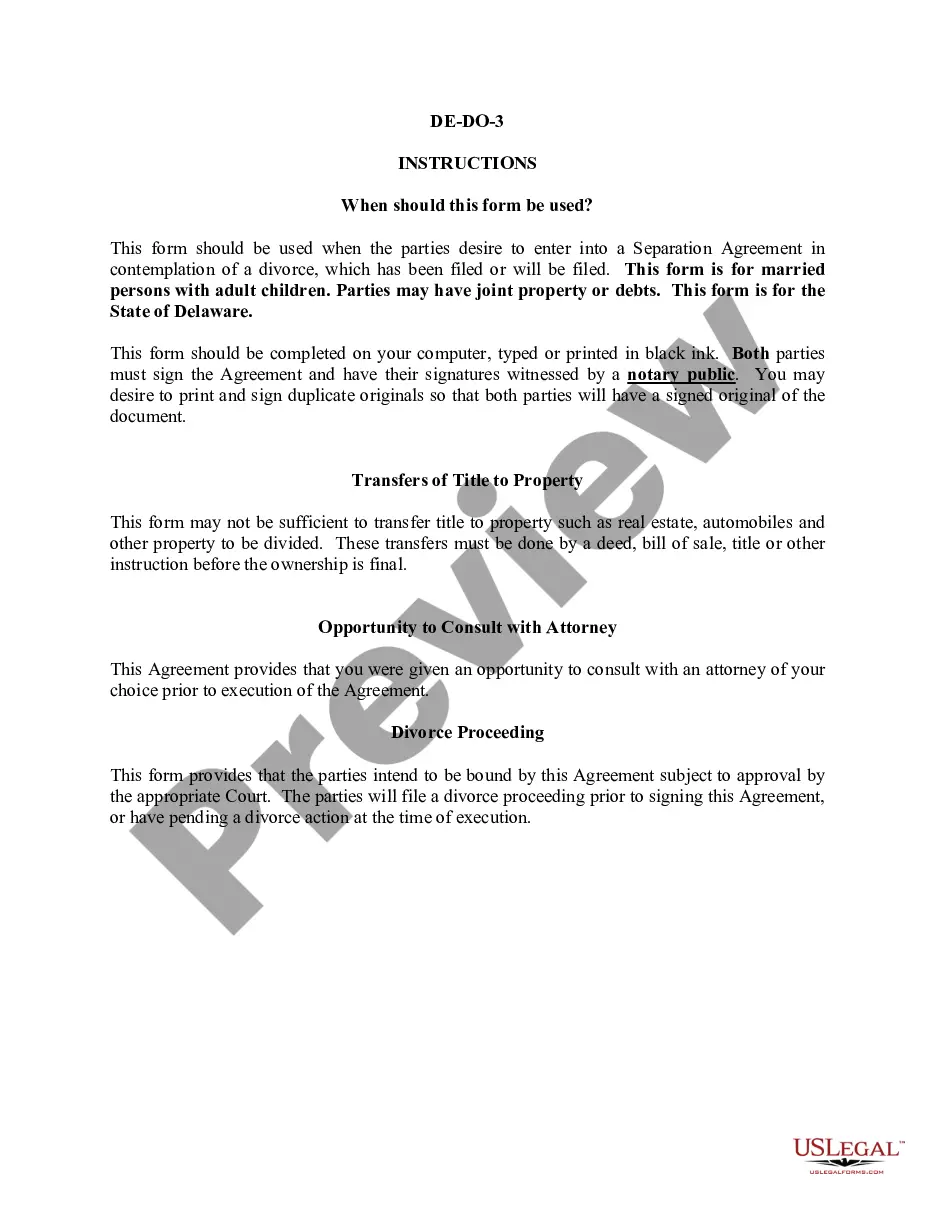

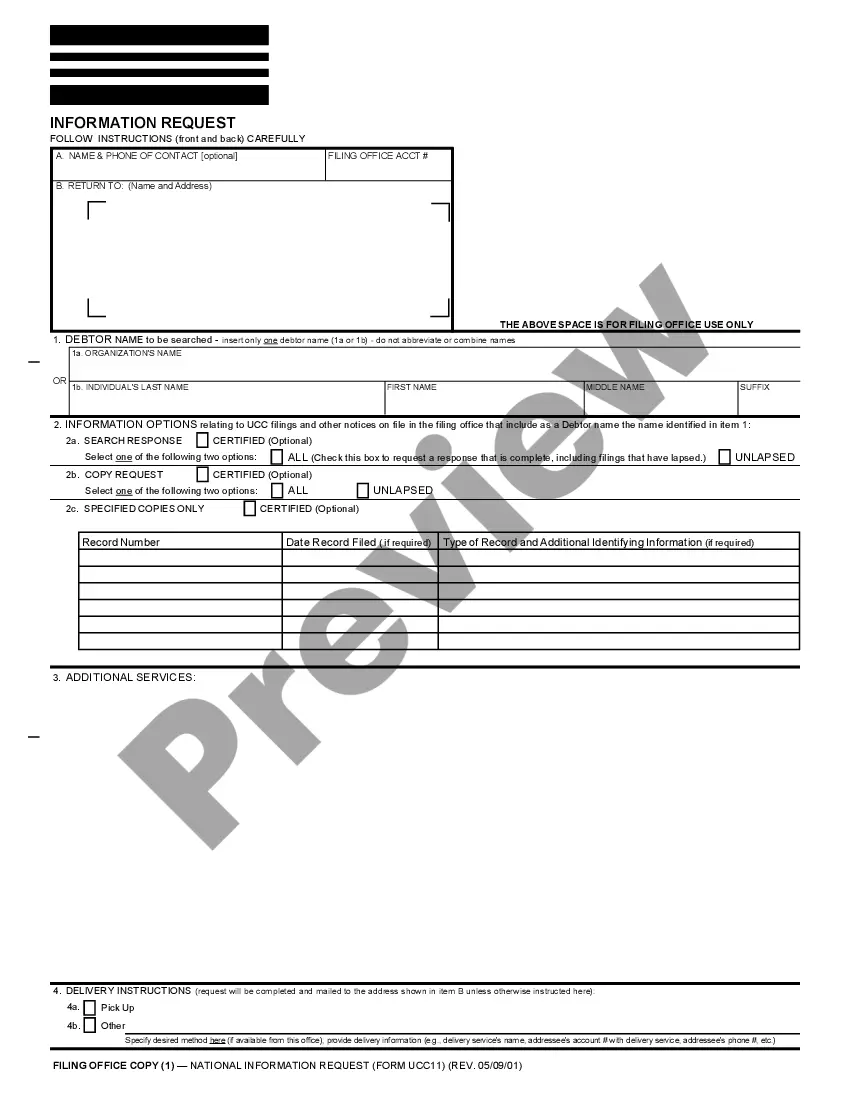

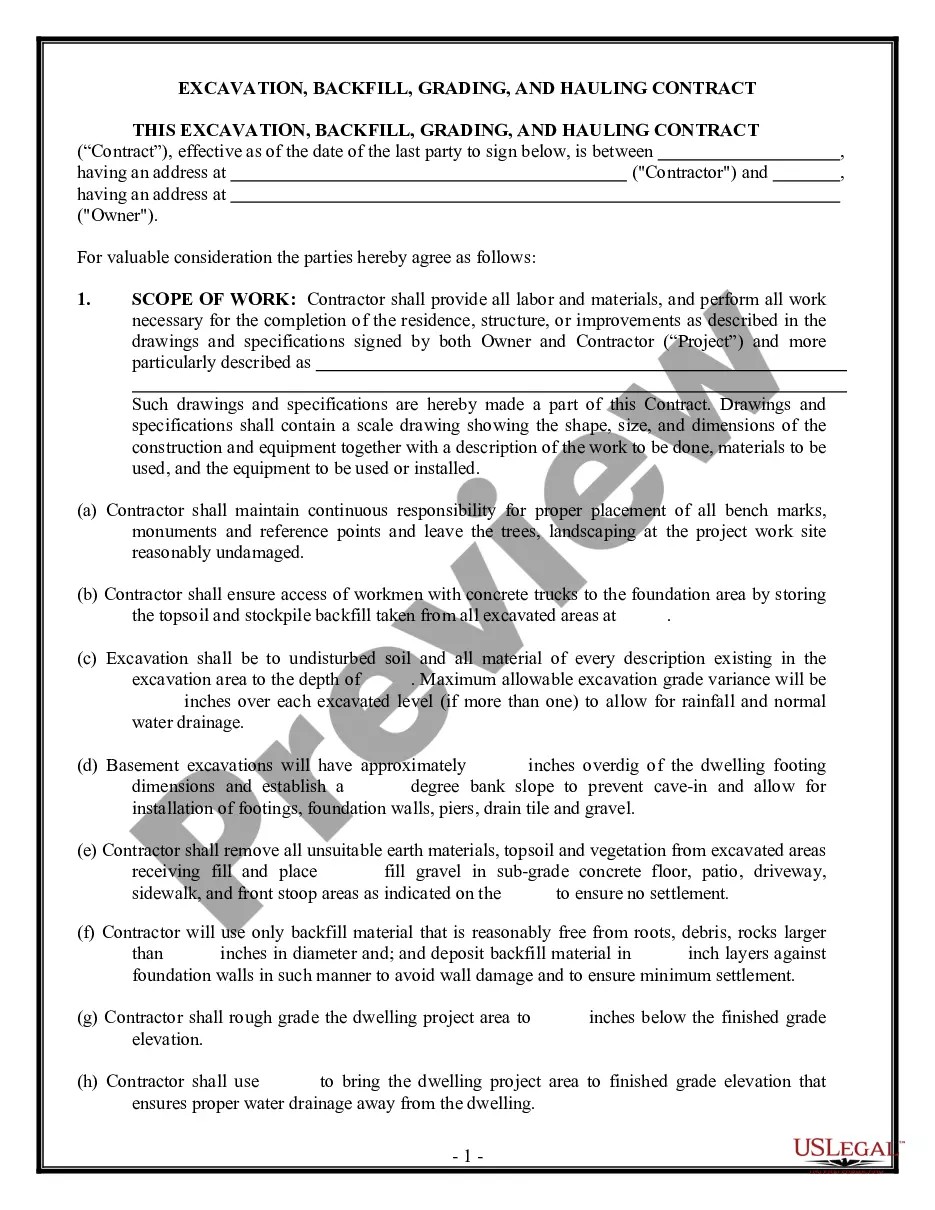

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to begin the ordering process or find another example using the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

When you’ve signed up and paid for your subscription, you may use your Rhode Island Complaint for Excessive Property Tax Against Tax Assessor and Tax Collector as often as you need or for as long as it continues to be valid in your state. Revise it in your preferred online or offline editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

The Personal Property Tax Relief Act of 1998 provides tax relief for any passenger car, motorcycle, or pickup or panel truck having a registered gross weight of less than 7,501 pounds.The vehicle is leased by an individual and the leasing company pays the tax without reimbursement from the individual.

Arizona. California. Oklahoma. South Carolina. Texas. Wisconsin.

The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States; . . . 240 U.S. at 12.

In California, for example, once you buy a house your assessment can't rise more than 2 percent a year.When you sell, the assessed value jumps up for the new buyers, based on the sales price. California lenders know the assessment has nothing to do with the home's current market value.

To arrive at the assessed value, an assessor first estimates the market value of your property by using one or a combination of three methods: performing a sales evaluation, the cost method, the income method. The market value is then multiplied by an assessment rate to arrive at the assessed value.

The tax assessed value is only used to determine property taxes.The higher the assessed value, the higher your property tax bill. The appraised value of a home is most commonly needed when the property is being purchased with a new mortgage loan or the existing loan is refinanced.

House assessments and appraisals are not the same species. Your county's tax assessor sets a value on your house as a step in setting your property taxes. The appraisal tells buyers how big a mortgage your house is worth. The tax assessor's judgment doesn't affect your home price or your appraiser's evaluation.

Your household income must have been $30,000 or less. You had to have lived in a household or rented a home that was subject to property taxes. You must be caught up and current with all property tax and rent payments due on your homestead for all previous years and current year.

Program provides state-funded tax credit to senior and disabled homeowners and renters whose property taxes exceed between 3% and 6% of their household income. For renters, property tax is calculated at 20% of annual rent. The maximum credit is $400 for 2020.