1. An Heirship Affidavit

2. A General Power of Attorney effective immediately

3. A Revocation of Power of Attorney

4. Declaration - Equivalent of Living Will

5. A Personal Planning Information and Document Inventory Worksheet

Rhode Island Newly Widowed Individuals Package

Description

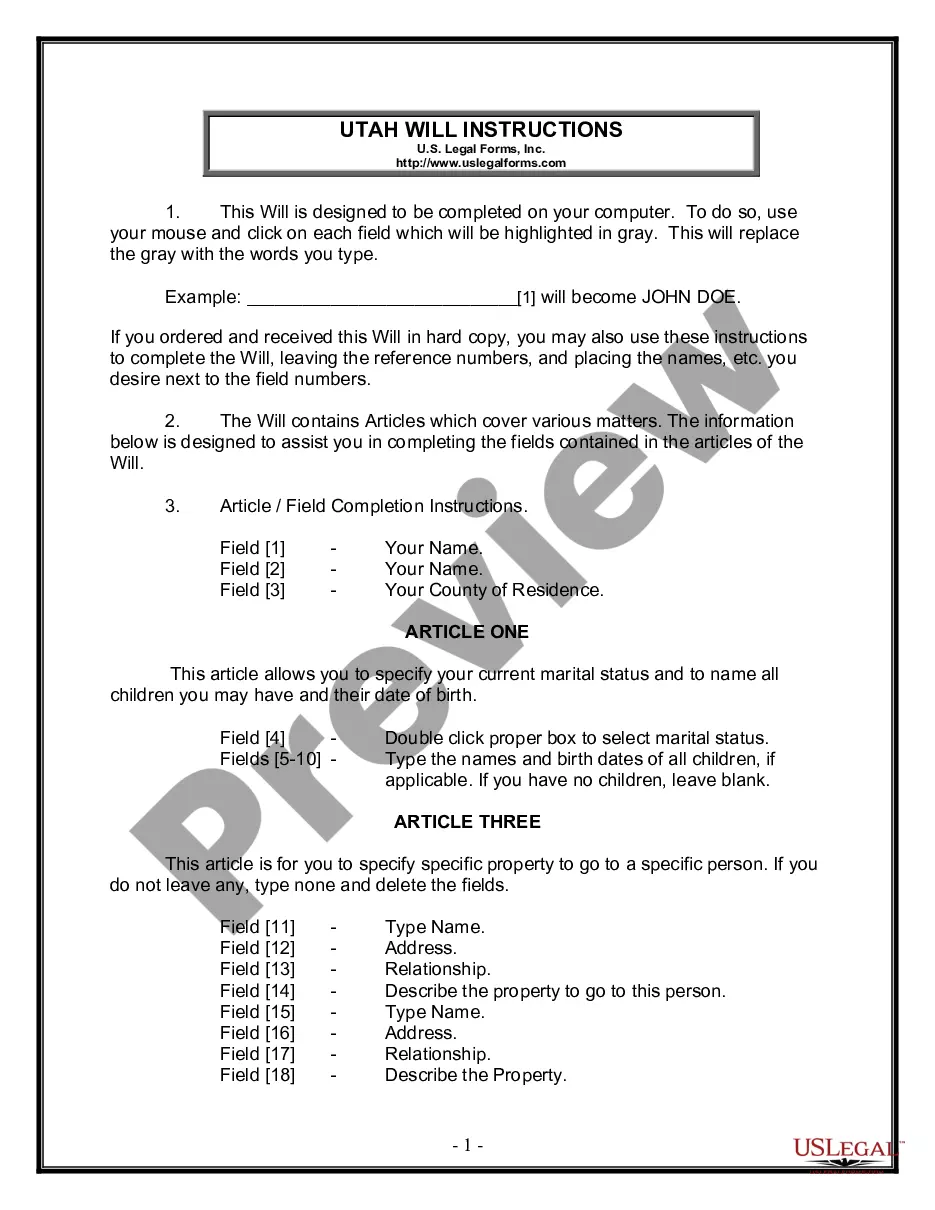

How to fill out Rhode Island Newly Widowed Individuals Package?

The work with papers isn't the most straightforward task, especially for people who rarely work with legal papers. That's why we advise making use of correct Rhode Island Newly Widowed Individuals Package templates made by professional lawyers. It allows you to eliminate problems when in court or dealing with formal institutions. Find the documents you want on our site for high-quality forms and correct information.

If you’re a user having a US Legal Forms subscription, just log in your account. Once you are in, the Download button will automatically appear on the file web page. After downloading the sample, it will be stored in the My Forms menu.

Users with no an active subscription can quickly create an account. Use this short step-by-step guide to get the Rhode Island Newly Widowed Individuals Package:

- Ensure that file you found is eligible for use in the state it’s needed in.

- Verify the file. Use the Preview option or read its description (if offered).

- Buy Now if this sample is the thing you need or return to the Search field to find another one.

- Select a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a required format.

After completing these easy steps, you can complete the sample in an appropriate editor. Double-check filled in info and consider requesting a legal professional to examine your Rhode Island Newly Widowed Individuals Package for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

Form popularity

FAQ

There are about four million widows and widowers receiving monthly Social Security benefits based on their deceased spouse's earnings record.Widows and widowers can receive: Reduced benefits as early as age 60 or full benefits at full retirement age or older.

As a widow: You must be at least 60 years old (unless you are disabled in which case you can claim your benefit as early as age 50). If you are divorced, you can claim the survivors benefit if you were married at least 10 years and are currently unmarried (unless you remarried after age 60).

Spousal benefits are based on a living spouse or ex-spouse's work history. Survivor benefits are based on a deceased spouse or ex-spouse's work history. The maximum spousal benefit is 50% of the worker's full retirement age (FRA) benefit.

Employees may also be eligible to receive Medicare benefits through a deceased spouse if that spouse had earned 40 credits prior to their death and they were married to them at the time of the spouse's death.

Social Security allows you to claim both a retirement and a survivor benefit at the same time, but the two won't be added together to produce a bigger payment; you will receive the higher of the two amounts.(Full retirement age, or FRA, is currently 66 and gradually rising to 67 over the next several years).

Many individuals who are divorced or widowed are concerned that the loss of their spouse will somehow affect their ability to qualify for Original Medicare (Parts A & B). You are: Age 65 or older or. Younger than 65 with a qualifying disability or.

For Your Widow Or Widower Widows and widowers can receive: Reduced benefits as early as age 60 or full benefits at full retirement age or older. If widows or widowers qualify for retirement benefits on their own record, they can switch to their own retirement benefit as early as age 62.

Catholic women lived 11 years after the death of their spouse while Jewish women lived 9.5 years after the deaths of their husbands. Similarly, the Jewish men lived 5 years after the death of the wives while the Catholic men lived about 8 years after the death of their wives.

Medicare will give the surviving spouse $255 if he or she resided with the beneficiary when the recipient passed away.In the event that no surviving spouse exists, the money goes to a qualifying child, if one exists.