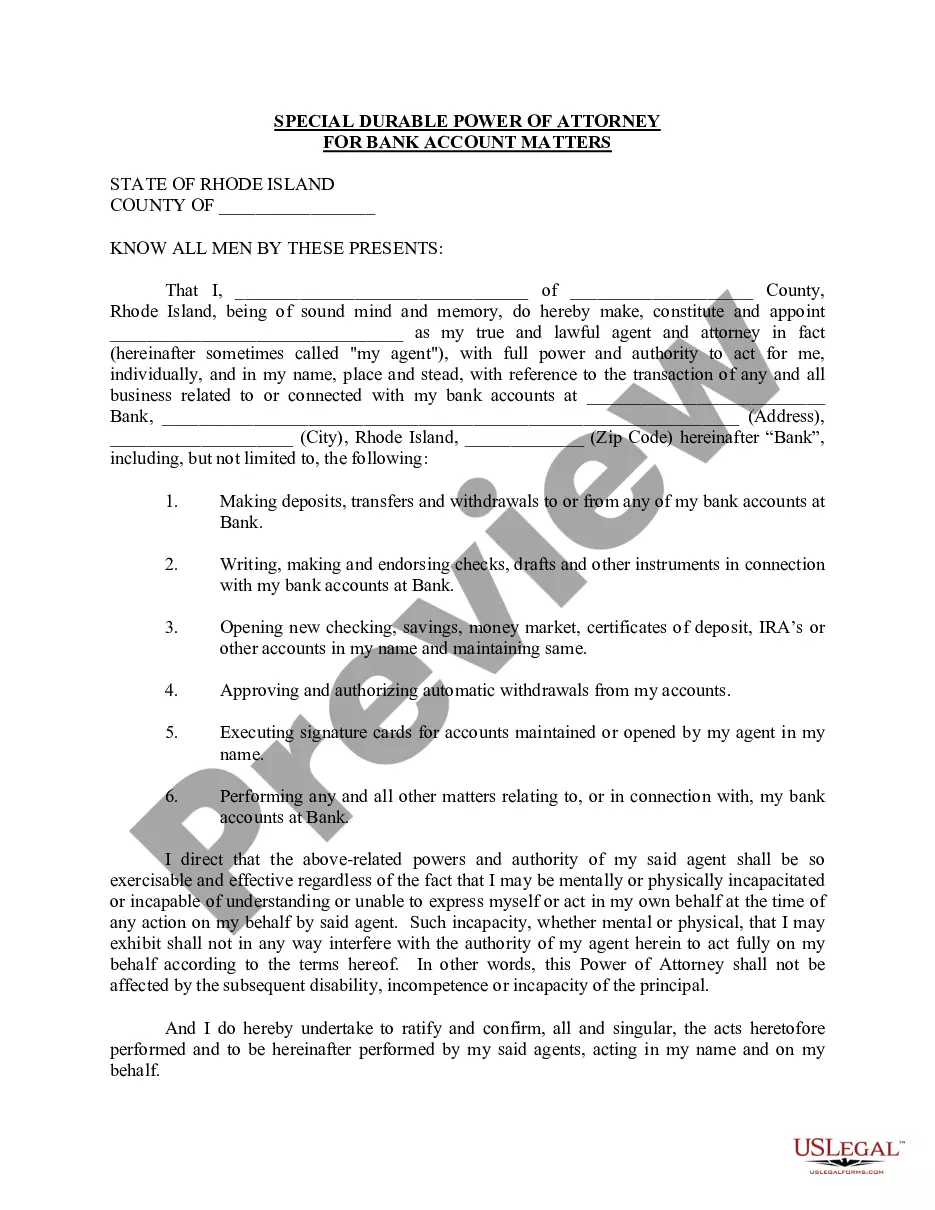

Rhode Island Special Durable Power of Attorney for Bank Account Matters

Description Ri Durable Power Of Attorney

How to fill out Rhode Island Special Durable Power Of Attorney For Bank Account Matters?

Creating papers isn't the most uncomplicated process, especially for those who rarely deal with legal papers. That's why we recommend utilizing accurate Rhode Island Special Durable Power of Attorney for Bank Account Matters templates made by skilled attorneys. It allows you to avoid troubles when in court or handling official organizations. Find the samples you need on our website for top-quality forms and correct information.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will automatically appear on the file webpage. Right after downloading the sample, it will be saved in the My Forms menu.

Customers without an active subscription can quickly get an account. Look at this simple step-by-step help guide to get the Rhode Island Special Durable Power of Attorney for Bank Account Matters:

- Ensure that the sample you found is eligible for use in the state it is needed in.

- Confirm the file. Utilize the Preview feature or read its description (if available).

- Buy Now if this file is the thing you need or use the Search field to find a different one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

Right after completing these simple actions, it is possible to complete the form in a preferred editor. Double-check completed data and consider requesting a legal professional to examine your Rhode Island Special Durable Power of Attorney for Bank Account Matters for correctness. With US Legal Forms, everything gets much simpler. Give it a try now!

Power Attorney Bank Form popularity

Rhode Island Poa Other Form Names

FAQ

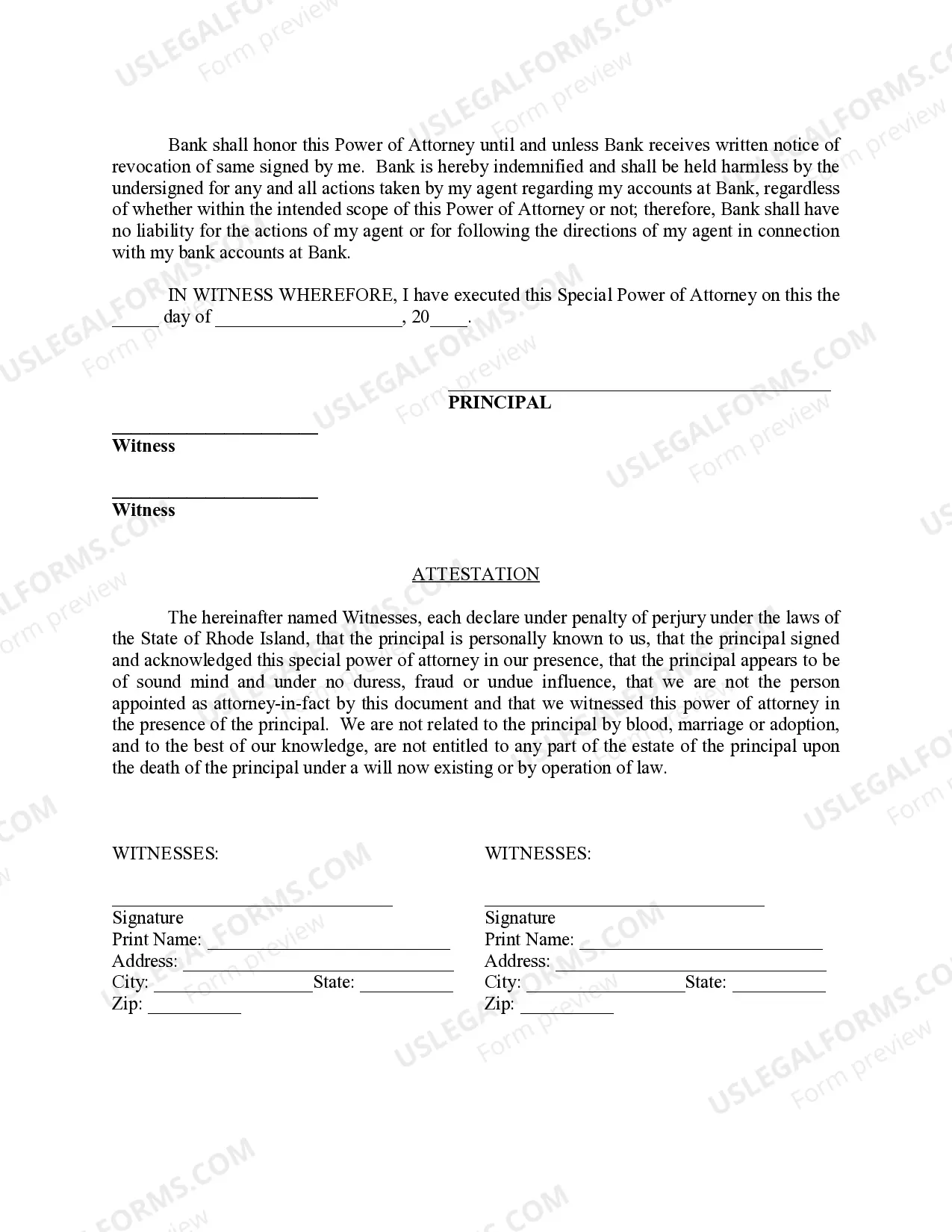

Before you can manage the donor's account, you must show the bank the original registered lasting power of attorney ( LPA ) or a copy of it signed on every page by the donor, a solicitor or notary.

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

But because of the risk of abuse, many banks will scrutinize a POA carefully before allowing the agent to act on the principal's behalf, and often a bank will refuse to honor a POA.The agent fought back in court and won a $64,000 judgment against the bank.

While laws vary between states, a POA can't typically add or remove signers from your bank account unless you include this responsibility in the POA document.If you don't include a clause giving the POA this authority, then financial institutions won't allow your POA to make ownership changes to your accounts.

Although third parties do sometimes refuse to honor an Agent's authority under a POA agreement, in most cases that refusal is not legal.In that case, the law allows you to collect attorney's fees if the third party unreasonably refused to accept the POA.

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

If you want your attorney to deal with any real estate you own in NSW, then the Power of Attorney document must be registered with the NSW Land Registry Services. Otherwise, there is no requirement for your Power of Attorney to be registered.

A Power of Attorney might be used to allow another person to sign a contract for the Principal. It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.