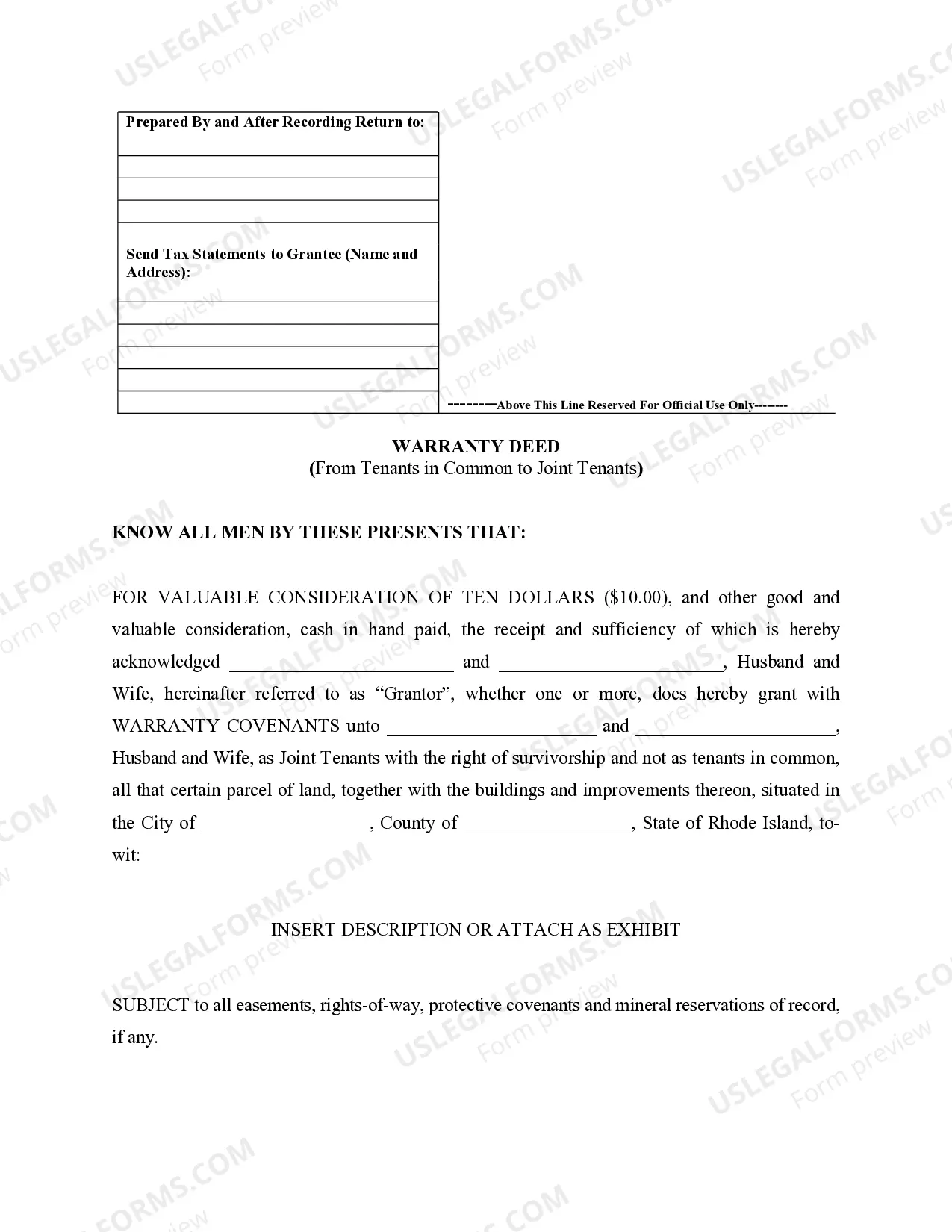

Rhode Island Warranty Deed for Husband and Wife Converting Property from Tenants in Common to Joint Tenancy

Description

How to fill out Rhode Island Warranty Deed For Husband And Wife Converting Property From Tenants In Common To Joint Tenancy?

Among hundreds of paid and free examples that you can get on the net, you can't be sure about their accuracy. For example, who created them or if they are qualified enough to take care of the thing you need those to. Keep relaxed and use US Legal Forms! Discover Rhode Island Warranty Deed for Husband and Wife Converting Property from Tenants in Common to Joint Tenancy samples created by professional legal representatives and avoid the expensive and time-consuming process of looking for an attorney and then having to pay them to write a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button near the form you’re trying to find. You'll also be able to access all of your previously downloaded templates in the My Forms menu.

If you are using our website for the first time, follow the guidelines below to get your Rhode Island Warranty Deed for Husband and Wife Converting Property from Tenants in Common to Joint Tenancy quick:

- Make sure that the document you discover is valid in the state where you live.

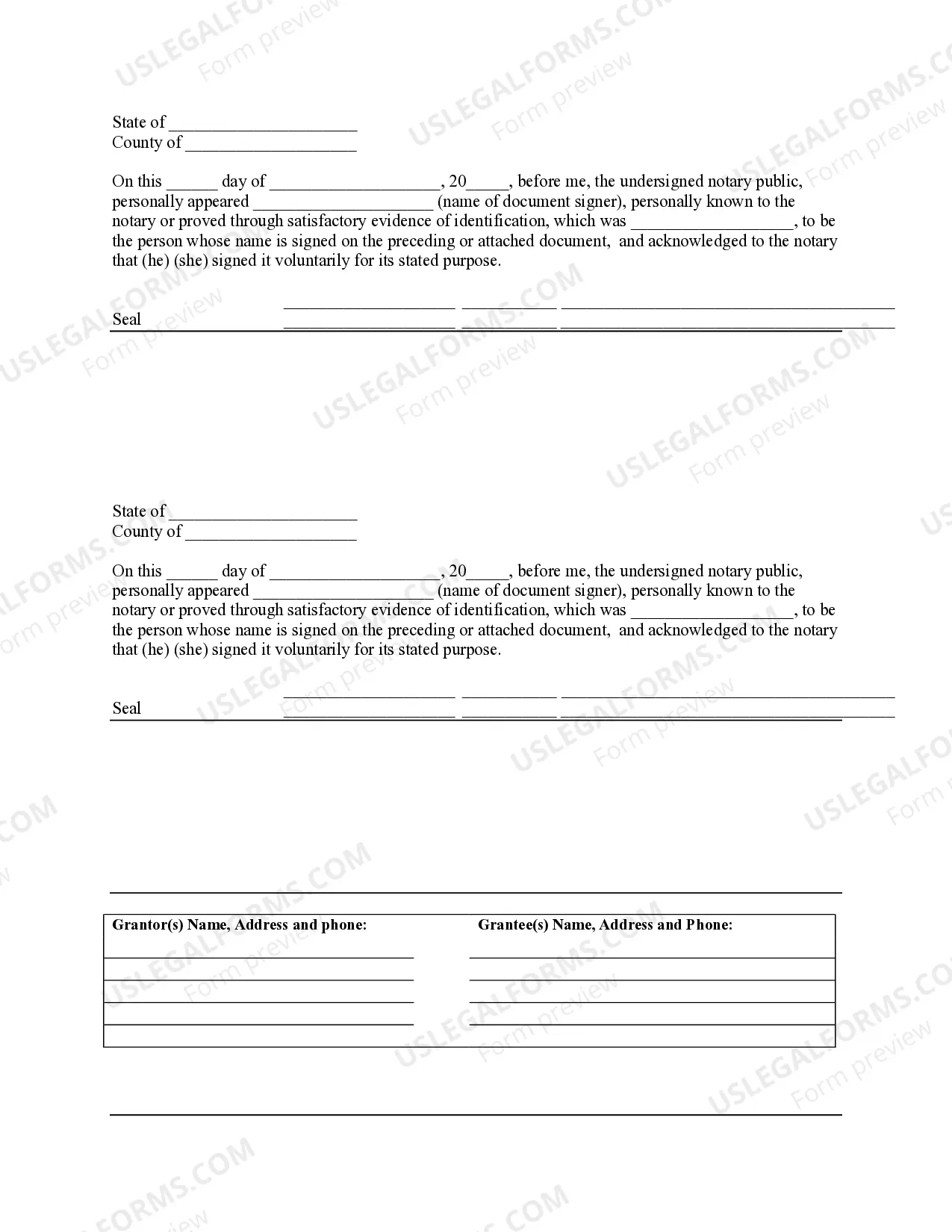

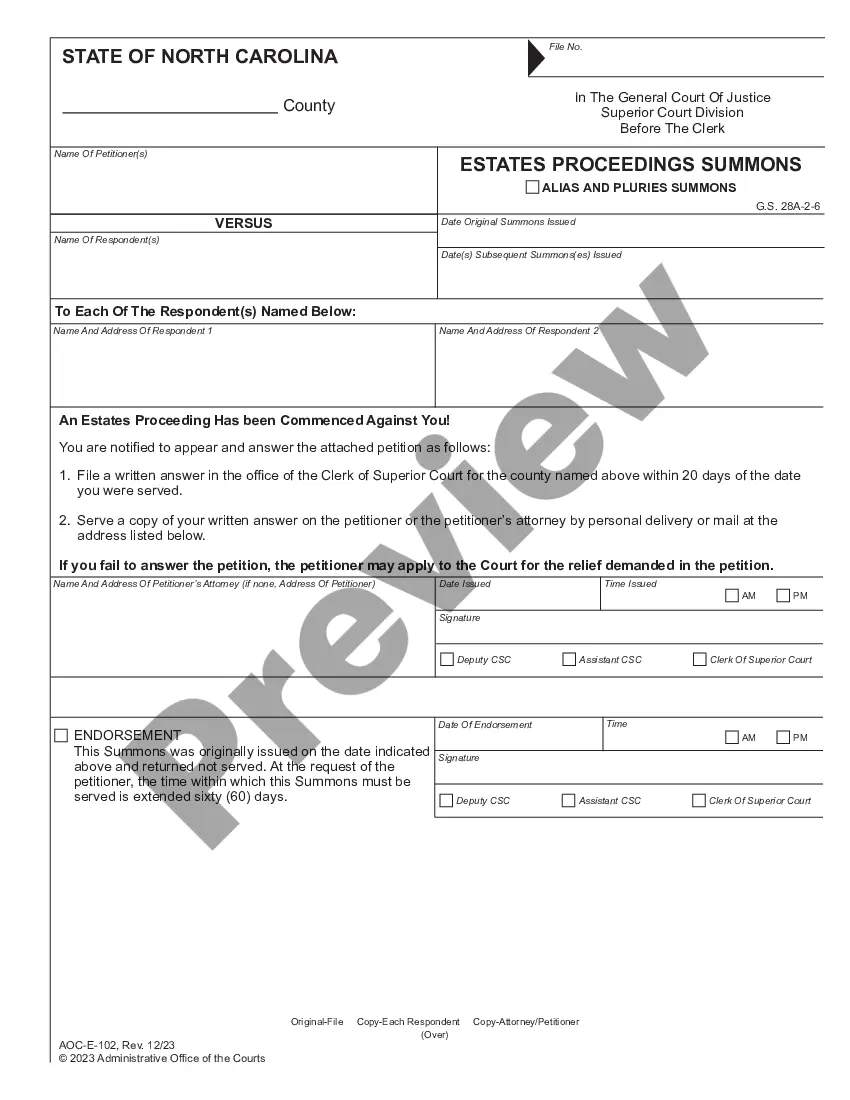

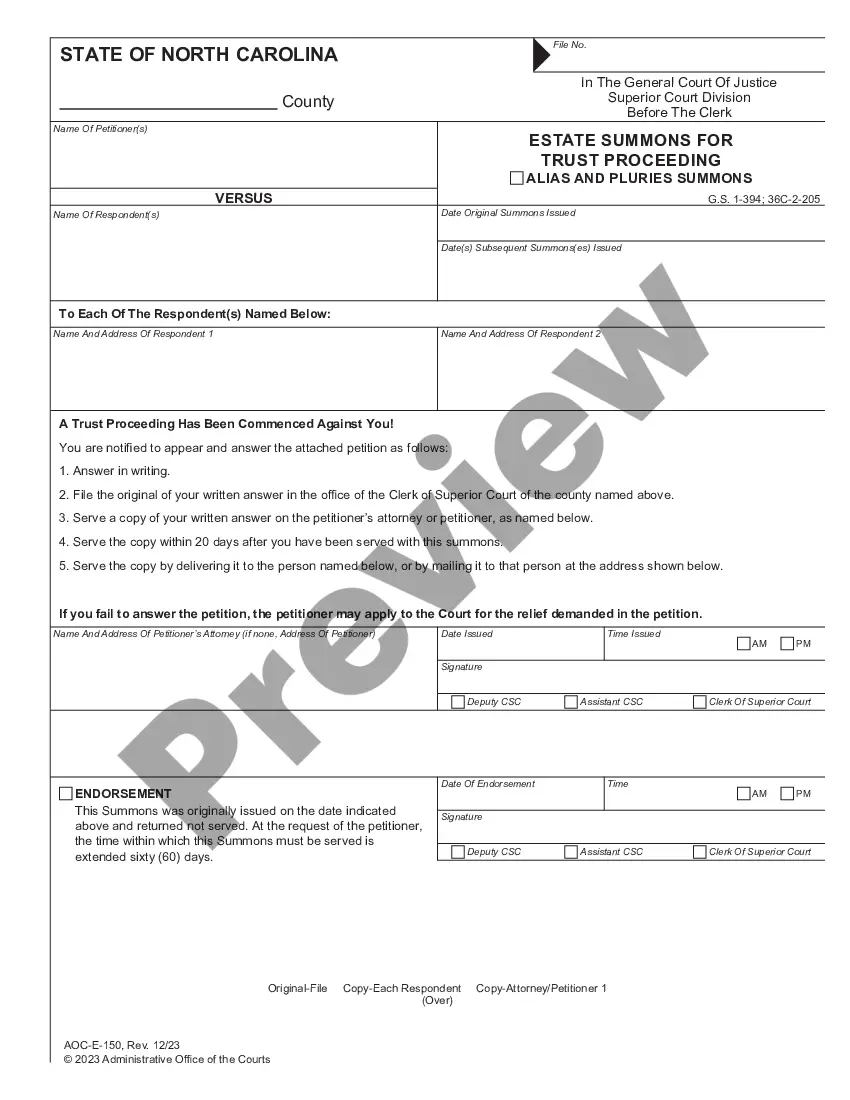

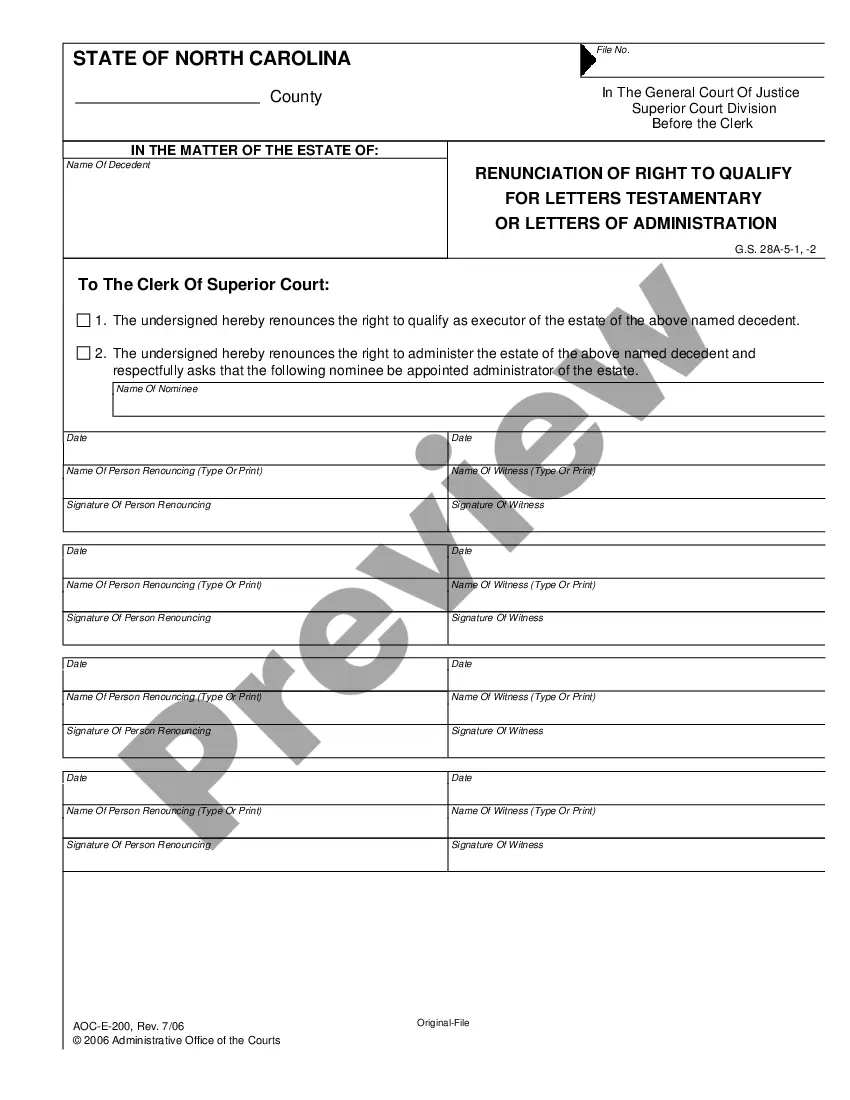

- Review the file by reading the description for using the Preview function.

- Click Buy Now to start the ordering process or look for another template utilizing the Search field in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

When you have signed up and bought your subscription, you may use your Rhode Island Warranty Deed for Husband and Wife Converting Property from Tenants in Common to Joint Tenancy as many times as you need or for as long as it stays active where you live. Edit it in your favored offline or online editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Joint tenants with right of survivorship means that you both own the property equally, and if one dies, the property is then owned by the survivor. Tenants in common means that you each own the whole property, but there is no right of survivorship with this type of tenancy.

When joint tenants have right of survivorship, it means that the property shares of one co-tenant are transferred directly to the surviving co-tenant (or co-tenants) upon their death. While ownership of the property is shared equally in life, the living owners gain total ownership of any deceased co-owners' shares.

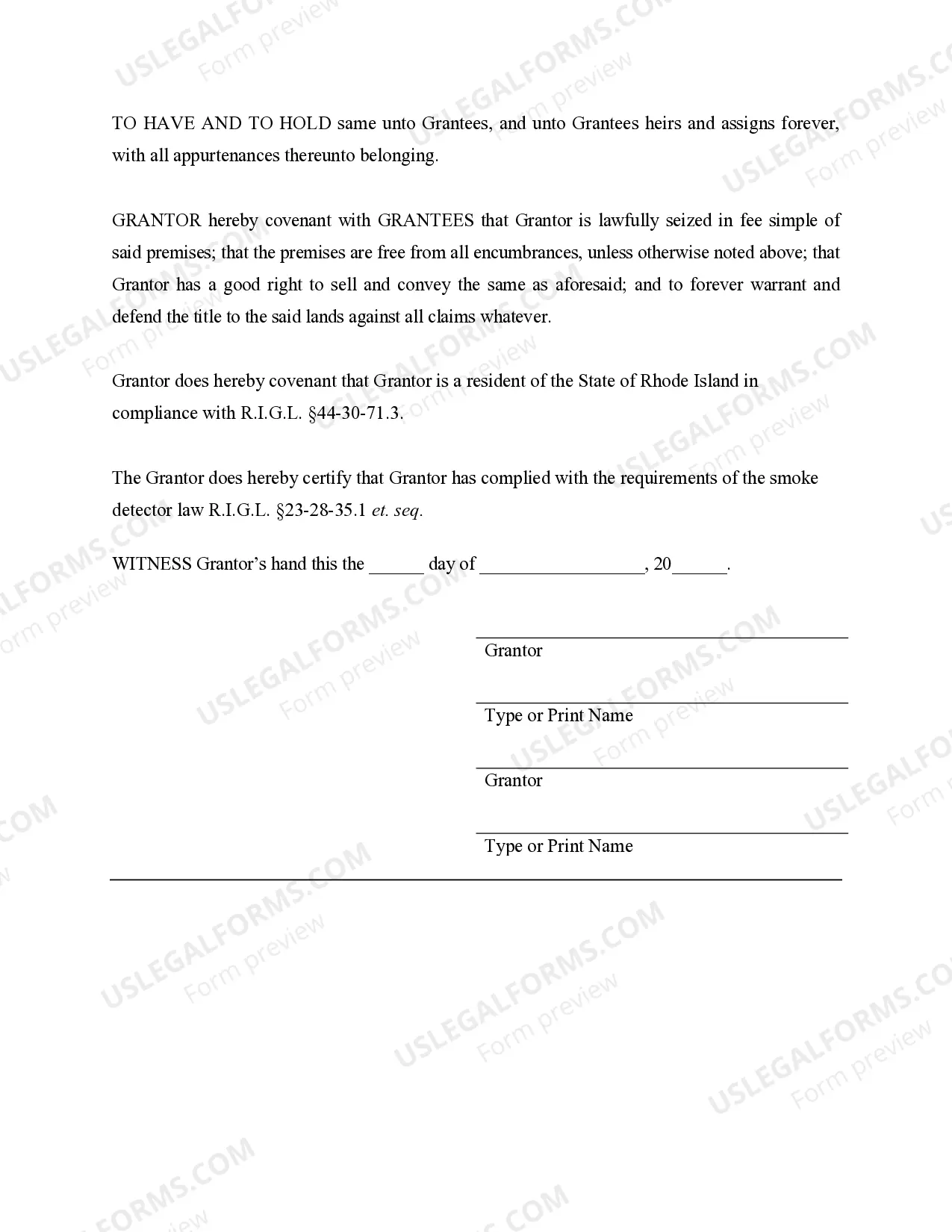

Survivorship rights take precedence over any contrary terms in a person's will because property subject to rights of survivorship is not legally part of their estate at death and so cannot be distributed through a will.

Danger #1: Only delays probate. Danger #2: Probate when both owners die together. Danger #3: Unintentional disinheriting. Danger #4: Gift taxes. Danger #5: Loss of income tax benefits. Danger #6: Right to sell or encumber. Danger #7: Financial problems.

Since the joint tenants have equal interest, the property cannot be sold without all parties' consent. Instead of selling, a joint tenant can choose to transfer their interest to another party. When interest is transferred, the new party may not enter the joint tenancy.

One of the main differences between the two types of shared ownership is what happens to the property when one of the owners dies. When a property is owned by joint tenants with survivorship, the interest of a deceased owner automatically gets transferred to the remaining surviving owners.

For one, if property is held in tenancy by the entirety, neither spouse can transfer his or her half of the property alone, either while alive or by will or trust. It must go to the surviving spouse. This is different from joint tenancy; a joint tenant is free to break the joint tenancy at any time.

Deeper definitionTenancy by the entirety describes a married couple that jointly owns real estate as one legal entity. Tenancy by the entirety can only be created by spouses.Tenancy by the entirety assumes rights of survivorship for when one spouse dies, similar to a joint tenancy with rights of survivorship.

While the joint tenant with right of survivorship can't will his share in the property to his heir, he can sell his interest in the property before his death. Once a joint tenant sells his share, this ends the joint tenancy ownership involving the share.