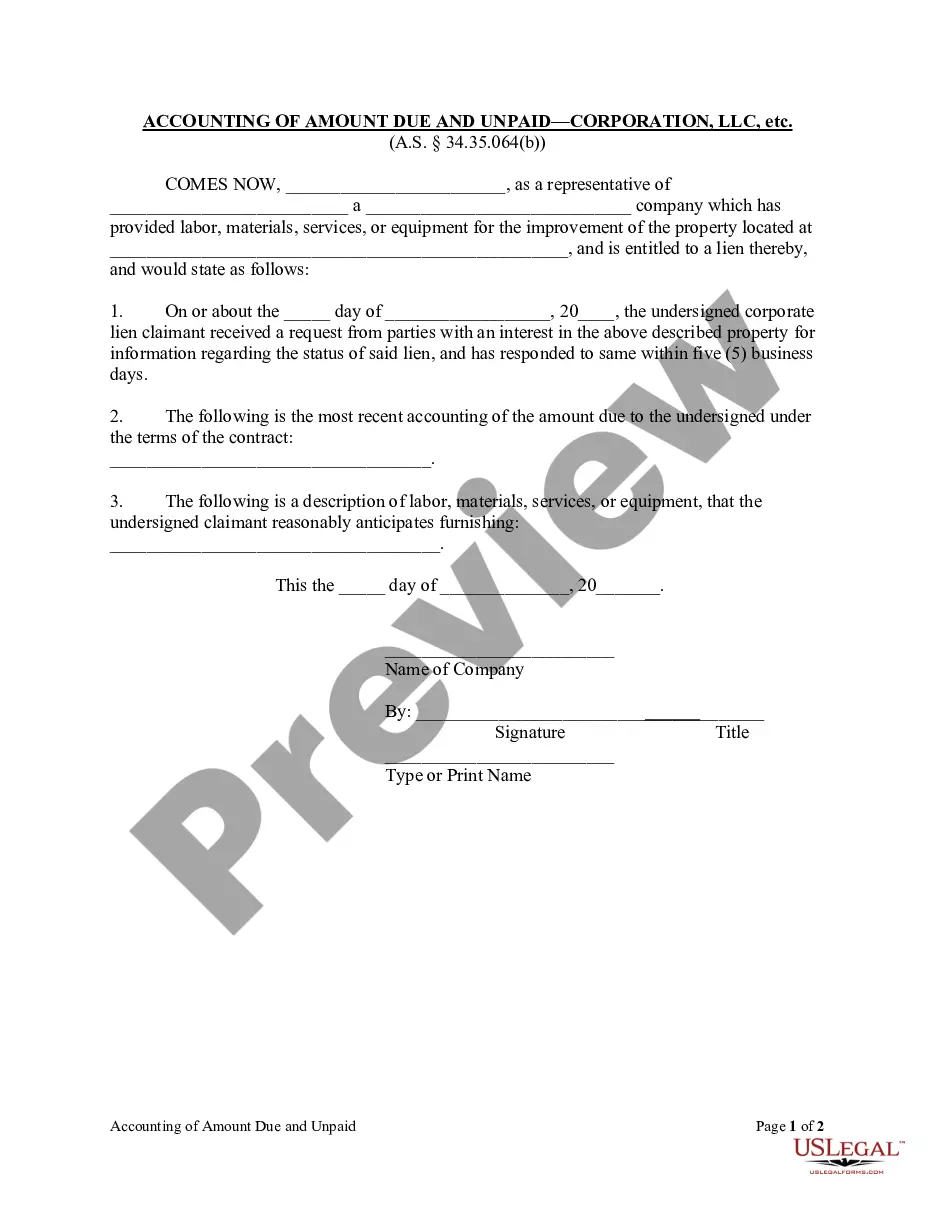

The Rhode Island Corporate or Business Identification Form for Unclaimed Dividends is a form used by corporations or businesses located in Rhode Island to identify unclaimed or unpaid dividends that are owed to their shareholders or owners. This form helps to address the issue of lost or forgotten stock dividends and can help to ensure that shareholders receive their rightful payments. There are two types of Rhode Island Corporate or Business Identification Form for Unclaimed Dividends — the RI-CID-1 and the RI-CID-2. The RI-CID-1 is used for corporations that are incorporated in Rhode Island and the RI-CID-2 is used for corporations that are not incorporated in Rhode Island. Both forms require information such as the company name, address, and contact information as well as the names and addresses of the shareholders entitled to the unclaimed dividends.

Rhode Island Corporate Or Business Indentification Form For Unclaimed Dividends

Description

How to fill out Rhode Island Corporate Or Business Indentification Form For Unclaimed Dividends?

Preparing official paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them correspond with federal and state regulations and are checked by our specialists. So if you need to prepare Rhode Island Corporate Or Business Indentification Form For Unclaimed Dividends, our service is the perfect place to download it.

Obtaining your Rhode Island Corporate Or Business Indentification Form For Unclaimed Dividends from our service is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they find the correct template. Afterwards, if they need to, users can use the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few moments. Here’s a brief instruction for you:

- Document compliance verification. You should attentively examine the content of the form you want and check whether it suits your needs and complies with your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab on the top of the page until you find an appropriate template, and click Buy Now when you see the one you need.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Rhode Island Corporate Or Business Indentification Form For Unclaimed Dividends and click Download to save it on your device. Print it to fill out your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service today to obtain any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

But most claims require a signed and completed claim form, as well as a copy of a photo ID and a legal document that includes a Social Security number. You will upload the documents via the state's secure link or mail documents to: Rhode Island Unclaimed Property Division, P.O. Box 1435; Providence, RI 02901-1435.

Rhode Island Withholding Account Number The first 9 digits of your new account number should match your federal EIN. If you already have a Rhode Island Withholding Account Number, you can find it on previous correspondence from the RI Department of Revenue or by contacting the agency at 401-574-8829.

This series of forms, also known as 'Corporate Tax Vouchers' will begin to phase-out as of January 1, 2023. Starting with tax year 2022, extensions and vouchers must be filed on the Rhode Island BUS-EXT and BUS-V forms. 1 The Division will no longer be using the RI-1120V, RI-1065V, and RI-7004.

Employers pay between 1.1% to 9.7% on the first $28,600 in wages paid to each employee in a calendar year. If you're a new employer (congratulations, by the way!), you pay 1.09% (which is a decrease from 1.19% from 2022). Job Development Fund, which is funding for training.

You must complete Form RI W-4 for your employer(s). Once you have completed Form RI W-4 for your employer, Form RI W-4 only needs to be completed if you are making changes to your withholding allowance or have a new employer. Form RI W-4 must be completed each year if you claim ?EXEMPT? or ?EXEMPT-MS? on line 3 below.

To have forms mailed to you, please call 401.574. 8970 or email Tax.Forms@tax.ri.gov.

Form RI-941, Employer's Quarterly Tax Return and Reconciliation must be filed no later than the last day of the month following the end of the quarter. 8. Some employers are required to file Form RI-941 and make payments via electronic means. Weekly payers must file and pay via electronic means.

Form RI-W3 - Transmittal of Wage and Tax Statements. INFORMATION FOR EMPLOYERS FILING TRANSMITTAL OF WAGE AND TAX STATEMENTS. 1. The employer's name and address should be pre-printed on the form. If incorrect, any necessary changes may be made directly on the form.